Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT PLEASE ANSWER THE QUESTION BELOW AND PASTE A COPY OF AN EXCEL LINK TO UNDERSTAND THE ASSIGNMENT BETTER. THIS IS AN INTRODUCTION TO CIVIL

URGENT PLEASE ANSWER THE QUESTION BELOW AND PASTE A COPY OF AN EXCEL LINK TO UNDERSTAND THE ASSIGNMENT BETTER. THIS IS AN INTRODUCTION TO CIVIL ENGINEERING AND WE ARE LEARNING SPREADSHEET AMORTIZATION SCHEDULE SO IT HAS TO DO SPECIFICALLY WITH THAT. I AM ATTACHING THE PROBLEM STATMENT BENEATH SO IF YOU HAVE ANY QUESTIONS PLEASE REACH OUT. BUT I REALLY DO NEED THE HELP THANK YOU.

heres a clearer version

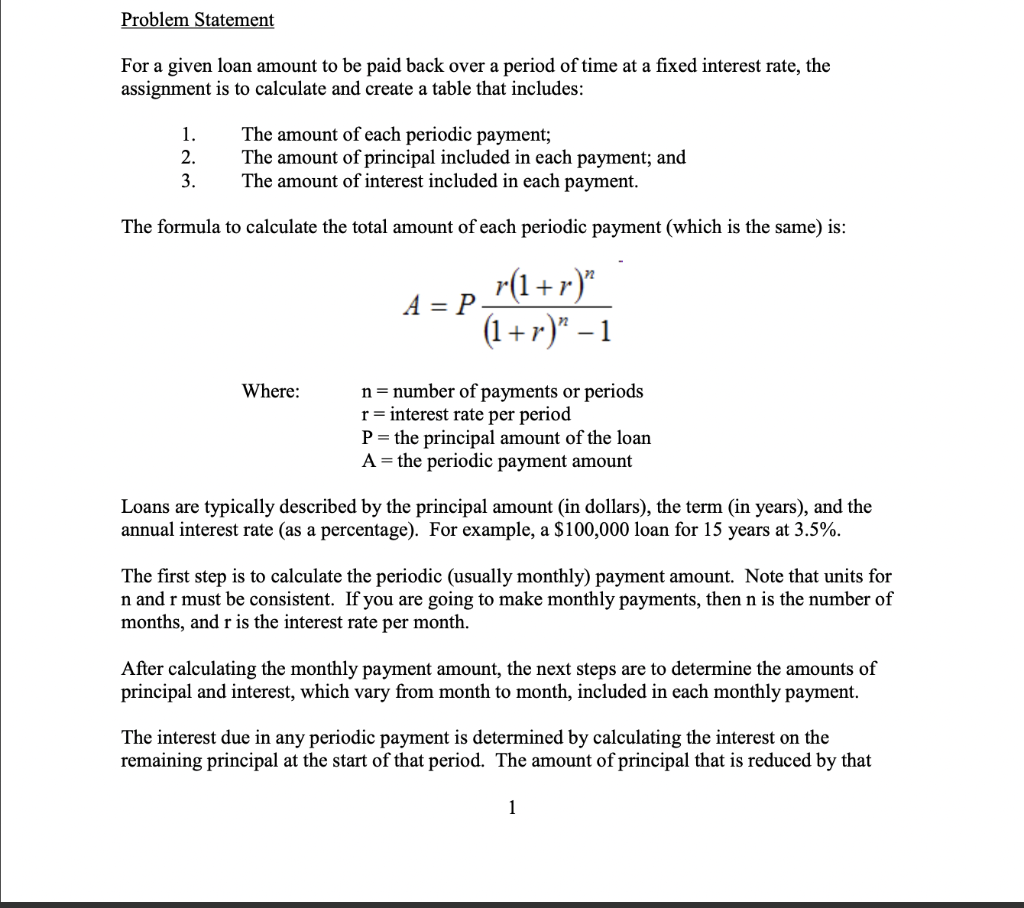

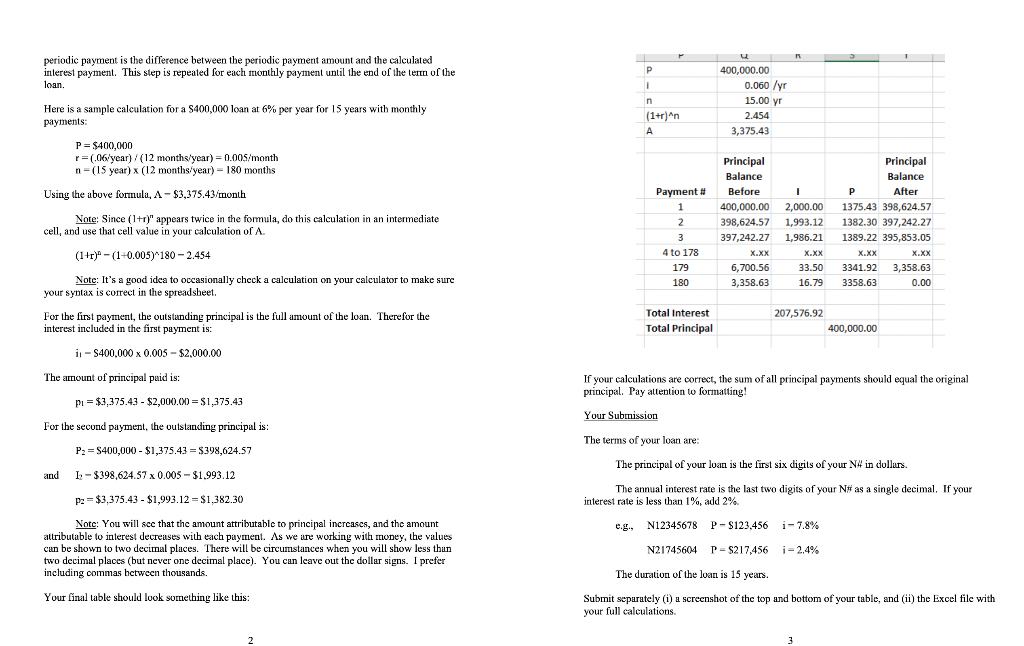

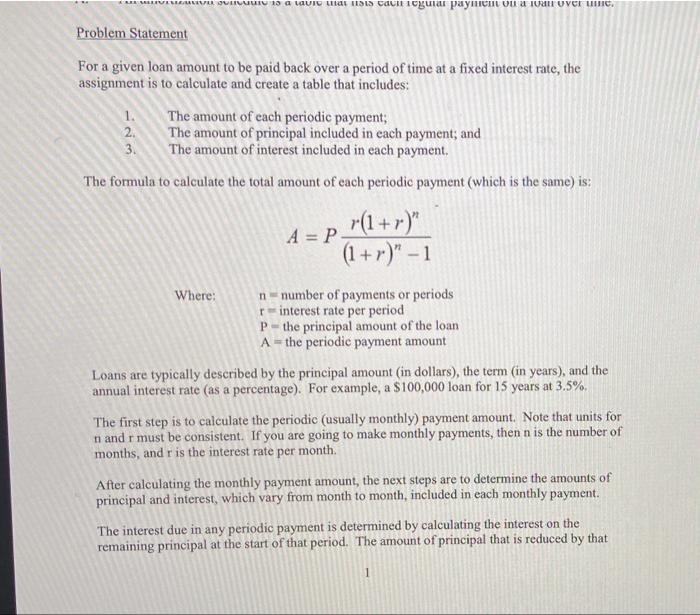

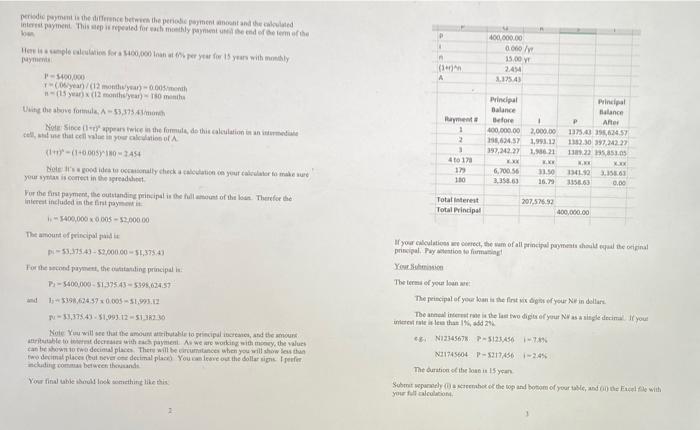

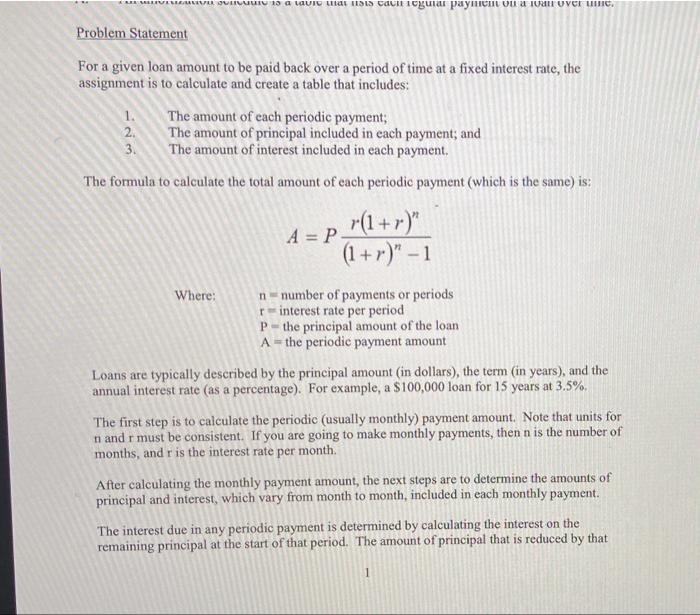

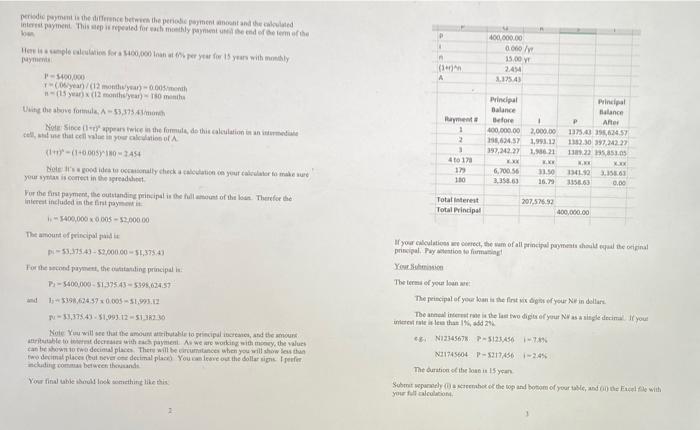

Problem Statement For a given loan amount to be paid back over a period of time at a fixed interest rate, the assignment is to calculate and create a table that includes: 1. 2. 3. The amount of each periodic payment; The amount of principal included in each payment; and The amount of interest included in each payment. The formula to calculate the total amount of each periodic payment (which is the same) is: r(1+r)" A = P (1+r)" 1 Where: n= number of payments or periods r= interest rate per period P= the principal amount of the loan A = the periodic payment amount Loans are typically described by the principal amount (in dollars), the term (in years), and the annual interest rate (as a percentage). For example, a $100,000 loan for 15 years at 3.5%. The first step is to calculate the periodic (usually monthly) payment amount. Note that units for n and r must be consistent. If you are going to make monthly payments, then n is the number of months, and r is the interest rate per month. After calculating the monthly payment amount, the next steps are to determine the amounts of principal and interest, which vary from month to month, included in each monthly payment. The interest due in any periodic payment is determined by calculating the interest on the remaining principal at the start of that period. The amount of principal that is reduced by that 1 periodic payment is the difference between the periodic payment amount and the calculated interest payment. This step is repeated for each monthly payment until the end of the term of the P loan i n 400,000.00 0.060 /yr 15.00 yr 2.454 3,375.43 Here is a sample calculation for a $400,000 loan at 6% per year for 15 years with monthly payments: (1+r)^n r A P= $400,000 r= (.06'year)/(12 months/year) - 0.00$/month n-(15 year) x (12 months/year)= 180 months Using the above formulu, A-$3,375,43/month Principal Balance Before 400,000.00 398,624.57 397,242.27 X.XX 6,700.56 Payment # 1 2 3 4 to 178 179 180 1 2,000.00 1.993.12 1,986.21 Note: Since (1+r)" appears twice in the fomula, do this calculation in an intermediate cell, and use that cell value in your calculation of A (1+r)" - (1+0.005)*180 -2.454 1+-( Note: It's a good idea to occasionally check a calculation on your calculator to make sure your synlax is correct in the spreadsheet For the first payment, the outstanding principal is the full amount of the loan. Therefor the interest included in the first payment is: Principal Balance P After 1375.43 398,624.57 1382.30 397,242.27 1389.22 395,853.05 X.XX X.XX 3341.92 3,358.63 3358.63 0.00 X.XX 33,50 16.79 3,358.63 Total Interest Total Principal 207,576.92 400,000.00 ii -S400.000 x 0.005 - $2,000.00 x The amount of principal paid is: pi=$3,375.43 - $2,000.00 = $1,375.43 If your calculations are correct, the sum of all principal payments should equal the original principal. Pay attention to formatting! Your Submission For the second payment, the outstanding principal is The terms of your loan are: P2 = S400,000 - $1,375.43 $398,624.57 The principal of your loan is the first six digits of your N4 in dollars. and I: - $398,624.57 x 0.005 - $1.993.12 pa=$3,375.43 - $1,993.12 = $1,382.30 The annual interest rate is the last two digits of your N as a single decimal. If your interest rate is less than 1%, add 2% e.g., N12345678 P - $123,456 i-7.8% Note: You will see that the amount attributable to principal increases, and the amount attributable to interest decreases with each payment. As we are working with money, the values can be shown to two decimal places. There will be circumstances when you will show less than two decimal places (but never one decimal place). You can leave out the dollar signs. I prefer including commas between thousands. N21745604 P = $217,456 i=2.4% The duration of the loan is 15 years. Your final table should look something like this: Submit separately (i) a screenshot of the top and bottom of your table, and (ii) the Excel file with your full calculations 2 3 SAMLEVIN DU LAVIC AL RISUS CUIR Cuia paymu UVC. Problem Statement For a given loan amount to be paid back over a period of time at a fixed interest rate, the assignment is to calculate and create a table that includes: The amount of each periodic payment; 2. The amount of principal included in each payment; and 3 The amount of interest included in each payment. The formula to calculate the total amount of each periodic payment (which is the same) is: r(1+r)" A = P (1+r)" - 1 Where: n-number of payments or periods r interest rate per period P - the principal amount of the loan A-the periodic payment amount Loans are typically described by the principal amount (in dollars), the term (in years), and the annual interest rate (as a percentage). For example, a $100,000 loan for 15 years at 3.5%. The first step is to calculate the periodic (usually monthly) payment amount. Note that units for n and r must be consistent. If you are going to make monthly payments, then n is the number of months, and is the interest rate per month After calculating the monthly payment amount, the next steps are to determine the amounts of principal and interest, which vary from month to month, included in each monthly payment. The interest due in any periodic payment is determined by calculating the interest on the remaining principal at the start of that period. The amount of principal that is reduced by that period payment is the difference between the perioden cand the lated intenst payment. This posted for each monthly payment and of the meth Heimples for 100.000 per you for 5 years with 400.000,00 0.000 15.00 244 21254) ( A Waywv| Principal Balance Before 400.000.00 64.57 399,2422 Principal Balance P After 1375.03 2,6245 1182.30 397,1M2 138.22 5.853.05 2 2,000.00 1.995.12 2.93621 100,000 yan/12 year) 0005month 15 year (2 sconto Using the above form 53,375.41month Note: Since-typprentice in the formule, do the coloration is in termine cells that all you call of A (+00001454 Note: It's poodides to check on your calatorie your correct in the spreadsheet For the first payment, the outstanding principal is the men of the loan. Therefor the Interest included in the first payo 1.5400000000-52.00000 The amount of principali D-53.7541-52.0000051,375.41 For the second payment, the standing principale - 5400.000 - 51.395.43 -5598.634.51 410178 1 110 6,700 56 3.358.63 11.50 16.79 13412.5863 11586) 0.00 Total interest Total Principal 207.52692 400,000.00 N-31.375.41-51.99.12 12.20 Note: You will see that the outsib table to principal create and the mount rite to decrease with each payment. As we are working with my, the values can be shown to two decimal place. There will be instances when you will shows the medecimal places but even decimal plane You are at the doller sister including comme between the You final while he looking like this If your list them of all principal payments that the original principal Paymention to firma Yevesi The terms of your The principal of your me the first dig sofyour Nin dollars. The list is the last two digits of your salle decimal if you telee the 21 N12345678-5123456 N11404-5217456 12:45 The art of the loan in 15 year Surat Bol the top and botom of your and on the Free with your full alone Problem Statement For a given loan amount to be paid back over a period of time at a fixed interest rate, the assignment is to calculate and create a table that includes: 1. 2. 3. The amount of each periodic payment; The amount of principal included in each payment; and The amount of interest included in each payment. The formula to calculate the total amount of each periodic payment (which is the same) is: r(1+r)" A = P (1+r)" 1 Where: n= number of payments or periods r= interest rate per period P= the principal amount of the loan A = the periodic payment amount Loans are typically described by the principal amount (in dollars), the term (in years), and the annual interest rate (as a percentage). For example, a $100,000 loan for 15 years at 3.5%. The first step is to calculate the periodic (usually monthly) payment amount. Note that units for n and r must be consistent. If you are going to make monthly payments, then n is the number of months, and r is the interest rate per month. After calculating the monthly payment amount, the next steps are to determine the amounts of principal and interest, which vary from month to month, included in each monthly payment. The interest due in any periodic payment is determined by calculating the interest on the remaining principal at the start of that period. The amount of principal that is reduced by that 1 periodic payment is the difference between the periodic payment amount and the calculated interest payment. This step is repeated for each monthly payment until the end of the term of the P loan i n 400,000.00 0.060 /yr 15.00 yr 2.454 3,375.43 Here is a sample calculation for a $400,000 loan at 6% per year for 15 years with monthly payments: (1+r)^n r A P= $400,000 r= (.06'year)/(12 months/year) - 0.00$/month n-(15 year) x (12 months/year)= 180 months Using the above formulu, A-$3,375,43/month Principal Balance Before 400,000.00 398,624.57 397,242.27 X.XX 6,700.56 Payment # 1 2 3 4 to 178 179 180 1 2,000.00 1.993.12 1,986.21 Note: Since (1+r)" appears twice in the fomula, do this calculation in an intermediate cell, and use that cell value in your calculation of A (1+r)" - (1+0.005)*180 -2.454 1+-( Note: It's a good idea to occasionally check a calculation on your calculator to make sure your synlax is correct in the spreadsheet For the first payment, the outstanding principal is the full amount of the loan. Therefor the interest included in the first payment is: Principal Balance P After 1375.43 398,624.57 1382.30 397,242.27 1389.22 395,853.05 X.XX X.XX 3341.92 3,358.63 3358.63 0.00 X.XX 33,50 16.79 3,358.63 Total Interest Total Principal 207,576.92 400,000.00 ii -S400.000 x 0.005 - $2,000.00 x The amount of principal paid is: pi=$3,375.43 - $2,000.00 = $1,375.43 If your calculations are correct, the sum of all principal payments should equal the original principal. Pay attention to formatting! Your Submission For the second payment, the outstanding principal is The terms of your loan are: P2 = S400,000 - $1,375.43 $398,624.57 The principal of your loan is the first six digits of your N4 in dollars. and I: - $398,624.57 x 0.005 - $1.993.12 pa=$3,375.43 - $1,993.12 = $1,382.30 The annual interest rate is the last two digits of your N as a single decimal. If your interest rate is less than 1%, add 2% e.g., N12345678 P - $123,456 i-7.8% Note: You will see that the amount attributable to principal increases, and the amount attributable to interest decreases with each payment. As we are working with money, the values can be shown to two decimal places. There will be circumstances when you will show less than two decimal places (but never one decimal place). You can leave out the dollar signs. I prefer including commas between thousands. N21745604 P = $217,456 i=2.4% The duration of the loan is 15 years. Your final table should look something like this: Submit separately (i) a screenshot of the top and bottom of your table, and (ii) the Excel file with your full calculations 2 3 SAMLEVIN DU LAVIC AL RISUS CUIR Cuia paymu UVC. Problem Statement For a given loan amount to be paid back over a period of time at a fixed interest rate, the assignment is to calculate and create a table that includes: The amount of each periodic payment; 2. The amount of principal included in each payment; and 3 The amount of interest included in each payment. The formula to calculate the total amount of each periodic payment (which is the same) is: r(1+r)" A = P (1+r)" - 1 Where: n-number of payments or periods r interest rate per period P - the principal amount of the loan A-the periodic payment amount Loans are typically described by the principal amount (in dollars), the term (in years), and the annual interest rate (as a percentage). For example, a $100,000 loan for 15 years at 3.5%. The first step is to calculate the periodic (usually monthly) payment amount. Note that units for n and r must be consistent. If you are going to make monthly payments, then n is the number of months, and is the interest rate per month After calculating the monthly payment amount, the next steps are to determine the amounts of principal and interest, which vary from month to month, included in each monthly payment. The interest due in any periodic payment is determined by calculating the interest on the remaining principal at the start of that period. The amount of principal that is reduced by that period payment is the difference between the perioden cand the lated intenst payment. This posted for each monthly payment and of the meth Heimples for 100.000 per you for 5 years with 400.000,00 0.000 15.00 244 21254) ( A Waywv| Principal Balance Before 400.000.00 64.57 399,2422 Principal Balance P After 1375.03 2,6245 1182.30 397,1M2 138.22 5.853.05 2 2,000.00 1.995.12 2.93621 100,000 yan/12 year) 0005month 15 year (2 sconto Using the above form 53,375.41month Note: Since-typprentice in the formule, do the coloration is in termine cells that all you call of A (+00001454 Note: It's poodides to check on your calatorie your correct in the spreadsheet For the first payment, the outstanding principal is the men of the loan. Therefor the Interest included in the first payo 1.5400000000-52.00000 The amount of principali D-53.7541-52.0000051,375.41 For the second payment, the standing principale - 5400.000 - 51.395.43 -5598.634.51 410178 1 110 6,700 56 3.358.63 11.50 16.79 13412.5863 11586) 0.00 Total interest Total Principal 207.52692 400,000.00 N-31.375.41-51.99.12 12.20 Note: You will see that the outsib table to principal create and the mount rite to decrease with each payment. As we are working with my, the values can be shown to two decimal place. There will be instances when you will shows the medecimal places but even decimal plane You are at the doller sister including comme between the You final while he looking like this If your list them of all principal payments that the original principal Paymention to firma Yevesi The terms of your The principal of your me the first dig sofyour Nin dollars. The list is the last two digits of your salle decimal if you telee the 21 N12345678-5123456 N11404-5217456 12:45 The art of the loan in 15 year Surat Bol the top and botom of your and on the Free with your full alone

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started