Answered step by step

Verified Expert Solution

Question

1 Approved Answer

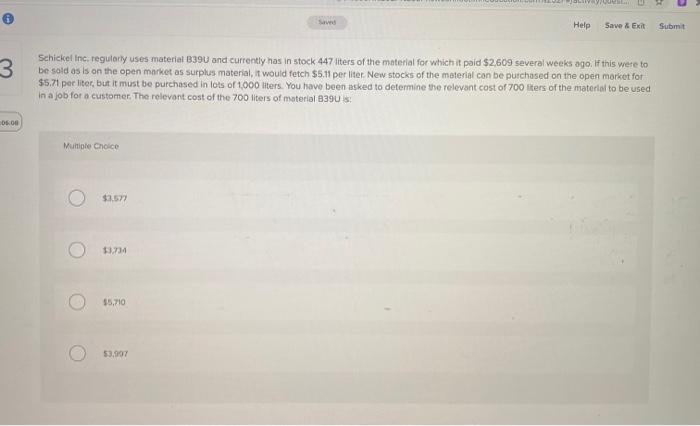

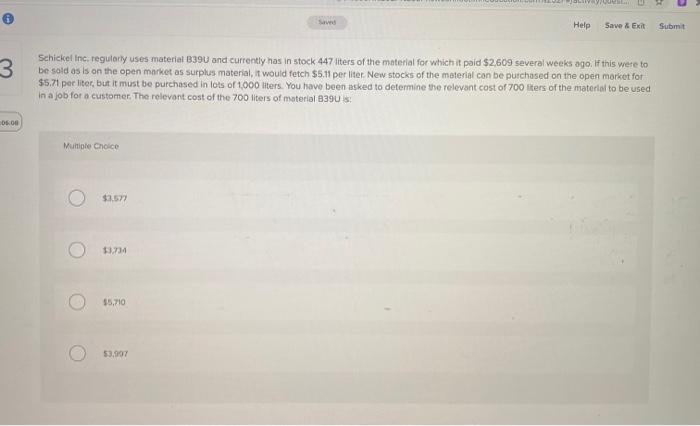

URGENT HELP PLEASE! Help Save & Exit Submit 3 Schickel Inc. regularly uses material B390 and currently has in stock 447 liters of the material

URGENT HELP PLEASE!

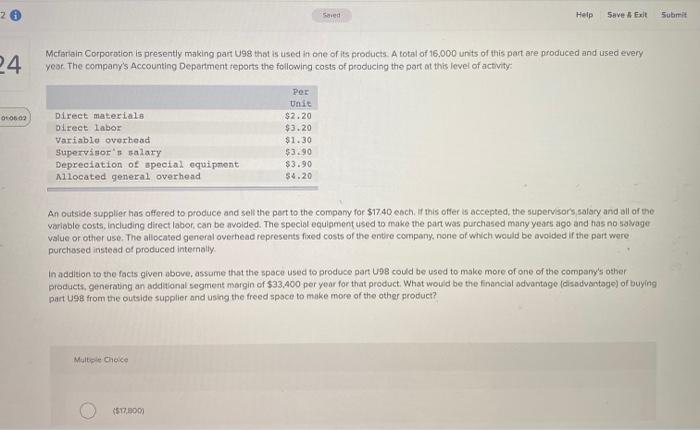

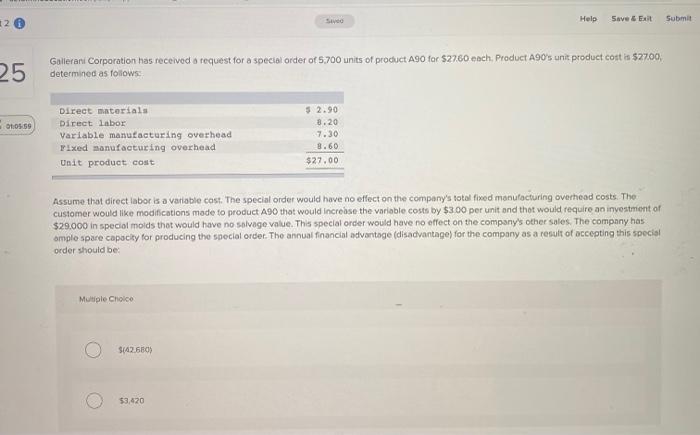

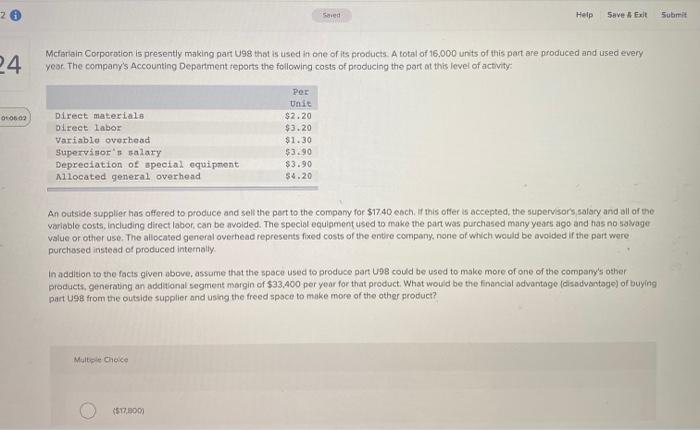

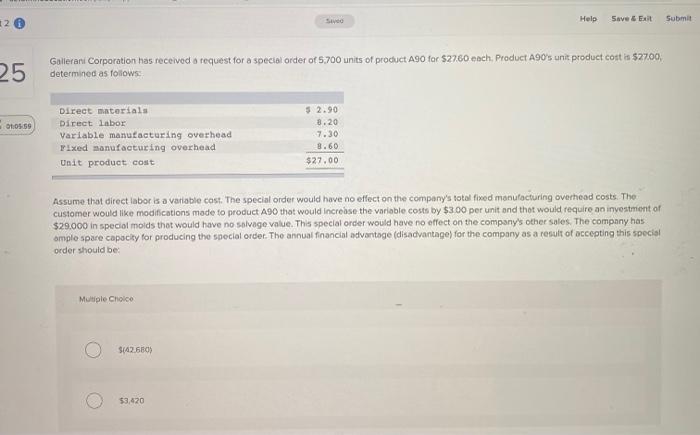

Help Save & Exit Submit 3 Schickel Inc. regularly uses material B390 and currently has in stock 447 liters of the material for which it paid $2,609 several weeks ago. If this were to be sold as is on the open market as surplus material, it would fetch $5.11 per liter. New stocks of the material can be purchased on the open market for $5.71 per liter, but it must be purchased in lots of 1,000 liters. You have been asked to determine the relevant cost of 700 liters of the material to be used in a job for a customer. The relevant cost of the 700 liters of material 6390 S 05.00 Multiple Choice $2.57 13.734 . $5.710 O 53.907 20 Saved Help Save Exit Submit 24 Mcfarlain Corporation is presently making part U98 that is used in one of its products. A total of 16,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part of this level of activity Donde Direct materials Direct Labor Variable overbead Supervisor's salary Depreciation of special equipment Allocated general overhead Per Unit $2.20 $3.20 $1.30 $3.90 $3.90 $4.20 An outside supplier has offered to produce and sell the part to the company for $1740 each. If this offer is accepted the supervisor's salary and all of the variable costs, including direct labor can be avoided. The special equipment used to make the part was purchased many years ago and has no savage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally In addition to the facts given above, assume that the space used to produce par U98 could be used to make more of one of the company's other products, generating an additional segment margin of $33,400 per year for that product. What would be the financial advantage (disadvantage) of buying part 98 from the outside supplier and using the freed space to make more of the other product? Muito Choco (577,200 SO Help Save Ex Submit 12 25 Gallerani Corporation has received a request for a special order of 5.700 units of product A90 for $2260 each. Product A90's unit product cost is $2700, determined as follows: 01.05.59 Direct materials Direct Labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost 5 2.90 3.20 7.30 8.60 $27.00 Assume that direct laboris a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $3.00 per unit and that would require an investment of $29.000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has omple spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be Multiple Choice 5442680) $3,420

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started