urgent help needed to answer these questions. pls provide correct answers only. thank u in advance!!

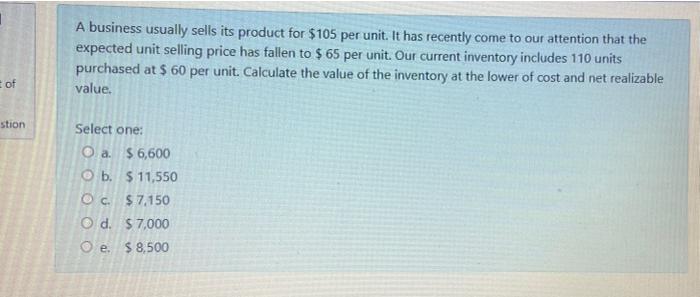

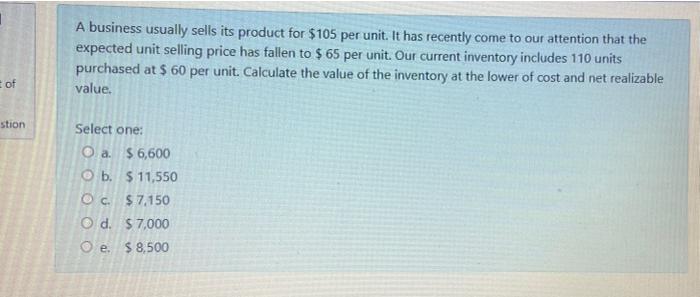

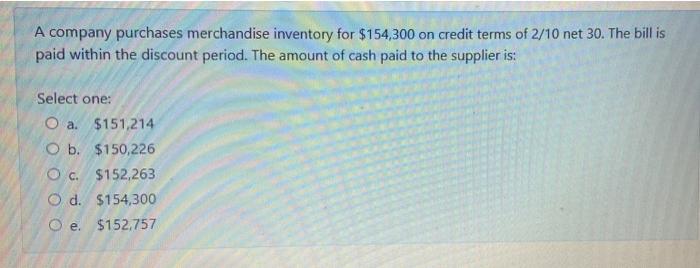

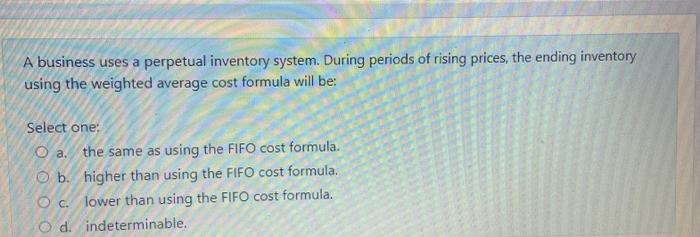

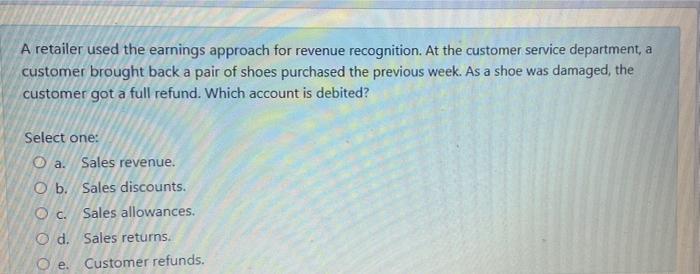

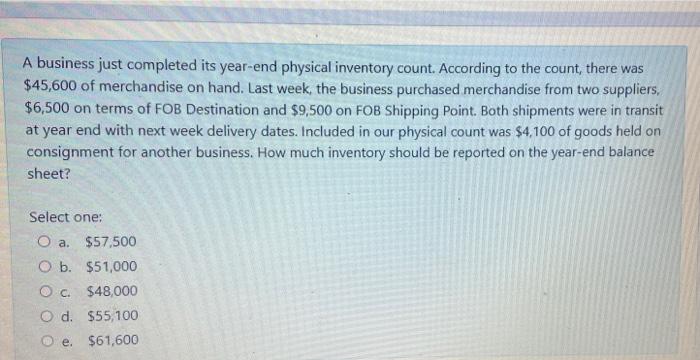

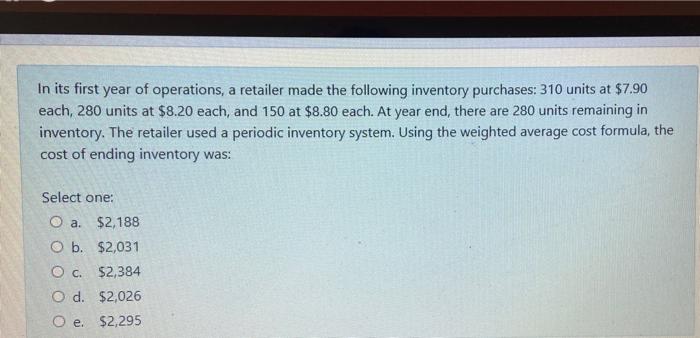

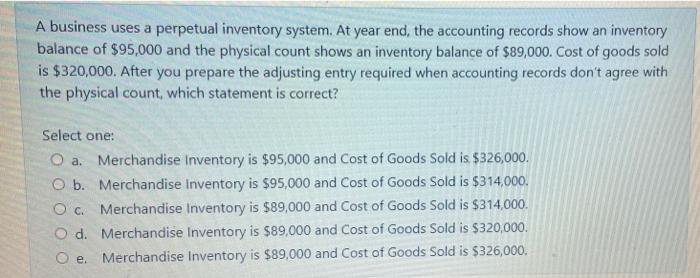

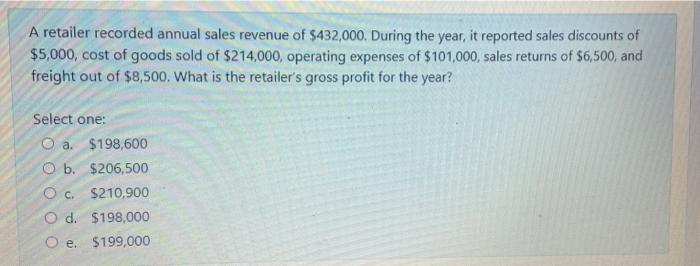

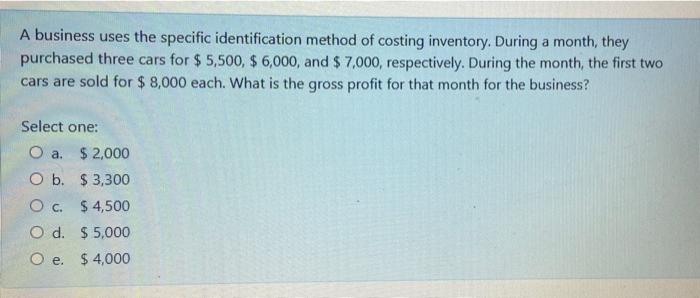

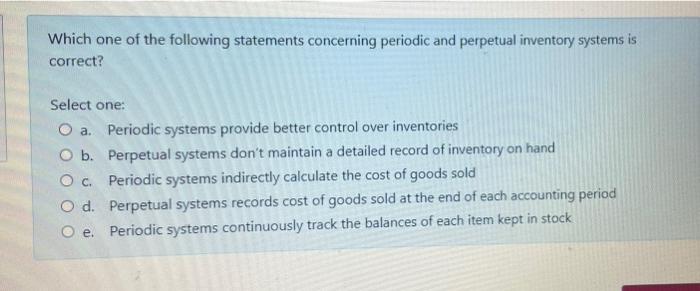

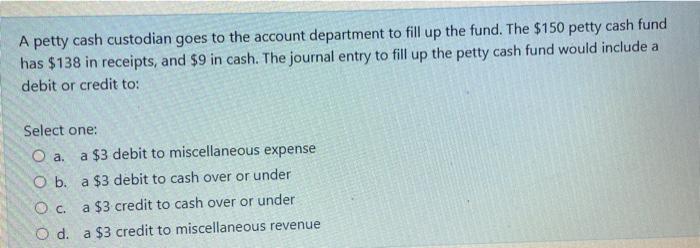

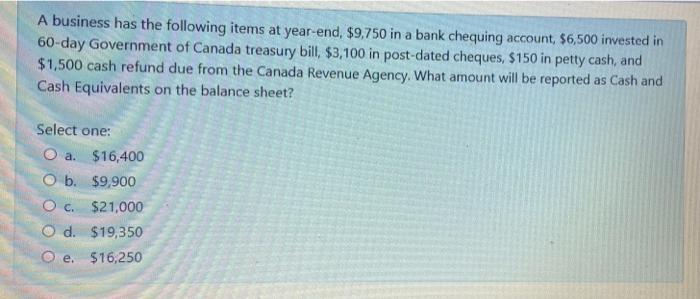

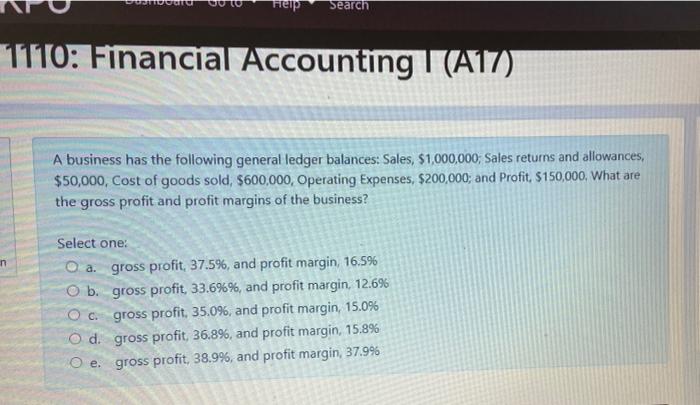

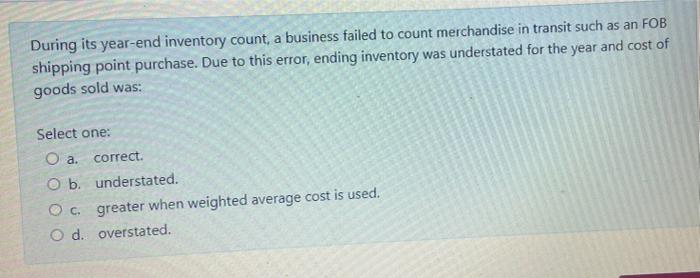

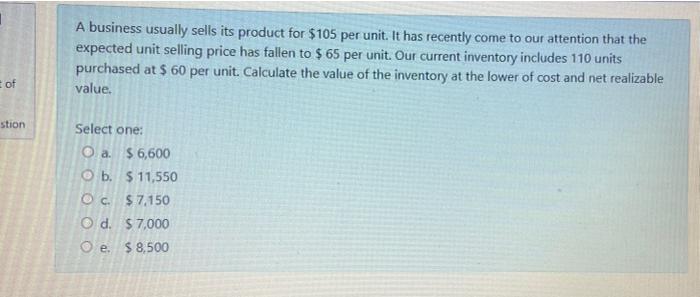

A business usually sells its product for $105 per unit. It has recently come to our attention that the expected unit selling price has fallen to $ 65 per unit. Our current inventory includes 110 units purchased at $ 60 per unit. Calculate the value of the inventory at the lower of cost and net realizable value. of stion Select one: O a $6,600 O b. $ 11,550 Oc$7,150 Od $7,000 e. $ 8,500 A company purchases merchandise inventory for $154,300 on credit terms of 2/10 net 30. The bill is paid within the discount period. The amount of cash paid to the supplier is: Select one: O a $151,214 O b. $150,226 O c. $152,263 O d. $154,300 Oe $152,757 A business uses a perpetual inventory system. During periods of rising prices, the ending inventory using the weighted average cost formula will be: Select one: O a. the same as using the FIFO cost formula. O b. higher than using the FIFO cost formula. Oc lower than using the FIFO cost formula. O dindeterminable. A retailer used the earnings approach for revenue recognition. At the customer service department, a customer brought back a pair of shoes purchased the previous week. As a shoe was damaged, the customer got a full refund. Which account is debited? Select one: O a. Sales revenue. O b. Sales discounts. O c. Sales allowances. O d. Sales returns Oe Customer refunds. A business just completed its year-end physical inventory count. According to the count, there was $45,600 of merchandise on hand. Last week, the business purchased merchandise from two suppliers, $6,500 on terms of FOB Destination and $9,500 on FOB Shipping Point. Both shipments were in transit at year end with next week delivery dates. Included in our physical count was $4,100 of goods held on consignment for another business. How much inventory should be reported on the year-end balance sheet? Select one: O a. $57,500 O b. $51,000 Oc. $48,000 O d. $55,100 $61,600 o e In its first year of operations, a retailer made the following inventory purchases: 310 units at $7.90 each, 280 units at $8.20 each, and 150 at $8.80 each. At year end, there are 280 units remaining in inventory. The retailer used a periodic inventory system. Using the weighted average cost formula, the cost of ending inventory was: Select one: O a $2,188 O b. $2,031 O c. $2,384 O d. $2,026 O e. $2,295 A business uses a perpetual inventory system. At year end, the accounting records show an inventory balance of $95,000 and the physical count shows an inventory balance of $89,000. Cost of goods sold is $320,000. After you prepare the adjusting entry required when accounting records don't agree with the physical count, which statement is correct? Select one: O a Merchandise Inventory is $95,000 and Cost of Goods Sold is $326,000. O b. Merchandise Inventory is $95,000 and Cost of Goods Sold is $314,000. Oc. Merchandise Inventory is $89,000 and Cost of Goods Sold is $314,000. O d. Merchandise Inventory is $89,000 and Cost of Goods Sold is $320,000. Oe. Merchandise Inventory is $89,000 and Cost of Goods Sold is $326,000. A retailer recorded annual sales revenue of $432,000. During the year, it reported sales discounts of $5,000, cost of goods sold of $214,000, operating expenses of $101,000, sales returns of $6,500, and freight out of $8,500. What is the retailer's gross profit for the year? Select one: O a $198,600 O b. $206,500 Oc. $210.900 O d. $198.000 e. $199,000 A business uses the specific identification method of costing inventory. During a month, they purchased three cars for $ 5,500, $ 6,000, and $ 7,000, respectively. During the month, the first two cars are sold for $ 8,000 each. What is the gross profit for that month for the business? Select one: O a $2,000 O b. $3,300 O c. $ 4,500 O d. $5,000 O e. $ 4,000 Which one of the following statements concerning periodic and perpetual inventory systems is correct? Select one: O a. Periodic systems provide better control over inventories O b. Perpetual systems don't maintain a detailed record of inventory on hand Oc. Periodic systems indirectly calculate the cost of goods sold O d. Perpetual systems records cost of goods sold at the end of each accounting period O e. Periodic systems continuously track the balances of each item kept in stock A petty cash custodian goes to the account department to fill up the fund. The $150 petty cash fund has $138 in receipts, and $9 in cash. The journal entry to fill up the petty cash fund would include a debit or credit to: Select one: O a. a $3 debit to miscellaneous expense O b. a $3 debit to cash over or under O c. a $3 credit to cash over or under O d. a $3 credit to miscellaneous revenue A business has the following items at year-end, $9,750 in a bank chequing account. $6,500 invested in 60-day Government of Canada treasury bill, $3,100 in post-dated cheques, $150 in petty cash, and $1,500 cash refund due from the Canada Revenue Agency. What amount will be reported as Cash and Cash Equivalents on the balance sheet? Select one: O a. $16,400 O b. $9,900 O c. $21,000 O d. $19,350 O e. $16,250 Help Search 1110: Financial Accounting (A17) A business has the following general ledger balances: Sales, $1,000,000, Sales returns and allowances, $50,000, Cost of goods sold, $600,000, Operating Expenses, $200,000; and Profit, $150,000. What are the gross profit and profit margins of the business? n Select one: O a. gross profit. 37.5%, and profit margin 16.5% O b. gross profit, 33.6%%, and profit margin 12.6% Ocgross profit, 35.0%, and profit margin, 15.0% O d. gross profit, 36.8%, and profit margin, 15.8% O e. gross profit, 38.9%, and profit margin, 37.9% During its year-end inventory count, a business failed to count merchandise in transit such as an FOB shipping point purchase. Due to this error, ending inventory was understated for the year and cost of goods sold was: Select one: O a. correct. Ob understated. Oc greater when weighted average cost is used. O d.overstated