urgent!!

help something wrong with my answers

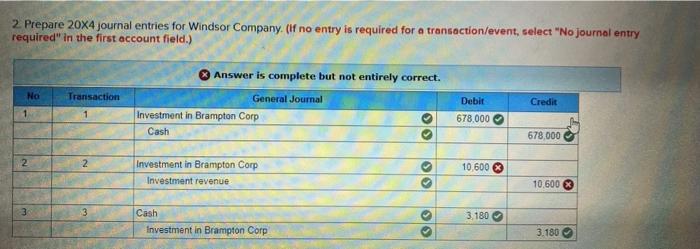

2.

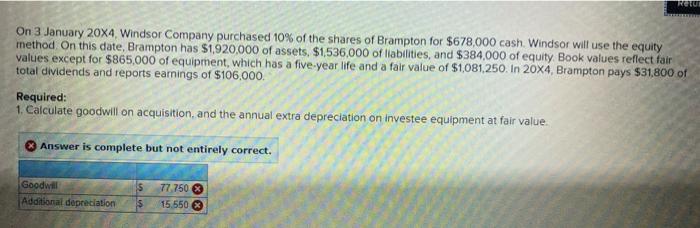

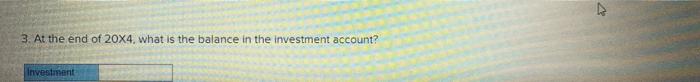

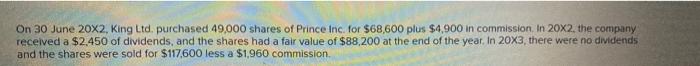

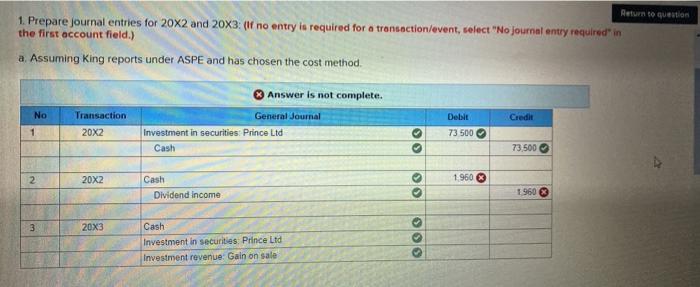

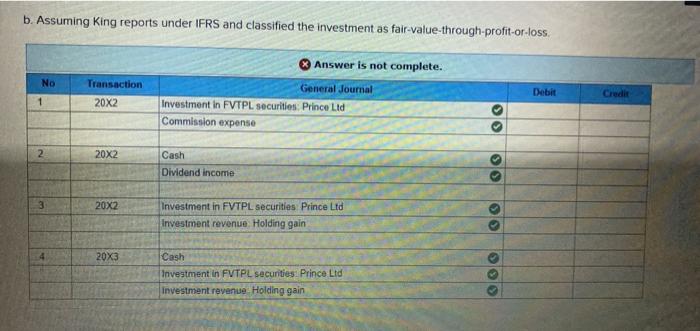

RETU On 3 January 20X4 Windsor Company purchased 10% of the shares of Brampton for $678,000 cash Windsor will use the equity method On this date, Brampton has $1,920,000 of assets, $1,536,000 of liabilities, and $384,000 of equity Book values reflect fair values except for $865,000 of equipment, which has a five-year life and a fair value of $1,081,250. In 20x4, Brampton pays $31.800 of total dividends and reports earings of $106.000. Required: 1. Calculate goodwill on acquisition, and the annual extra depreciation on investee equipment at fair value 3 Answer is complete but not entirely correct. Goodwill Additional depreciation 77.750 15,5503 2. Prepare 20X4 journal entries for Windsor Company. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Transaction Answer is complete but not entirely correct. General Journal Investment in Brampton Corp Cash Credit 1 1 Debit 678,000 678,000 2 Investment in Brampton Corp Investment revenue ols 10.600 3 10.600 3 180 Cash Investment in Brampton Corp ols 3.180 3. At the end of 20X4, what is the balance in the investment account? Investment On 30 June 20x2, King Ltd, purchased 49.000 shares of Prince Inc. for $68,600 plus $4,900 in commission. In 20x2. the company received a $2.450 of dividends, and the shares had a fair value of $88,200 at the end of the year. In 20x3, there were no dividends and the shares were sold for $117.600 less a $1,960 commission Return to question 1. Prepare journal entries for 20x2 and 20x3: (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. Assuming King reports under ASPE and has chosen the cost method. Answer is not complete. Credit No 1 Transaction 20X2 General Journal Investment in securities: Prince Ltd Cash Debit 73 500 00 73,500 2 20X2 lo 1960 Cash Dividend Income 1960 3 20x3 Cash Investment in securities Prince Ltd Investment revenue Gain on sale SO b. Assuming King reports under IFRS and classified the investment as fair-value-through-profit-or-loss. No 1 Transaction 20X2 Answer is not complete. General Journal Investment in FVTPL securities: Prince Ltd Commission expense Debit Credhe 2 20X2 3 Cash Dividend income 20X2 Investment in FVTPL Securities Prince Ltd Investment revenue Holding gain 20X3 Cash Investment in FVTPL securities Prince Ltd investment revenue Holding gain ololo