Answered step by step

Verified Expert Solution

Question

1 Approved Answer

urgent For the BBS Ltd the only temporary difference for tax-effect accounting purpose relates to the depreciation of a newly acquired machine. The machine is

urgent

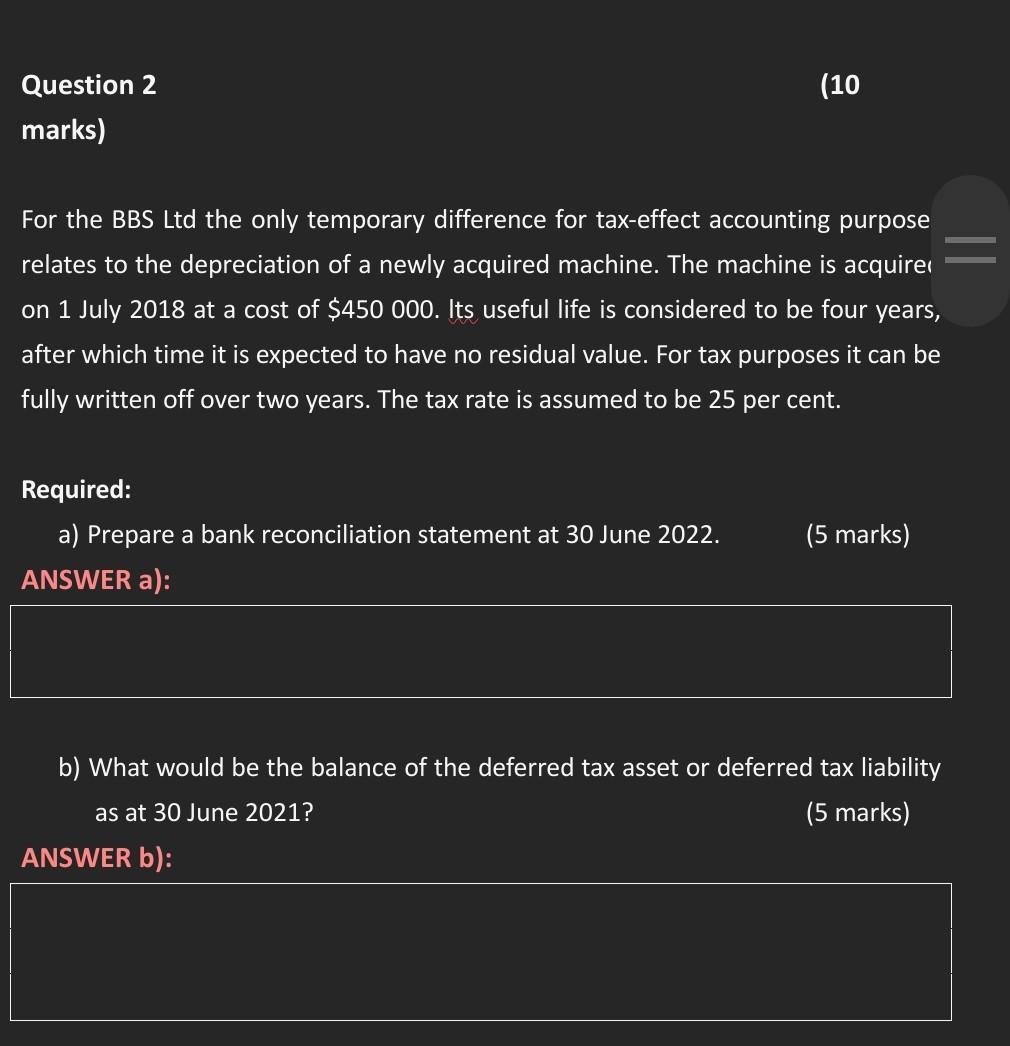

For the BBS Ltd the only temporary difference for tax-effect accounting purpose relates to the depreciation of a newly acquired machine. The machine is acquire on 1 July 2018 at a cost of $450000. Its useful life is considered to be four years, after which time it is expected to have no residual value. For tax purposes it can be fully written off over two years. The tax rate is assumed to be 25 per cent. Required: a) Prepare a bank reconciliation statement at 30 June 2022. (5 marks) ANSWER a): b) What would be the balance of the deferred tax asset or deferred tax liability as at 30 June 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started