Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Urgent I need Help, please I do not understand the assumptions for expanding Please use the following information to analyze what CLEAN should do. -

Urgent I need Help, please I do not understand the assumptions for expanding

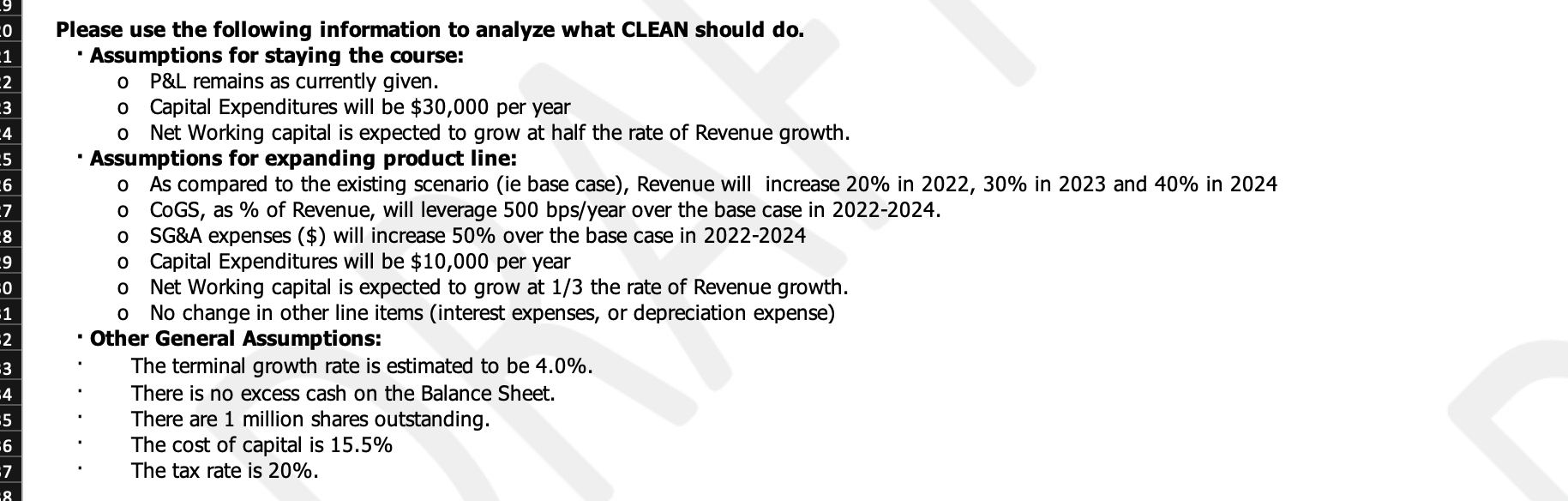

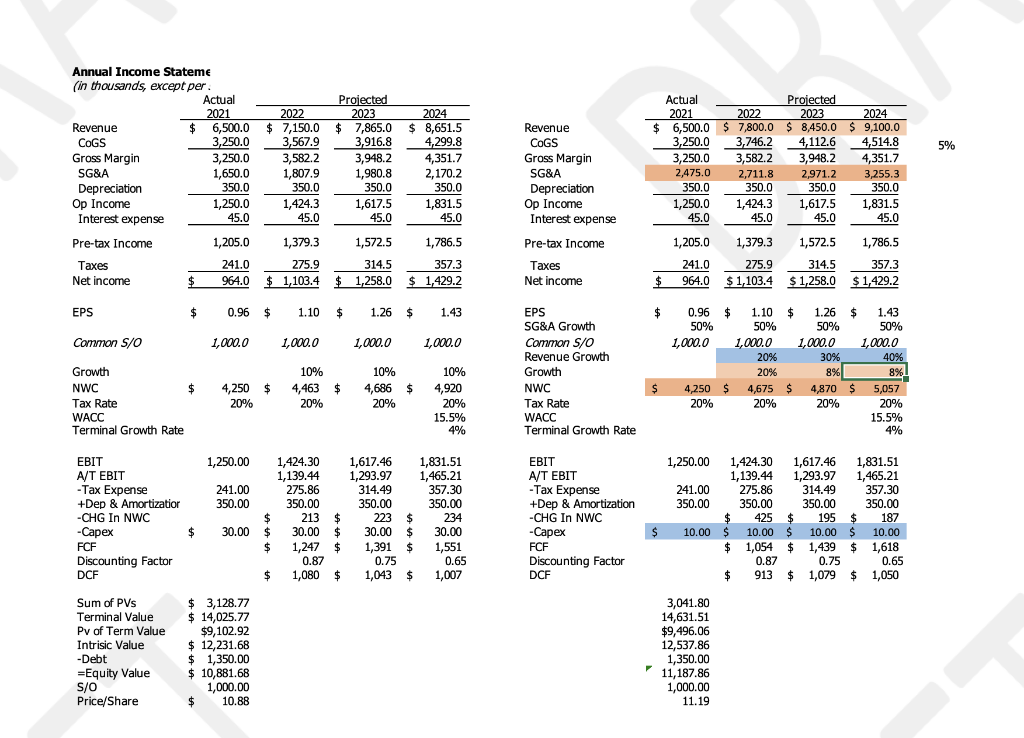

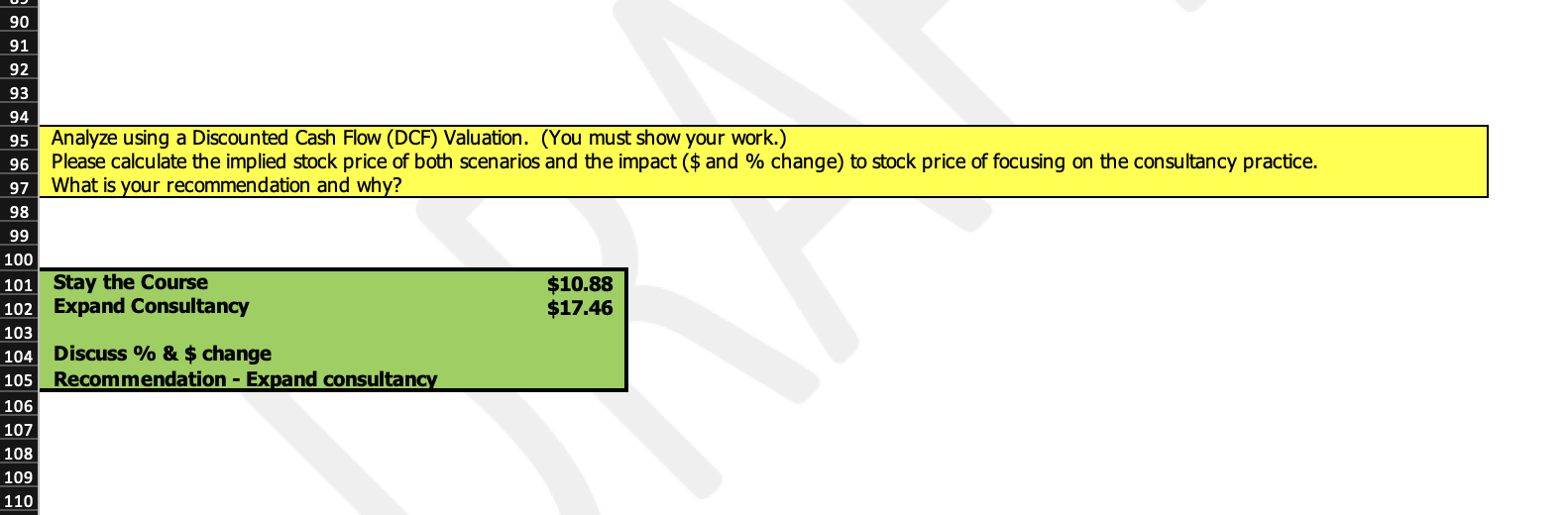

Please use the following information to analyze what CLEAN should do. - Assumptions for staying the course: o P\&L remains as currently given. o Capital Expenditures will be $30,000 per year o Net Working capital is expected to grow at half the rate of Revenue growth. - Assumptions for expanding product line: o As compared to the existing scenario (ie base case), Revenue will increase 20% in 2022,30% in 2023 and 40% in 2024 o CoGS, as \% of Revenue, will leverage 500bps /year over the base case in 2022-2024. o SG\&A expenses (\$) will increase 50% over the base case in 2022-2024 0 Capital Expenditures will be $10,000 per year o Net Working capital is expected to grow at 1/3 the rate of Revenue growth. o No change in other line items (interest expenses, or depreciation expense) - Other General Assumptions: The terminal growth rate is estimated to be 4.0%. There is no excess cash on the Balance Sheet. There are 1 million shares outstanding. The cost of capital is 15.5% The tax rate is 20%. Annual Income Statem (in thousands, except per. Analyze using a Discounted Cash Flow (DCF) Valuation. (You must show your work.) Please calculate the implied stock price of both scenarios and the impact ( $ and % change) to stock price of focusing on the consultancy practice. What is your recommendation and why? Please use the following information to analyze what CLEAN should do. - Assumptions for staying the course: o P\&L remains as currently given. o Capital Expenditures will be $30,000 per year o Net Working capital is expected to grow at half the rate of Revenue growth. - Assumptions for expanding product line: o As compared to the existing scenario (ie base case), Revenue will increase 20% in 2022,30% in 2023 and 40% in 2024 o CoGS, as \% of Revenue, will leverage 500bps /year over the base case in 2022-2024. o SG\&A expenses (\$) will increase 50% over the base case in 2022-2024 0 Capital Expenditures will be $10,000 per year o Net Working capital is expected to grow at 1/3 the rate of Revenue growth. o No change in other line items (interest expenses, or depreciation expense) - Other General Assumptions: The terminal growth rate is estimated to be 4.0%. There is no excess cash on the Balance Sheet. There are 1 million shares outstanding. The cost of capital is 15.5% The tax rate is 20%. Annual Income Statem (in thousands, except per. Analyze using a Discounted Cash Flow (DCF) Valuation. (You must show your work.) Please calculate the implied stock price of both scenarios and the impact ( $ and % change) to stock price of focusing on the consultancy practice. What is your recommendation and whyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started