Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Urgent Please!!! Additional information for the year 1 July 2019 - 30 June 2020: The company borrowed $20,000 to purchase equipment with the balance of

Urgent Please!!!

Additional information for the year 1 July 2019 - 30 June 2020:

- The company borrowed $20,000 to purchase equipment with the balance of the purchase paid in cash.

- Plant with a carrying amount value of $15,000 (accumulated depreciation $5,000) was sold. A loss on sale of plant $2,000 was recorded.

- The directors paid out a bonus share dividend of $8,000.

- The company made a repayment on borrowings of $20,000.

- The profit after tax for the year ended 30 June 2020 was $92,000. Included in the profit were the following: sales $1,084,000; cost of sales $708,000; administration costs $96,000; distribution costs $136,000; interest expense $6,000; and, income tax expense $46,000.

- Included in distribution costs was a bad debts expense of $9,000, the loss on sale of plant $2,000 and depreciation expense for the year.

- Surf Ltd uses the direct method for presenting cash flows from operating activities.

Required:

Prepare a Statement of Cash Flows for Surf Life Ltd for the year end 30 June 2020.

You must show all your calculations (keep these separate from the formal presentation of the Statement)

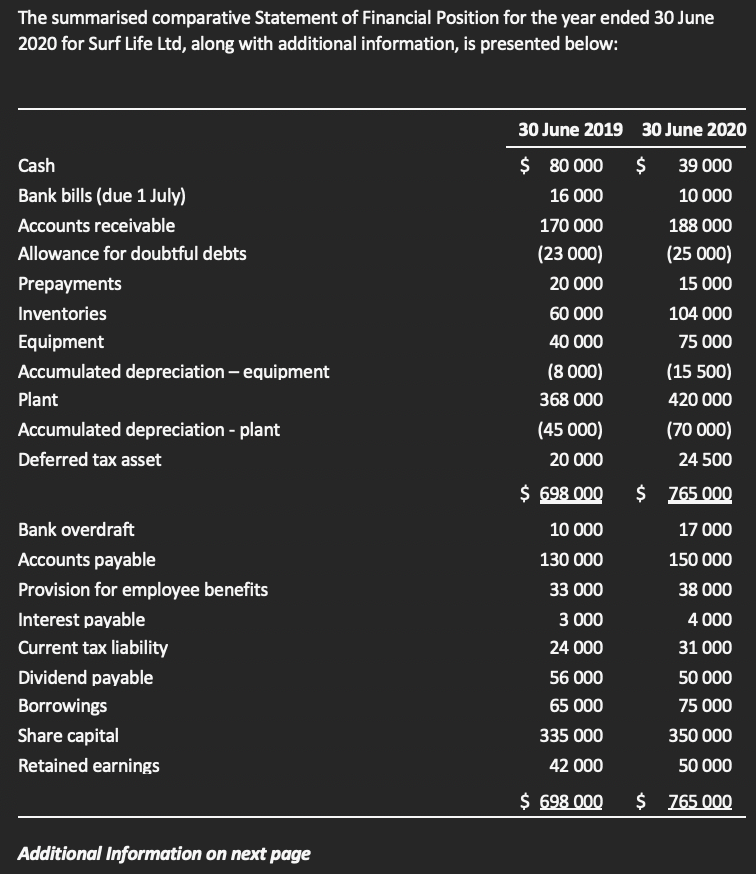

The summarised comparative Statement of Financial Position for the year ended 30 June 2020 for Surf Life Ltd, along with additional information, is presented below: 30 June 2019 30 June 2020 Cash $ 80 000 $ 39 000 Bank bills (due 1 July) 16 000 10 000 Accounts receivable 170 000 188 000 Allowance for doubtful debts (23 000) (25 000) Prepayments 20 000 15 000 Inventories 60 000 104 000 Equipment 40 000 75 000 Accumulated depreciation - equipment (8 000) (15 500) Plant 368 000 420 000 Accumulated depreciation - plant (45 000) (70 000) Deferred tax asset 20 000 24 500 $ 698 000 $ 765 000 Bank overdraft 10 000 17 000 Accounts payable 130 000 150 000 Provision for employee benefits 33 000 38 000 Interest payable 3 000 4 000 Current tax liability 24 000 31 000 Dividend payable 56 000 50 000 Borrowings 65 000 75 000 Share capital 335 000 350 000 Retained earnings 42 000 50 000 $ 698 000 765 000 Additional Information on next page $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started