Answered step by step

Verified Expert Solution

Question

1 Approved Answer

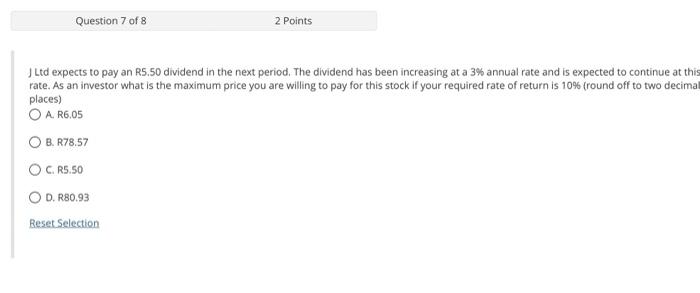

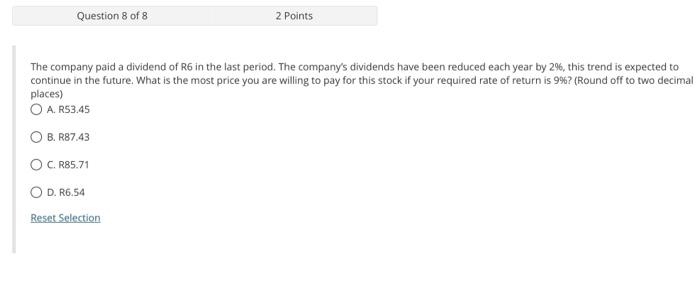

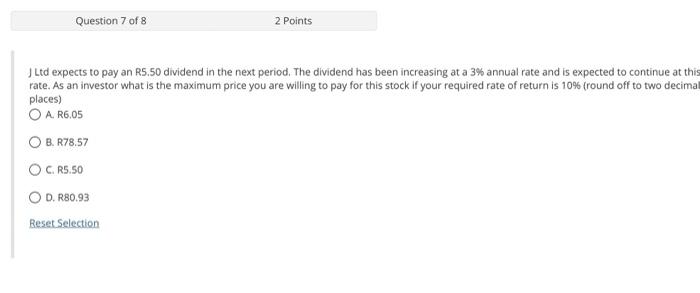

urgent: please help Question 7 of 8 2 Points J Ltd expects to pay an R5.50 dividend in the next period. The dividend has been

urgent: please help

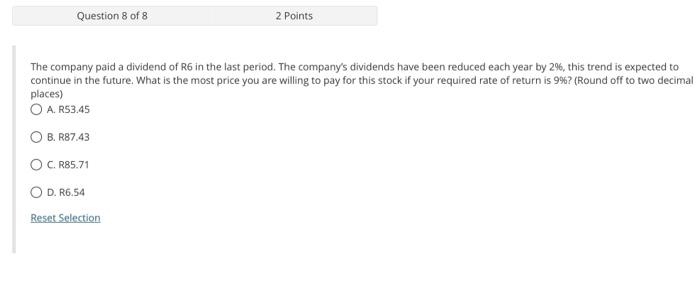

Question 7 of 8 2 Points J Ltd expects to pay an R5.50 dividend in the next period. The dividend has been increasing at a 3% annual rate and is expected to continue at this rate. As an investor what is the maximum price you are willing to pay for this stock if your required rate of return is 10% (round off to two decimal places) O A R6.05 OB.R78.57 OG R5.50 O D. R80.93 Reset Selection Question 8 of 8 2 Points The company paid a dividend of R6 in the last period. The company's dividends have been reduced each year by 2%, this trend is expected to continue in the future. What is the most price you are willing to pay for this stock if your required rate of return is 997 (Round off to two decimal places) O A. R53.45 B. R87,43 C. R85.71 O D. R6.54 Reset Selection

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started