Urgent help please. thank you.

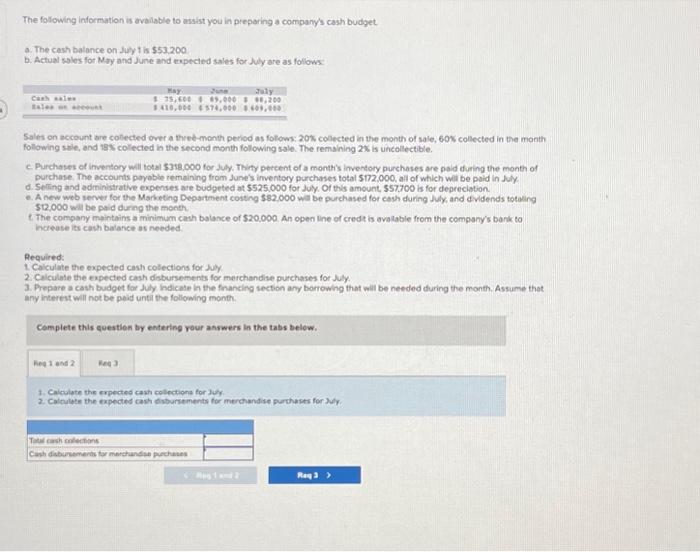

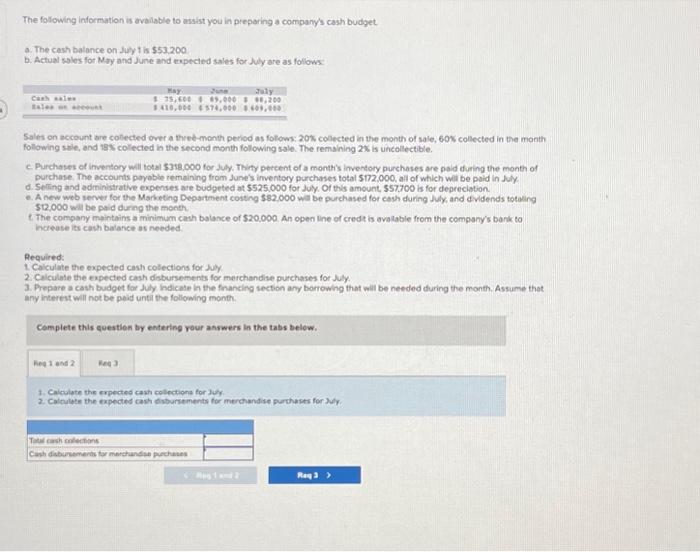

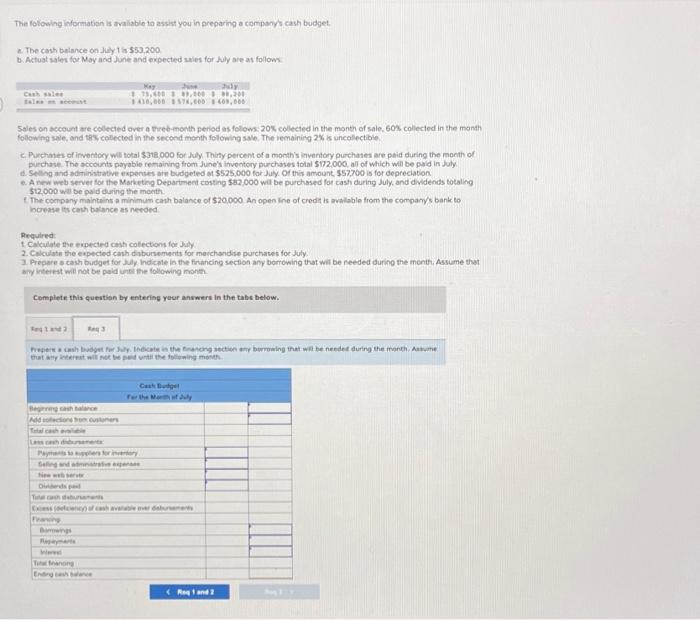

The following information is available to assist you in preparing a company's cash budget. a. The cesh balance on July 1 is $53.200 b. Actual soles for Moy and June and expecled sales for July are as follows: Soles on account bre colfected over a thred-menth period as folows: 20os colected in the month of sale, 60 s colected in the month following sele, and 185 collected in the second month following sole. The remsining 2% is uncollectible. c. Purchases of imventory will total 5318,000 for july. Thity percent of a month's inventory purchases are noid during the month of purchase. The accounts poyable remaining from June's imventory purchases total 5172.000 , ali of which wei be paid in July. d. Seling and administratve expenses are budpeted at 5525,000 for July, Of this amount, 557700 is for depreciation. e. A new web server for the Marketing Department costing $82.000 wit be purchased for cash during July, and d vidends totaling 512.000 will be paid during the month. t. The company meintains a minimum cash balance of $20.000. An open line of credt is avalable from the company's bark to horease its cash balance as needed. Required: 1 Calculate the expected cash collections for Jvly 2. Culculate the expected cash disbursements for merchandise purchases for July. 3. Prepare a cash budget for July indicate in the fonancing section any borrowing that will be needed during the month. Assume that any interest will not be poid until the following month. Complete this euestion by entering your answers in the tabs below. 1. Calculate the erpected cash collectiona for July. 2. Caltulten the expected cash diburnements for merchandise purthuses for Jdy. The folowing infomation is twaliable ta assist you in preparing a compony's cash buidget. 2. The cash balmance on duly 1 in 533,200 b. Actuat sales foe May and June and expected awies for Jly are as follow. Sales on account are colected over a tred-honth period as folows: 20% collected in the month of sale, 605 collected in the month folowing sale, and ths collected in the second month folowing sale. The vemaining 2% is uncolectible. c. Pucchmes of inventory wil total $318000 for Jly. Thiny percent of a moeth's inventory purchates are paid during the month of purchase. The accounts potyable remaining from June s livectory purchases total $132,000, all of which will be paid in July d. Selling and adininistrateve expenses are budgeted at 5525,000 for July. Of thes amount, 557,700 is for depreciation. e. A new web server for the Marketing Department costing 532,000 wal be purchased for cash during July, and dividends toealing \$12.000 wall be pald daring the month. f The company maintains a minimum cath balance of 520,000 An open ine of credt is avalable from the compam/s bank to hovase its cach balance as needed Requlred 1 Calculate the expected cosh colections for July. 2. Calculate the expected cash dibbusemects for merchandise purchates foc July. 1. Prepare o cash budget for July, hndicate in the firtancing seclion any borrowing that wit be reeded during the month. Assume that. by inteiest wit not be pald unti the following inonth. Complete this question by entering your answers in the tabe below