Answered step by step

Verified Expert Solution

Question

1 Approved Answer

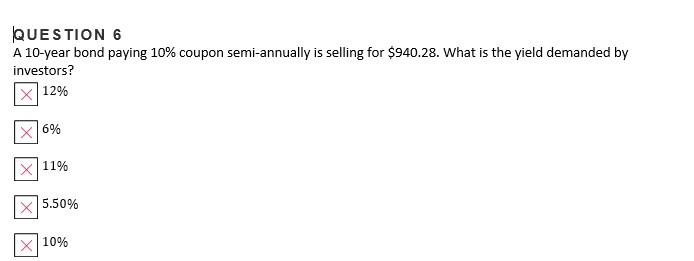

Urgent help: Answer all the mcqs with correctly with workings QUESTION 6 A 10-year bond paying 10% coupon semi-annually is selling for $940.28. What is

Urgent help: Answer all the mcqs with correctly with workings

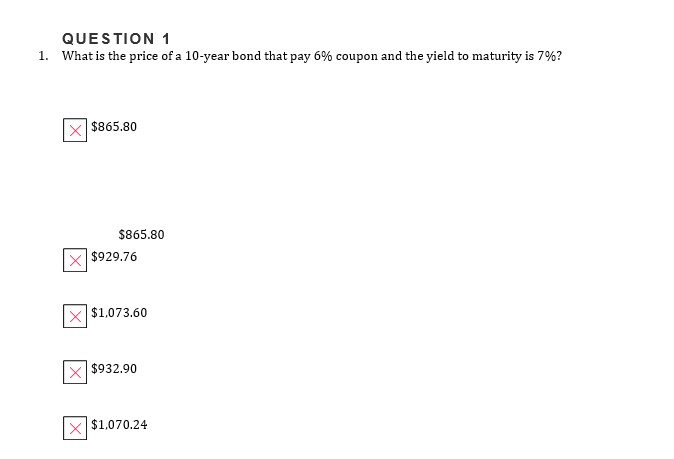

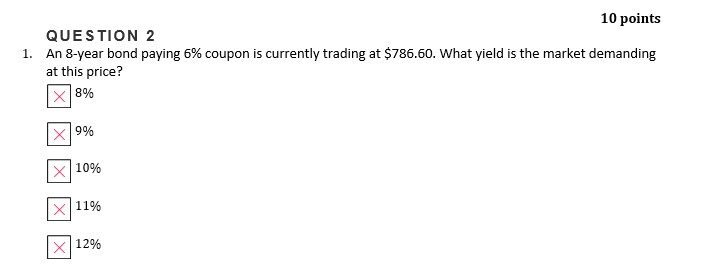

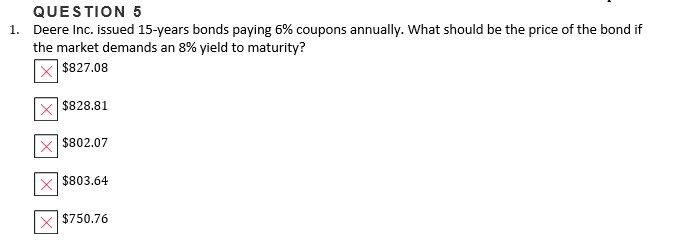

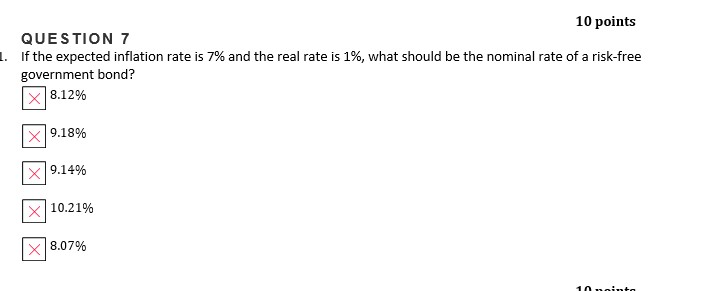

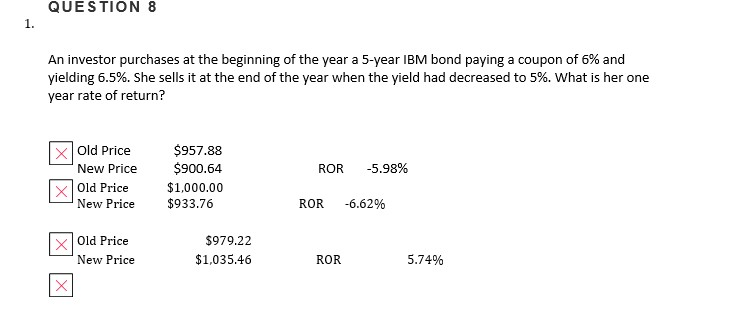

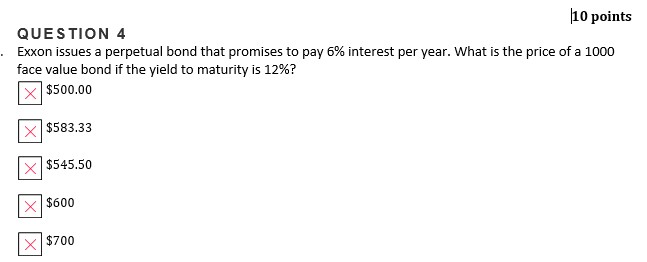

QUESTION 6 A 10-year bond paying 10% coupon semi-annually is selling for $940.28. What is the yield demanded by investors? X12% 5.50% 10% QUESTION 1 1. What is the price of a 10-year bond that pay 6% coupon and the yield to maturity is 7%? $865.80 $865.80 $929.76 X|$1,073.60 X|$932.90 X|$1,070.24 QUESTION 6 A 10-year bond paying 10% coupon semi-annually is selling for $940.28. What is the yield demanded by investors? X12% 5.50% 10% QUESTION 6 A 10-year bond paying 10% coupon semi-annually is selling for $940.28. What is the yield demanded by investors? X12% 5.50% 10% 10 points QUESTION 2 1. An 8-year bond paying 6% coupon is currently trading at $786.60. What yield is the market demanding at this price? [%]8% X]9% ]11% 12% QUESTION 5 1. Deere Inc. issued 15-years bonds paying 6% coupons annually. What should be the price of the bond if the market demands an 8% yield to maturity? $827.08 [x]$828.81 $802.07 |$803.64 X $750.76 10 points QUESTION 7 1. If the expected inflation rate is 7% and the real rate is 1%, what should be the nominal rate of a risk-free government bond? X8.12% 79.18% X]9.14% ] 10.21% +]8.07% 10ita QUESTION 8 An investor purchases at the beginning of the year a 5-year IBM bond paying a coupon of 6% and yielding 6.5%. She sells it at the end of the year when the yield had decreased to 5%. What is her one year rate of return? ROR -5.98% XOld Price New Price Old Price New Price $957.88 $900.64 $1,000.00 $933.76 ROR -6.62% Old Price New Price $979.22 $1,035.46 ROR 5.74% QUESTION 4 10 points Exxon issues a perpetual bond that promises to pay 6% interest per year. What is the price of a 1000 face value bond if the yield to maturity is 12%? X $500.00 $583.33 X|$545.50 ||$600 X$700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started