Question

Urgent DON'T copy-paste from another expert because I already saw their answer please don't write with your hands Meal Corporation obtained authorization to issue 30-year

Urgent

DON'T copy-paste from another expert because I already saw their answer

please don't write with your hands

Meal Corporation obtained authorization to issue 30-year bonds with a face value of 15 million. The bonds are dated May 1, 2020, and have a contract rate of interest of 8 percent. They pay interest on November 1 and May 1. The bonds were issued on July 1, 2020, at 100 plus two months accrued interest.

Instructions:

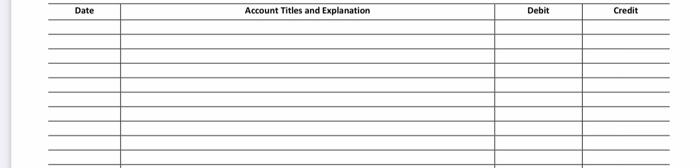

Prepare the necessary journal entries in general journal form on the following.

(a). August 1, 2020, to record the issuance of the bonds.

(b). November 1, 2020, to record the first semi-annual interest payment on the bond issue.

(c). December 31, 2020, to record interest expense accrued through year-end. (Round to the nearest full number.)

(d) .May 1, 2021, to record the second semi-annual interest payment. (Round to the nearest full number.)

please don't write with your hands

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started