Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT!! I POSTED THE STEPS TO PREVIOUSLY WRONG ONE AND THE SOLUTION WITH FORMULA IS SHOWN THEREFORE PLEASE FOLLOW FORMULA. THE Assignment you're solving is

URGENT!! I POSTED THE STEPS TO PREVIOUSLY WRONG ONE AND THE SOLUTION WITH FORMULA IS SHOWN THEREFORE PLEASE FOLLOW FORMULA. THE Assignment you're solving is the last image.

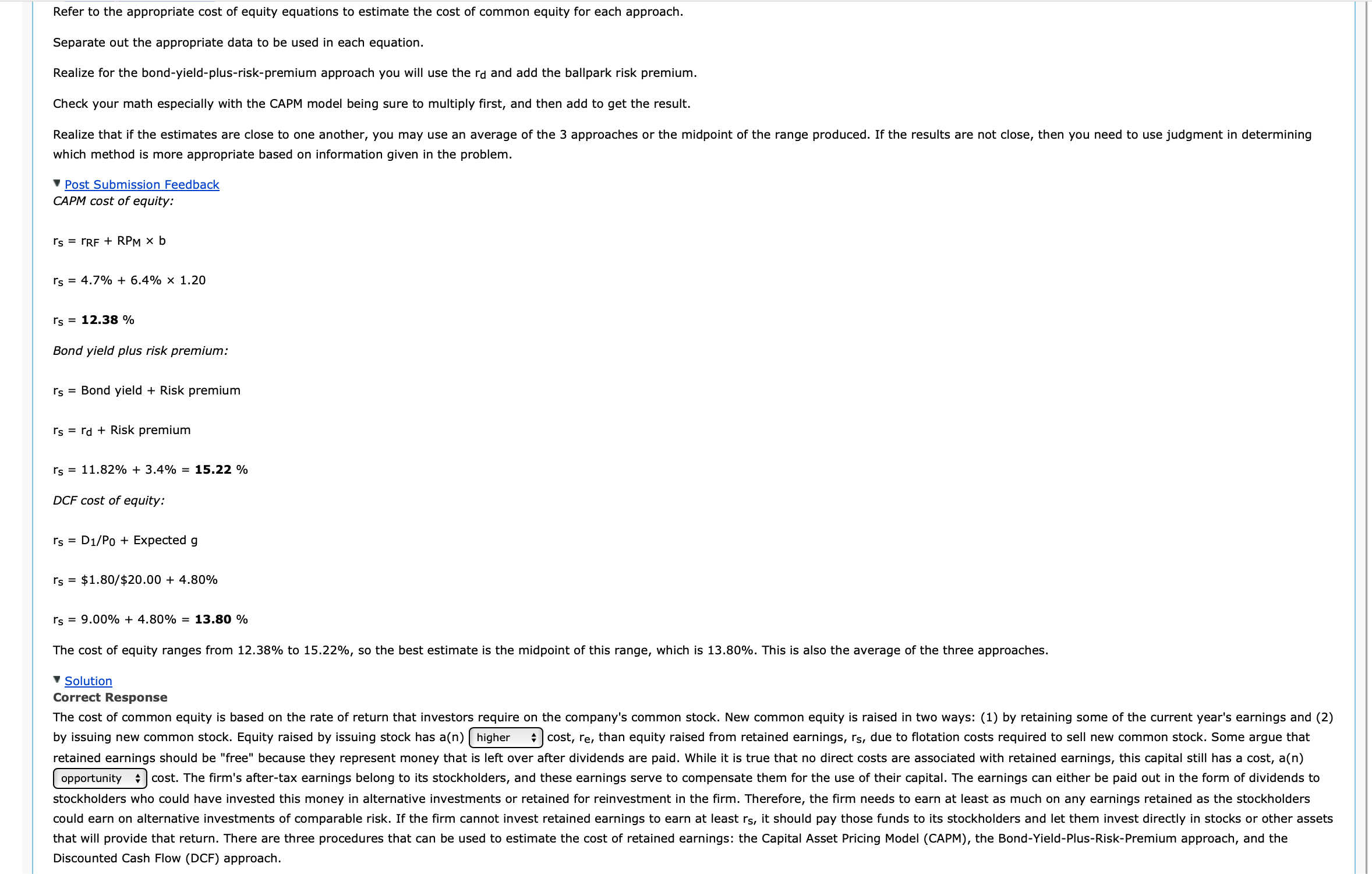

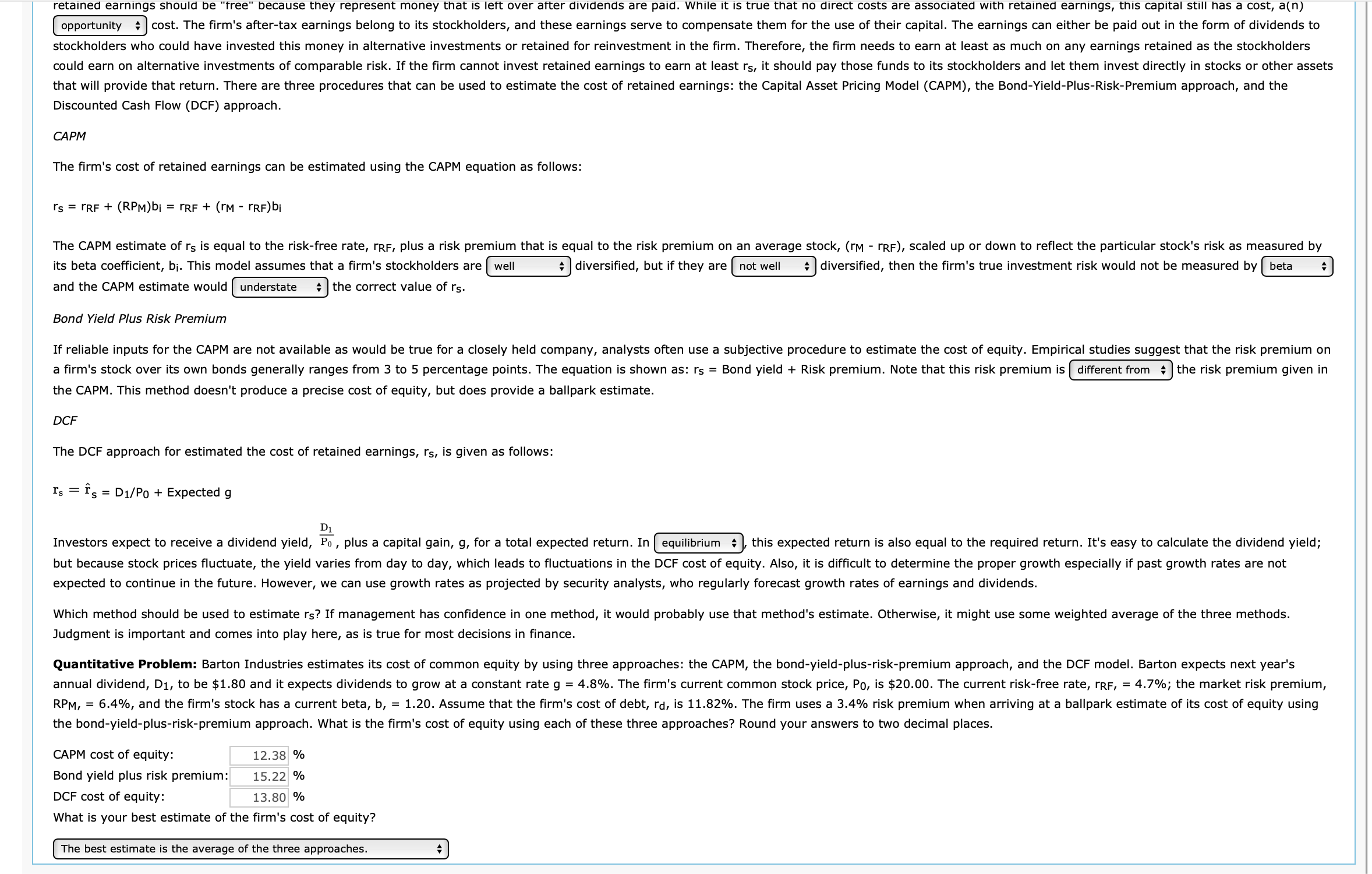

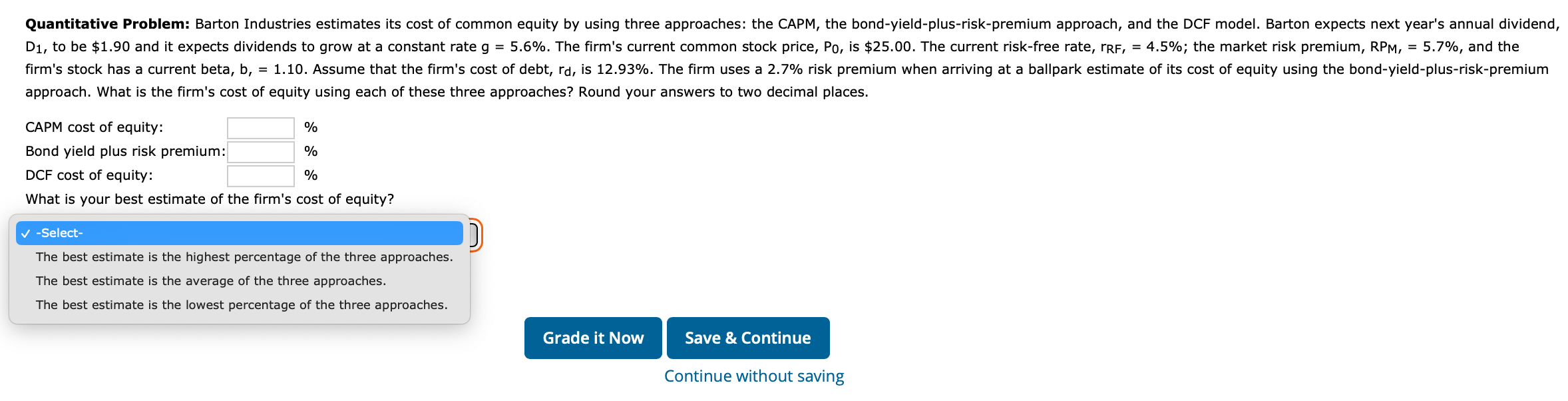

Refer to the appropriate cost of equity equations to estimate the cost of common equity for each approach. Separate out the appropriate data to be used in each equation. Realize for the bond-yield-plus-risk-premium approach you will use the rd and add the ballpark risk premium. Check your math especially with the CAPM model being sure to multiply first, and then add to get the result. which method is more appropriate based on information given in the problem. P Post Submission Feedback CAPM cost of equity: rS=rRF+RPMbrs=4.7%+6.4%1.20rs=12.38% Bond yield plus risk premium: rs= Bond yield + Risk premium rs=rd+ Risk premium rs=11.82%+3.4%=15.22% DCF cost of equity: rs=D1/P0+Expectedgrs=$1.80/$20.00+4.80%rs=9.00%+4.80%=13.80% The cost of equity ranges from 12.38% to 15.22%, so the best estimate is the midpoint of this range, which is 13.80%. This is also the average of the the Solution Correct Response Discounted Cash Flow (DCF) approach. Discounted Cash Flow (DCF) approach. CAPM The firm's cost of retained earnings can be estimated using the CAPM equation as follows: rs=rRF+(RPM)bi=rRF+(rMrRF)bi its beta coefficient, bi. This model assumes that a firm's stockholders are diversified, but if they are diversified, then the firm's true investment risk would not be measured by and the CAPM estimate would the correct value of rs. Bond Yield Plus Risk Premium a firm's stock over its own bonds generally ranges from 3 to 5 percentage points. The equation is shown as: r s = Bond yield + Risk premium. Note that this risk premium is the risk premium given in the CAPM. This method doesn't produce a precise cost of equity, but does provide a ballpark estimate. DCF The DCF approach for estimated the cost of retained earnings, rs, is given as follows: rs=r^s=D1/P0+ Expected g Investors expect to receive a dividend yield, P0D1, plus a capital gain, g, for a total expected return. In , this expected return is also equal to the required return. It's easy to calculate the dividend yield; expected to continue in the future. However, we can use growth rates as projected by security analysts, who regularly forecast growth rates of earnings and dividends. Judgment is important and comes into play here, as is true for most decisions in finance. the bond-yield-plus-risk-premium approach. What is the firm's cost of equity using each of these three approaches? Round your answers to two decimal places. CAPM cost of equity: Bond yield plus risk premium % DCF cost of equity: % What is your best estimate of the firm's cost of equity? approach. What is the firm's cost of equity using each of these three approaches? Round your answers to two decimal places. CAPM cost of equity: % Bond yield plus risk premium: % DCF cost of equity: What is your best estimate of the firm's cost of equity? -Select- The best estimate is the highest percentage of the three approaches. The best estimate is the average of the three approaches. The best estimate is the lowest percentage of the three approaches

Refer to the appropriate cost of equity equations to estimate the cost of common equity for each approach. Separate out the appropriate data to be used in each equation. Realize for the bond-yield-plus-risk-premium approach you will use the rd and add the ballpark risk premium. Check your math especially with the CAPM model being sure to multiply first, and then add to get the result. which method is more appropriate based on information given in the problem. P Post Submission Feedback CAPM cost of equity: rS=rRF+RPMbrs=4.7%+6.4%1.20rs=12.38% Bond yield plus risk premium: rs= Bond yield + Risk premium rs=rd+ Risk premium rs=11.82%+3.4%=15.22% DCF cost of equity: rs=D1/P0+Expectedgrs=$1.80/$20.00+4.80%rs=9.00%+4.80%=13.80% The cost of equity ranges from 12.38% to 15.22%, so the best estimate is the midpoint of this range, which is 13.80%. This is also the average of the the Solution Correct Response Discounted Cash Flow (DCF) approach. Discounted Cash Flow (DCF) approach. CAPM The firm's cost of retained earnings can be estimated using the CAPM equation as follows: rs=rRF+(RPM)bi=rRF+(rMrRF)bi its beta coefficient, bi. This model assumes that a firm's stockholders are diversified, but if they are diversified, then the firm's true investment risk would not be measured by and the CAPM estimate would the correct value of rs. Bond Yield Plus Risk Premium a firm's stock over its own bonds generally ranges from 3 to 5 percentage points. The equation is shown as: r s = Bond yield + Risk premium. Note that this risk premium is the risk premium given in the CAPM. This method doesn't produce a precise cost of equity, but does provide a ballpark estimate. DCF The DCF approach for estimated the cost of retained earnings, rs, is given as follows: rs=r^s=D1/P0+ Expected g Investors expect to receive a dividend yield, P0D1, plus a capital gain, g, for a total expected return. In , this expected return is also equal to the required return. It's easy to calculate the dividend yield; expected to continue in the future. However, we can use growth rates as projected by security analysts, who regularly forecast growth rates of earnings and dividends. Judgment is important and comes into play here, as is true for most decisions in finance. the bond-yield-plus-risk-premium approach. What is the firm's cost of equity using each of these three approaches? Round your answers to two decimal places. CAPM cost of equity: Bond yield plus risk premium % DCF cost of equity: % What is your best estimate of the firm's cost of equity? approach. What is the firm's cost of equity using each of these three approaches? Round your answers to two decimal places. CAPM cost of equity: % Bond yield plus risk premium: % DCF cost of equity: What is your best estimate of the firm's cost of equity? -Select- The best estimate is the highest percentage of the three approaches. The best estimate is the average of the three approaches. The best estimate is the lowest percentage of the three approaches Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started