Answered step by step

Verified Expert Solution

Question

1 Approved Answer

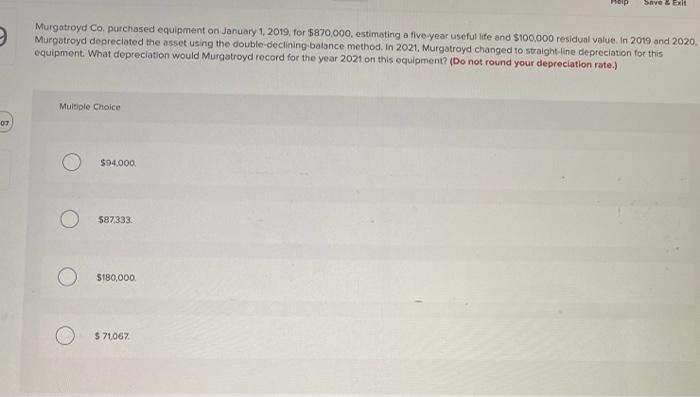

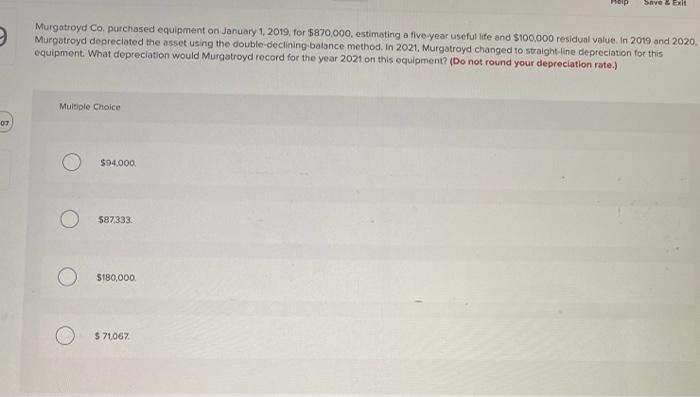

URGENT HELP Save & Ext Murgatroyd Co purchased equipment on January 1, 2019, for $870,000, estimating a five-year useful life and $100.000 residual value in

URGENT HELP

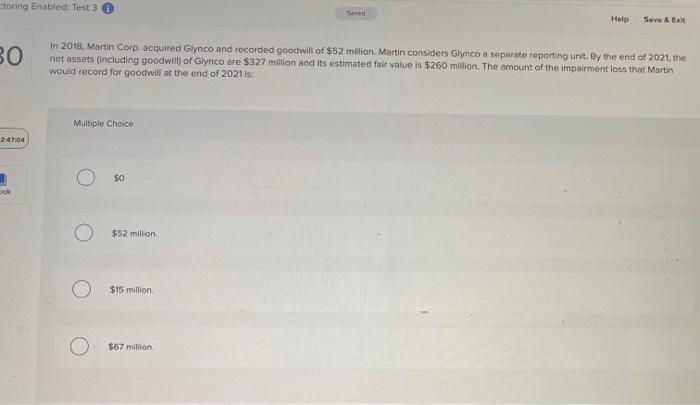

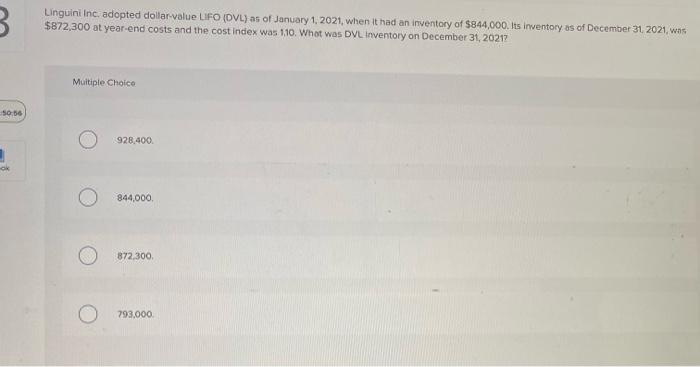

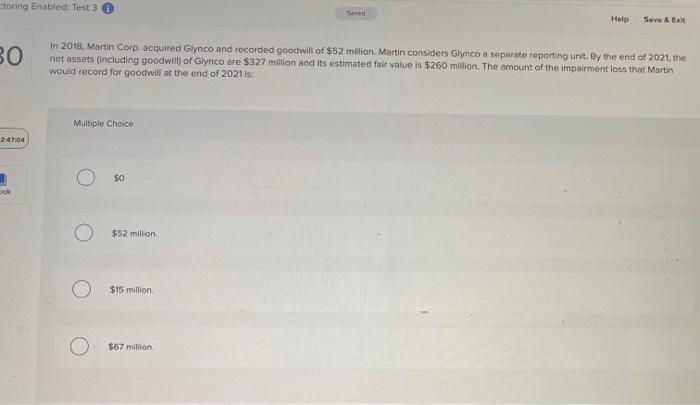

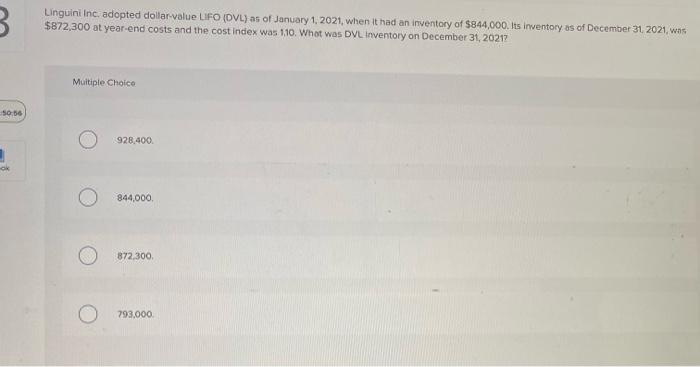

Save & Ext Murgatroyd Co purchased equipment on January 1, 2019, for $870,000, estimating a five-year useful life and $100.000 residual value in 2019 and 2020, Murgotroyd depreciated the asset using the double-declining balance method. In 2021, Murgatroyd changed to straight line depreciation for this equipment What depreciation would Murgatroyd record for the year 2021 on this equipment? (Do not round your depreciation rate.) Multiple Choice 07 $94.000 O 587333 $180,000 $ 71,067 toring Enabled: Test 3 Help Save & ER BO In 2018, Martin Corp, acquired Glynco and recorded goodwill of $52 million Martin considers Glynco a separate reporting unit. By the end of 2021, the net assets (including goodwill) of Glynco are $327 million and its estimated fair value is $260 million. The amount of the impairment loss that Martin would record for goodwill at the end of 2021 is: Multiple Choice 37:04 $0 Ook $52 million $15 million $67 million 3 Linguini Inc. adopted dollar value LIFO (OVL) as of January 1, 2021, when it had an inventory of $844,000. Its inventory as of December 31, 2021, was $872,300 at year-end costs and the cost index was 110. What was DVL Inventory on December 31, 2021? Multiple Choice 50:56 928.400 844,000 872,300 793.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started