Answered step by step

Verified Expert Solution

Question

1 Approved Answer

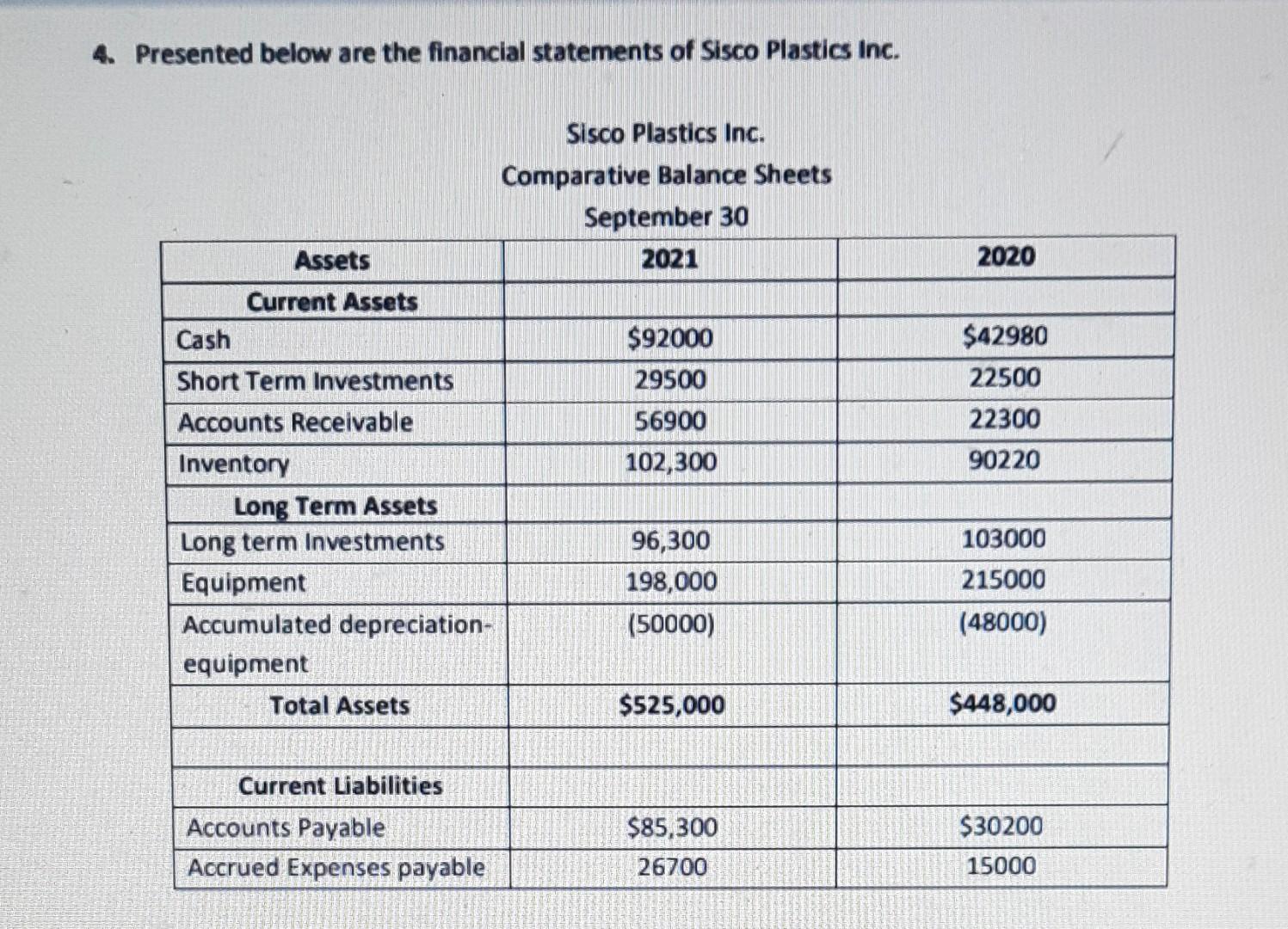

URGENT: Need solution ASAP in 20 mins 4. Presented below are the financial statements of Sisco Plastics Inc. Sisco Plastics Inc. Comparative Balance Sheets September

URGENT: Need solution ASAP

in 20 mins

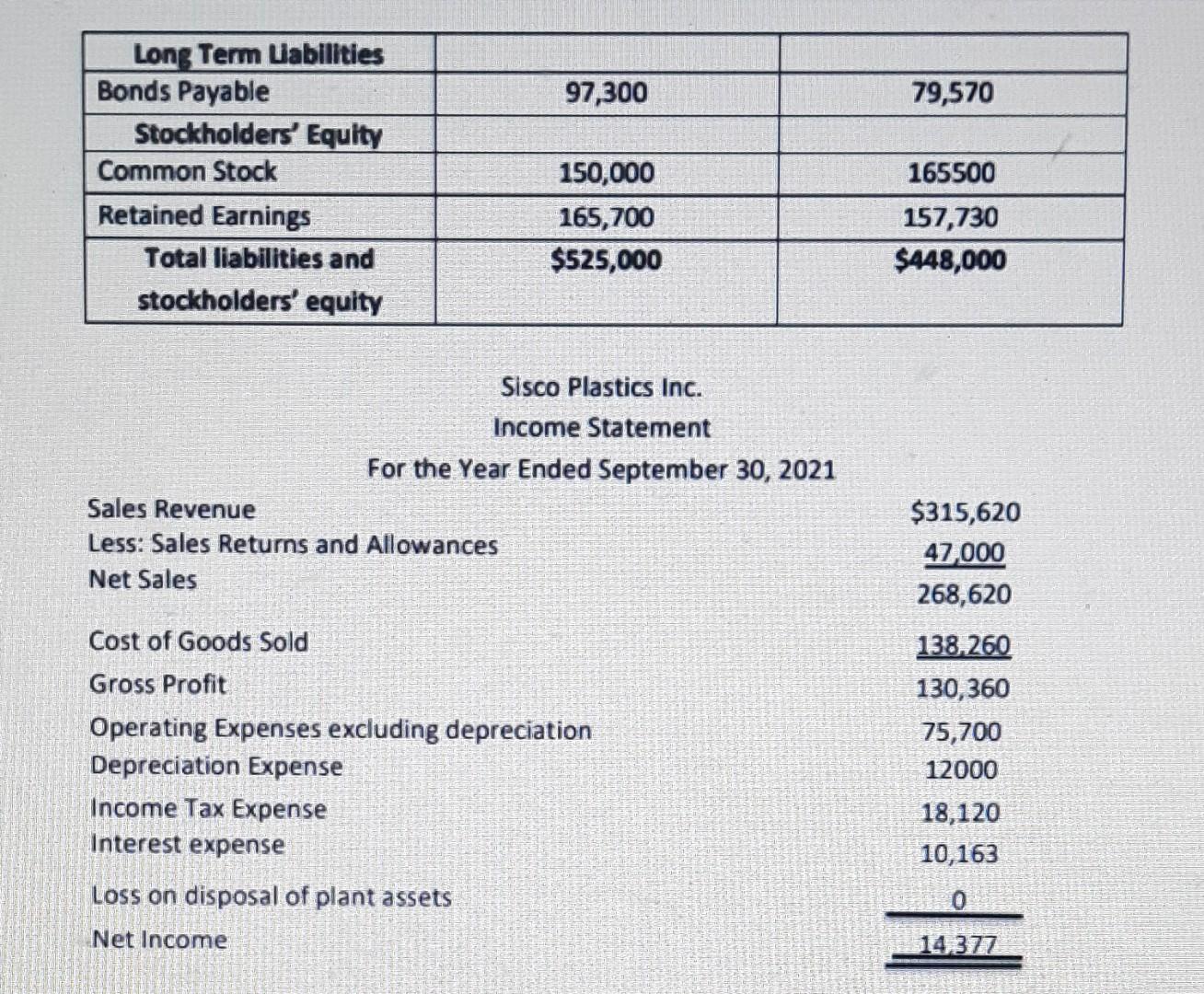

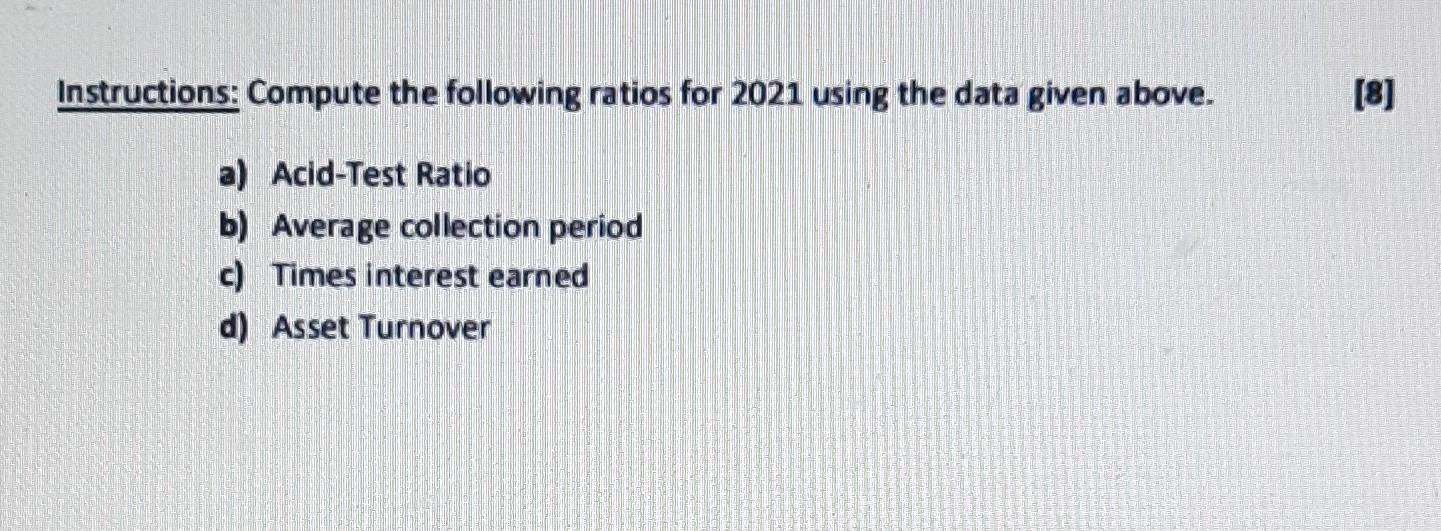

4. Presented below are the financial statements of Sisco Plastics Inc. Sisco Plastics Inc. Comparative Balance Sheets September 30 2021 2020 Assets Current Assets Cash $92000 29500 56900 102,300 $42980 22500 22300 90220 Short Term Investments Accounts Receivable Inventory Long Term Assets Long term Investments Equipment Accumulated depreciation- equipment Total Assets 103000 96,300 198,000 (50000) 215000 (48000) $525,000 $448,000 Current Liabilities Accounts Payable Accrued Expenses payable $85,300 26700 $30200 15000 97,300 79,570 Long Term Liabilities Bonds Payable Stockholders' Equity Common Stock Retained Earnings Total liabilities and stockholders' equity 150,000 165,700 $525,000 165500 157,730 $448,000 Sisco Plastics Inc. Income Statement For the Year Ended September 30, 2021 Sales Revenue Less: Sales Returns and Allowances Net Sales $315,620 47.000 268,620 Cost of Goods Sold Gross Profit Operating Expenses excluding depreciation Depreciation Expense Income Tax Expense Interest expense 138.260 130,360 75,700 12000 18,120 10,163 Loss on disposal of plant assets 0 Net Income 14 377 Instructions: Compute the following ratios for 2021 using the data given above. [8] a) Acid-Test Ratio b) Average collection period c) Times interest earned d) Asset TurnoverStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started