Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT: Please complete part A and B based on the info from the first picture by completing the table in the second picture please! (Determination

URGENT: Please complete part A and B based on the info from the first picture by completing the table in the second picture please!

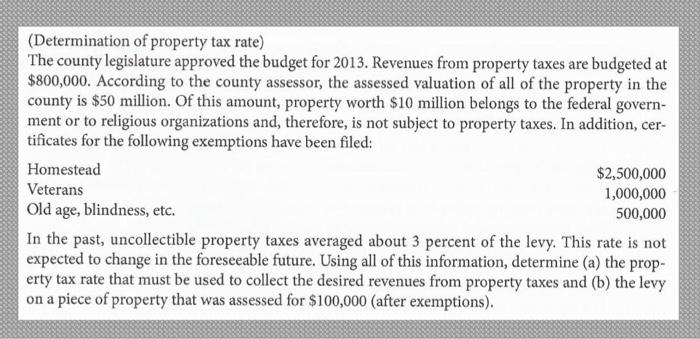

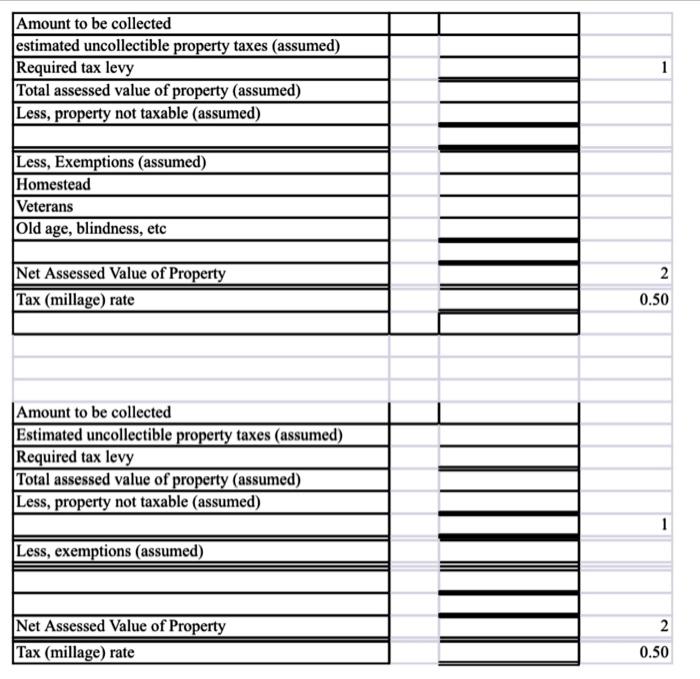

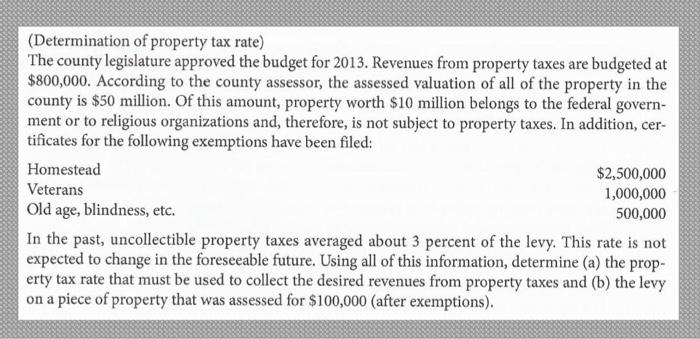

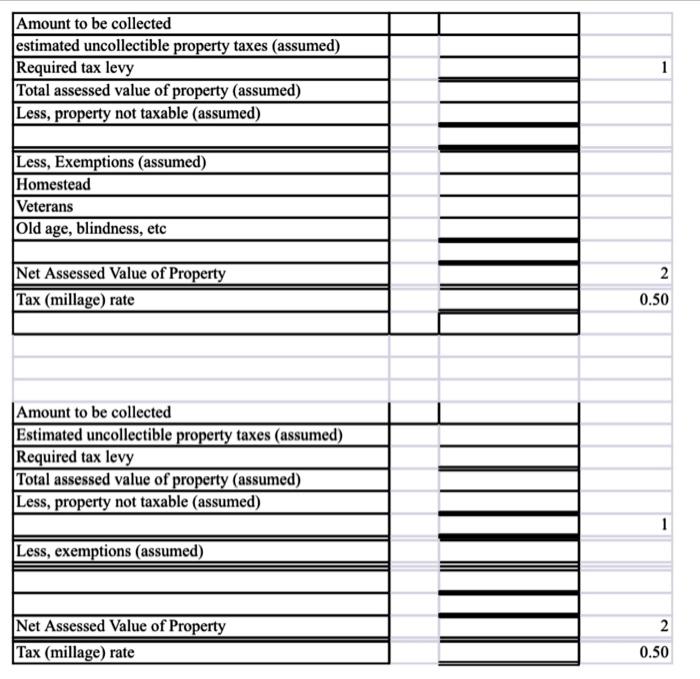

(Determination of property tax rate) The county legislature approved the budget for 2013. Revenues from property taxes are budgeted at $800,000. According to the county assessor, the assessed valuation of all of the property in the county is $50 million. Of this amount, property worth $10 million belongs to the federal government or to religious organizations and, therefore, is not subject to property taxes. In addition, certificates for the following exemptions have been filed: \begin{tabular}{lr} Homestead & $2,500,000 \\ Veterans & 1,000,000 \\ Old age, blindness, etc. & 500,000 \end{tabular} In the past, uncollectible property taxes averaged about 3 percent of the levy. This rate is not expected to change in the foreseeable future. Using all of this information, determine (a) the property tax rate that must be used to collect the desired revenues from property taxes and (b) the levy on a piece of property that was assessed for $100,000 (after exemptions). \begin{tabular}{|l|c|l|} \hline Amount to be collected & & \\ \hline estimated uncollectible property taxes (assumed) & & \\ \hline Required tax levy & & \\ \hline Total assessed value of property (assumed) & & \\ \hline Less, property not taxable (assumed) & & \\ \hline \hline Less, Exemptions (assumed) & & \\ \hline Homestead & & \\ \hline Veterans & & \\ \hline Old age, blindness, etc & & \\ \hline & & \\ \hline Net Assessed Value of Property & & \\ \hline \hline Tax (millage) rate & & \\ \hline & & \\ \hline & & \\ \hline Amount to be collected & & \\ \hline Estimated uncollectible property taxes (assumed) & & \\ \hline Required tax levy & & \\ \hline Total assessed value of property (assumed) & \\ \hline Less, property not taxable (assumed) & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started