URGENT PLEASE HELP ASAP

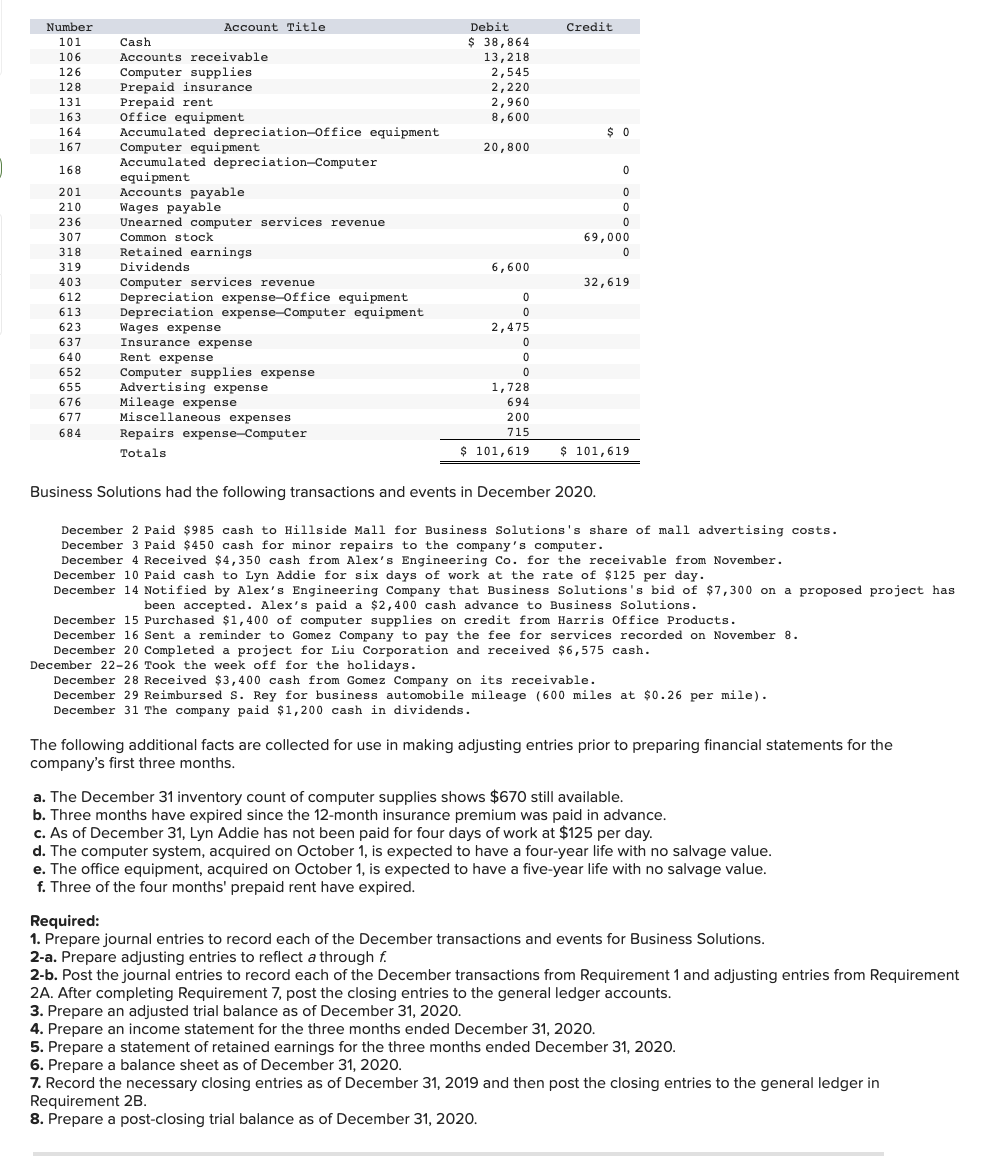

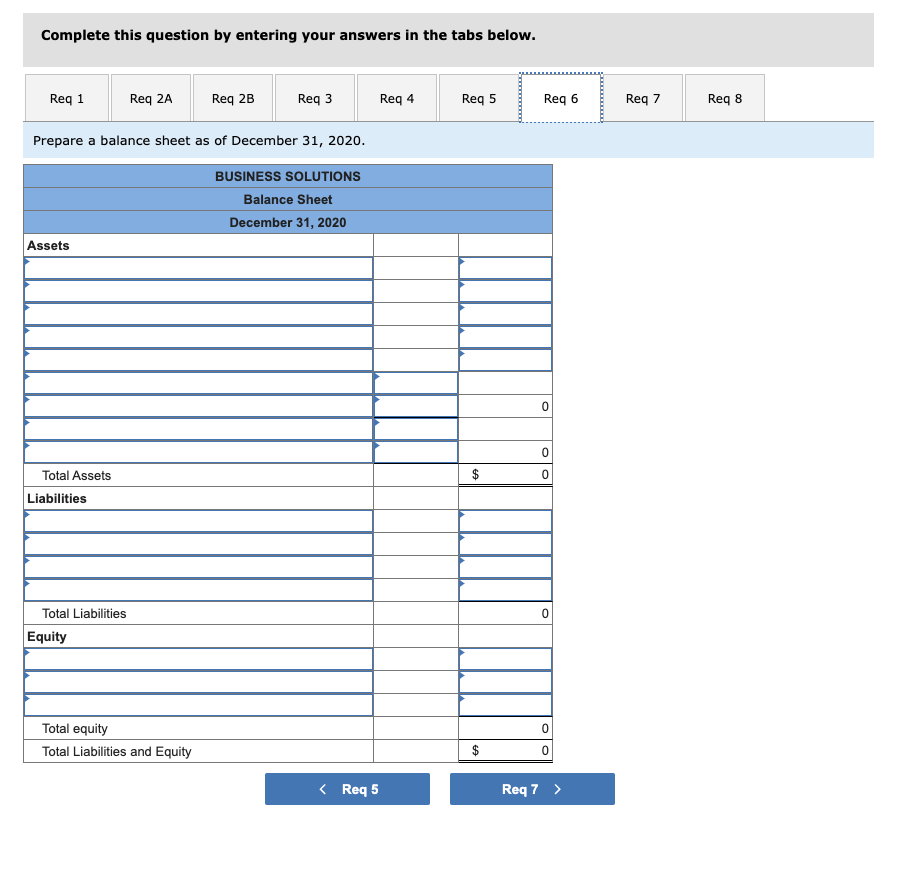

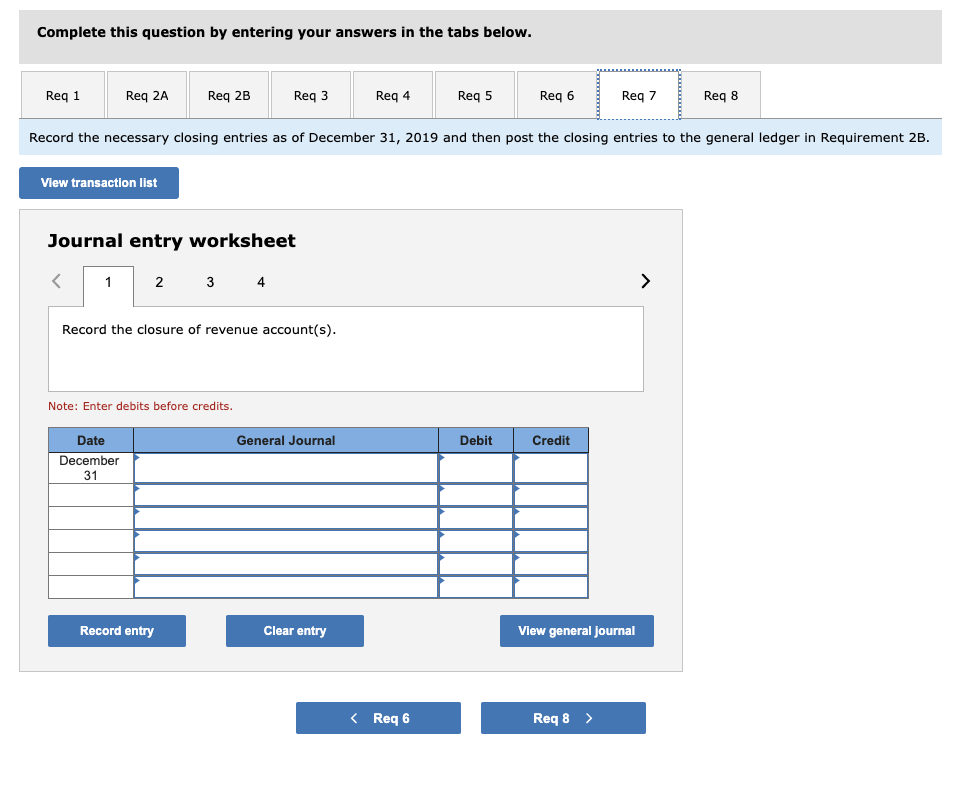

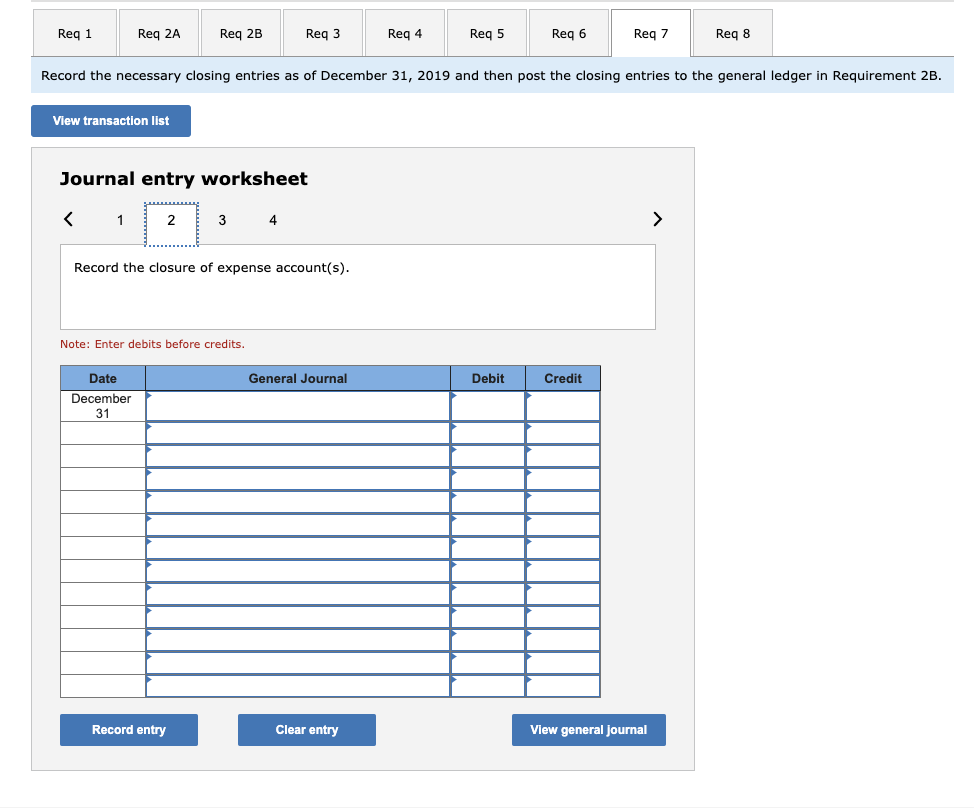

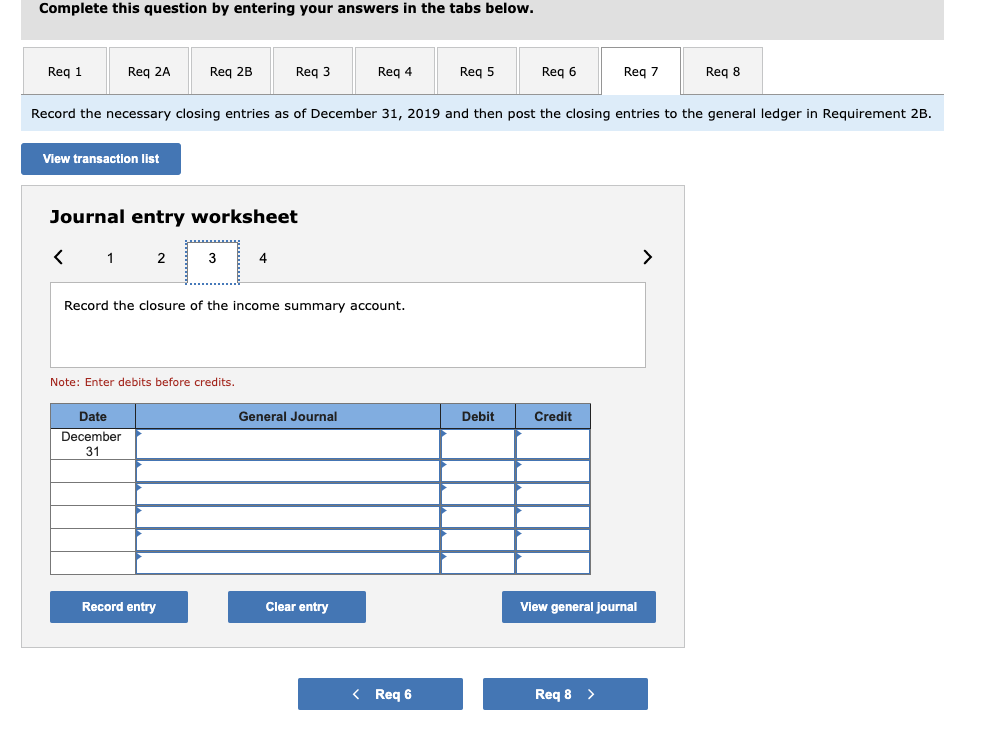

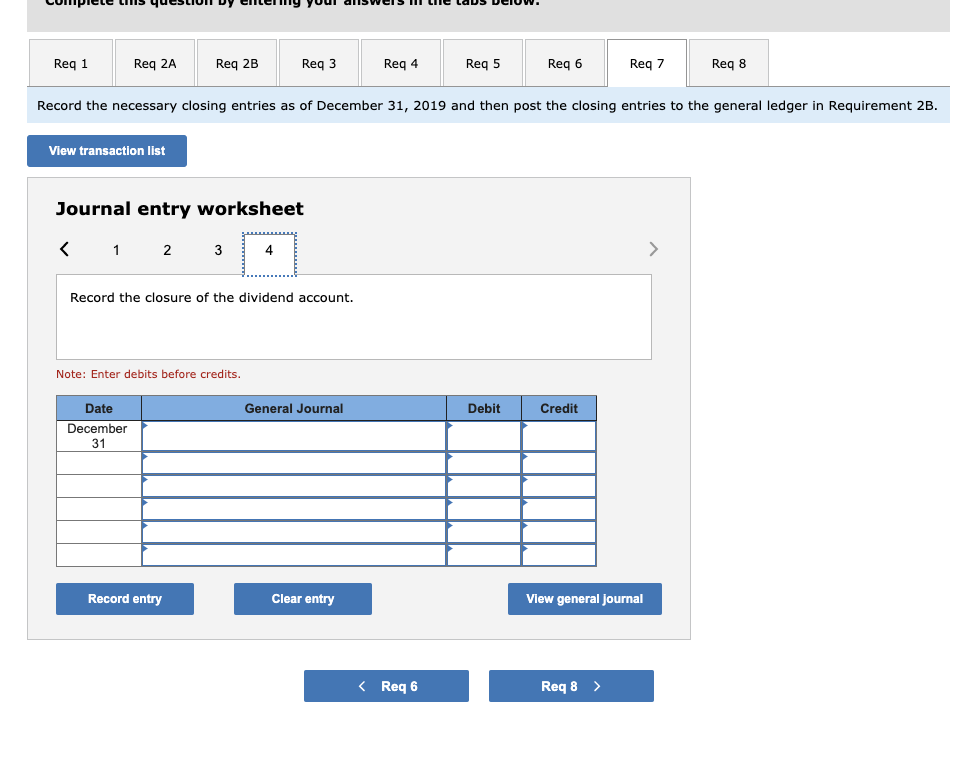

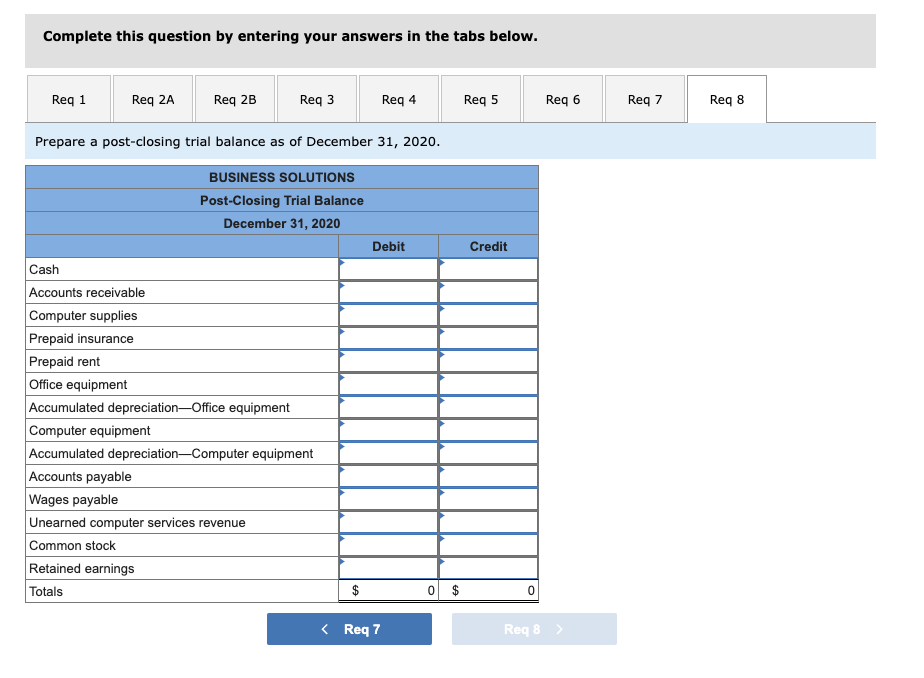

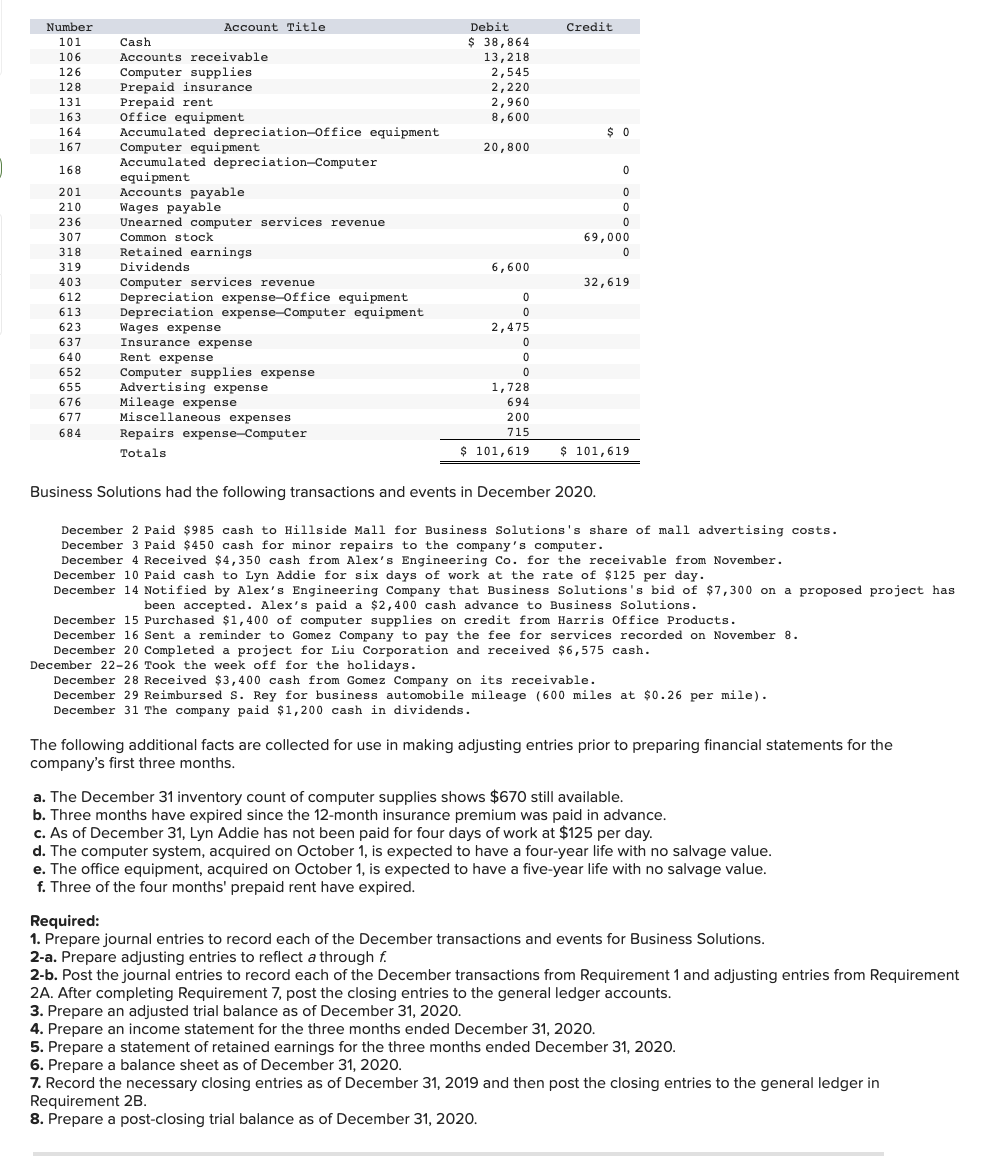

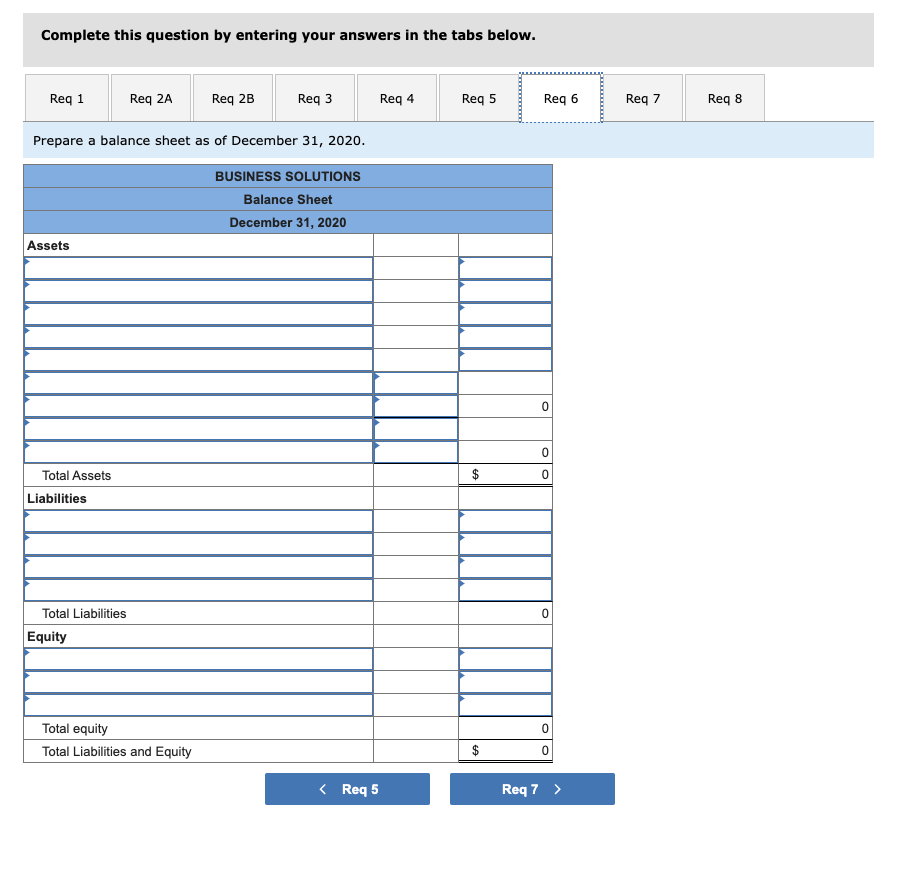

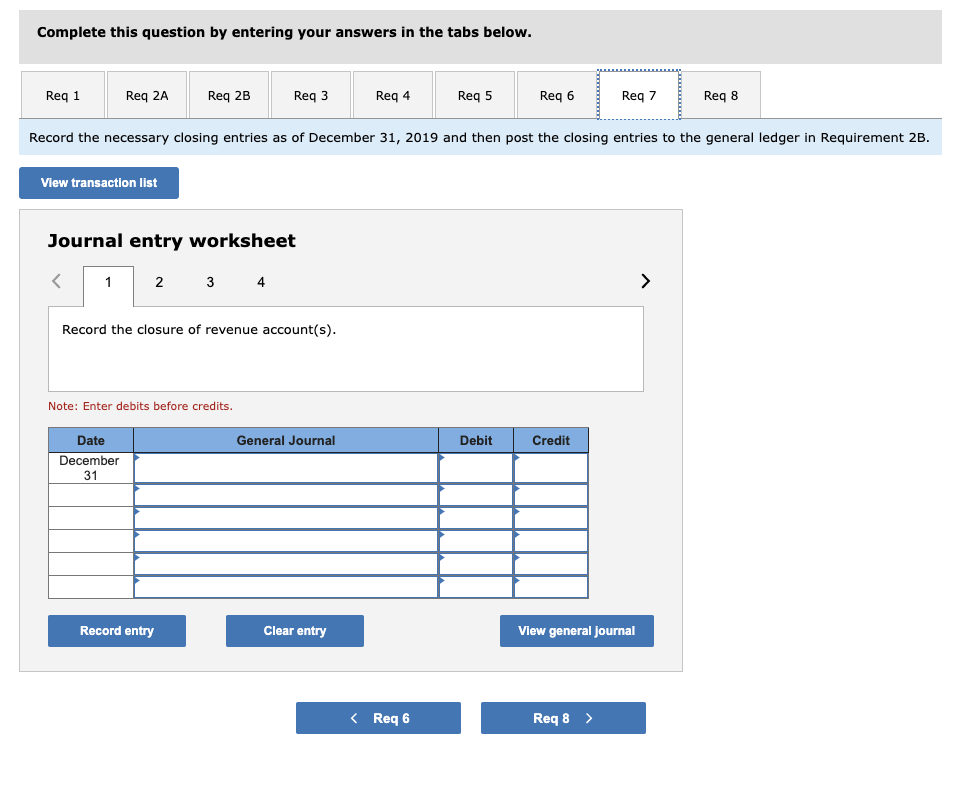

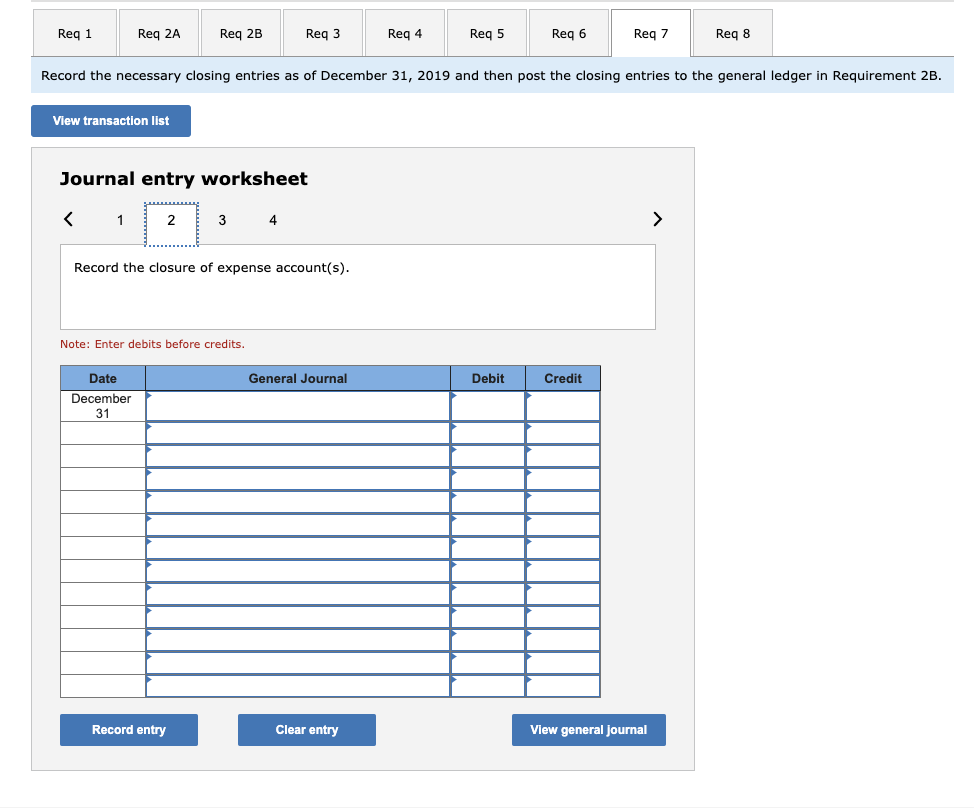

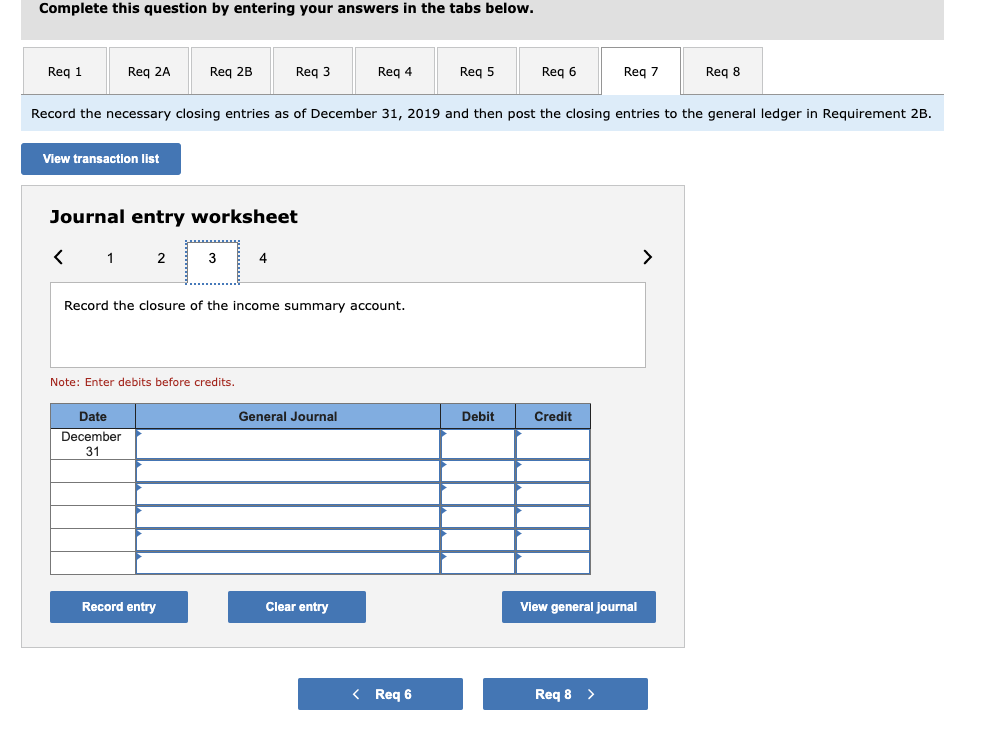

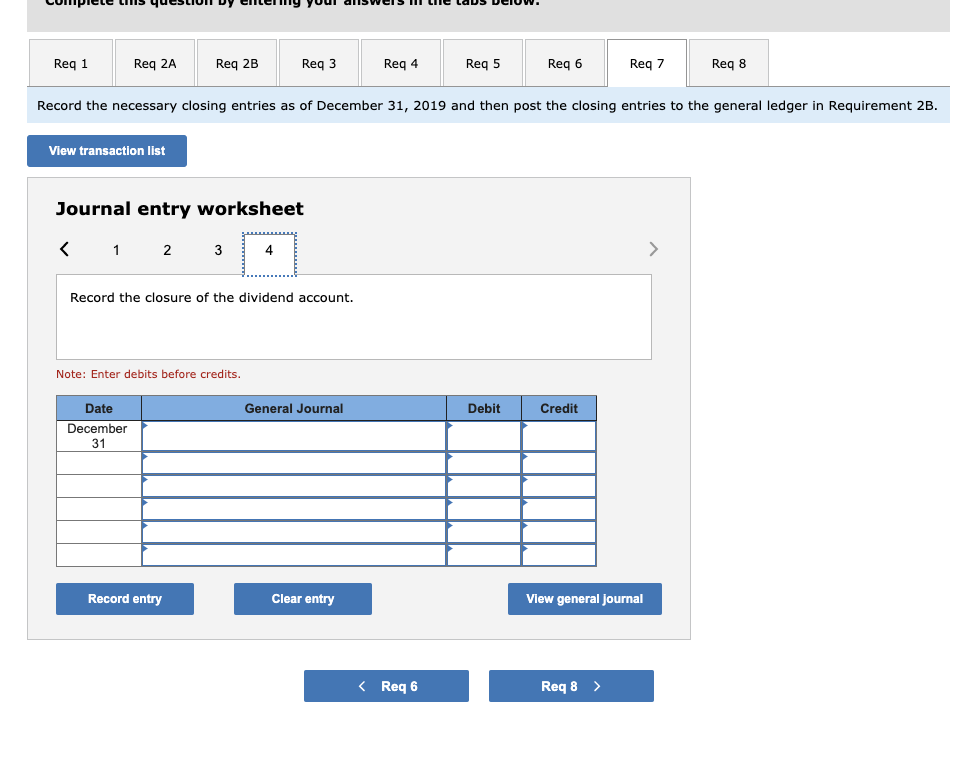

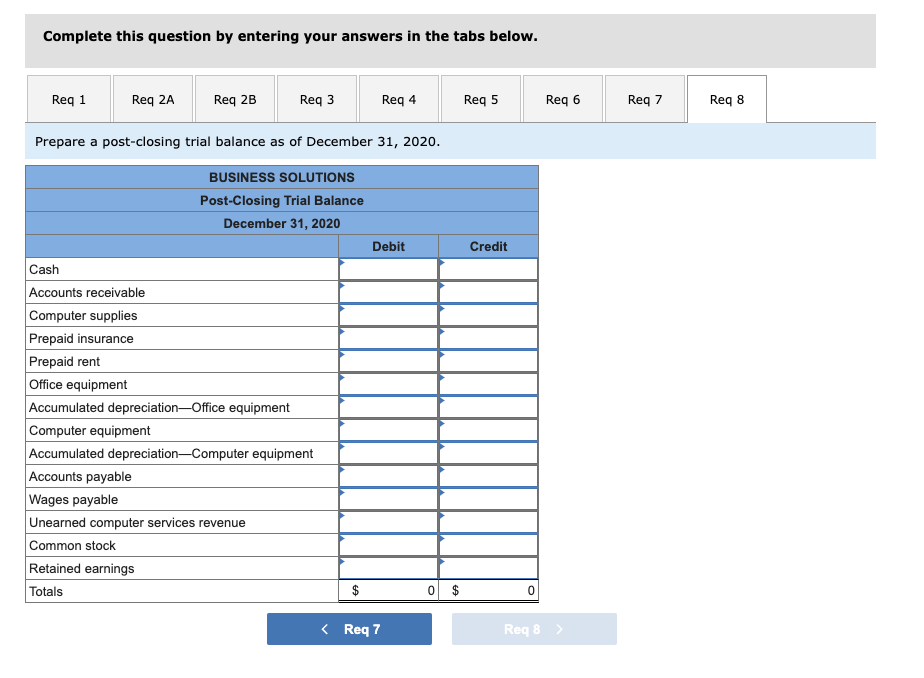

December 3 Paid $450 cash for minor repairs to the company's computer. December 4 Received $4,350 cash from Alex's Engineering Co. for the receivable from November. December 10 Paid cash to Lyn Addie for six days of work at the rate of $125 per day. December 14 Notified by Alex's Engineering Company that Business Solutions's bid of $7,300 on a proposed project has been accepted. Alex's paid a $2,400 cash advance to Business Solutions. December 15 Purchased $1,400 of computer supplies on credit from Harris office Products. December 16 Sent a reminder to Gomez Company to pay the fee for services recorded on November 8 . December 20 Completed a project for Liu Corporation and received $6,575 cash. December 22-26 Took the week off for the holidays. December 28 Received $3,400 cash from Gomez Company on its receivable. December 29 Reimbursed S. Rey for business automobile mileage ( 600miles at $0.26 per mile). December 31 The company paid $1,200 cash in dividends. The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company's first three months. a. The December 31 inventory count of computer supplies shows $670 still available. b. Three months have expired since the 12-month insurance premium was paid in advance. c. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day. d. The computer system, acquired on October 1 , is expected to have a four-year life with no salvage value. e. The office equipment, acquired on October 1 , is expected to have a five-year life with no salvage value. f. Three of the four months' prepaid rent have expired. Required: 1. Prepare journal entries to record each of the December transactions and events for Business Solutions. 2-a. Prepare adjusting entries to reflect a through f. 2-b. Post the journal entries to record each of the December transactions from Requirement 1 and adjusting entries from Requiremen 2A. After completing Requirement 7, post the closing entries to the general ledger accounts. 3. Prepare an adjusted trial balance as of December 31, 2020. 4. Prepare an income statement for the three months ended December 31, 2020. 5. Prepare a statement of retained earnings for the three months ended December 31, 2020. 6. Prepare a balance sheet as of December 31, 2020. 7. Record the necessary closing entries as of December 31, 2019 and then post the closing entries to the general ledger in Requirement 2B. Complete this question by entering your answers in the tabs below. Prepare a balance sheet as of December 31,2020. Complete this question by entering your answers in the tabs below. Record the necessary closing entries as of December 31, 2019 and then post t Journal entry worksheet 4 Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. tecord the necessary closing entries as of December 31, 2019 and then post Journal entry worksheet Record the closure of the income summary account. Note: Enter debits before credits. Record the necessary closing entries as of December 31,2019 and then post the closing entries to the general ledger in Requirement 2B. Journal entry worksheet Record the closure of the dividend account. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare a post-closing trial balance as of December 31, 2020