Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Urgent help needed, thank you a lot in advance QUESTION 1. a) You are the CEO of a highly profitable firm and you expect the

Urgent help needed, thank you a lot in advance

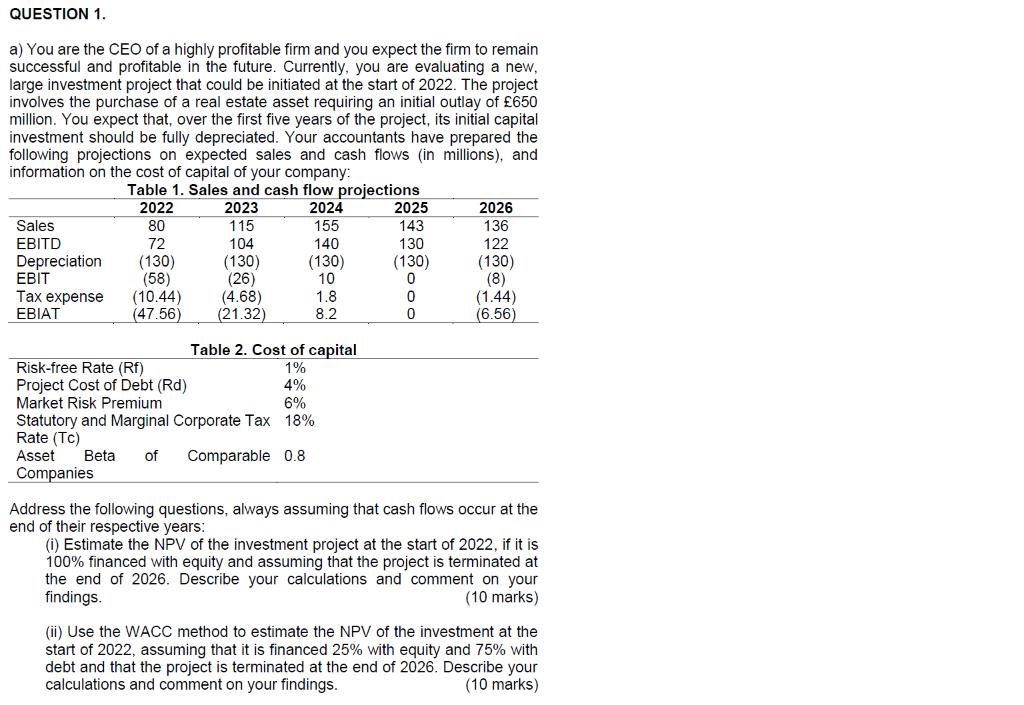

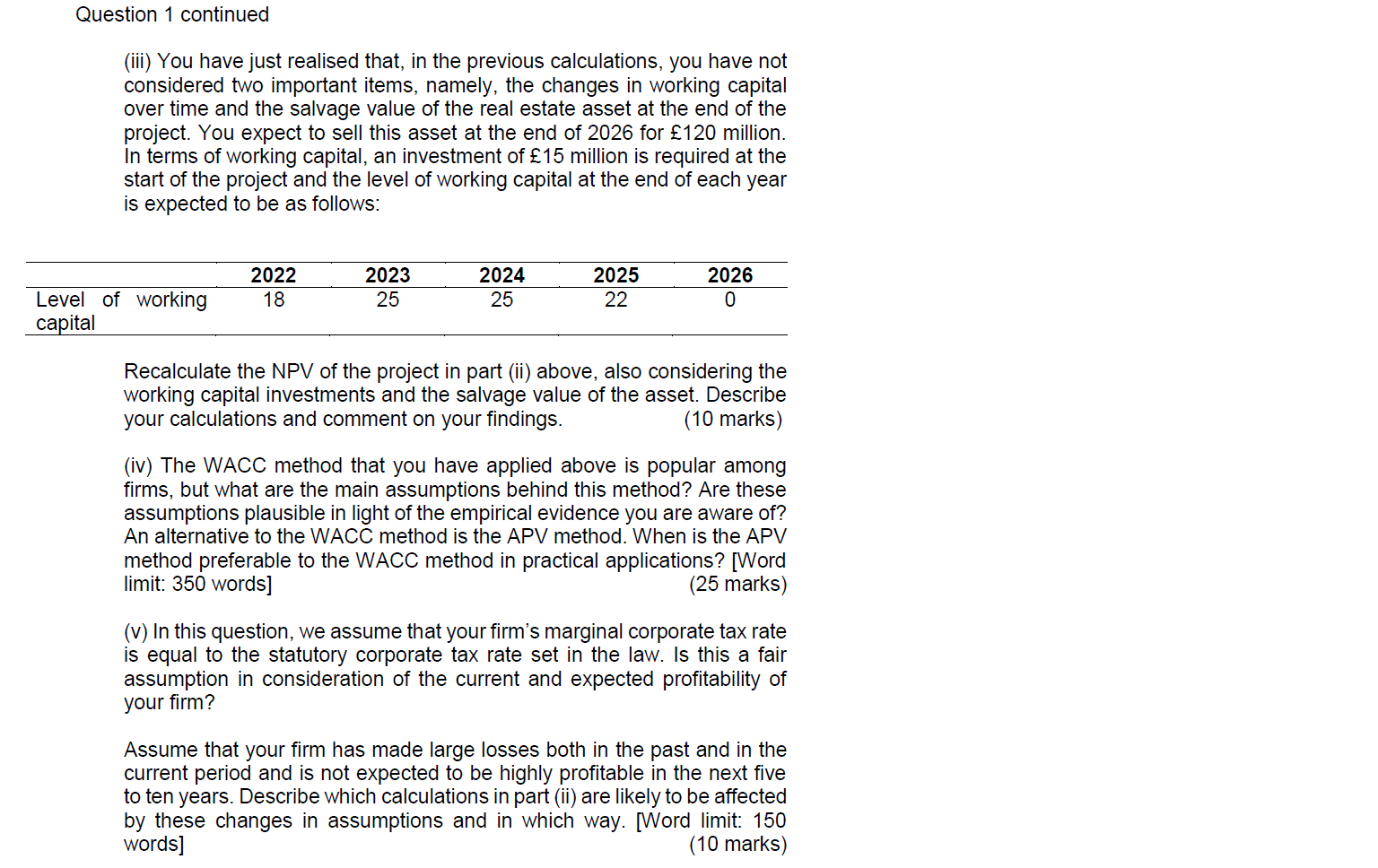

QUESTION 1. a) You are the CEO of a highly profitable firm and you expect the firm to remain successful and profitable in the future. Currently, you are evaluating a new, large investment project that could be initiated at the start of 2022. The project involves the purchase of a real estate asset requiring an initial outlay of 650 million. You expect that, over the first five years of the project, its initial capital investment should be fully depreciated. Your accountants have prepared the following projections on expected sales and cash flows (in millions), and information on the cost of capital of your company: Table 1. Sales and cash flow projections 2022 2023 2024 2025 2026 Sales 80 115 155 143 136 EBITD 72 104 140 130 122 Depreciation (130) (130) (130) (130) (130) EBIT (58) (26) 10 0 (8) Tax expense (10.44) (4.68) 1.8 0 (1.44) EBIAT (47.56) (21.32) 8.2 (6.56) 0 Table 2. Cost of capital Risk-free Rate (RF) 1% Project Cost of Debt (Rd) 4% Market Risk Premium 6% Statutory and Marginal Corporate Tax 18% Rate (TC) Asset Beta of Comparable 0.8 Companies Address the following questions, always assuming that cash flows occur at the end of their respective years: (i) Estimate the NPV of the investment project at the start of 2022, if it is 100% financed with equity and assuming that the project is terminated at the end of 2026. Describe your calculations and comment on your findings. (10 marks) (ii) Use the WACC method to estimate the NPV of the investment at the start of 2022, assuming that it is financed 25% with equity and 75% with debt and that the project is terminated at the end of 2026. Describe your calculations and comment on your findings. (10 marks) Question 1 continued (iii) You have just realised that, in the previous calculations, you have not considered two important items, namely, the changes in working capital over time and the salvage value of the real estate asset at the end of the project. You expect to sell this asset at the end of 2026 for 120 million. In terms of working capital, an investment of 15 million is required at the start of the project and the level of working capital at the end of each year is expected to be as follows: 2022 18 2023 25 2024 25 2025 22 2026 0 Level of working capital Recalculate the NPV of the project in part (ii) above, also considering the working capital investments and the salvage value of the asset. Describe your calculations and comment on your findings. (10 marks) (iv) The WACC method that you have applied above is popular among firms, but what are the main assumptions behind this method? Are these assumptions plausible in light of the empirical evidence you are aware of? An alternative to the WACC method is the APV method. When is the APV method preferable to the WACC method in practical applications? [Word limit: 350 words] (25 marks) (v) In this question, we assume that your firm's marginal corporate tax rate is equal to the statutory corporate tax rate set in the law. Is this a fair assumption in consideration of the current and expected profitability of your firm? Assume that your firm has made large losses both in the past and in the current period and is not expected to be highly profitable in the next five to ten years. Describe which calculations in part (ii) are likely to be affected by these changes in assumptions and in which way. [Word limit: 150 words] (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started