urgent needed

urgent needed

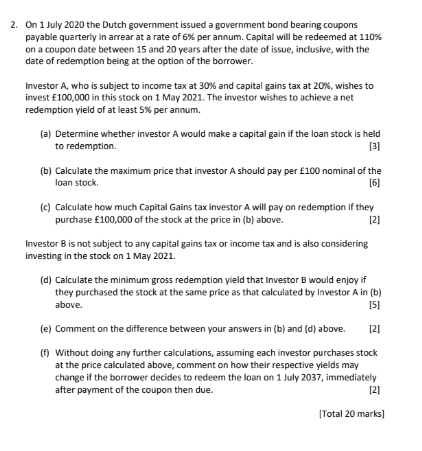

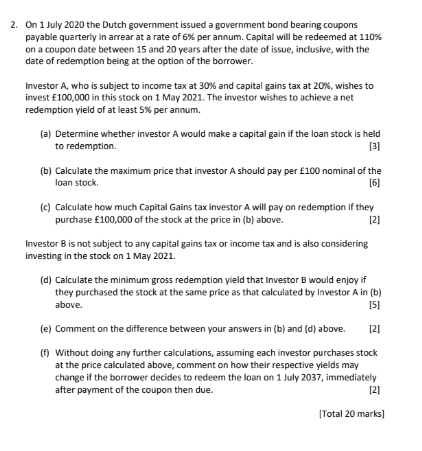

2. On 1 July 2020 the Dutch government issued a government bond bearing coupons payable quarterly in arrear at a rate of 6% per annum. Capital will be redeemed at 110% on a coupon date between 15 and 20 years after the date of issue, inclusive, with the date of redemption being at the option of the borrower. Investor A, who is subject to income tax at 30% and capital gains tax at 20%, wishes to invest 100,000 in this stock on 1 May 2021. The investor wishes to achieve a net redemption yield of at least 5% per annum. (a) Determine whether investor A would make a capital gain if the loan stock is held to redemption [3] (b) Calculate the maximum price that investor A should pay per 100 nominal of the loan stock [6] (c) Calculate how much Capital Gains tax investor A will pay on redemption if they purchase E100,000 of the stock at the price in (b) above. 121 Investor B is not subject to any capital gains tax or income tax and is also considering investing in the stock on 1 May 2021. (d) Calculate the minimum gross redemption yield that Investor B would enjoy if they purchased the stock at the same price as that calculated by Investor A in (b) above. [5] (e) Comment on the difference between your answers in (b) and (d) above. [2] (F) Without doing any further calculations, assuming each investor purchases stock at the price calculated above, comment on how their respective yields may change if the borrower decides to redeem the loan on 1 July 2037, immediately after payment of the coupon then due. [2] Total 20 marks] 2. On 1 July 2020 the Dutch government issued a government bond bearing coupons payable quarterly in arrear at a rate of 6% per annum. Capital will be redeemed at 110% on a coupon date between 15 and 20 years after the date of issue, inclusive, with the date of redemption being at the option of the borrower. Investor A, who is subject to income tax at 30% and capital gains tax at 20%, wishes to invest 100,000 in this stock on 1 May 2021. The investor wishes to achieve a net redemption yield of at least 5% per annum. (a) Determine whether investor A would make a capital gain if the loan stock is held to redemption [3] (b) Calculate the maximum price that investor A should pay per 100 nominal of the loan stock [6] (c) Calculate how much Capital Gains tax investor A will pay on redemption if they purchase E100,000 of the stock at the price in (b) above. 121 Investor B is not subject to any capital gains tax or income tax and is also considering investing in the stock on 1 May 2021. (d) Calculate the minimum gross redemption yield that Investor B would enjoy if they purchased the stock at the same price as that calculated by Investor A in (b) above. [5] (e) Comment on the difference between your answers in (b) and (d) above. [2] (F) Without doing any further calculations, assuming each investor purchases stock at the price calculated above, comment on how their respective yields may change if the borrower decides to redeem the loan on 1 July 2037, immediately after payment of the coupon then due. [2] Total 20 marks]

urgent needed

urgent needed