urgent help needed, thanks!

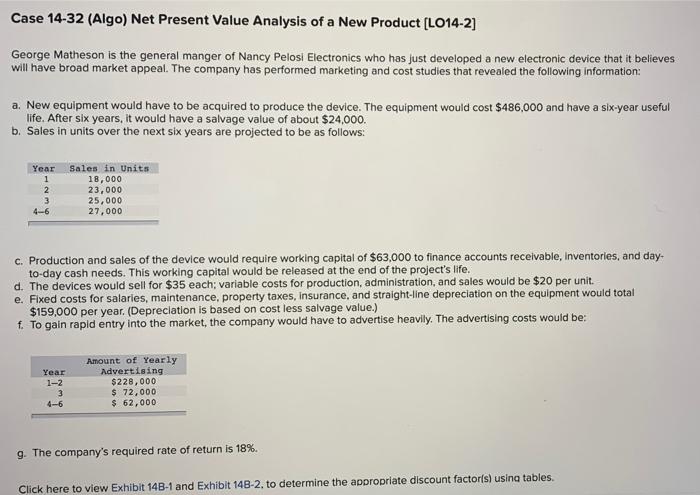

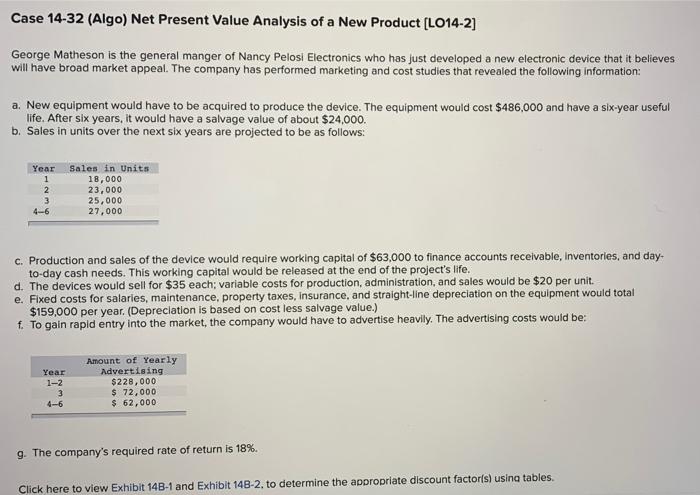

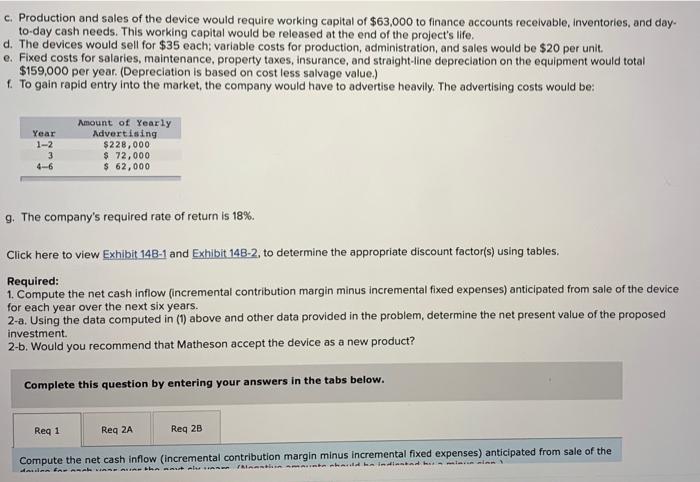

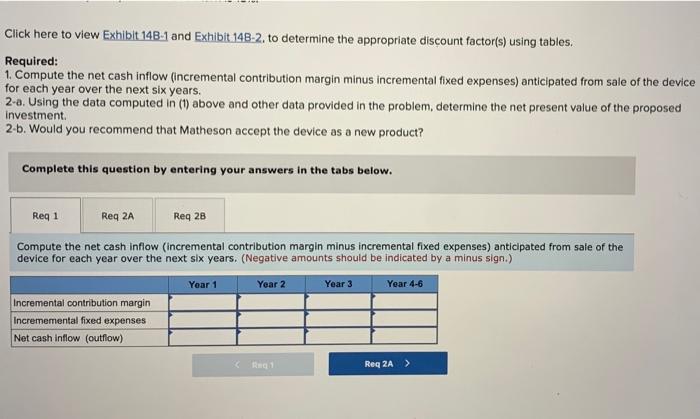

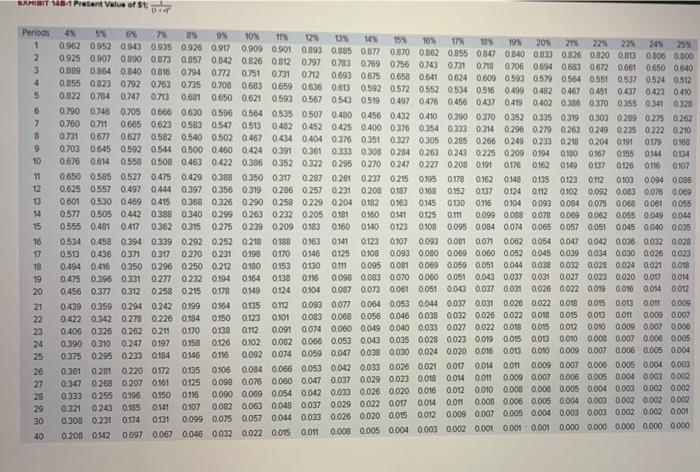

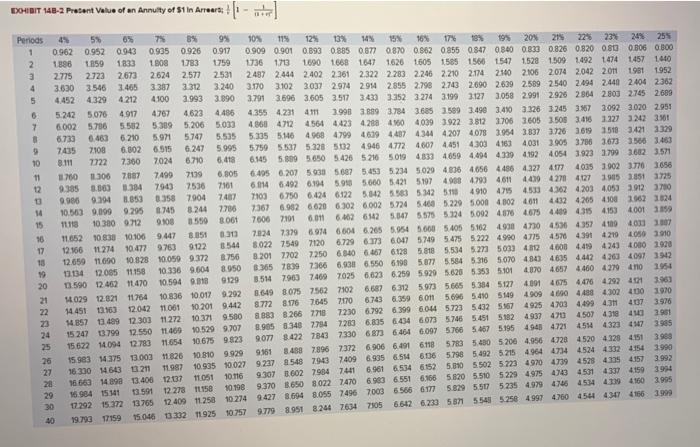

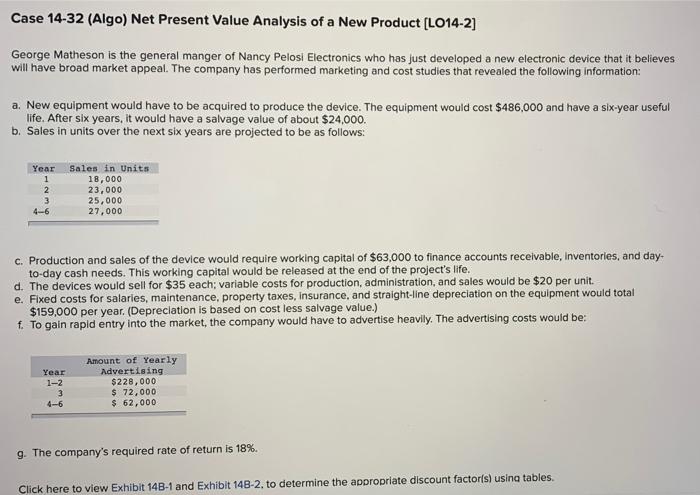

Case 14-32 (Algo) Net Present Value Analysis of a New Product (L014-2] George Matheson is the general manger of Nancy Pelosi Electronics who has just developed a new electronic device that it believes will have broad market appeal . The company has performed marketing and cost studies that revealed the following information: a. New equipment would have to be acquired to produce the device. The equipment would cost $486,000 and have a six-year useful life. After six years, it would have a salvage value of about $24,000. b. Sales in units over the next six years are projected to be as follows: Year 1 2 3 4-6 Sales in Units 18,000 23,000 25,000 27,000 c. Production and sales of the device would require working capital of $63,000 to finance accounts receivable, Inventories, and day- to-day cash needs. This working capital would be released at the end of the project's life. d. The devices would sell for $35 each; variable costs for production, administration, and sales would be $20 per unit. e. Fixed costs for salaries, maintenance, property taxes, insurance, and straight-line depreciation on the equipment would total $159,000 per year. (Depreciation is based on cost less salvage value.) f. To gain rapid entry into the market, the company would have to advertise heavily. The advertising costs would be: Year 1-2 3 4-6 Amount of Yearly Advertising $228,000 $ 72,000 $ 62,000 9. The company's required rate of return is 18%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. c. Production and sales of the device would require working capital of $63,000 to finance accounts receivable, Inventories, and day- to-day cash needs. This working capital would be released at the end of the project's life. d. The devices would sell for $35 each: variable costs for production, administration, and sales would be $20 per unit, e. Fixed costs for salaries, maintenance, property taxes, insurance, and straight-line depreciation on the equipment would total $159,000 per year. (Depreciation is based on cost less salvage value.) 1. To gain rapid entry into the market, the company would have to advertise heavily. The advertising costs would be: Year 1-2 3 4-6 Amount of Yearly Advertising $220,000 $ 72,000 $ 62,000 9. The company's required rate of return is 18% Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the device for each year over the next six years. 2-a. Using the data computed in (1) above and other data provided in the problem, determine the net present value of the proposed investment 2-b. Would you recommend that Matheson accept the device as a new product? Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Reg 2B Compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the FAIRLimited dan Am Click here to view Exhibit 14B-1 and Exhibit 148-2. to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the device for each year over the next six years. 2-a. Using the data computed in (1) above and other data provided in the problem, determine the net present value of the proposed investment 2.b. Would you recommend that Matheson accept the device as a new product? Complete this question by entering your answers in the tabs below. Reg 1 Req 2A Req 28 Compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the device for each year over the next six years. (Negative amounts should be indicated by a minus sign.) Year 1 Year 2 Year 3 Year 4-6 Incremental contribution margin Incrememental fixed expenses Net cash inflow (outflow) RE Reg 2A > AMIBIT 140-1 Present Value of St. Periods 4% 5% 6% 7% 86 9 10% 17 123 1 0.962 0952 0943 0935 0.926 0.917 0.909 0.901 0.893 0.385 0877 0.870 0.362 0.855 0947 0.840 0.831 0826 0.020 0.83 0.806 0.000 13 14% 15 16% 17% 10% 103 200 203 22 23 245 2 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0783 0.769 0.756 0243 0731 0.710 0706 0.694 0683 0.672 0661 0.650 0.540 3 0.889 0.864 0.840 0.816 0.794 0772 0.750 0.731 0.712 4 0.855 0.823 0.792 0763 07350.700 0.683 0.659 0.636 0613 0.592 0572 0.552 0534 0.516 0.499 0.482 0.467 0.451 0.437 0.423 0410 0.693 0.675 0.658 0.641 0624 0.009 0.593 0.579 0564 0.551 0537 0.524 0.512 5 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0456 0.437 0.419 0.402 0.396 03700355 03410320 6 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0352 0.335 0.319 0.303 0.299 0.275 0.262 7 0.750 0.711 0.665 0.023 0.583 0.547 0.513 0.482 0.452 0425 0.400 0.376 0.354 0333 0.314 0.296 0279 0.263 0249 0.235 0222 0.210 8 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0351 0.327 0.305 0.285 0.266 0.2490.233 0.2180204 0.191 9 0.179 0.168 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.204 0.263 0.243 0.225 0.209 0.194 0190 0.167 0155 0544 01034 10 0.676 0614 0.558 0.508 0463 0.422 0.386 0352 0.322 0.295 0.270 0.247 0.227 0.200 0.191 0.176 0.162 0.149 0.137 0120 0.116 0107 11 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0148 0.135 0.123 0.112 0.03 0.094 0086 12 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.21 0.208 0.187 0.168 0152 0137 0.124 0.112 0.1020.092 0.003 0.076 0.069 13 0.601 0.530 0.489 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0130 0.116 0.104 0,093 0.084 0.075 0.068 0.061 0.055 14 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.11 0.099 0.088 0.078 0.069 0.062 0.055 0.049 0044 15 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 0.40 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0.051 0.045 0.040 0.035 16 0534 0.458 0.394 0.339 0.292 0.252 0.218 0.1880.163 0.41 0.123 0107 0.093 0.081 0.071 0062 0.054 0.047 0.042 0.036 0.032 0.028 17 0.53 0.436 0.371 0317 0.270 0.231 0198 0.170 0.146 0125 0108 0.093 0.080 0.069 0.060 0052 0.045 0.039 0.034 0.030 0.026 0.023 18 0,494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.001 0.069 0.059 0.051 0.044 0.038 0.032 0.025 0.024 0.021 0.018 19 0.475 0.396 0.331 0.277 0.232 0.194 0164 0.138 0.116 0.098 0.003 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0.020 0.017 0.014 20 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.022 0.019 0.01 0.014 0.012 21 0.439 0.359 0294 0242 0.199 0.135 0.112 0.093 0.077 0.054 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0.015 0.003 0.011 0.009 22 0422 0342 0.278 0.226 0.184 0.150 0.123 0.101 0.083 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.007 23 0.400 0.326 0.262 0.211 0.170 0138 0.112 0,091 0.074 0.000 0.049 0.040 0.033 0.027 0.022 0.018 0.015 0.012 0010 0.009 0.007 0.006 24 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.002 0.066 0.053 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.010 0.008 0.007 0.008 0.005 25 0.375 0.295 0.233 0.194 0.146 0.156 0.092 0.074 0.059 0.047 0038 0.030 0.024 0.020 0.016 0.03 0.00 0.000 0.007 0.006 0.005 0.004 26 0.361 0.281 0.220 0.172 0.135 0.106 0084 0.066 0.053 0.042 0.033 0.025 0.021 0.017 0.014 0.01 0.009 0.007 0.006 0.005 0.004 0.003 27 0347 0.268 0.207 0.161 0.125 0.098 0.076 0.060 0.047 0.037 0.029 0.023 0.018 0.014 0.01 0.009 0.007 0.006 0.005 0.004 0.003 0.002 28 0.333 0.255 0.196 0.150 0.116 0.090 0.009 0.054 0.042 0.033 0.026 0.020 0.016 0.012 0.010 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.014 29 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.002 0.321 0.243 0.185 0141 0011 0107 0.082 0.063 0.048 0.037 0.029 0.022 0.017 30 0.308 0.231 0.174 0131 0.099 0.075 0.057 0.044 0.033 0.025 0.020 0,015 0,012 0009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001 40 0 200 0.542 0.097 0.067 0.046 0.032 0.022 0.015 0.01 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0164 EXHIBIT 148-2 Present Value of an Annuity of $1 in Arrears: Periods 1 2 3 4 5 0 7 . 9 10 77 11 12 2785 14 15 16 17 18 1 20 20 22 23 24 25 26 27 20 29 30 49 5% 0% 73 3% 9% 10% 115 12% 13% 14 15 16% 17% 18% 0.962 0.952 0.943 0.935 0.926 0.917 198 20% 21% 22% 23% 24% 255 0.909 0.901 0.893 0.885 0877 0.870 0.362 0855 0.847 0840 0.830 0.826 0.820 080 0.006 0000 1886 1859 1833 1808 1783 1759 1736 1713 1690 1668 1641 2775 1626 1605 1565 1560 1547 2.723 2673 2624 2.577 1.528 1.509 1492 1474 1457 1.440 2531 2487 2.444 2.402 2361 2322 2.283 2.246 2.210 2174 2100 2106 2.074 2.042 2011 3.630 3546 1465 3.387 1981 1952 3.312 3.240 3.170 3.102 3037 2.974 2954 2.855 2.798 2.743 2690 2.639 2.589 2540 2.494 2.440 2404 2362 4.452 4329 4212 4100 2.993 3.090 3.791 3.696 3.6053517 3.439 3.352 3274 3199 3127 3058 2.991 2925 2864 2.803 2745 2.689 5.242 5076 4.917 4767 4623 4.486 4355 4.231 41 3.9983389 3.784 3685 3589 3.490 3.410 3326 3245 3367 3.092 3.020 2.951 6002 5706 5.502 5389 5.200 5.033 4.860 4712 4564 4423 4288 4040393.922 3812 37063605 3.5053015 1.327 32423.01 6.730 6.463 6.210 5.971 5747 5.535 5.335 5.146 4.968 47994619 4407 43444207 4078 3.954 3.837 3.726 3619 518 3421 2329 7435 2108 6302 6.515 6.247 5.995 5.759 5.537 5328 5032 49464772 4607 4.451 4.303416340313.905 376 36733566 3.463 3.111 7722 7,300 7024 6.710 6.418 6.545 5.8.995.650 5.426 5216 5019 4.831 4659 4494 43394192 40543923 3.7993612 3.571 1700 1300 7496 709 6.805 6.4056 207 5030 5687 5450 5234 5029 4.6364656 4.486 4.327 4.177 4035 3.902 37701058 9.385 0.000 1334 7903 7536 7161 6,014 6492 614 5918 5.000 5.4215197 4900 4.793 4611 440 4270 4127 1905 1851 3725 9.986 9.394 3.850 0.350 7904 7487 1103 6.750 6.424 6122 5.642 3.583 5.342 5110 4910 4715 4.50343624.203 4.05339123780 10.563 9.099 9.295 0745 8.244 7.367 6.932 6620 6.302 6.002 57245.460 5.229 5.000 4102 4.011 4 432 4.205 4108 1062 1024 10.3009712 9.00 3550 8061 7000 2101 6.01 6462 6542 5.347 5.575.324 5.092 4.176 4.675 4409 435 4.15340013159 11.652 10.838 10:106 9.447 8.051 0313 7024737969146004 6.265 5.954 5.600 5.405 5162 4998 4730453643574119401 1007 12.166 11274 10.477 9763 9.122 3544 30227549 2120 6.729 6.373 60475749 5.475 5222 4990 4775 4570 4391 4210 LOSO 1910 12.659 1690 10.828 10.050 9.372 8.750 8.201 2702 7.250 6.40 6.457 6128 5.818 5,534 5.271503344.000 4.419 42434000 1920 1134 12.005 11158 10.336 9.604 8.950 3.365 789 7366 6.931 6.550 6,198 5.877 5.584 5.316 5.070 4.341 4635 4442 4260 4097 32 10.594 2018 13 590 12.462 1470 9129 1954 3.514 7.963 7469 7025 6.623 6.259 5.929 5.628 5.353 51014370 4657 446042794no 1029 12.021 11754 8.649 3.0757562 7102 10.836 10 017 9.292 3963 6.687 6312 5973 5665 5384 5127 4.091 4675 476 4292401 10.201 9442 7645 87728.176 7.170 14.451 9.163 12.042 11061 4.909 460 4.488 4.302 400 1970 6736359 601 5696 5490 5149 10 371 9580 14.357 1499 12.303 11.272 8.883 8266 7710 4037 3576 7230 6.792 6.399 6.04 5723 5432 5567 4925 473 4499 4.31 15 247 3799 12.550 11469 4507 431842901 8.905 83432754 10.529 9.707 7203 6.805 434 60735746 5.451 5182 4937 40 3905 15.622 14.094 12783 11654 10675 9.823 907784227343 7330687364646,097 5766 5467 51954943 4.721 451 4323 47 39 5703 5430 5 200 4.956 4723 4520 43284151 9151 15 983 14.375 13.003 11.826 10 810 9.929 84887896 7372 6906 6.491 6118 16300 14643 1211 5.798 5.492 5.215 49644734 4.524 4332 4154 1990 10 935 10.027 11987 92371548 7943 7409 6.935 6.514 6.36 3.992 6534 61525.010 5502 5223 4970 47394528 495 4.157 12.37 7441 11051 16 663 14.898 13:406 6.961 9307 1.6027984 10.116 4571 5.620 5.510 5229 4.975 4743 433741593994 6.903 6551 6166 2591 16.984 15.341 12.278 1150 9.370 650 8022 2470 10198 5.829 5507 5 235 4.979 470 4534 419 4100 3.995 12.292 15 372 13765 12.409 11258 10 274 9427 8.694 8.055 7496 7003 6586 6177 7105 6612 6.233 557 554 5.258 4997 4.760 454 4317 4156 3999 19.793 17159 15 046 0339211925 10.7579.7798.951 8.244 7634 g. The company's required rate of return is 18% Click here to view Exhibit 148.1 and Exhibit 14B-2. to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the device for each year over the next six years. 2-a. Using the data computed in (1) above and other data provided in the problem, determine the net present value of the proposed Investment 2-b. Would you recommend that Matheson accept the device as a new product? Complete this question by entering your answers in the tabs below. Req 1 Req 2A Reg 2B Using the data computed in (1) above and other data provided in the problem, determine the net present value of the proposed investment. (Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount.) Net present value g. The company's required rate of return is 18%. Click here to view Exhibit 148-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the device for each year over the next six years. 2-a. Using the data computed in (1) above and other data provided in the problem, determine the net present value of the proposed 2-b. Would you recommend that Matheson accept the device as a new product? investment. Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Reg 2B Would you recommend that Matheson accept the device as a new product? O No 10Yes