Answered step by step

Verified Expert Solution

Question

1 Approved Answer

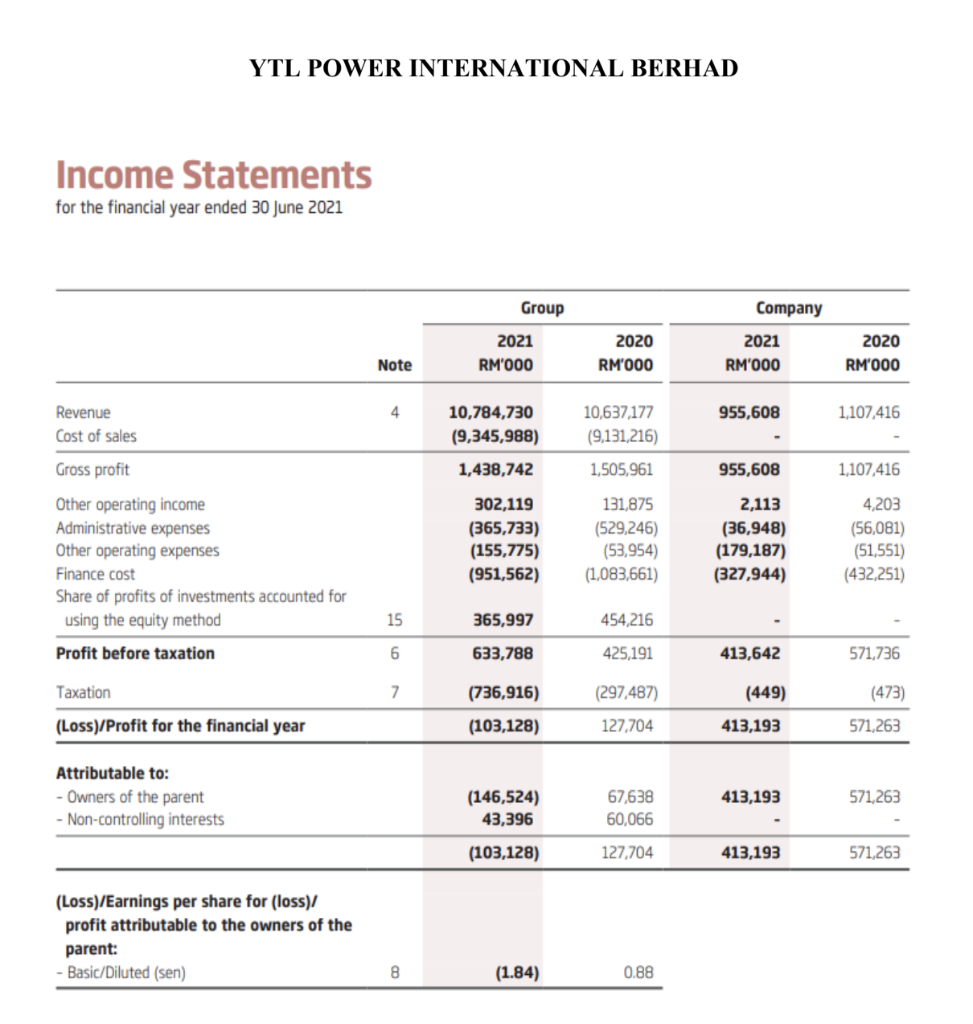

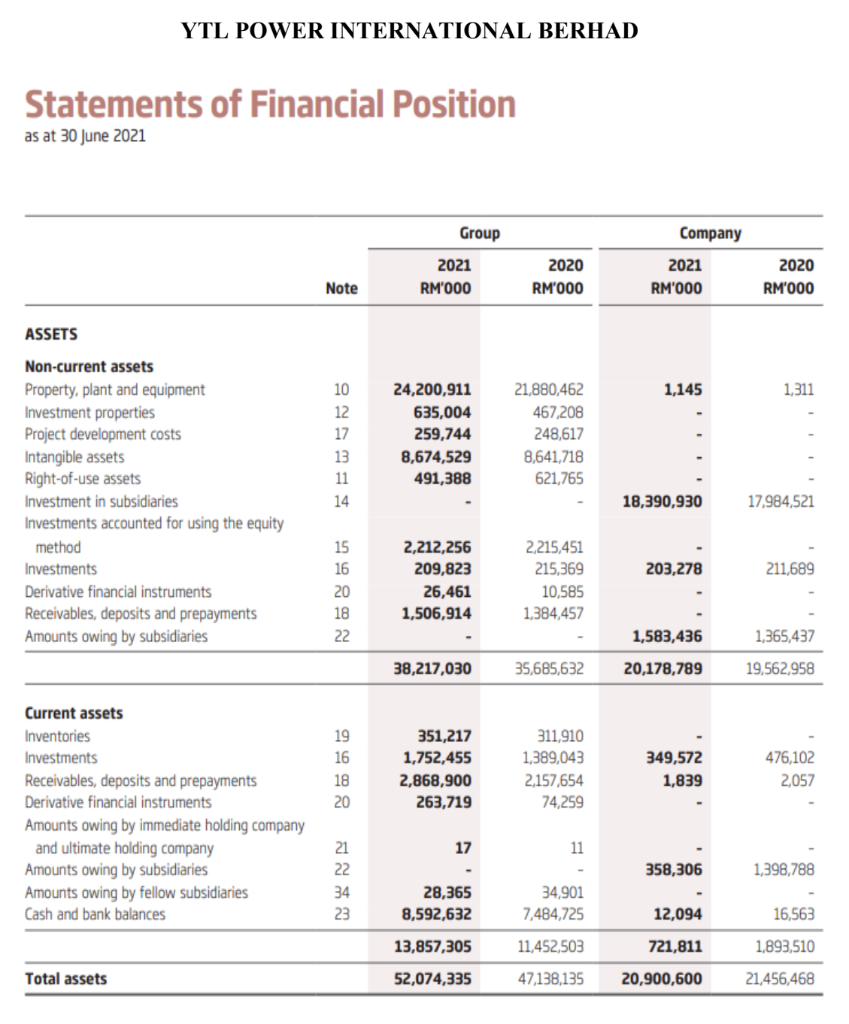

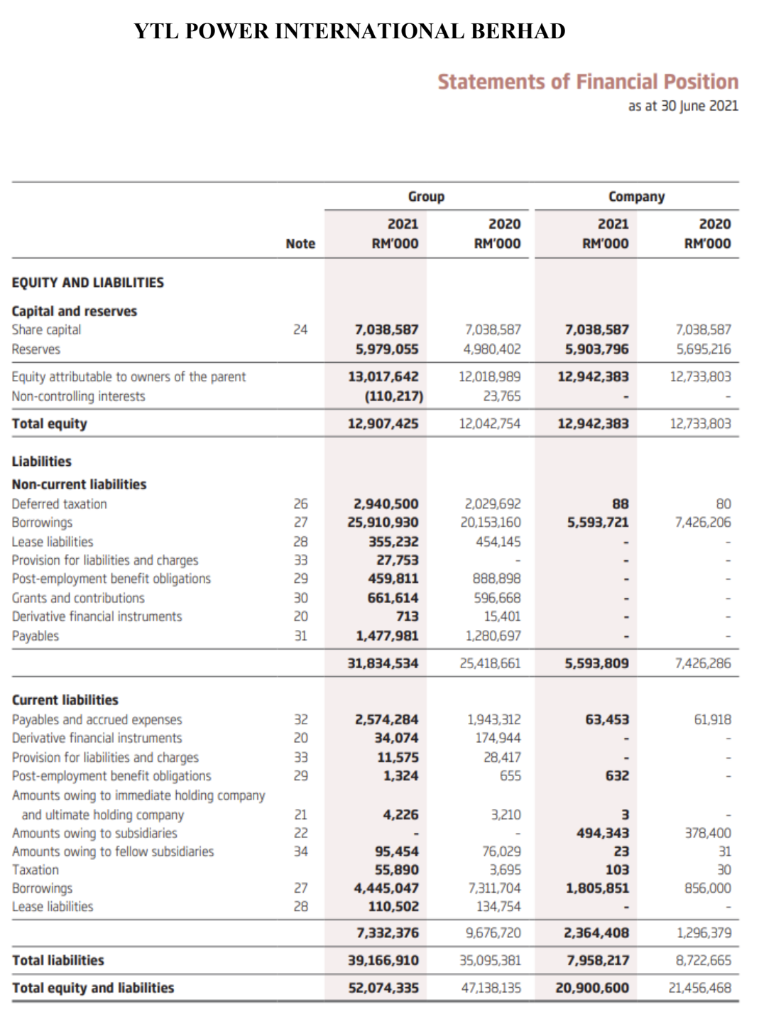

URGENT!! Definitely will upvote!! Based on the attached Group Statements of Profit or Loss and Other Comprehensive Income AND Statements of Financial Position, compute the

URGENT!! Definitely will upvote!!

Based on the attached Group Statements of Profit or Loss and Other Comprehensive Income AND Statements of Financial Position, compute the changes in revenue, gross profit, profit before taxation, net income and earnings per ordinary share for the financial period 2021 and 2020.

YTL POWER INTERNATIONAL BERHAD Group 2020 RM'000 10,637,177 (9,131,216) 1,505,961 131,875 (529,246) (53,954) (1,083,661) 454,216 425,191 (297,487) 127,704 67,638 60,066 127,704 0.88 Income Statements for the financial year ended 30 June 2021 Revenue Cost of sales Gross profit Other operating income Administrative expenses Other operating expenses Finance cost Share of profits of investments accounted for using the equity method Profit before taxation Taxation (Loss)/Profit for the financial year Attributable to: - Owners of the parent -Non-controlling interests (Loss)/Earnings per share for (loss)/ profit attributable to the owners of the parent: Basic/Diluted (sen) Note 4 15 6 7 8 2021 RM'000 10,784,730 (9,345,988) 1,438,742 302,119 (365,733) (155,775) (951,562) 365,997 633,788 (736,916) (103,128) (146,524) 43,396 (103,128) (1.84) Company 2021 RM'000 955,608 955,608 2,113 (36,948) (179,187) (327,944) 413,642 (449) 413,193 413,193 413,193 2020 RM'000 1,107,416 1,107,416 4,203 (56,081) (51,551) (432,251) 571,736 (473) 571,263 571,263 571,263 YTL POWER INTERNATIONAL BERHAD Statements of Financial Position as at 30 June 2021 Group Note ASSETS Non-current assets Property, plant and equipment 10 Investment properties 12 17 Project development costs Intangible assets 13 Right-of-use assets 11 Investment in subsidiaries 14 Investments accounted for using the equity method 15 Investments 16 Derivative financial instruments 20 Receivables, deposits and prepayments 18 Amounts owing by subsidiaries 22 Current assets Inventories 19 Investments 16 Receivables, deposits and prepayments 18 Derivative financial instruments 20 Amounts owing by immediate holding company and ultimate holding company Amounts owing by subsidiaries Amounts owing by fellow subsidiaries Cash and bank balances Total assets 2222 21 34 23 2021 RM'000 24,200,911 635,004 259,744 8,674,529 491,388 2,212,256 209,823 26,461 1,506,914 38,217,030 351,217 1,752,455 2,868,900 263,719 17 28,365 8,592,632 13,857,305 52,074,335 Company 2020 2021 RM'000 RM'000 1,145 21,880,462 467,208 248,617 8,641,718 621,765 18,390,930 2,215,451 215,369 203,278 10,585 1,384,457 1,583,436 35,685,632 20,178,789 311,910 1,389,043 349,572 2,157,654 1,839 74,259 11 358,306 34,901 7,484,725 12,094 11,452,503 721,811 47,138,135 20,900,600 2020 RM'000 1,311 17,984,521 211,689 1,365,437 19,562,958 476,102 2,057 1,398,788 16,563 1,893,510 21,456,468 YTL POWER INTERNATIONAL BERHAD Note 24 EQUITY AND LIABILITIES Capital and reserves Share capital Reserves Equity attributable to owners of the parent Non-controlling interests Total equity Liabilities Non-current liabilities Deferred taxation Borrowings Lease liabilities Provision for liabilities and charges Post-employment benefit obligations Grants and contributions Derivative financial instruments Payables Current liabilities Payables and accrued expenses Derivative financial instruments Provision for liabilities and charges Post-employment benefit obligations Amounts owing to immediate holding company and ultimate holding company Amounts owing to subsidiaries Amounts owing to fellow subsidiaries Taxation Borrowings Lease liabilities Total liabilities Total equity and liabilities 26 27 28 33 29 30 20 31 32 20 33 29 21 22 34 27 28 Statements of Financial Position as at 30 June 2021 Group 2020 2020 RM'000 RM'000 7,038,587 7,038,587 4,980,402 5,695.216 12,018,989 12,733,803 23,765 12,042,754 12,733,803 2,029,692 80 20,153,160 7,426,206 454,145 888,898 596,668 15,401 1,280,697 25,418,661 7,426,286 1,943,312 61,918 174,944 28,417 655 3,210 378,400 76,029 31 3,695 30 7,311,704 856,000 134,754 9,676,720 1,296,379 35,095,381 8,722,665 47,138,135 21,456,468 2021 RM'000 7,038,587 5,979,055 13,017,642 (110,217) 12,907,425 2,940,500 25,910,930 355,232 27,753 459,811 661,614 713 1,477,981 31,834,534 2,574,284 34,074 11,575 1,324 4,226 95,454 55,890 4,445,047 110,502 7,332,376 39,166,910 52,074,335 Company 2021 RM'000 7,038,587 5,903,796 12,942,383 12,942,383 88 5,593,721 5,593,809 63,453 632 3 494,343 23 103 1,805,851 2,364,408 7,958,217 20,900,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started