Answered step by step

Verified Expert Solution

Question

1 Approved Answer

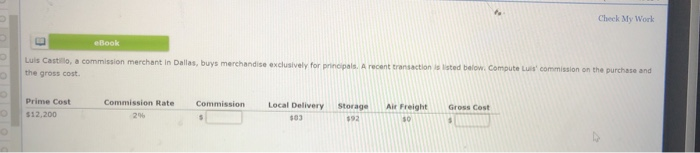

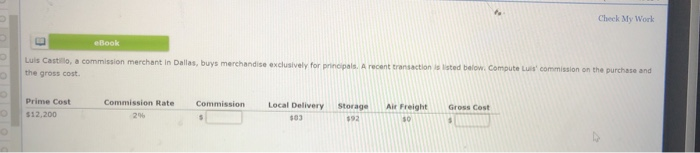

Urgent Help!! Check My Work ok Luis Castro, a commission merchant in Dallas, buys merchandise exclusively for repais. A recent transaction is listed below. Compute

Urgent Help!!

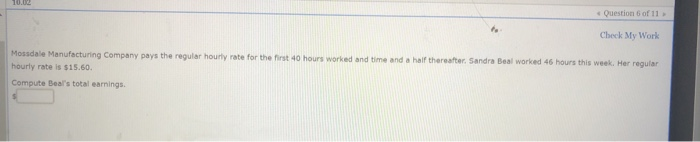

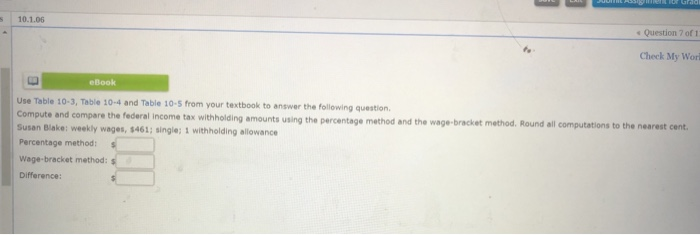

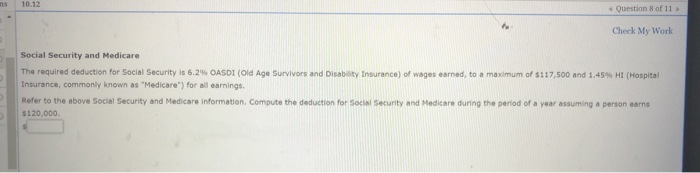

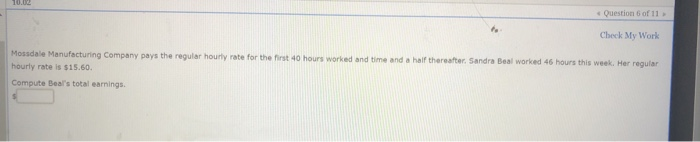

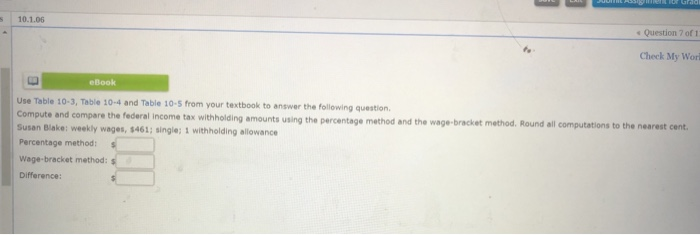

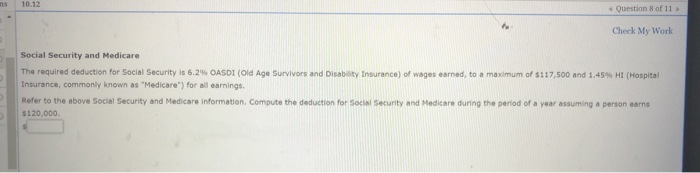

Check My Work ok Luis Castro, a commission merchant in Dallas, buys merchandise exclusively for repais. A recent transaction is listed below. Compute the gross cost commission on the purchase and Commission Rate Commission Prime Cost 512.200 Local Delivery Storage At Freight Gross Cost Question 6 of 11 Check My Work Mossdale Manufacturing Company pays the regular hourly rate for the first 40 hours worked and time and a half thereafter. Sandra Beal worked 46 hours this week. Her regular hourly rate is $15.60. Compute Bear's total earnings. 10.1.06 Question 7 of 1 Check My Wor Book Use Table 10-3, Table 10-4 and Table 10-5 from your textbook to answer the following question Compute and compare the federal income tax withholding amounts using the percentage method and the wage bracket method. Round all computations to the nearest cent. Susan Blake: weekly wages, 5461; single; 1 withholding allowance Percentage method: S Wage-bracket method: $ Difference: 10.12 Question 8 of 11 Check My Work Social Security and Medicare The required deduction for Social Security is 6.2% OASDI (Old Age Survivors and Disability Insurance) of wages earned, to a maximum of $117,500 and 1,45% HI (Hospital Insurance, commonly known as "Medicare") for all earnings. Refer to the above Social Security and Medicare Information Compute the deduction for Social Security and Medicare during the period of a year assuming a person earns $120,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started