Answered step by step

Verified Expert Solution

Question

1 Approved Answer

urgent Gollatin Carpet Cleaning is a small, familly-owned business operating out of Bozeman, Montana. For its services, the compary has always charged a flat fee

urgent

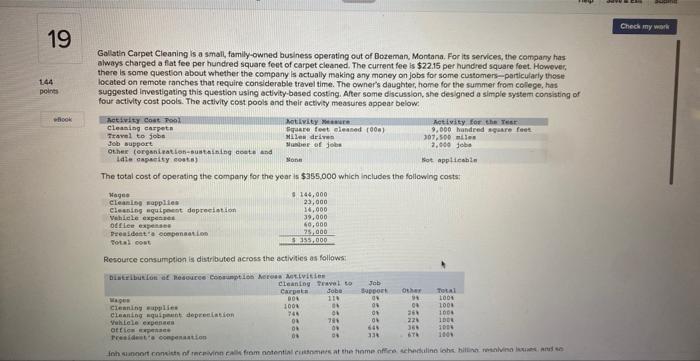

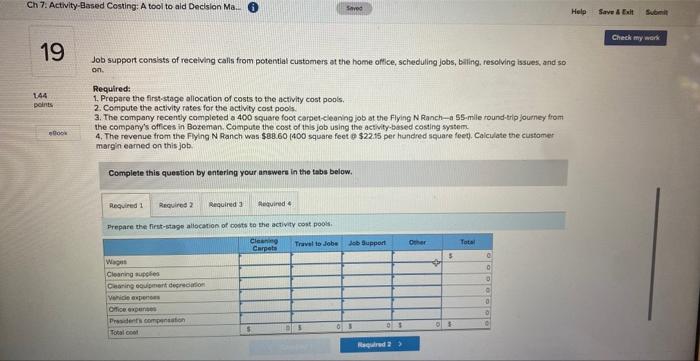

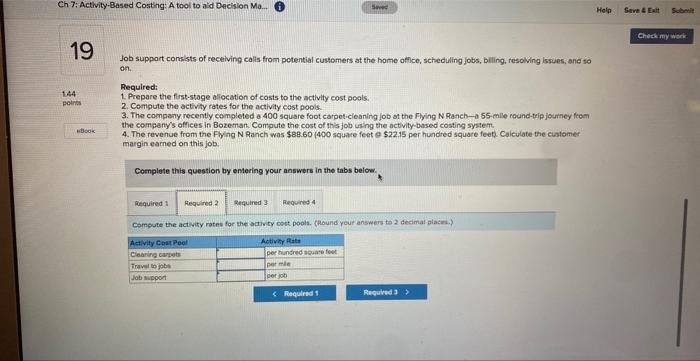

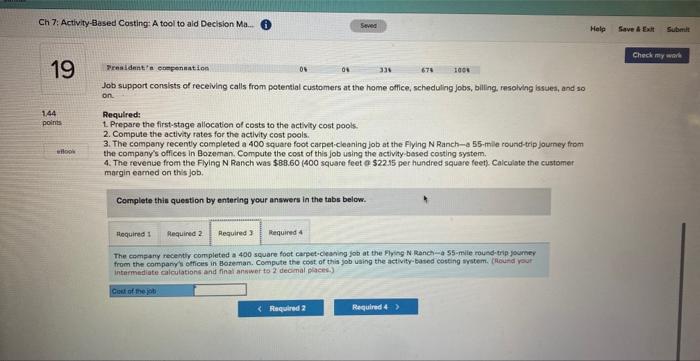

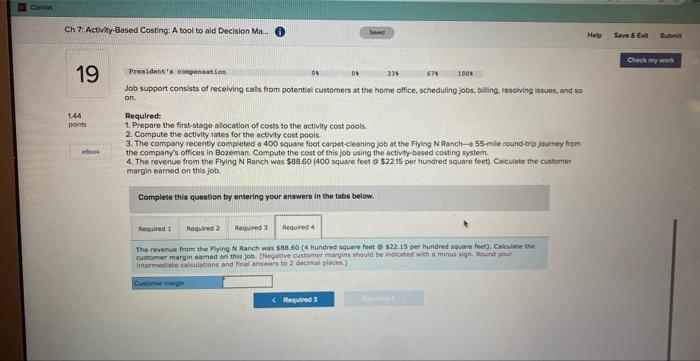

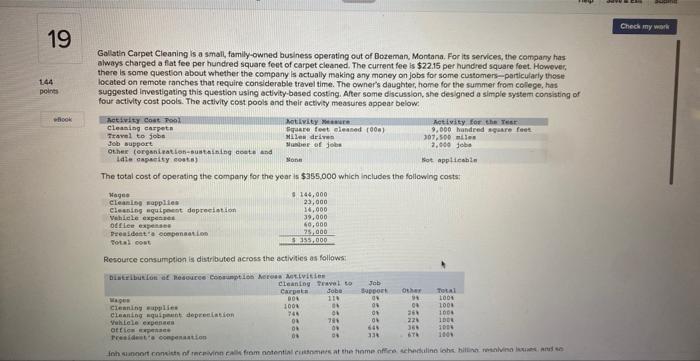

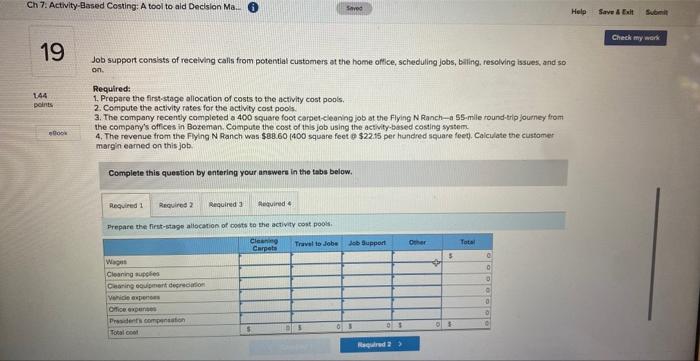

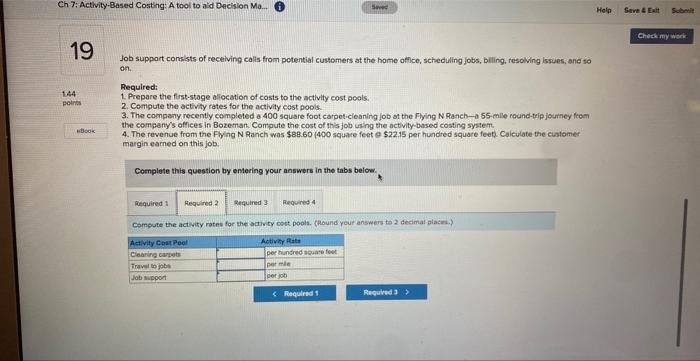

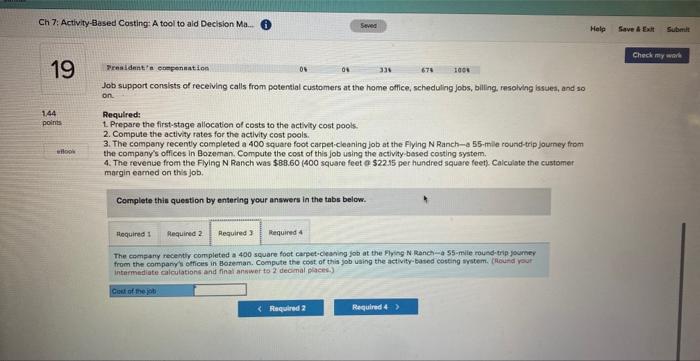

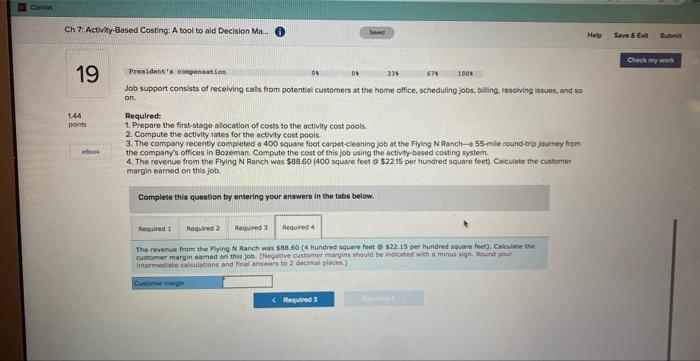

Gollatin Carpet Cleaning is a small, familly-owned business operating out of Bozeman, Montana. For its services, the compary has always charged a flat fee per hundred square fent of carpet cleaned. The current fee is $22.15 per hundred square foet. However: there is some question about whether the company is actually making any money on jobs for some customers-particularly those: located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simplie system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: The total cost of operating the company for the year is $355,000 which includes the fallowing costs: Resource consumption is disarlbuted across the activities as followsi Job support consists of recelving calls from potential custamers at the home office, schedulling jobs, baling. resclving issues, and so on. Required: 1. Prepare the first-stage allocation of costs to the activity cost ponis. 2. Compute the activity rates for the activity cost pools. 3. The company recently completed a 400 square foot carpet-ceaning job at the Fiying N Ranch-a 55 -mlie round trip journey fromt the compory's offices in Bozeman. Compute the cost of this job using the activitybssed costing system 4. The revenue from the Fyling N Ranch was $88.60 (400 square feet 8$22.15 per hundred seuare feet). Calculate the customer margin earned on this job. Complete this question by entering your answers in the tabs below. Prepare the first-stage allocation of oosts to the activity cost pooss, Job support consists of recelving calls from potential customers at the home atfice, scheduling Jobs, billing, resolving issues, and so on. Required: 1. Prepare the first-stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cest popls. 3. The company recently completed a 400 square foot carpet-ieaning job st the Flying N Ranch-a 55 -mile round-teip jouriney from the company's offices in Bozemank. Compute the cost of this job using the activity-based costing system. 4. The revenue from the Flying N Ranch was $88.60 (400 square feet o $22.15 per hundred square feeth Calculate the customer margin earned on this job. Complete this question by entering your answers in the tabs below. Compoute the activity rotes for the actioty cost pools. (Phound yout answers to 2 decimal glacer.) Job support consists of receiving calls from potential customers at the home office, scheduling jobs, billing, resolving issues, and so on. Requlred: 1. Prepare the first-stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cost pools. 3. The company recently completed a 400 square foot carpet-cleaning job at the Flying N Ranch-a 55 -trile round-trip journey from the company's offices in Bozeman. Compute the cost of this job ising the activity besed costing system, 4. The reventse from the Flying N Ranch was $8:.60 (400 square feet o $22.15 per hundred square feet) Calculate the customer margin eamed on this job. Complete thil question by entering your answers in the tabs below. The compary recenty completed a 400 square foet carpet-cleshing job at the Pying N Rainch-a 55 -mile round-tirp yourner intermediate calculations and final arwwer to 2 dec.mal placed.] Ch 7: Actrify-Based Costing: A tool to aid Decision Ma. 19 presidentes conpensastion Job support conssats of recelving cals from potential cussemers of the home office, scheduling jobs, baling tesoiving issues, and so on. t44 Required: points 1. Prepare the first-stage allocation of costs to the activity cost pooks 2. Compute the activity rates for the activity cost pools. 3. The company recenty completed a 400 square foot carpet-iearing job at the Flying N Ranch-a 55 -mile round-tro journey from the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system. 4. The revenue from the Fining N Ranch was $83.60 (400 square feet 0$22.15 per hundred square feet Calculate the customer margin earned on this job. Complete this question by entering your answers in the tabs below. The revenue from the firing N Panch was $38.60 (4 hundred square feet 9.32.15 per hundred square feet). Calcuate toe

Gollatin Carpet Cleaning is a small, familly-owned business operating out of Bozeman, Montana. For its services, the compary has always charged a flat fee per hundred square fent of carpet cleaned. The current fee is $22.15 per hundred square foet. However: there is some question about whether the company is actually making any money on jobs for some customers-particularly those: located on remote ranches that require considerable travel time. The owner's daughter, home for the summer from college, has suggested investigating this question using activity-based costing. After some discussion, she designed a simplie system consisting of four activity cost pools. The activity cost pools and their activity measures appear below: The total cost of operating the company for the year is $355,000 which includes the fallowing costs: Resource consumption is disarlbuted across the activities as followsi Job support consists of recelving calls from potential custamers at the home office, schedulling jobs, baling. resclving issues, and so on. Required: 1. Prepare the first-stage allocation of costs to the activity cost ponis. 2. Compute the activity rates for the activity cost pools. 3. The company recently completed a 400 square foot carpet-ceaning job at the Fiying N Ranch-a 55 -mlie round trip journey fromt the compory's offices in Bozeman. Compute the cost of this job using the activitybssed costing system 4. The revenue from the Fyling N Ranch was $88.60 (400 square feet 8$22.15 per hundred seuare feet). Calculate the customer margin earned on this job. Complete this question by entering your answers in the tabs below. Prepare the first-stage allocation of oosts to the activity cost pooss, Job support consists of recelving calls from potential customers at the home atfice, scheduling Jobs, billing, resolving issues, and so on. Required: 1. Prepare the first-stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cest popls. 3. The company recently completed a 400 square foot carpet-ieaning job st the Flying N Ranch-a 55 -mile round-teip jouriney from the company's offices in Bozemank. Compute the cost of this job using the activity-based costing system. 4. The revenue from the Flying N Ranch was $88.60 (400 square feet o $22.15 per hundred square feeth Calculate the customer margin earned on this job. Complete this question by entering your answers in the tabs below. Compoute the activity rotes for the actioty cost pools. (Phound yout answers to 2 decimal glacer.) Job support consists of receiving calls from potential customers at the home office, scheduling jobs, billing, resolving issues, and so on. Requlred: 1. Prepare the first-stage allocation of costs to the activity cost pools. 2. Compute the activity rates for the activity cost pools. 3. The company recently completed a 400 square foot carpet-cleaning job at the Flying N Ranch-a 55 -trile round-trip journey from the company's offices in Bozeman. Compute the cost of this job ising the activity besed costing system, 4. The reventse from the Flying N Ranch was $8:.60 (400 square feet o $22.15 per hundred square feet) Calculate the customer margin eamed on this job. Complete thil question by entering your answers in the tabs below. The compary recenty completed a 400 square foet carpet-cleshing job at the Pying N Rainch-a 55 -mile round-tirp yourner intermediate calculations and final arwwer to 2 dec.mal placed.] Ch 7: Actrify-Based Costing: A tool to aid Decision Ma. 19 presidentes conpensastion Job support conssats of recelving cals from potential cussemers of the home office, scheduling jobs, baling tesoiving issues, and so on. t44 Required: points 1. Prepare the first-stage allocation of costs to the activity cost pooks 2. Compute the activity rates for the activity cost pools. 3. The company recenty completed a 400 square foot carpet-iearing job at the Flying N Ranch-a 55 -mile round-tro journey from the company's offices in Bozeman. Compute the cost of this job using the activity-based costing system. 4. The revenue from the Fining N Ranch was $83.60 (400 square feet 0$22.15 per hundred square feet Calculate the customer margin earned on this job. Complete this question by entering your answers in the tabs below. The revenue from the firing N Panch was $38.60 (4 hundred square feet 9.32.15 per hundred square feet). Calcuate toe

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started