Answered step by step

Verified Expert Solution

Question

1 Approved Answer

urgent .. need asap please answer these questions a,b and c. Which of the following represents an adverse foreign exchange rate movement to the MNC

urgent .. need asap please answer these questions a,b and c.

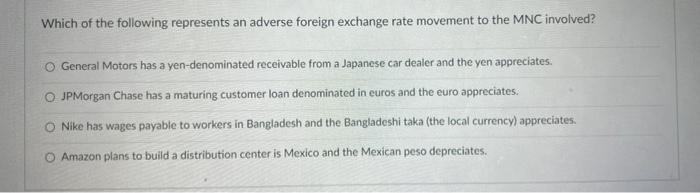

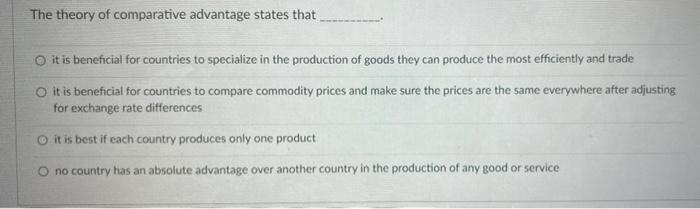

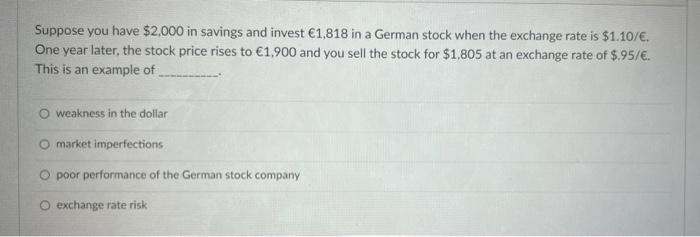

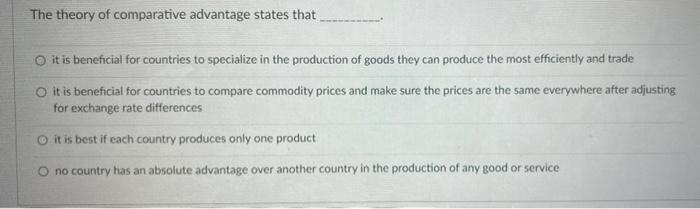

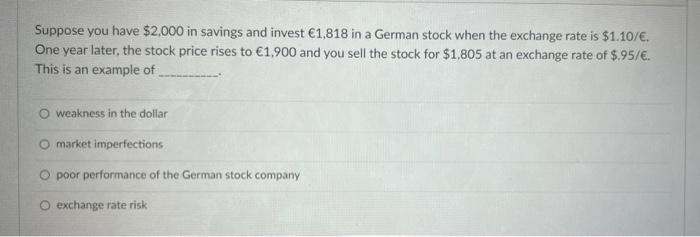

Which of the following represents an adverse foreign exchange rate movement to the MNC involved? o General Motors has a yen-denominated receivable from a Japanese car dealer and the yen appreciates. O JPMorgan Chase has a maturing customer loan denominated in euros and the euro appreciates. Nike has wages payable to workers in Bangladesh and the Bangladeshi taka (the local currency) appreciates Amazon plans to build a distribution center is Mexico and the Mexican peso depreciates. The theory of comparative advantage states that it is beneficial for countries to specialize in the production of goods they can produce the most efficiently and trade o it is beneficial for countries to compare commodity prices and make sure the prices are the same everywhere after adjusting for exchange rate differences o it is best if each country produces only one product no country has an absolute advantage over another country in the production of any good or service Suppose you have $2,000 in savings and invest 1,818 in a German stock when the exchange rate is $1.10/. One year later, the stock price rises to 1,900 and you sell the stock for $1,805 at an exchange rate of $.95/. This is an example of weakness in the dollar market imperfections O poor performance of the German stock company O exchange rate risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started