urgent please help

finance management

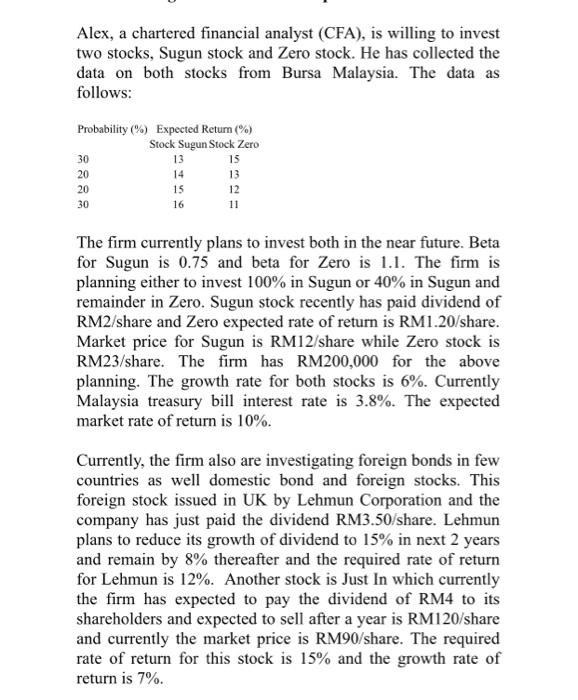

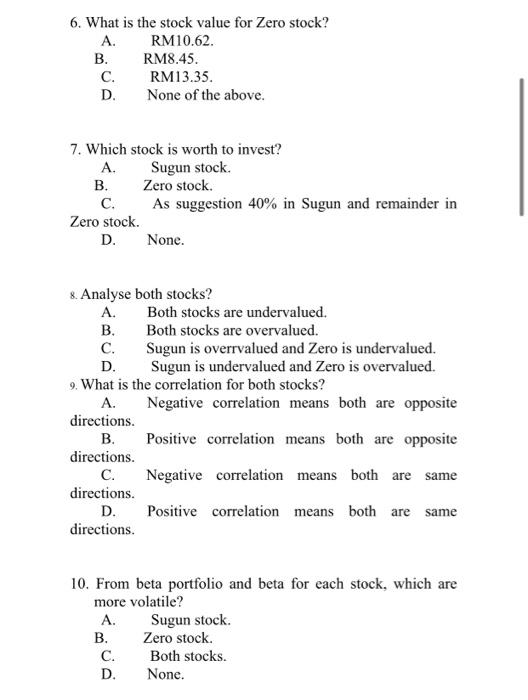

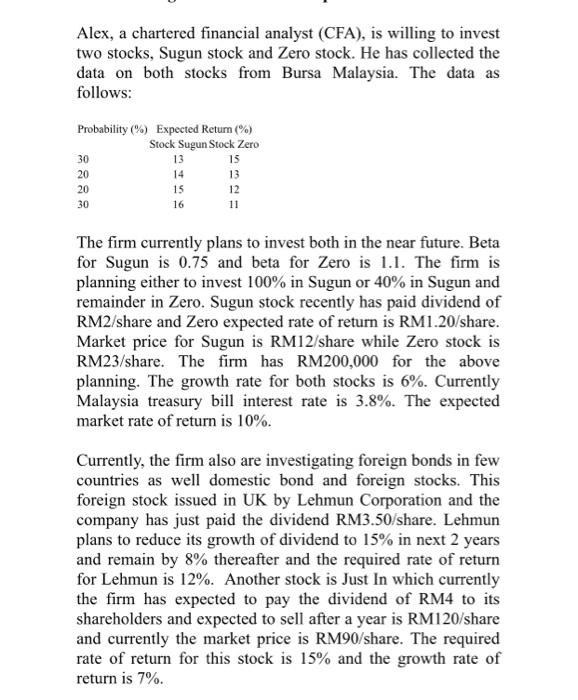

Alex, a chartered financial analyst (CFA), is willing to invest two stocks, Sugun stock and Zero stock. He has collected the data on both stocks from Bursa Malaysia. The data as follows: Probability (%) Expected Return (%) Stock Sugun Stock Zero 30 13 15 20 14 13 20 15 12 30 16 11 The firm currently plans to invest both in the near future. Beta for Sugun is 0.75 and beta for Zero is 1.1. The firm is planning either to invest 100% in Sugun or 40% in Sugun and remainder in Zero. Sugun stock recently has paid dividend of RM2/share and Zero expected rate of return is RM1.20/share. Market price for Sugun is RM12/ share while Zero stock is RM23/share. The firm has RM200,000 for the above planning. The growth rate for both stocks is 6%. Currently Malaysia treasury bill interest rate is 3.8%. The expected market rate of return is 10%. Currently, the firm also are investigating foreign bonds in few countries as well domestic bond and foreign stocks. This foreign stock issued in UK by Lehmun Corporation and the company has just paid the dividend RM3.50/share. Lehmun plans to reduce its growth of dividend to 15% in next 2 years and remain by 8% thereafter and the required rate of return for Lehmun is 12%. Another stock is Just In which currently the firm has expected to pay the dividend of RM4 to its shareholders and expected to sell after a year is RM120/share and currently the market price is RM90/share. The required rate of return for this stock is 15% and the growth rate of return is 7%. 6. What is the stock value for Zero stock? A. RM10.62. B. RM8.45. c. RM13.35. D. None of the above 7. Which stock is worth to invest? A. Sugun stock. B. Zero stock. C. As suggestion 40% in Sugun and remainder in Zero stock. D. None. 8. Analyse both stocks? A. Both stocks are undervalued. B. Both stocks are overvalued. c. Sugun is overrvalued and Zero is undervalued. D. Sugun is undervalued and Zero is overvalued. 9. What is the correlation for both stocks? A. Negative correlation means both are opposite directions. B. Positive correlation means both are opposite directions. C. Negative correlation means both are same directions. Positive correlation means both are same directions. D. 10. From beta portfolio and beta for each stock, which are more volatile? A. Sugun stock. B. Zero stock. C. Both stocks. D None. Alex, a chartered financial analyst (CFA), is willing to invest two stocks, Sugun stock and Zero stock. He has collected the data on both stocks from Bursa Malaysia. The data as follows: Probability (%) Expected Return (%) Stock Sugun Stock Zero 30 13 15 20 14 13 20 15 12 30 16 11 The firm currently plans to invest both in the near future. Beta for Sugun is 0.75 and beta for Zero is 1.1. The firm is planning either to invest 100% in Sugun or 40% in Sugun and remainder in Zero. Sugun stock recently has paid dividend of RM2/share and Zero expected rate of return is RM1.20/share. Market price for Sugun is RM12/ share while Zero stock is RM23/share. The firm has RM200,000 for the above planning. The growth rate for both stocks is 6%. Currently Malaysia treasury bill interest rate is 3.8%. The expected market rate of return is 10%. Currently, the firm also are investigating foreign bonds in few countries as well domestic bond and foreign stocks. This foreign stock issued in UK by Lehmun Corporation and the company has just paid the dividend RM3.50/share. Lehmun plans to reduce its growth of dividend to 15% in next 2 years and remain by 8% thereafter and the required rate of return for Lehmun is 12%. Another stock is Just In which currently the firm has expected to pay the dividend of RM4 to its shareholders and expected to sell after a year is RM120/share and currently the market price is RM90/share. The required rate of return for this stock is 15% and the growth rate of return is 7%. 6. What is the stock value for Zero stock? A. RM10.62. B. RM8.45. c. RM13.35. D. None of the above 7. Which stock is worth to invest? A. Sugun stock. B. Zero stock. C. As suggestion 40% in Sugun and remainder in Zero stock. D. None. 8. Analyse both stocks? A. Both stocks are undervalued. B. Both stocks are overvalued. c. Sugun is overrvalued and Zero is undervalued. D. Sugun is undervalued and Zero is overvalued. 9. What is the correlation for both stocks? A. Negative correlation means both are opposite directions. B. Positive correlation means both are opposite directions. C. Negative correlation means both are same directions. Positive correlation means both are same directions. D. 10. From beta portfolio and beta for each stock, which are more volatile? A. Sugun stock. B. Zero stock. C. Both stocks. D None