Answered step by step

Verified Expert Solution

Question

1 Approved Answer

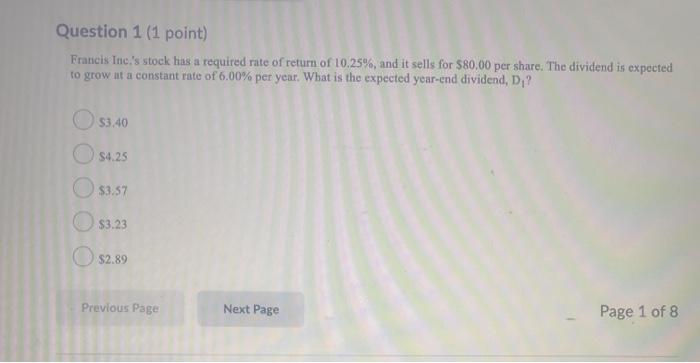

URGENT HELP PLEASE!!!! Question 1 (1 point) Francis Inc.'s stock has a required rate of return of 10.25%, and it sells for $80,00 per share.

URGENT HELP PLEASE!!!!

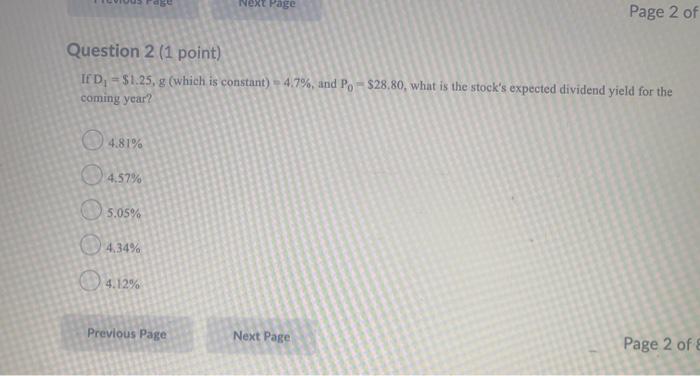

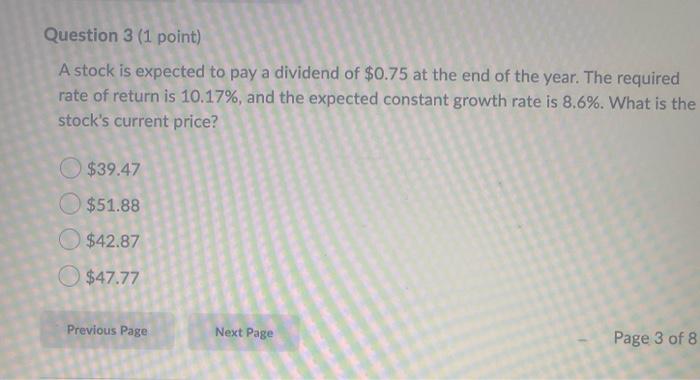

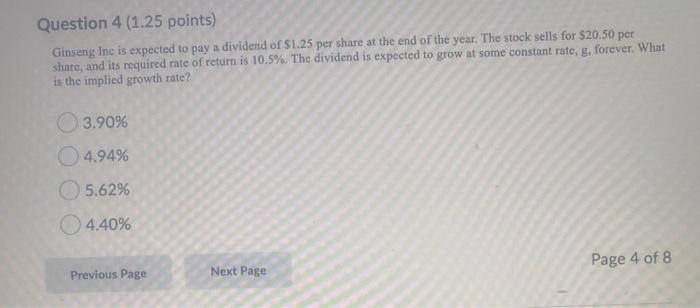

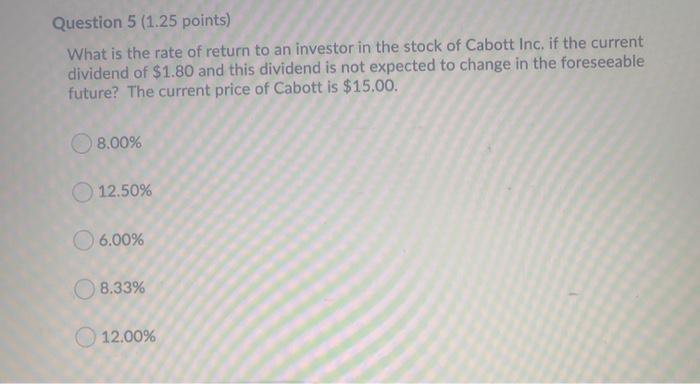

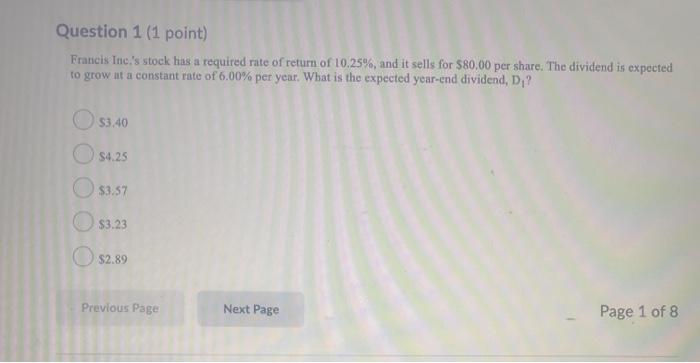

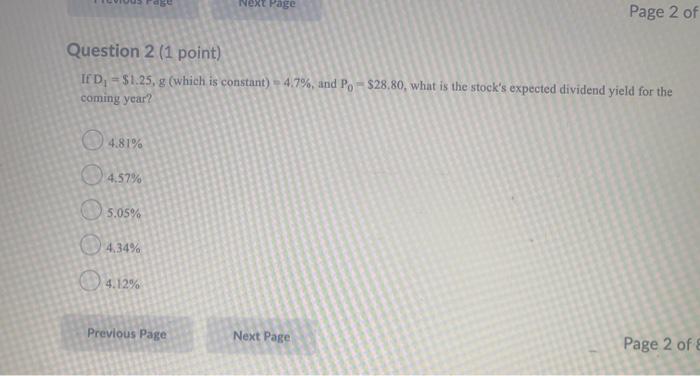

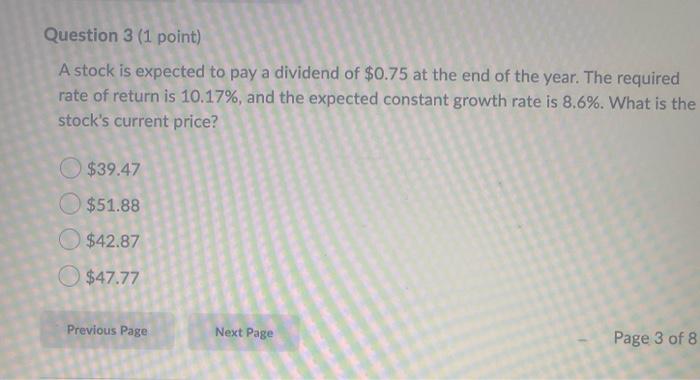

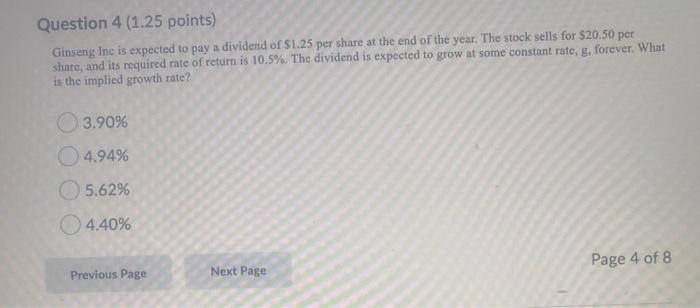

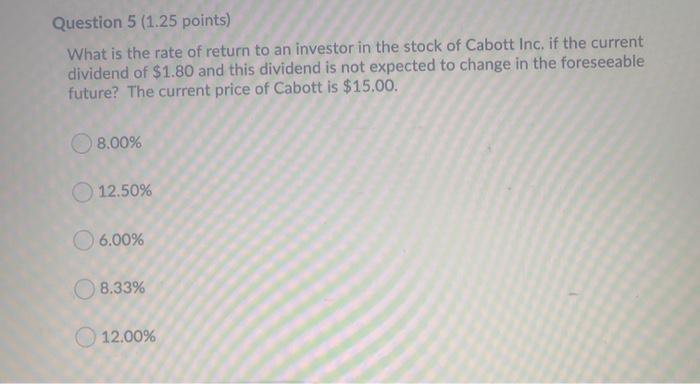

Question 1 (1 point) Francis Inc.'s stock has a required rate of return of 10.25%, and it sells for $80,00 per share. The dividend is expected to grow at a constant rate of 6.00% per year. What is the expected year-end dividend, D;? $3,40 54.25 $3.57 $3.23 $2.89 Previous Page Next Page Page 1 of 8 Next Page Page 2 of Question 2 (1 point) IFD, = $1.25, g (which is constant) - 4.7%, and Po - $28,80, what is the stock's expected dividend yield for the coming year? 4.81% 4.57% 5.05% 4.34% 43 4.12% Previous Page Next Page Page 2 of 8 Question 3 (1 point) A stock is expected to pay a dividend of $0.75 at the end of the year. The required rate of return is 10.17%, and the expected constant growth rate is 8.6%. What is the stock's current price? $39.47 $51.88 $42.87 $47.77 Previous Page Next Page Page 3 of 8 Question 4 (1.25 points) Ginseng Inc is expected to pay a dividend of $1.25 per share at the end of the year. The stock sells for $20.50 per share, and its required rate of return is 10.5%. The dividend is expected to grow at some constant rate, g, forever. What is the implied growth rate? 3.90% 4.94% 5.62% 4.40% Page 4 of 8 Previous Page Next Page Question 5 (1.25 points) What is the rate of return to an investor in the stock of Cabott Inc. if the current dividend of $1.80 and this dividend is not expected to change in the foreseeable future? The current price of Cabott is $15.00. 8.00% 12.50% 6.00% 8.33% 12.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started