[URGENT] PLEASE HELP: Financial Accounting Chapter 4 Homework (Part 2-5)

Part 2-

Part 3-

Part 4-

Part 5-

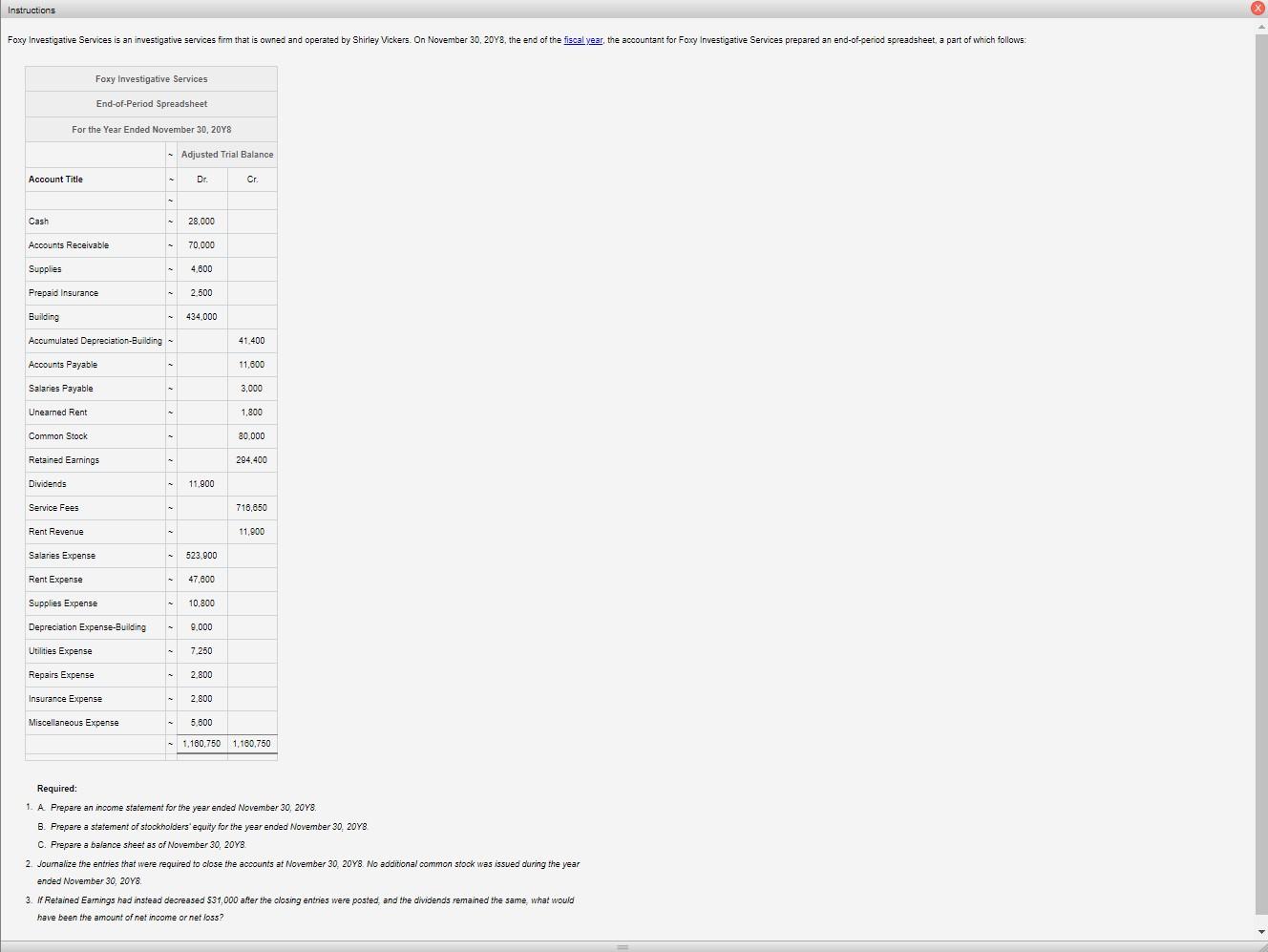

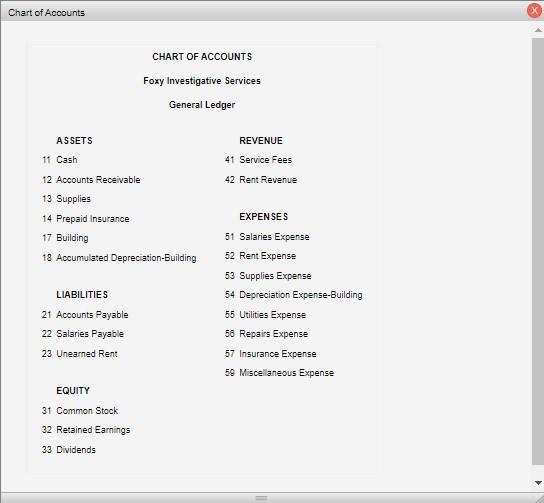

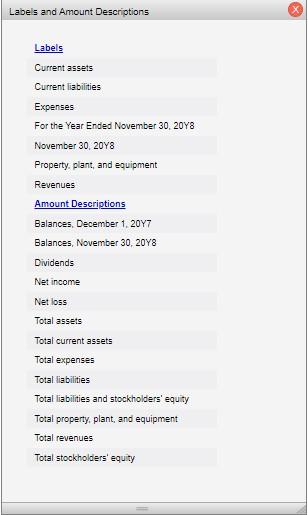

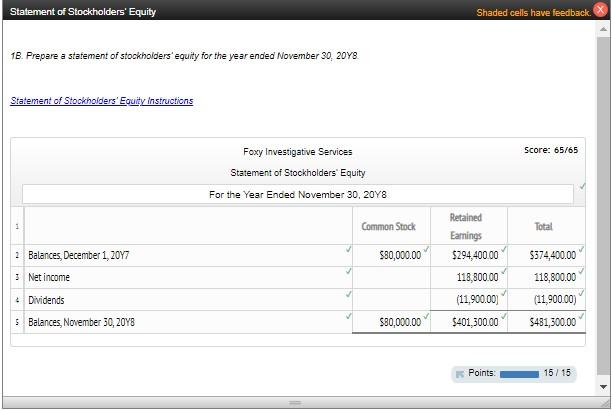

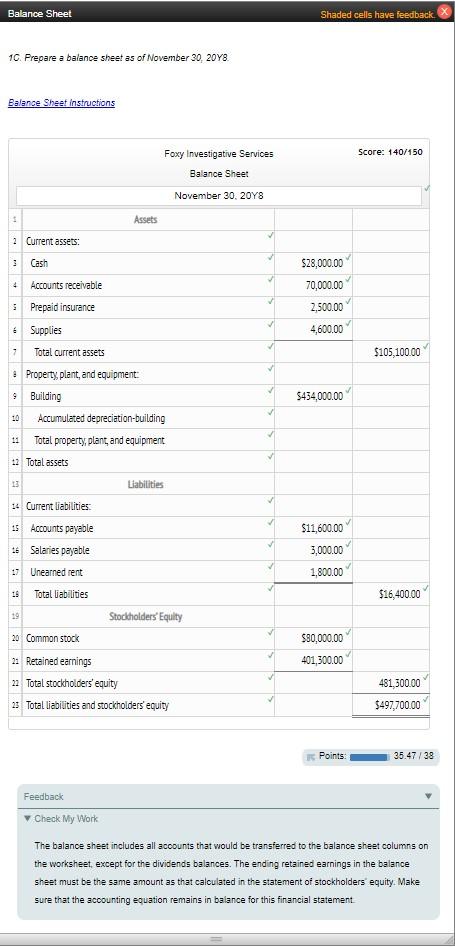

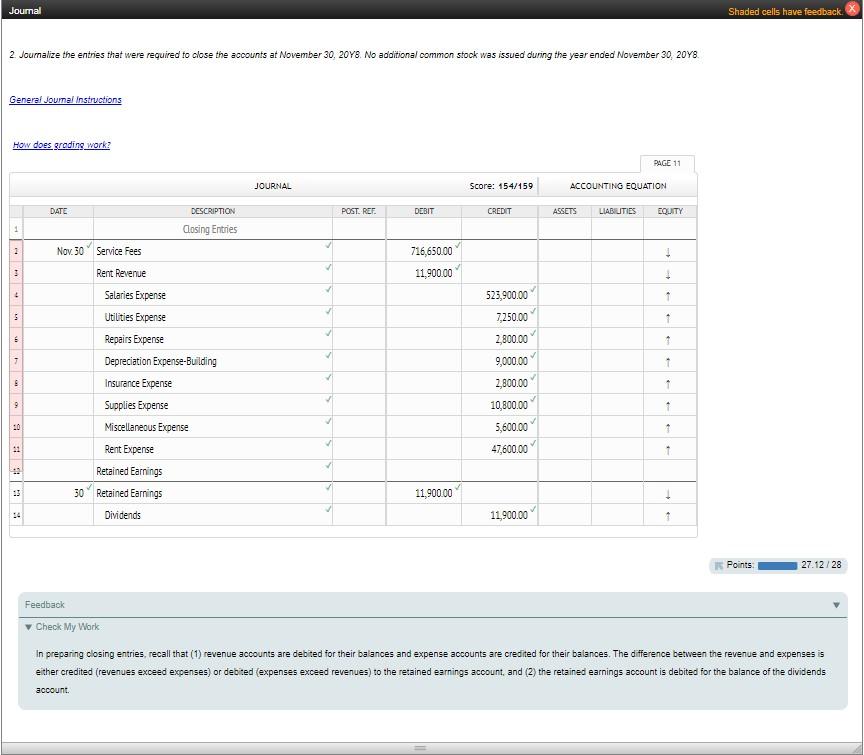

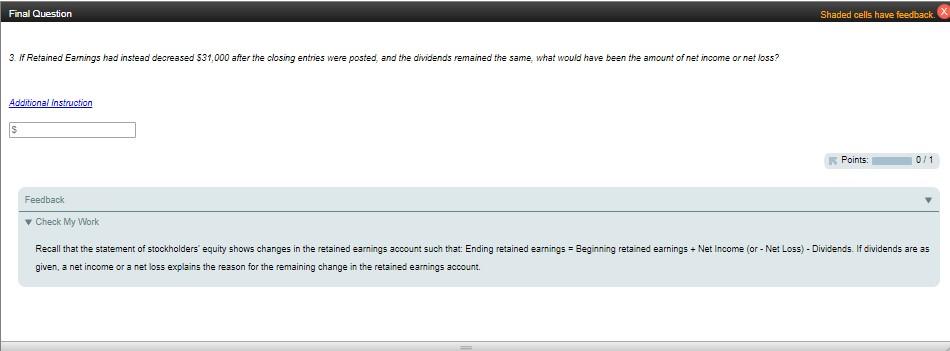

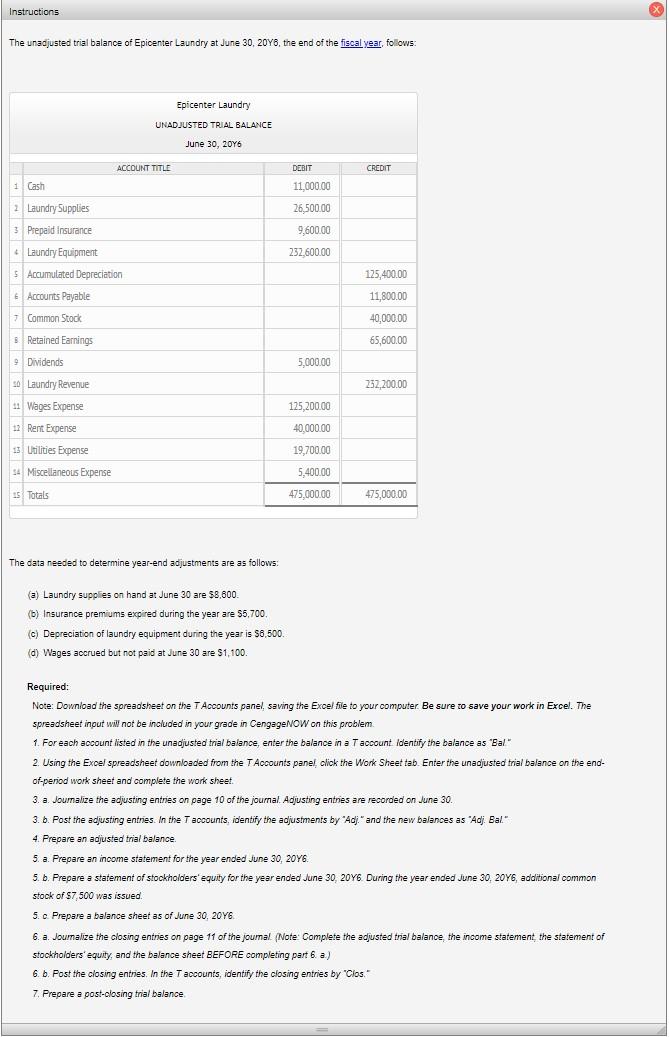

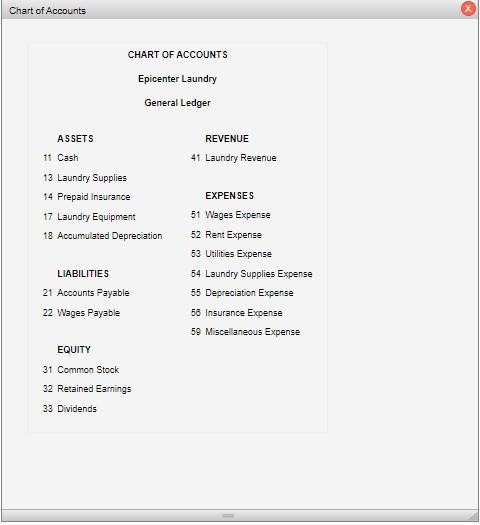

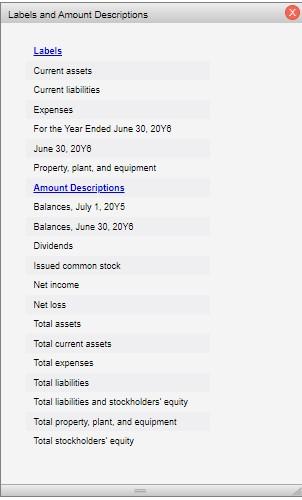

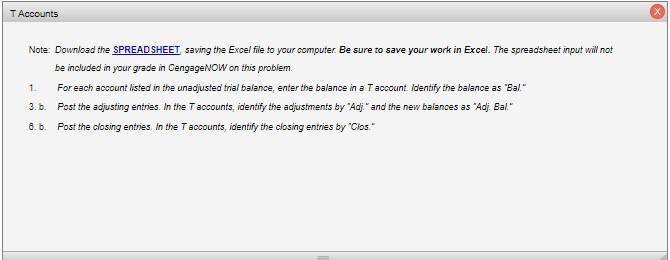

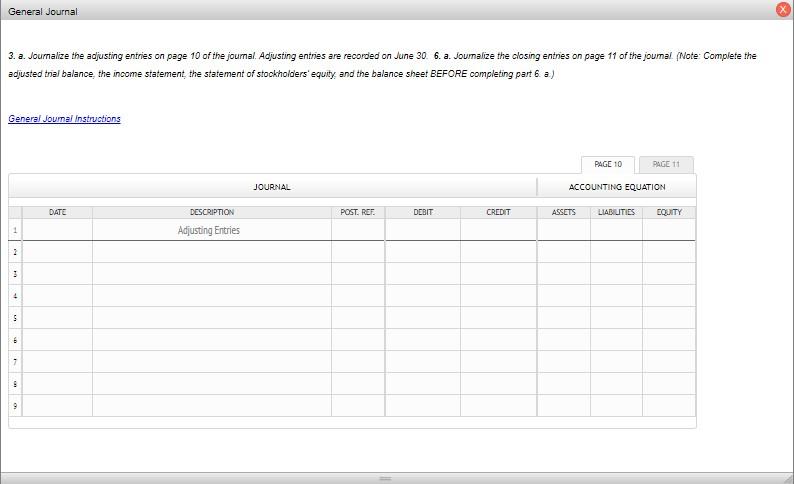

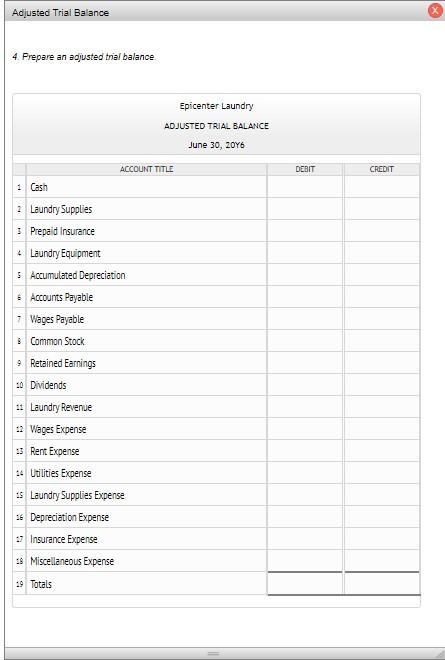

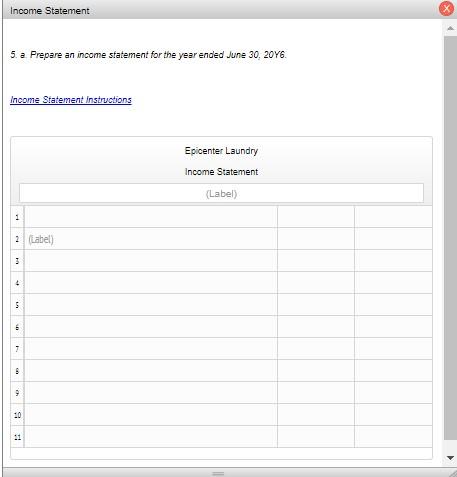

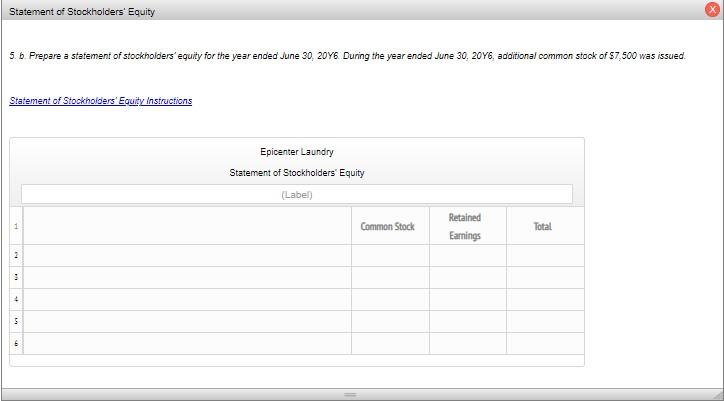

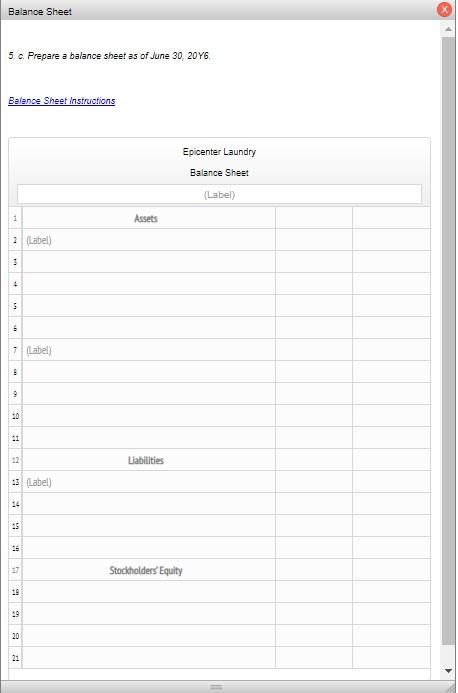

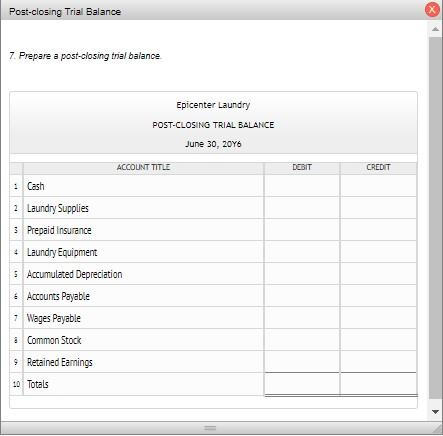

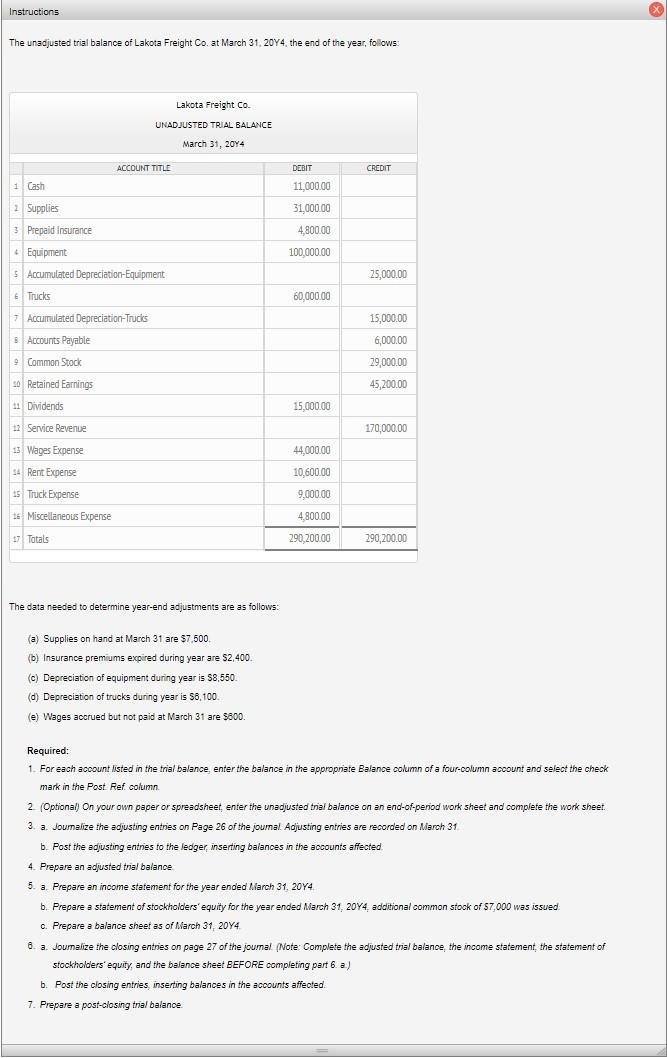

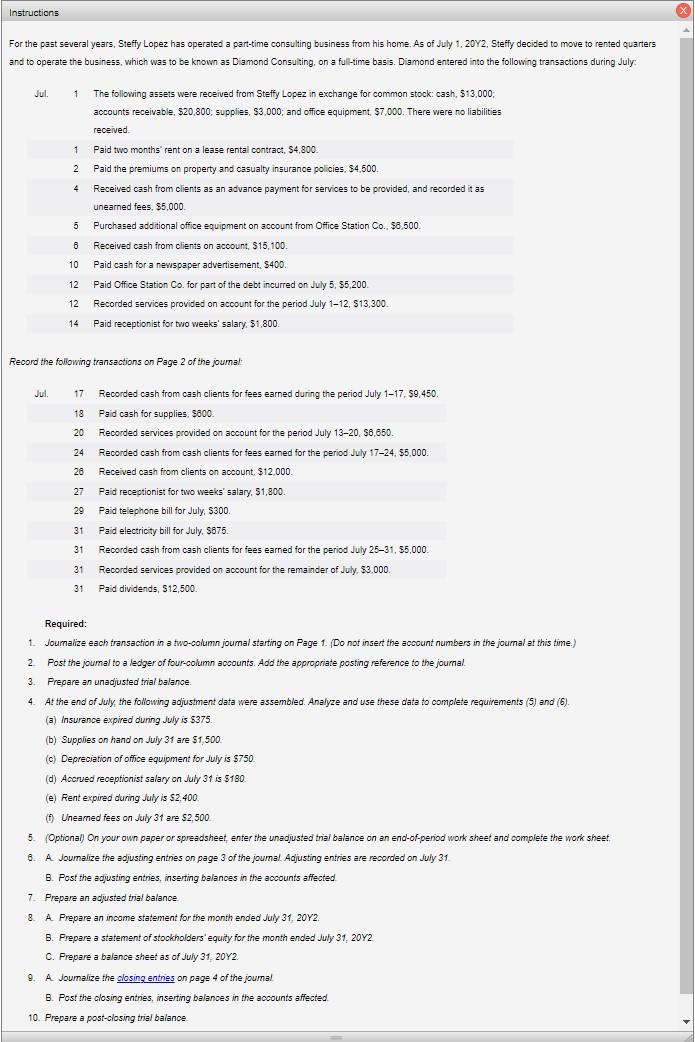

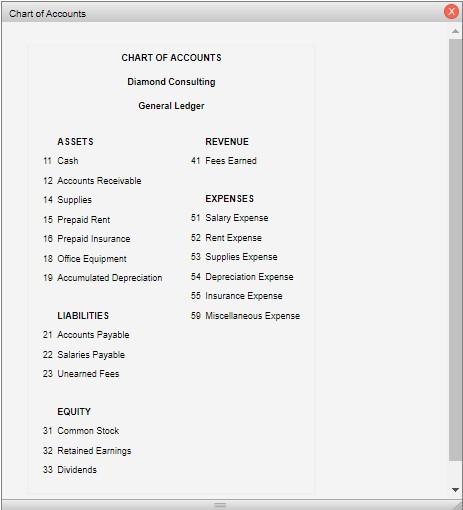

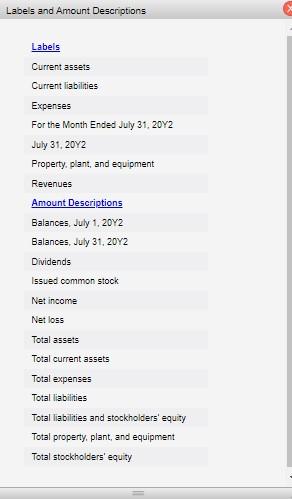

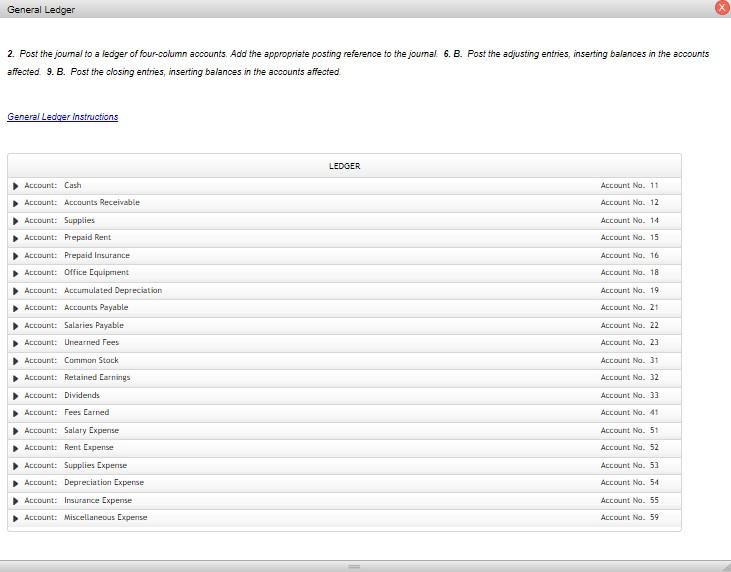

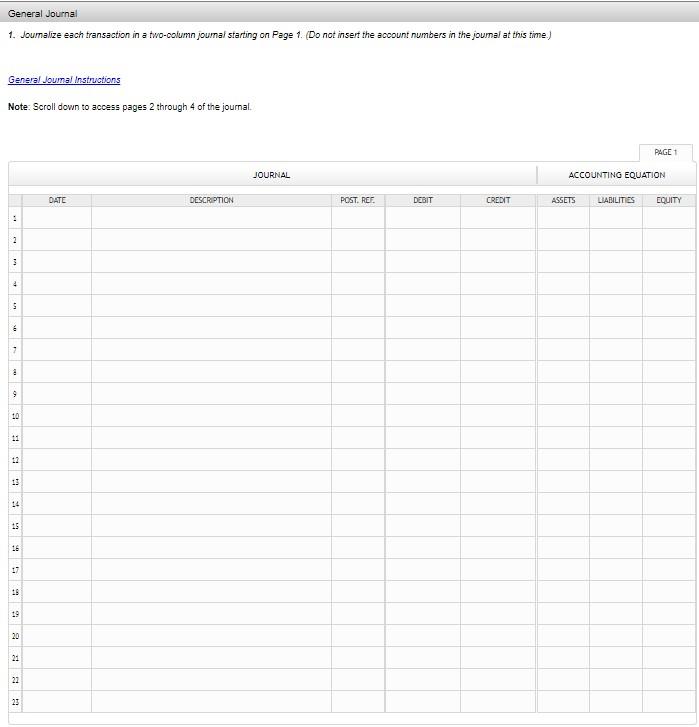

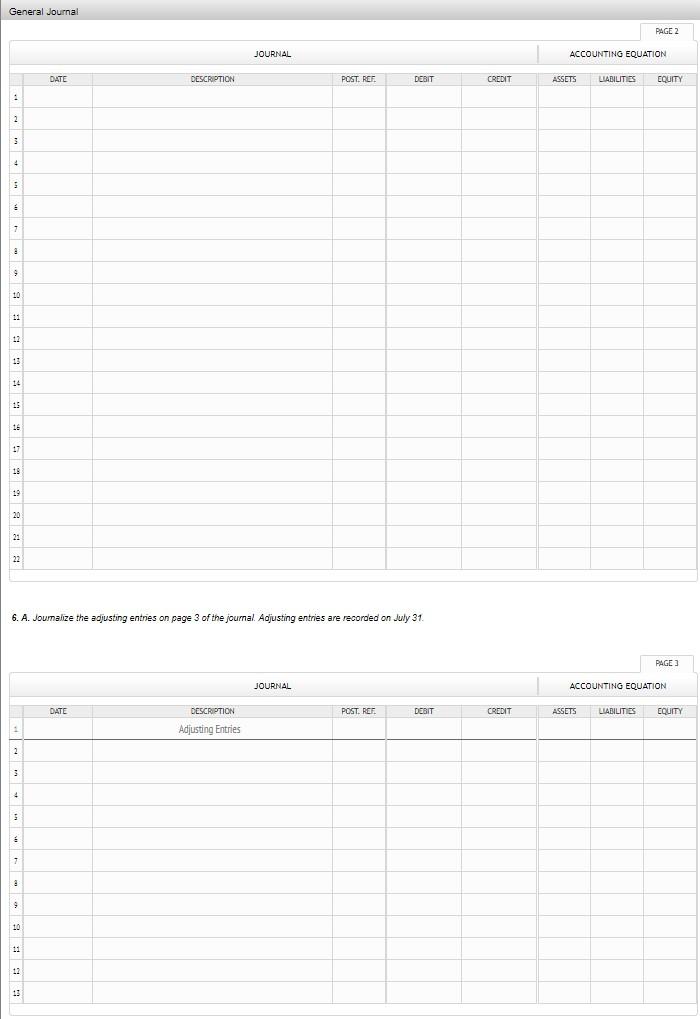

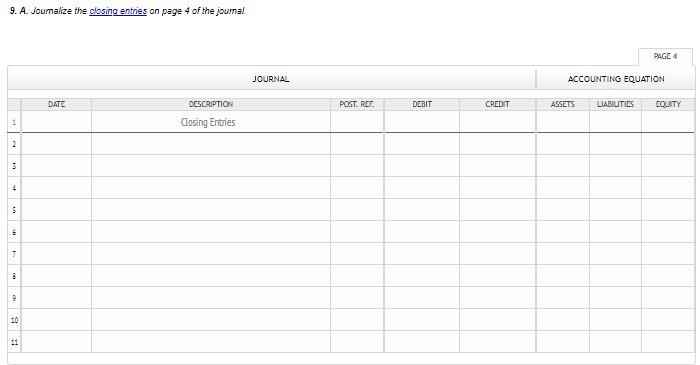

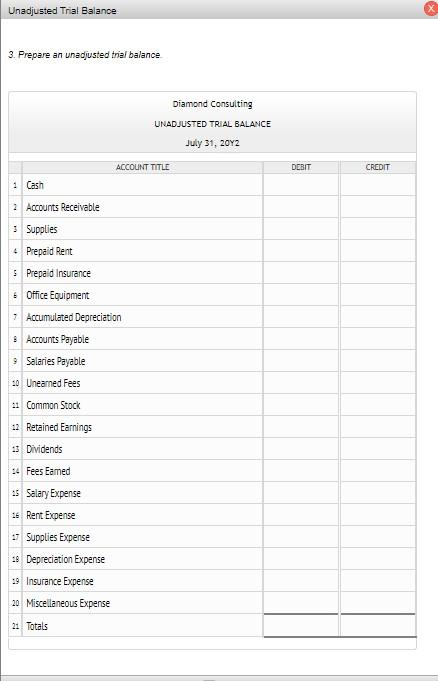

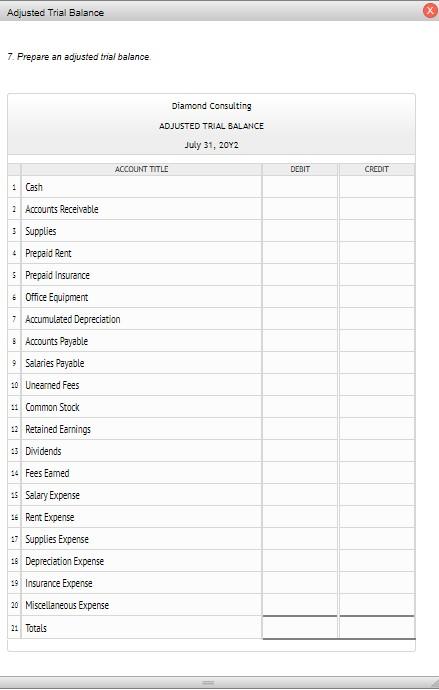

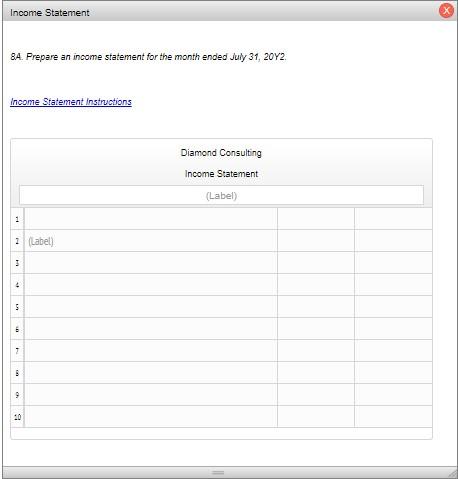

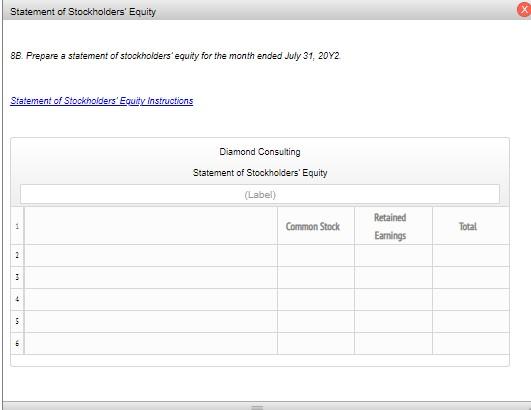

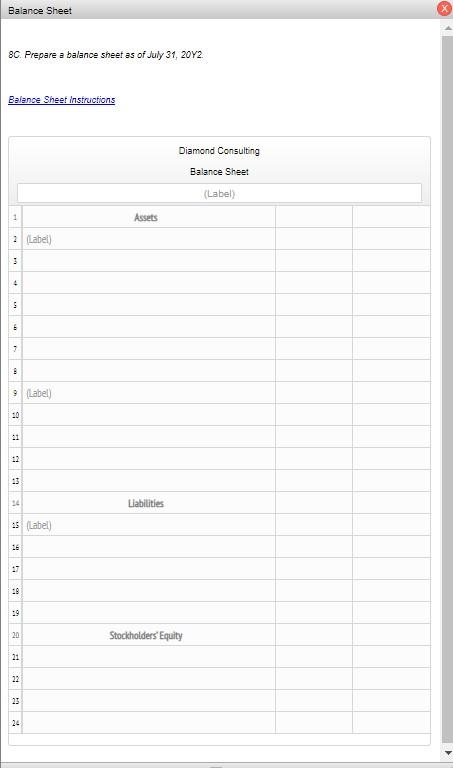

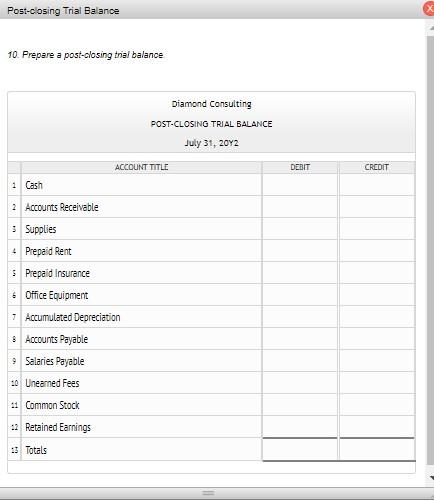

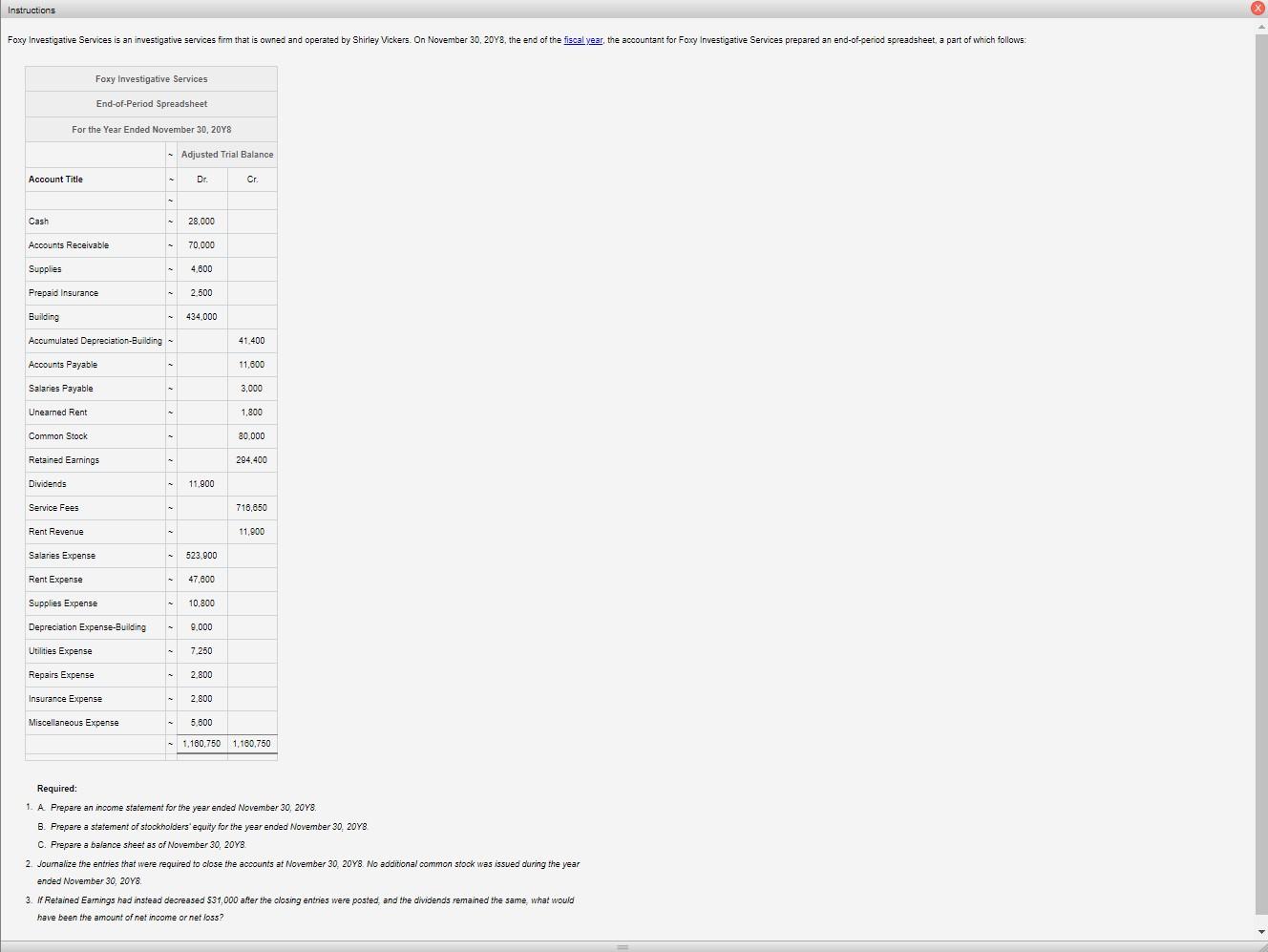

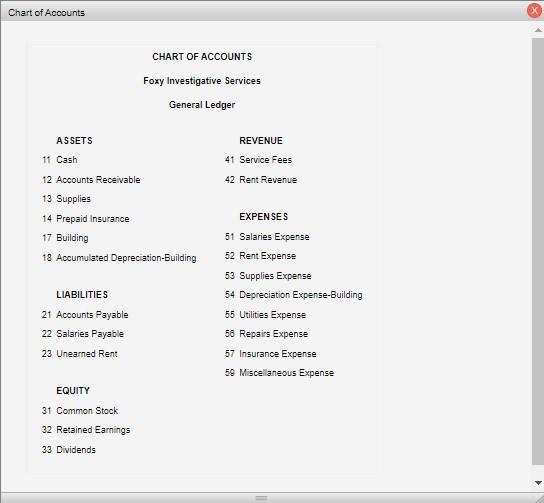

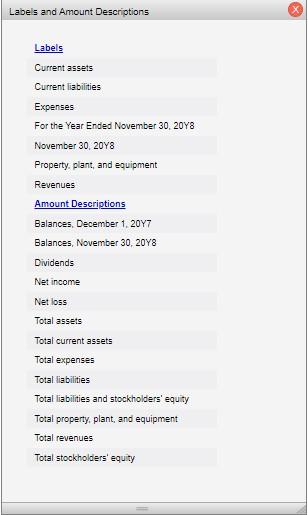

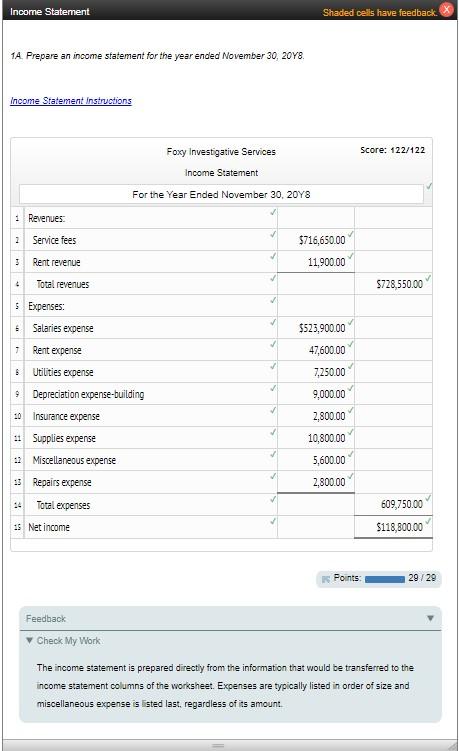

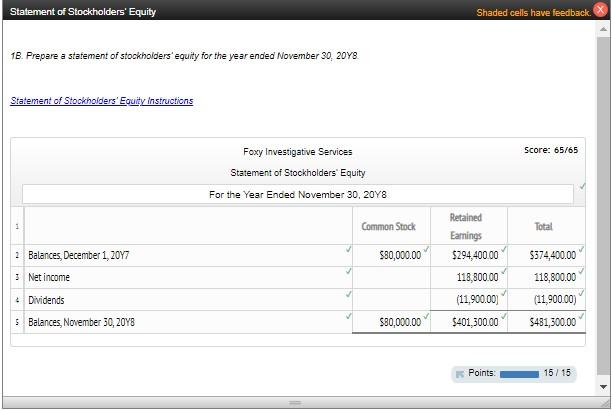

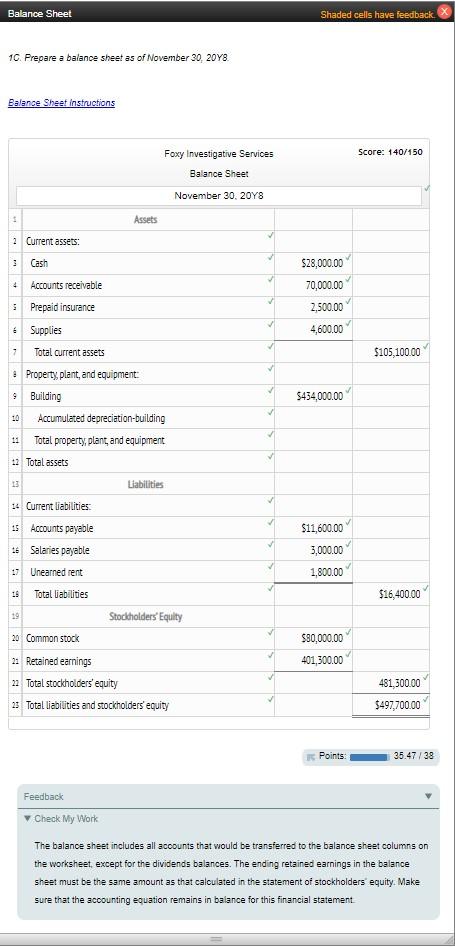

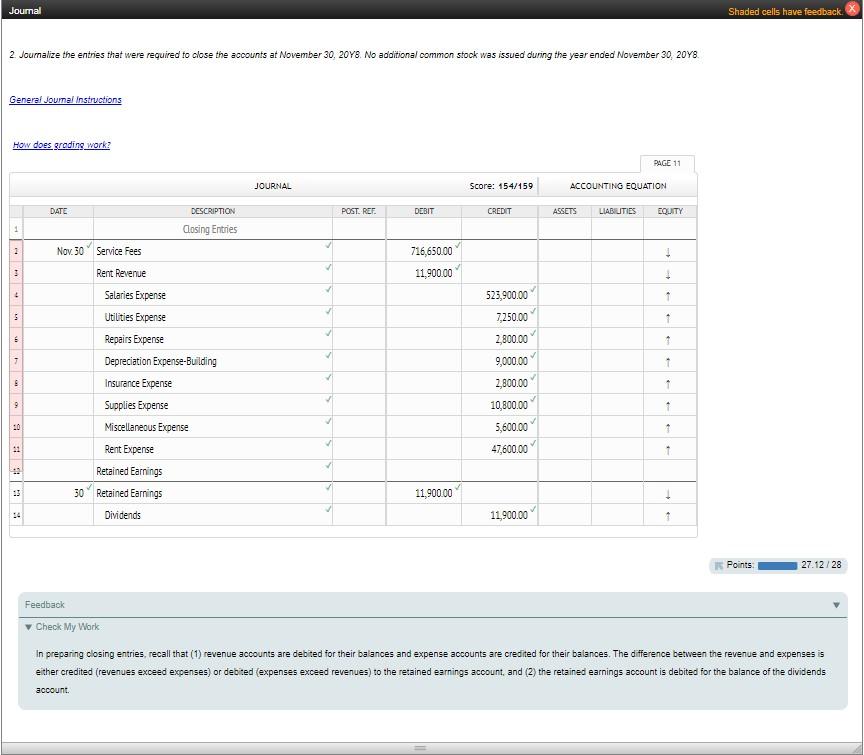

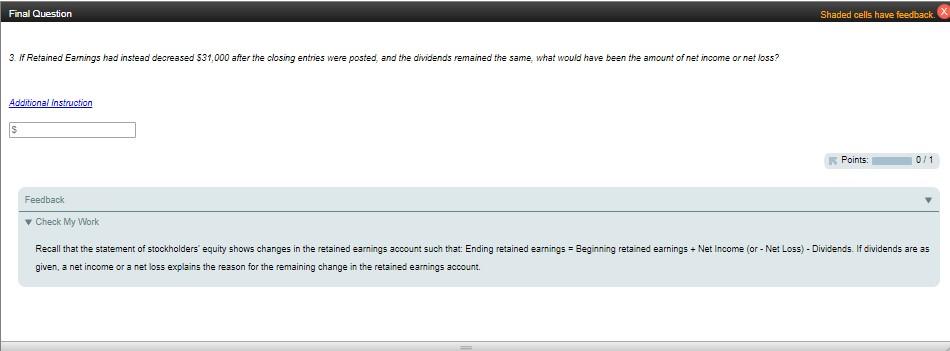

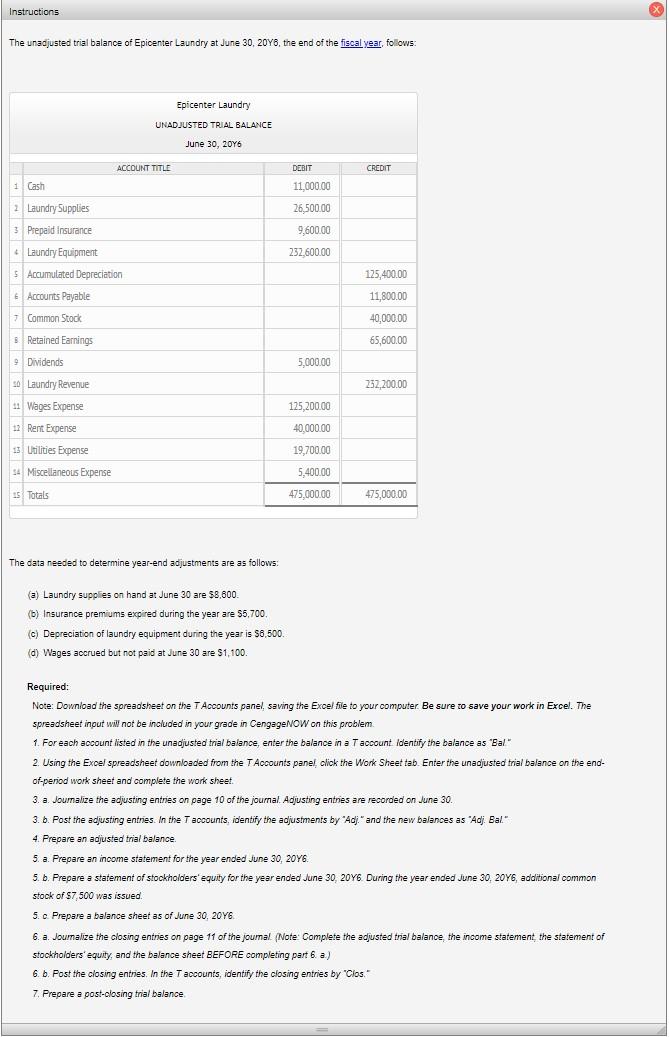

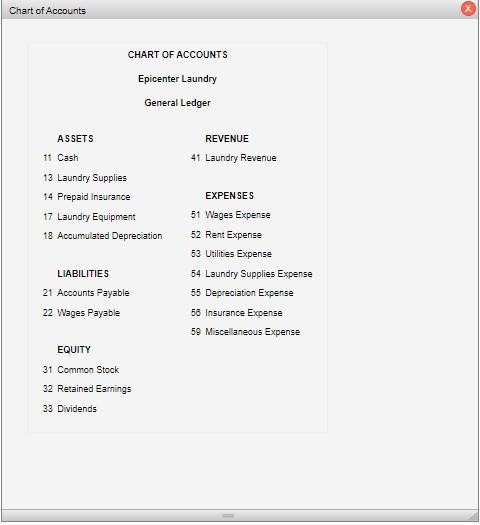

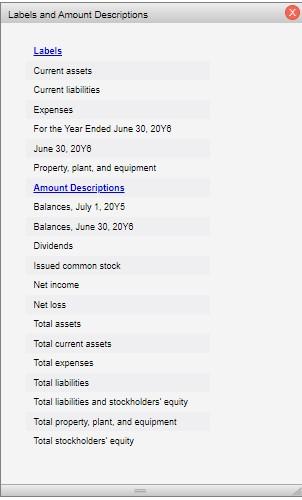

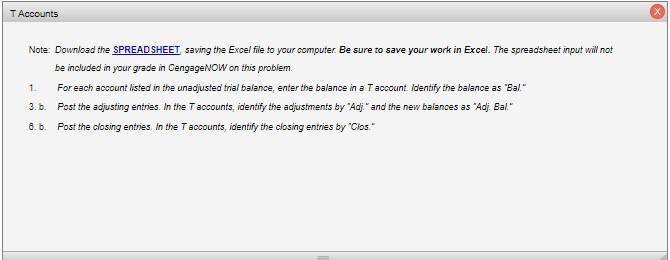

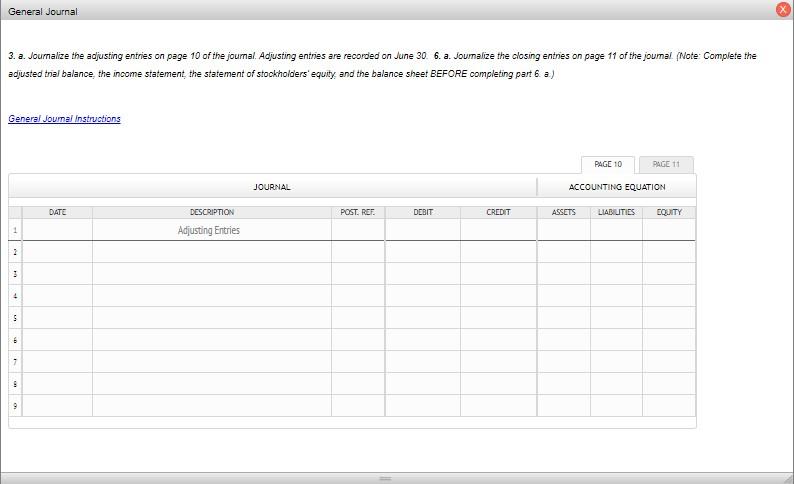

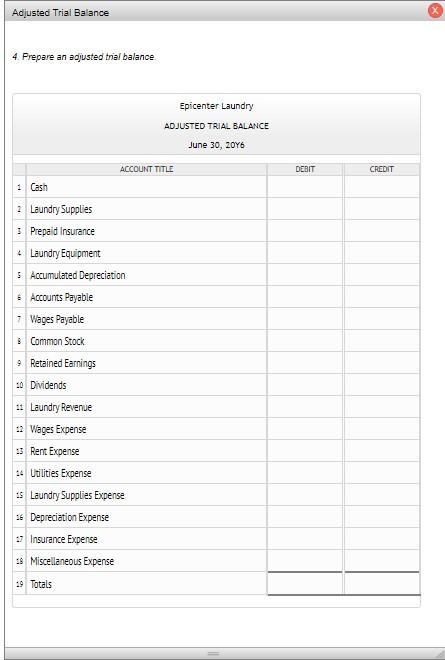

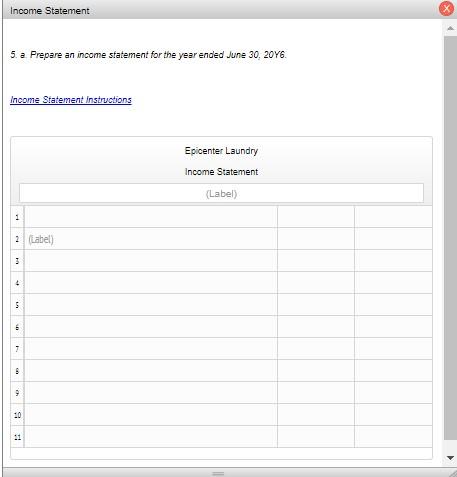

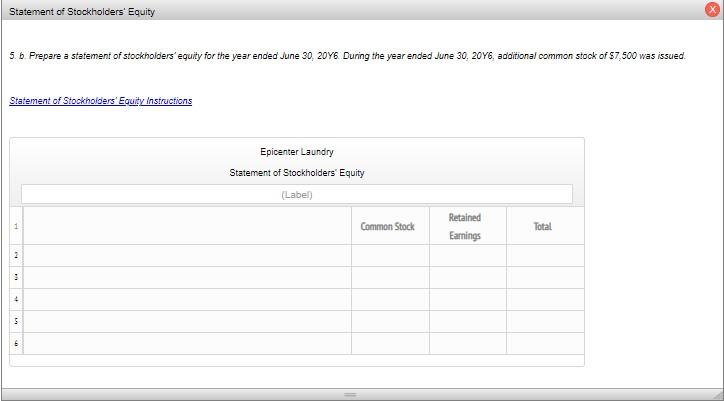

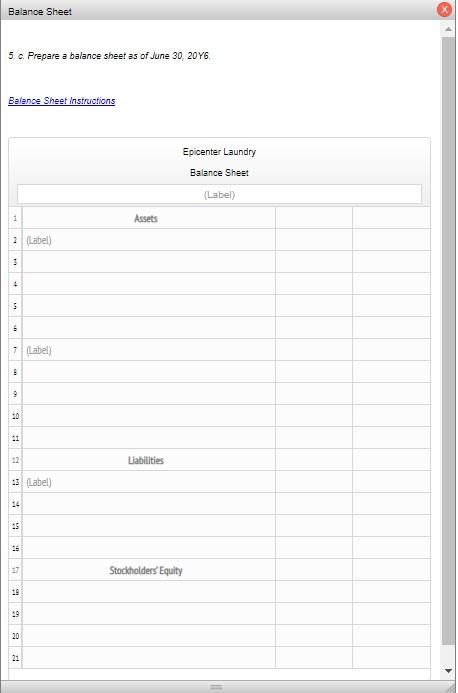

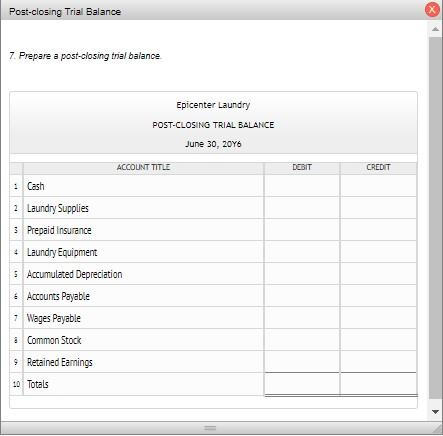

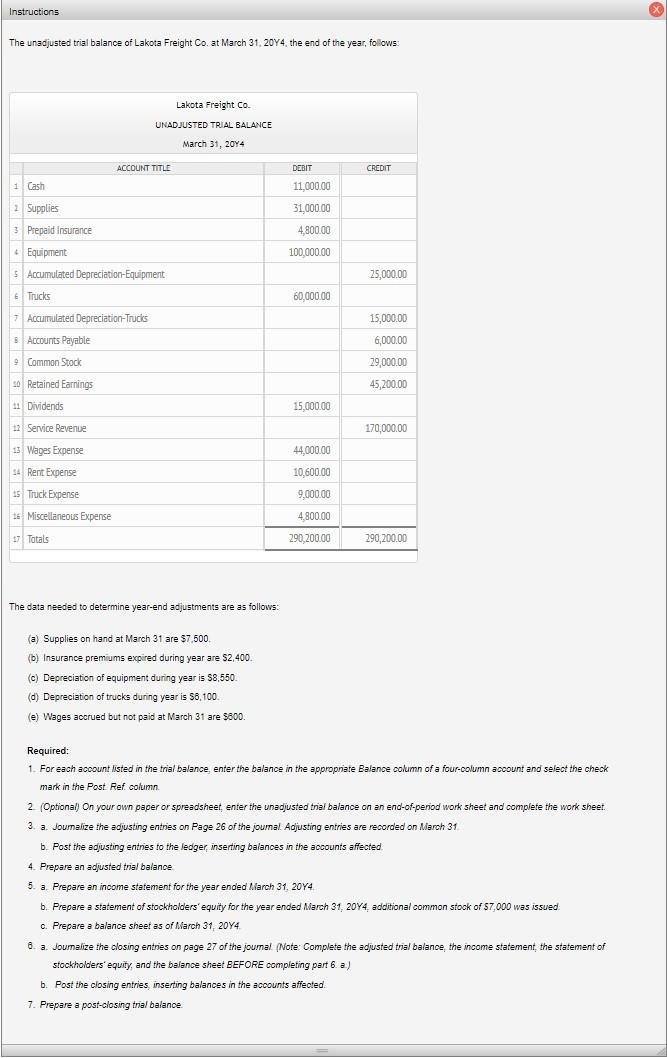

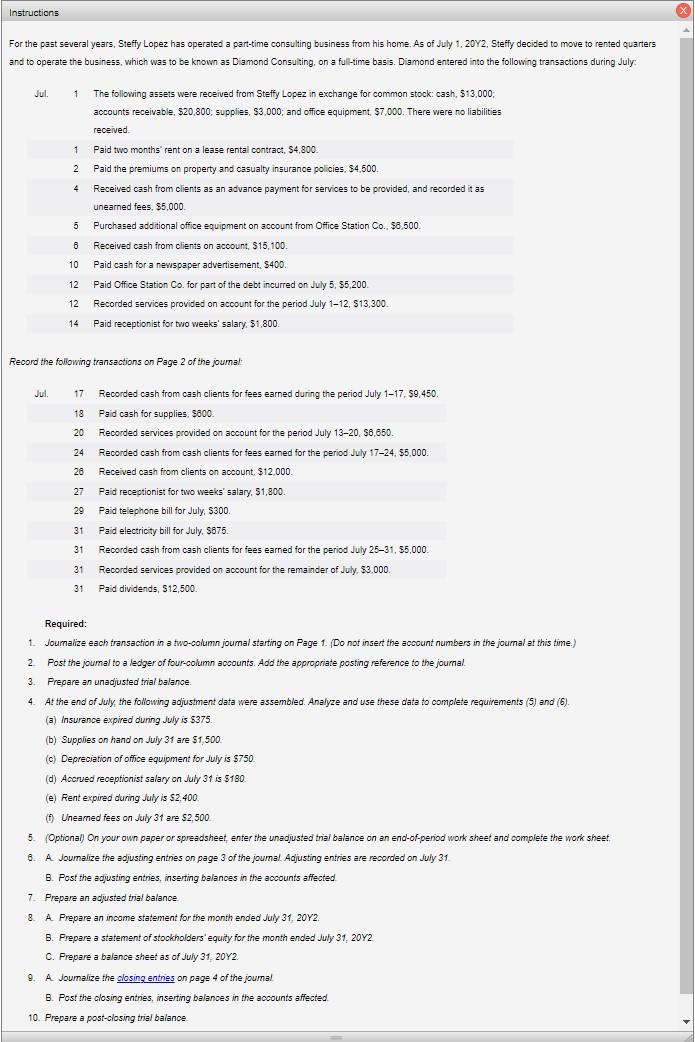

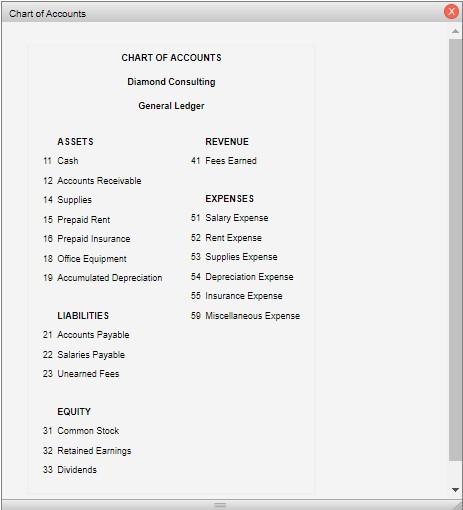

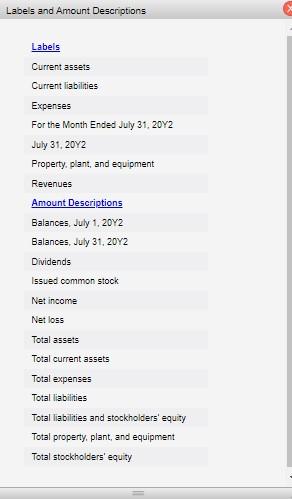

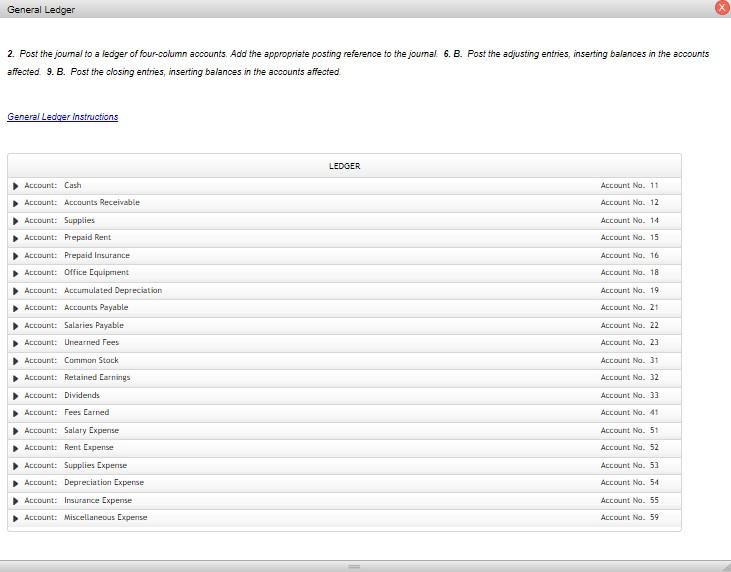

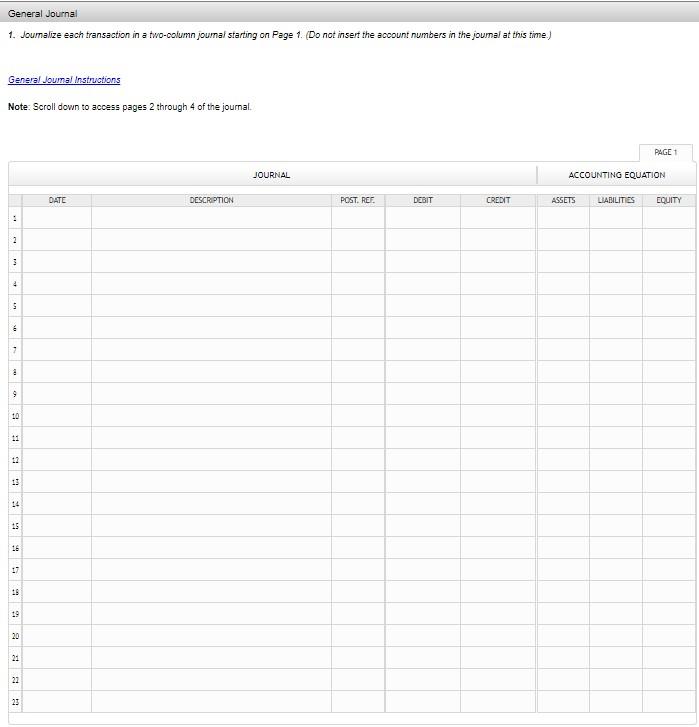

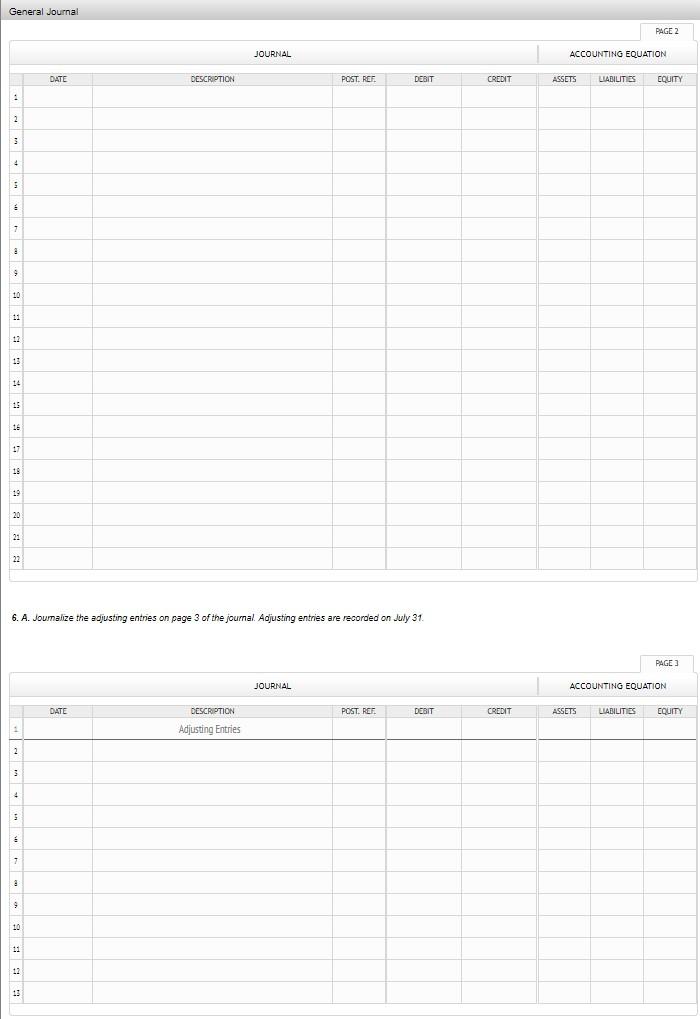

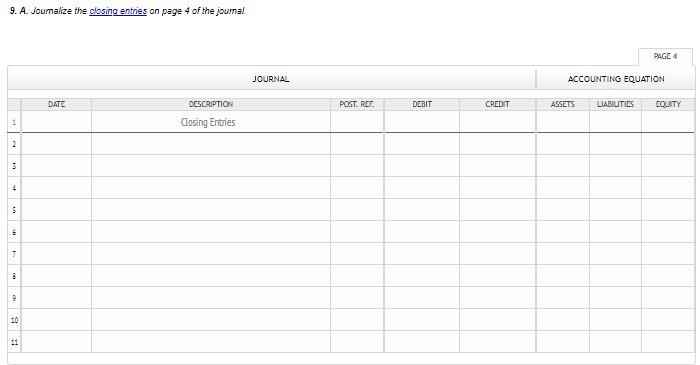

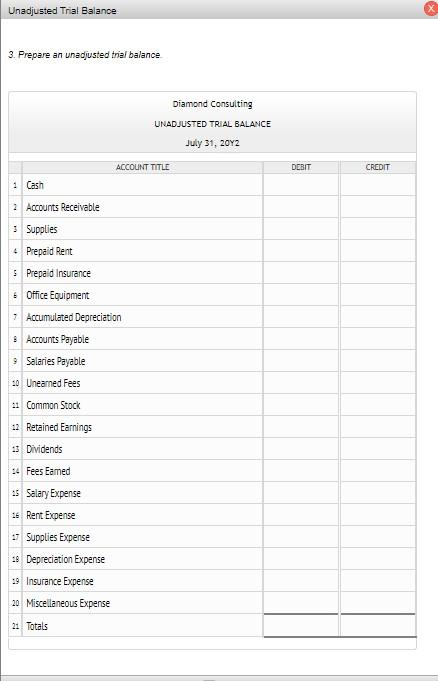

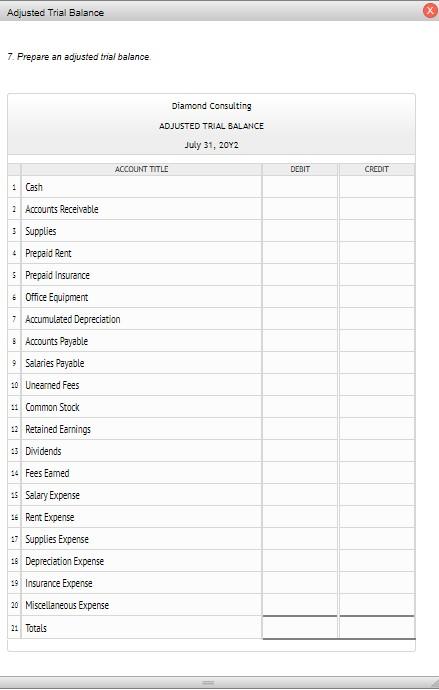

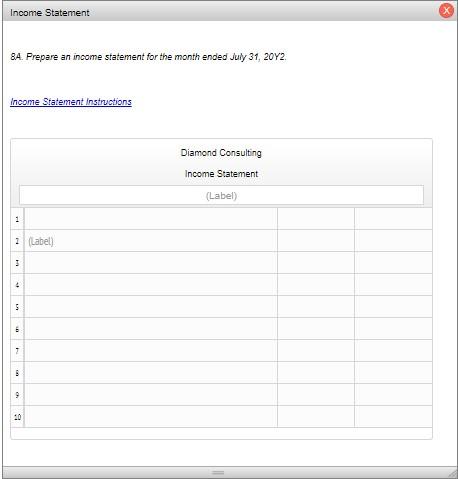

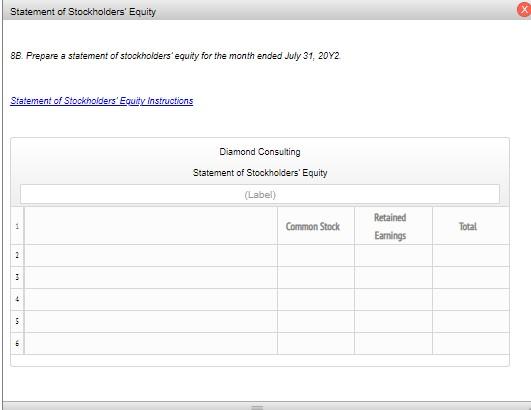

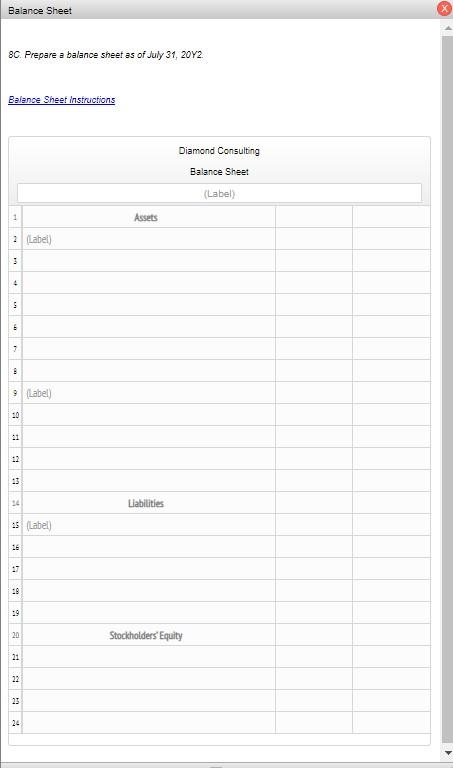

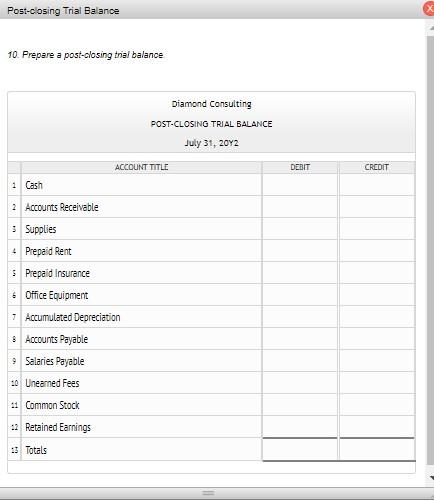

Required: 1. A. Prepare an income statement for the year ended November 30,20 Y8. B. Prepare a statement of stockholders' equity for the year ended November 30,20 y 8 C. Prepare a balance sheet as of November 30,20Y8 2. Joumalize the entries that were required to close the accounts at November 30,20Y8. No additional common stock was issued during the year ended November 30,20Y8. 3. If Retained Eamings had instead decreased $31,000 after the closing entries were posted, and the olvidends remained the same, what would have been the amount of net income or net lass? Chart of Accounts CHART OF ACCOUNTS Foxy Investigative Services General Ledger ASSETS REVENUE 11 Cash 41 Service Fees 12 Accounts Receivable 42 Rent Revenue 13 Supplies 14 Prepaid insurance EXPENSES 17 Building 51 Salaries Expense 18 Accumulated Depreciation-Building 52 Rent Expense 53 Supplies Expense LIABILITIES 54 Depreciation Expense-Building 21 Accounts Payable 55 Utilites Expense 22 Salaries Payable 56 Repairs Expense 23 Unearned Rent 57 Insurance Expense 59 Miscellaneous Expense EQUITY 31 Common Stock 32 Retained Earnings 33 Dividends Labels and Amount Descriptions Labels Current assets Current liabilities Expenses For the Year Ended November 30, 20 Y 8 November 30,20 Y 8 Property, plant, and equipment Revenues Amount Descriptions Balances, December 1, 20Y7 Balances, November 30,20Y8 Dividends Net income Net loss Total assets Total current assets Total expenses Total liabilities Total liabilities and stockholders' equity Total property, plant, and equipment Total revenues Total stockholders' equity 1A. Prepare an income statement for the year ended November 30,20Y8. Point: 39/28 Feedback Check My Work The income statement is prepared directly from the information that would be transferred to the income statement columns of the worksheet. Expenses are typically listed in order of size and miscellaneous expense is listed last, regardless of its amount. 18. Prepare a statement of stockholders' equity for the year ended November 30,20 y 8 1C. Prepare a balance sheet as of November 30,20Y8 Feedback Check Ny Work The balance sheet includes all acoounts that would be transferred to the balance sheet columns on the worksheet, except for the dividends balances. The ending retained earnings in the balance sheet must be the same amount as that calculated in the statement of stockholders equity. Make sure that the acoounting equation remains in balance for this financial statement. 2. Journalize the entries that were required to olose the accounts at November 30,20r8. No additional common stock was issued during the year ended November 30,20 Y 8 . Feedback Check My Work In preparing closing entries, recall that (1) revenue accounts are debited for their balances and expense accounts are credited for their balances. The difference between the revenue and expenses is exther credited (revenues exceed expenses) or debied (expenses exceed revenues) to the retained earnings account, and (2) the retained earnings account is debited for the balance of the dividends account. If Retained Eamings had instead decreased 531,000 after the closing entries were posted, and the dividends remained the same, what would have been the amount of net income or net loss? Feedback Check My Work given, a net income or a net loss explains the reason for the remaining change in the retained earnings account. The unadjusted trial balance of Epicenter Laundry at June 30,20Y8, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: (a) Laundry supplies on hand at June 30 are $8,800. (b) Insurance premiums expired during the year are 55,700 . Depreciation of laundry equipment duning the year is S6,500. (d) Wages accrued but not paid at June 30 are S1, 100 . Required: Note: Download the spreadsheet on the T Accounts panel, saving the Excel file to your computer. Be sure to save your work in Excel. The spreadsheet inout wil not be included in your grade in CengageNOW on this problem. 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. lolentify the balance as "Bal" 2. Using the Excel spreadsheet downloaded from the T Accounts panel, olick the Work Sheet tab. Enter the unadjusted trial balance on the endof-period work sheet and complete the work sheet. 3. a. Joumalize the adjusting entries on page 10 of the joumal. A diusting entries are recorded on June 30. 3. b. Post the adjusting entries. In the T accounts, identify the adjustments by "Adj.. and the new balances as "Aoj. Bal." 4. Prepare an adjusted trial balance. 5. a. Prepare an income statement for the year ended fune 30,20Y6. 5. b. Prepare a statement of stockholders' equity for the year ended June 30, 20Y6. During the year ended June 30 , 20 Y 6 , additional common stock of $7,500 was issued. 5. c. Prepare a balance sheet as of dune 30,20Y6. 6. a. Joumalize the closing entries on page 11 of the joumal. fNote: Complete the adjusted trial balance, the income statement, the statement of stockholders' equity, and the balance sheet BEFORE completing part 6 a.) 6. b. Post the ciosing entries. In the T accounts, identify the closing entries by "Clos." 7. Prepare a post-closing trial balance, Chart of Accounts CHART OF ACCOUNTS Epicenter Laundry General Ledger ASSETS REVENUE 11 Cash 41. Laundry Revenue 13 Laundry Supplies 14 Prepaid Insurance EXPENSES 17 Laundry Equipment 51 Wages Expense 18 Accumulated Depreciation 52 Rent Expense 53 Utilities Expense LIABILITIES 54 Laundry Supplies Expense 21 Accounts Payable 55 Depreciation Expense 22 Wages Payable 56 Insurance Expense 59 Miscellaneous Expense EQUITY 31 Common Stock 32 Retained Earnings 33 Dividends Labels and Amount Descriptions Note: Download the saving the Excel file to your computer. Be sure to save your work in Excel. The spreadsheet input will not be included in your grade in CengageNOW on this problem. 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. lolentify the balance as "Bal." 3. b. Post the adjusting entries. In the T accounts, identify the adjustments by "Adj." and the new balances as "Adj. Bal." 6. b. Post the closing entries. In the T accounts, identify the closing entries by "Clos" 2. Using the Excel spreadsheet downloaded from the T Accounts panel, click the Work Sheet tab. Enter the unadjusted tral balance on the end-of-period work sheet and complete the work sheet 3. a. Joumalize the adjusting entries on page 10 of the joumal. Adjusting entries are recorded on June 30.6. a. Joumalize the closing entries on page 11 of the joumal. Note: Complete the adjusted tral balance, the income statement, the statement of stockholders' equity and the balance sheet BEFORE completing part 6 a.) 4. Prepare an adiusted tral balance 5. a. Prepare an income statement for the year ended June 30, 20Y6. 5. 6. Prepare a statement of stockholders' equity for the year ended June 30,20Y6. During the year ended June 30,20Y6, additional common stock of $7,500 was issued. Statement of Stockhoiders' Equity instructions 5. c. Prepare a balance sheet as of June 30, 20Y6. Post-closing Trial Balance 7. Prepare a post-closing trial balance Epicenter Laundry POST-CLOSING TRIAL BALANCE June 30,20 Y6 ACCOUNT TITLL \begin{tabular}{l|l} DEBI CREDT \end{tabular} 1 Cash 2 Laundry Supplies 3 Prepaid Insurance 4 Laundry Equipment. 5 Accumulated Depreciation \& Accounts Payable 7 Wages Payable a Common 5tock 9 Retained Earnings 10 Totals The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y4, the end of the year, follows: The data needed to determine year-end adjustments are as follows: (a) Supplies on hand at March 31 are $7,500. (b) Insurance premiums expired during year are $2,400. (c) Depreciation of equipment during year is $8,550. (d) Depreciation of trucks duning year is $6,100. (e) Wages accrued but not paid at March 31 are 9600 . Required: 1. For each account listed in the trial balance, enter the balance in the appropnate Balance column of a four-column account and select the check mark in the Post. Ref. column. 2. (Optional) On your own paper or spreadsheet, enter the unadjusted thal balance on an end-of-period work sheet and complefe the work sheet. 3. a. Joumalize the adjusting entries on Page 26 of the joumal. Adjusting entries are recorded on March 31. b. Post the adjusting entries to the ledger, inserting balances in the accounts affected. 4. Prepare an adjusted trial balance 5. a. Prepare an income statement for the year ended March 31,20Y4. b. Prepare a statement of stockholders' equity for the year ended March 31,20Y4, additional common stock of 57,000 was issued. c. Prepare a balance sheet as of March 31,20Y4. 6. a. Joumalize the closing entries on page 27 of the joumal. Note: Complete the adjusted tral balance, the income statement, the statement of stockholders' equity, and the balance sheet BEFORE completing part 6 . a.) b. Post the closing entries, inserting balances in the accounts affected. 7. Prepare a post-closing trial balance For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 20Y2, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consuling, on a full-time basis. Diamond entered into the following transactions during July: Jul. 1 The following assets were received from Steffy Lopez in exchange for common stock: cash, \$13,000; accounts receivable, $20,800; supplies, $3,000; and office equipment, $7,000. There were no liabilities received. 1 Paid two months' rent on a lease rental contract, $4,800. 2 Paid the premiums on property and casualty insurance policies, $4,500. 4 Received cash from clients as an advance payment for services to be provided, and recorded it as unearned fees, $5,000. 5 Purchased additional office equipment on account from Office Station Co., $6,500. 6 Received cash from clients on account, $15,100. 10 Paid cash for a nevispaper advertisement, $400. 12 Paid Cffice Station Co. for part of the debt incurred on July 5, \$5,200. 12 Recorded services provided on account for the period July 112,$13,300. 14 Paid receptionist for two weeks' salary, \$1,800. Record the following transactions on Page 2 of the joumat: Jul. 17 Recorded cash from cash clients for fees earned during the period July 117,59,450. 18 Paid cash for supplies, $800. 20 Recorded services provided on account for the period July 13-20, S6,650. 24 Recorded cash from cash clients for fees earned for the period July 1724,$5,000. 26 Received cash from clients on account, \$12,000. 27 Paid receptionist for two weeks' salary, \$1,800. 29 Paid telephone bill for July, \$300. 31 Paid electricity bill for July, S675. 31 Recorded cash from cash clients for fees earned for the period July 2531,$5,000. 31 Recorded services provided on account for the remainder of July, $3,000. 31 Paid dividends, $12,500. Required: 1. Joumalize each transaction in a two-column joumal starting on Page 1 . Do not insert the account numbers in the joumal at this time.) 2. Post the joumal to a ledger of four-column accounts. Add the appropriate posting reference to the joumal. 3. Prepare an unadjusted trial balance. 4. At the end of July, the following adjustment data were assembled. Analyze and use these data to complete requirements (5) and (6). (a) insurance expired duning July is $375. (b) Supplies on hand on fuly 31 are $1,500. (c) Depreciation of office equipment for July is $750. (d) Accued receptionist salary on July 31 is $180. (e) Rent expired during July is $2,400. (f) Uneamed fees on July 31 are \$2,500. 5. (Optional) On your own paper or spreadsheet, enter the unadjusted trial balance on an enol-of-peniod work sheet and complete the work sheet, 6. A. Joumalize the adjusting entres on page 3 of the joumal. Adjusting entries are recorded on duly 31 . B. Post the adjusting entries, inserting balances in the accounts affected. 7. Prepare an adjusted tnal balance 8. A. Prepare an income statement for the month ended July 31,20Y2, B. Prepare a statement of stockholders' equity for the month ended July 31,20Y2 C. Prepare a balance sheet as of July 31,20Y2. 9. A. Joumalize the alosing entries on page 4 of the joumal. B. Post the closing entries, inserting balances in the accounts affected. Chart of Accounts CHART OF ACCOUNTS Diamond Consulting General Ledger ASSETS REVENUE 11 Cash 41 Fees Earned 12 Accounts Receivable 14 Supplies EXPENSES 15. Prepaid Rent 51 Salary Expense 16 Prepaid insurance 52 Rent Expense 18 Office Equipment 53 Supplies Expense 19 Accumulated Depreciation 54 Depreciation Expense 55 Insurance Expense LIABILITIES 59 Miscellaneous Expense 21 Accounts Payable 22 Salaries Payable 23 Unearned Fees EQUITY 31 Common Stock 32 Retained Earnings 33 Dividends Labels and Amount Descriptions 5. (Optional) On your own paper or spreadsheet, enter the unaojusted trial balance on an end-of-period work sheet and complete the work sheet. 2. Post the joumal to a ledger of four-column accounts. Add the appropriate posting reference to the joumal. 6 . B. Post the adjusting entries, inserting balances in the account affected. 9. B. Post the closing entries, inserting balances in the accounts affected 1. Joumalize each transaction in a two-column joumal starting on Page 1 . (Do not insert the account numbers in the joumal at this time.) Note: Scroll down to access pages 2 through 4 of the journal. 6. A. Joumalize the adjusting entries on page 3 of the joumal. Adjusting entries are recorded on dely 31. 9. A. Joumalize the closing entries on page 4 of the joumal. Unadjusted Trial Balance 3. Prepare an unadiusted trial balance Diamond Consulting UNADIUSTED TRIAL BALANCE July 31, 20Y2 1 Cash 2 Accounts Receivable 3 Supplies 4 Prepaid Rent 5 Prepaid insurance 6 Office Equipment 7 Accumulated Depreciation 8 Accounts Payable 9 Salaries Payable 40 Uneamed Fees Common Stock 12 Retained Earnings t5. Dividends Fees Eamed i5 Salary Expense It Rent Expense IT Supplies Expense A8 Depreciation Expense 29 Insurance Expense 20 Miscellaneous Expense 21 Totals Adjusted Trial Balance 7. Prepare an adjusted tral balance Diamond Consulting ADJUSTED TRIAL BALANCE July 31, 20Y2 ACCOUNT TITLE DEaIT CREDIT Cash 2 Accounts Receivable 3 Supplies 4 Prepaid Rent. 5 Prepaid insurance s Office Equipment 7 Accumulated Depreciation 8 Accounts Payable 9 Salaries Payable 10. Uneaned Fees A Common Stock 2 Retained Earnings D. Dividends Fees Eamed is Salary Expense it Rent Expense i7 Supplies Expense 18 Depreciation Expense 19 Insurance Expense 20 Miscellaneous Expense 21 Totals 84. Prepare an income statement for the month ended July 31, 20Y2. Statement of Stockholders' Equity 8B. Prepare a statement of stockholders' equity for the month ended July 31,20Y2 Statement of Stockhoiders' Equity instructions Diamond Consulting Statement of Stockholders' Equity (Labeli) \begin{tabular}{|l|l|l|l|l|l|} \hline 1 & Common Stock & \begin{tabular}{l|l|} Retained \\ Earnings \end{tabular} \\ \hline 2 & Total \\ \hline 3 & & & & \\ \hline 4 & & & \\ \hline 5 & & & \\ \hline 6 & & & \\ \hline \end{tabular} 8C. Prepare a balance sheet as of July 31, 20Y2. Post-closing Trial Balance 10. Prepare a post-olosing tral balance Diamond Consulting POST-CLOSING TRIAL BALANCE July 31, 20Y2 ACCOUNT TITLE CREOIT 1 Cash 2 Accounts Receivable 3 Supplies 4 Prepaid Pent 5 Prepaid insurance 6 Office Equipment 7 Accumulated Depreciation 8 Aocounts Payable 9 Salaries Payable :0. Uneaned Fees 1 Common Stock i2 Retained Earnings 3 Totals Required: 1. A. Prepare an income statement for the year ended November 30,20 Y8. B. Prepare a statement of stockholders' equity for the year ended November 30,20 y 8 C. Prepare a balance sheet as of November 30,20Y8 2. Joumalize the entries that were required to close the accounts at November 30,20Y8. No additional common stock was issued during the year ended November 30,20Y8. 3. If Retained Eamings had instead decreased $31,000 after the closing entries were posted, and the olvidends remained the same, what would have been the amount of net income or net lass? Chart of Accounts CHART OF ACCOUNTS Foxy Investigative Services General Ledger ASSETS REVENUE 11 Cash 41 Service Fees 12 Accounts Receivable 42 Rent Revenue 13 Supplies 14 Prepaid insurance EXPENSES 17 Building 51 Salaries Expense 18 Accumulated Depreciation-Building 52 Rent Expense 53 Supplies Expense LIABILITIES 54 Depreciation Expense-Building 21 Accounts Payable 55 Utilites Expense 22 Salaries Payable 56 Repairs Expense 23 Unearned Rent 57 Insurance Expense 59 Miscellaneous Expense EQUITY 31 Common Stock 32 Retained Earnings 33 Dividends Labels and Amount Descriptions Labels Current assets Current liabilities Expenses For the Year Ended November 30, 20 Y 8 November 30,20 Y 8 Property, plant, and equipment Revenues Amount Descriptions Balances, December 1, 20Y7 Balances, November 30,20Y8 Dividends Net income Net loss Total assets Total current assets Total expenses Total liabilities Total liabilities and stockholders' equity Total property, plant, and equipment Total revenues Total stockholders' equity 1A. Prepare an income statement for the year ended November 30,20Y8. Point: 39/28 Feedback Check My Work The income statement is prepared directly from the information that would be transferred to the income statement columns of the worksheet. Expenses are typically listed in order of size and miscellaneous expense is listed last, regardless of its amount. 18. Prepare a statement of stockholders' equity for the year ended November 30,20 y 8 1C. Prepare a balance sheet as of November 30,20Y8 Feedback Check Ny Work The balance sheet includes all acoounts that would be transferred to the balance sheet columns on the worksheet, except for the dividends balances. The ending retained earnings in the balance sheet must be the same amount as that calculated in the statement of stockholders equity. Make sure that the acoounting equation remains in balance for this financial statement. 2. Journalize the entries that were required to olose the accounts at November 30,20r8. No additional common stock was issued during the year ended November 30,20 Y 8 . Feedback Check My Work In preparing closing entries, recall that (1) revenue accounts are debited for their balances and expense accounts are credited for their balances. The difference between the revenue and expenses is exther credited (revenues exceed expenses) or debied (expenses exceed revenues) to the retained earnings account, and (2) the retained earnings account is debited for the balance of the dividends account. If Retained Eamings had instead decreased 531,000 after the closing entries were posted, and the dividends remained the same, what would have been the amount of net income or net loss? Feedback Check My Work given, a net income or a net loss explains the reason for the remaining change in the retained earnings account. The unadjusted trial balance of Epicenter Laundry at June 30,20Y8, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: (a) Laundry supplies on hand at June 30 are $8,800. (b) Insurance premiums expired during the year are 55,700 . Depreciation of laundry equipment duning the year is S6,500. (d) Wages accrued but not paid at June 30 are S1, 100 . Required: Note: Download the spreadsheet on the T Accounts panel, saving the Excel file to your computer. Be sure to save your work in Excel. The spreadsheet inout wil not be included in your grade in CengageNOW on this problem. 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. lolentify the balance as "Bal" 2. Using the Excel spreadsheet downloaded from the T Accounts panel, olick the Work Sheet tab. Enter the unadjusted trial balance on the endof-period work sheet and complete the work sheet. 3. a. Joumalize the adjusting entries on page 10 of the joumal. A diusting entries are recorded on June 30. 3. b. Post the adjusting entries. In the T accounts, identify the adjustments by "Adj.. and the new balances as "Aoj. Bal." 4. Prepare an adjusted trial balance. 5. a. Prepare an income statement for the year ended fune 30,20Y6. 5. b. Prepare a statement of stockholders' equity for the year ended June 30, 20Y6. During the year ended June 30 , 20 Y 6 , additional common stock of $7,500 was issued. 5. c. Prepare a balance sheet as of dune 30,20Y6. 6. a. Joumalize the closing entries on page 11 of the joumal. fNote: Complete the adjusted trial balance, the income statement, the statement of stockholders' equity, and the balance sheet BEFORE completing part 6 a.) 6. b. Post the ciosing entries. In the T accounts, identify the closing entries by "Clos." 7. Prepare a post-closing trial balance, Chart of Accounts CHART OF ACCOUNTS Epicenter Laundry General Ledger ASSETS REVENUE 11 Cash 41. Laundry Revenue 13 Laundry Supplies 14 Prepaid Insurance EXPENSES 17 Laundry Equipment 51 Wages Expense 18 Accumulated Depreciation 52 Rent Expense 53 Utilities Expense LIABILITIES 54 Laundry Supplies Expense 21 Accounts Payable 55 Depreciation Expense 22 Wages Payable 56 Insurance Expense 59 Miscellaneous Expense EQUITY 31 Common Stock 32 Retained Earnings 33 Dividends Labels and Amount Descriptions Note: Download the saving the Excel file to your computer. Be sure to save your work in Excel. The spreadsheet input will not be included in your grade in CengageNOW on this problem. 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. lolentify the balance as "Bal." 3. b. Post the adjusting entries. In the T accounts, identify the adjustments by "Adj." and the new balances as "Adj. Bal." 6. b. Post the closing entries. In the T accounts, identify the closing entries by "Clos" 2. Using the Excel spreadsheet downloaded from the T Accounts panel, click the Work Sheet tab. Enter the unadjusted tral balance on the end-of-period work sheet and complete the work sheet 3. a. Joumalize the adjusting entries on page 10 of the joumal. Adjusting entries are recorded on June 30.6. a. Joumalize the closing entries on page 11 of the joumal. Note: Complete the adjusted tral balance, the income statement, the statement of stockholders' equity and the balance sheet BEFORE completing part 6 a.) 4. Prepare an adiusted tral balance 5. a. Prepare an income statement for the year ended June 30, 20Y6. 5. 6. Prepare a statement of stockholders' equity for the year ended June 30,20Y6. During the year ended June 30,20Y6, additional common stock of $7,500 was issued. Statement of Stockhoiders' Equity instructions 5. c. Prepare a balance sheet as of June 30, 20Y6. Post-closing Trial Balance 7. Prepare a post-closing trial balance Epicenter Laundry POST-CLOSING TRIAL BALANCE June 30,20 Y6 ACCOUNT TITLL \begin{tabular}{l|l} DEBI CREDT \end{tabular} 1 Cash 2 Laundry Supplies 3 Prepaid Insurance 4 Laundry Equipment. 5 Accumulated Depreciation \& Accounts Payable 7 Wages Payable a Common 5tock 9 Retained Earnings 10 Totals The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y4, the end of the year, follows: The data needed to determine year-end adjustments are as follows: (a) Supplies on hand at March 31 are $7,500. (b) Insurance premiums expired during year are $2,400. (c) Depreciation of equipment during year is $8,550. (d) Depreciation of trucks duning year is $6,100. (e) Wages accrued but not paid at March 31 are 9600 . Required: 1. For each account listed in the trial balance, enter the balance in the appropnate Balance column of a four-column account and select the check mark in the Post. Ref. column. 2. (Optional) On your own paper or spreadsheet, enter the unadjusted thal balance on an end-of-period work sheet and complefe the work sheet. 3. a. Joumalize the adjusting entries on Page 26 of the joumal. Adjusting entries are recorded on March 31. b. Post the adjusting entries to the ledger, inserting balances in the accounts affected. 4. Prepare an adjusted trial balance 5. a. Prepare an income statement for the year ended March 31,20Y4. b. Prepare a statement of stockholders' equity for the year ended March 31,20Y4, additional common stock of 57,000 was issued. c. Prepare a balance sheet as of March 31,20Y4. 6. a. Joumalize the closing entries on page 27 of the joumal. Note: Complete the adjusted tral balance, the income statement, the statement of stockholders' equity, and the balance sheet BEFORE completing part 6 . a.) b. Post the closing entries, inserting balances in the accounts affected. 7. Prepare a post-closing trial balance For the past several years, Steffy Lopez has operated a part-time consulting business from his home. As of July 1, 20Y2, Steffy decided to move to rented quarters and to operate the business, which was to be known as Diamond Consuling, on a full-time basis. Diamond entered into the following transactions during July: Jul. 1 The following assets were received from Steffy Lopez in exchange for common stock: cash, \$13,000; accounts receivable, $20,800; supplies, $3,000; and office equipment, $7,000. There were no liabilities received. 1 Paid two months' rent on a lease rental contract, $4,800. 2 Paid the premiums on property and casualty insurance policies, $4,500. 4 Received cash from clients as an advance payment for services to be provided, and recorded it as unearned fees, $5,000. 5 Purchased additional office equipment on account from Office Station Co., $6,500. 6 Received cash from clients on account, $15,100. 10 Paid cash for a nevispaper advertisement, $400. 12 Paid Cffice Station Co. for part of the debt incurred on July 5, \$5,200. 12 Recorded services provided on account for the period July 112,$13,300. 14 Paid receptionist for two weeks' salary, \$1,800. Record the following transactions on Page 2 of the joumat: Jul. 17 Recorded cash from cash clients for fees earned during the period July 117,59,450. 18 Paid cash for supplies, $800. 20 Recorded services provided on account for the period July 13-20, S6,650. 24 Recorded cash from cash clients for fees earned for the period July 1724,$5,000. 26 Received cash from clients on account, \$12,000. 27 Paid receptionist for two weeks' salary, \$1,800. 29 Paid telephone bill for July, \$300. 31 Paid electricity bill for July, S675. 31 Recorded cash from cash clients for fees earned for the period July 2531,$5,000. 31 Recorded services provided on account for the remainder of July, $3,000. 31 Paid dividends, $12,500. Required: 1. Joumalize each transaction in a two-column joumal starting on Page 1 . Do not insert the account numbers in the joumal at this time.) 2. Post the joumal to a ledger of four-column accounts. Add the appropriate posting reference to the joumal. 3. Prepare an unadjusted trial balance. 4. At the end of July, the following adjustment data were assembled. Analyze and use these data to complete requirements (5) and (6). (a) insurance expired duning July is $375. (b) Supplies on hand on fuly 31 are $1,500. (c) Depreciation of office equipment for July is $750. (d) Accued receptionist salary on July 31 is $180. (e) Rent expired during July is $2,400. (f) Uneamed fees on July 31 are \$2,500. 5. (Optional) On your own paper or spreadsheet, enter the unadjusted trial balance on an enol-of-peniod work sheet and complete the work sheet, 6. A. Joumalize the adjusting entres on page 3 of the joumal. Adjusting entries are recorded on duly 31 . B. Post the adjusting entries, inserting balances in the accounts affected. 7. Prepare an adjusted tnal balance 8. A. Prepare an income statement for the month ended July 31,20Y2, B. Prepare a statement of stockholders' equity for the month ended July 31,20Y2 C. Prepare a balance sheet as of July 31,20Y2. 9. A. Joumalize the alosing entries on page 4 of the joumal. B. Post the closing entries, inserting balances in the accounts affected. Chart of Accounts CHART OF ACCOUNTS Diamond Consulting General Ledger ASSETS REVENUE 11 Cash 41 Fees Earned 12 Accounts Receivable 14 Supplies EXPENSES 15. Prepaid Rent 51 Salary Expense 16 Prepaid insurance 52 Rent Expense 18 Office Equipment 53 Supplies Expense 19 Accumulated Depreciation 54 Depreciation Expense 55 Insurance Expense LIABILITIES 59 Miscellaneous Expense 21 Accounts Payable 22 Salaries Payable 23 Unearned Fees EQUITY 31 Common Stock 32 Retained Earnings 33 Dividends Labels and Amount Descriptions 5. (Optional) On your own paper or spreadsheet, enter the unaojusted trial balance on an end-of-period work sheet and complete the work sheet. 2. Post the joumal to a ledger of four-column accounts. Add the appropriate posting reference to the joumal. 6 . B. Post the adjusting entries, inserting balances in the account affected. 9. B. Post the closing entries, inserting balances in the accounts affected 1. Joumalize each transaction in a two-column joumal starting on Page 1 . (Do not insert the account numbers in the joumal at this time.) Note: Scroll down to access pages 2 through 4 of the journal. 6. A. Joumalize the adjusting entries on page 3 of the joumal. Adjusting entries are recorded on dely 31. 9. A. Joumalize the closing entries on page 4 of the joumal. Unadjusted Trial Balance 3. Prepare an unadiusted trial balance Diamond Consulting UNADIUSTED TRIAL BALANCE July 31, 20Y2 1 Cash 2 Accounts Receivable 3 Supplies 4 Prepaid Rent 5 Prepaid insurance 6 Office Equipment 7 Accumulated Depreciation 8 Accounts Payable 9 Salaries Payable 40 Uneamed Fees Common Stock 12 Retained Earnings t5. Dividends Fees Eamed i5 Salary Expense It Rent Expense IT Supplies Expense A8 Depreciation Expense 29 Insurance Expense 20 Miscellaneous Expense 21 Totals Adjusted Trial Balance 7. Prepare an adjusted tral balance Diamond Consulting ADJUSTED TRIAL BALANCE July 31, 20Y2 ACCOUNT TITLE DEaIT CREDIT Cash 2 Accounts Receivable 3 Supplies 4 Prepaid Rent. 5 Prepaid insurance s Office Equipment 7 Accumulated Depreciation 8 Accounts Payable 9 Salaries Payable 10. Uneaned Fees A Common Stock 2 Retained Earnings D. Dividends Fees Eamed is Salary Expense it Rent Expense i7 Supplies Expense 18 Depreciation Expense 19 Insurance Expense 20 Miscellaneous Expense 21 Totals 84. Prepare an income statement for the month ended July 31, 20Y2. Statement of Stockholders' Equity 8B. Prepare a statement of stockholders' equity for the month ended July 31,20Y2 Statement of Stockhoiders' Equity instructions Diamond Consulting Statement of Stockholders' Equity (Labeli) \begin{tabular}{|l|l|l|l|l|l|} \hline 1 & Common Stock & \begin{tabular}{l|l|} Retained \\ Earnings \end{tabular} \\ \hline 2 & Total \\ \hline 3 & & & & \\ \hline 4 & & & \\ \hline 5 & & & \\ \hline 6 & & & \\ \hline \end{tabular} 8C. Prepare a balance sheet as of July 31, 20Y2. Post-closing Trial Balance 10. Prepare a post-olosing tral balance Diamond Consulting POST-CLOSING TRIAL BALANCE July 31, 20Y2 ACCOUNT TITLE CREOIT 1 Cash 2 Accounts Receivable 3 Supplies 4 Prepaid Pent 5 Prepaid insurance 6 Office Equipment 7 Accumulated Depreciation 8 Aocounts Payable 9 Salaries Payable :0. Uneaned Fees 1 Common Stock i2 Retained Earnings 3 Totals