Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT help with this econ question, please show all steps and explaination clearly, thanks! QUESTION 2 - PART C (25 Points] The following figures are

URGENT help with this econ question, please show all steps and explaination clearly, thanks!

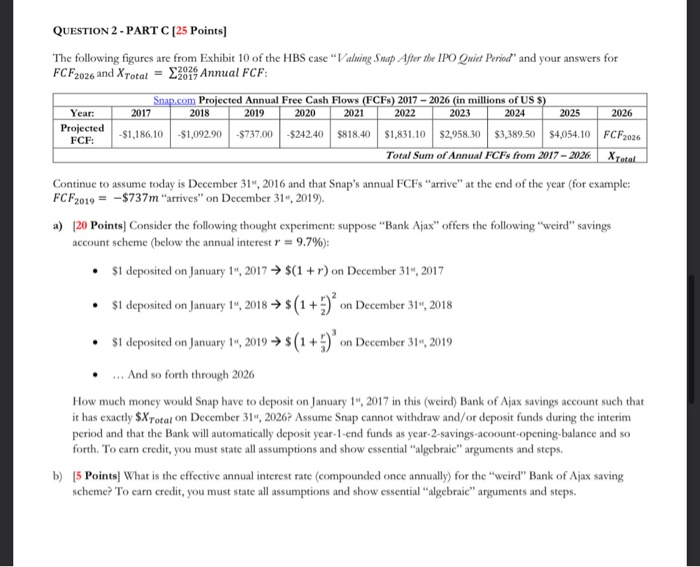

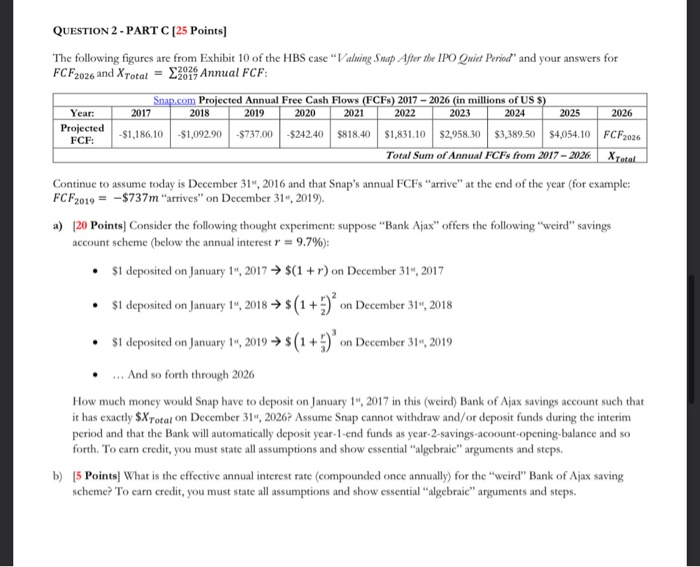

QUESTION 2 - PART C (25 Points] The following figures are from Exhibit 10 of the HBS case "Valming Snap After the IPO Qwiel Period and your answers for FCF2026 and XTotal = 22029 Annual FCF: Snap.com Projected Annual Free Cash Flows (FCFS) 2017 - 2026 (in millions of US S) Year: 2018 2019 2020 2022 2023 2024 Projected FCF: -$1,186,10-$1,092.90-$737.00 $242.40 $818.40 $1,831.10 $2,958,30 $3,389,50 $4,054.10 FCF2026 Total Sum of Annual FCFs from 2017 2026 Xrotal Continue to assume today is December 31, 2016 and that Snap's annual FCFs "arrive at the end of the year (for example: FCF2019 = $737m "arrives" on December 31, 2019). 2017 2021 2025 2026 a) (20 Points) Consider the following thought experiment: suppose "Bank Ajax" offers the following "weird" savings account scheme (below the annual interest r = 9.7%): $1 deposited on January 1, 2017 $(1 + r) on December 314, 2017 $1 deposited on January 1", 2018 $(1 +)' on December 31", 2018 $1 deposited on January 1", 2019 +$(1+)' on December 31, 2019 ... And so forth through 2026 How much money would Snap have to deposit on January 14, 2017 in this (weird) Bank of Ajax savings account such that it has exactly $XTotal on December 31, 20262 Assume Snap cannot withdraw and/or deposit funds during the interim period and that the Bank will automatically deposit year-1-end funds as year-2-savings-account-opening-balance and so forth. To carn credit, you must state all assumptions and show essential "algebraic" arguments and steps. b) (5 Points) What is the effective annual interest rate (compounded once annually) for the "weird" Bank of Ajax saving scheme? To earn credit, you must state all assumptions and show essential "algebraic" arguments and steps. QUESTION 2 - PART C (25 Points] The following figures are from Exhibit 10 of the HBS case "Valming Snap After the IPO Qwiel Period and your answers for FCF2026 and XTotal = 22029 Annual FCF: Snap.com Projected Annual Free Cash Flows (FCFS) 2017 - 2026 (in millions of US S) Year: 2018 2019 2020 2022 2023 2024 Projected FCF: -$1,186,10-$1,092.90-$737.00 $242.40 $818.40 $1,831.10 $2,958,30 $3,389,50 $4,054.10 FCF2026 Total Sum of Annual FCFs from 2017 2026 Xrotal Continue to assume today is December 31, 2016 and that Snap's annual FCFs "arrive at the end of the year (for example: FCF2019 = $737m "arrives" on December 31, 2019). 2017 2021 2025 2026 a) (20 Points) Consider the following thought experiment: suppose "Bank Ajax" offers the following "weird" savings account scheme (below the annual interest r = 9.7%): $1 deposited on January 1, 2017 $(1 + r) on December 314, 2017 $1 deposited on January 1", 2018 $(1 +)' on December 31", 2018 $1 deposited on January 1", 2019 +$(1+)' on December 31, 2019 ... And so forth through 2026 How much money would Snap have to deposit on January 14, 2017 in this (weird) Bank of Ajax savings account such that it has exactly $XTotal on December 31, 20262 Assume Snap cannot withdraw and/or deposit funds during the interim period and that the Bank will automatically deposit year-1-end funds as year-2-savings-account-opening-balance and so forth. To carn credit, you must state all assumptions and show essential "algebraic" arguments and steps. b) (5 Points) What is the effective annual interest rate (compounded once annually) for the "weird" Bank of Ajax saving scheme? To earn credit, you must state all assumptions and show essential "algebraic" arguments and steps

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started