Answered step by step

Verified Expert Solution

Question

1 Approved Answer

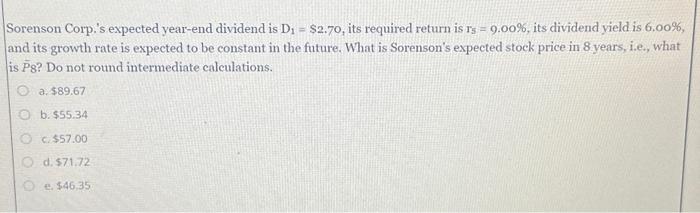

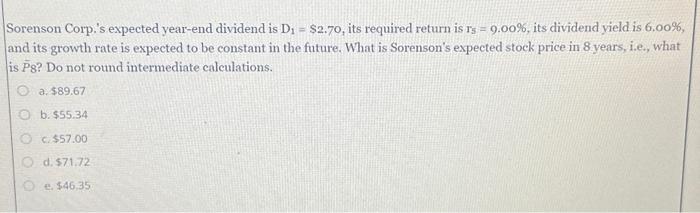

URGENT- PLEASE HELP! Sorenson Corp.'s expected year-end dividend is D1=$2.70, its required return is r5=9.00%, its dividend yield is 6.00%, and its growth rate is

URGENT- PLEASE HELP!

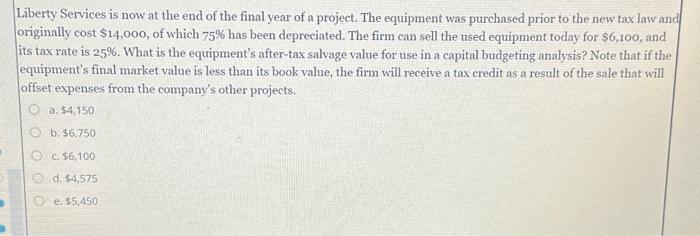

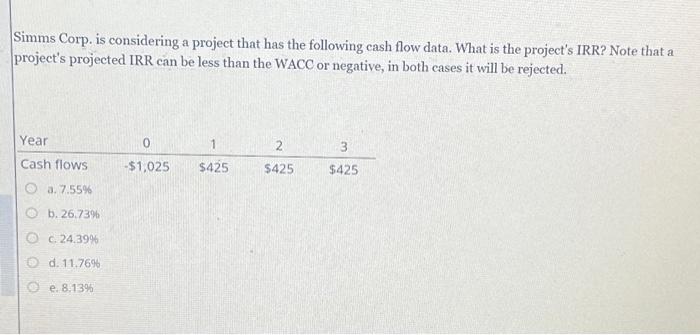

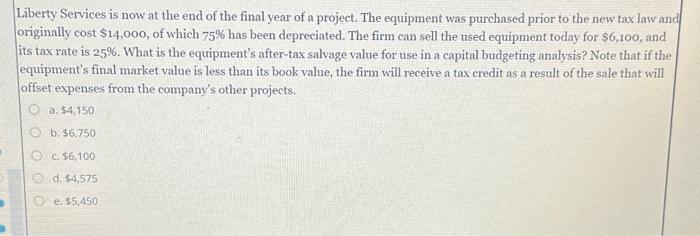

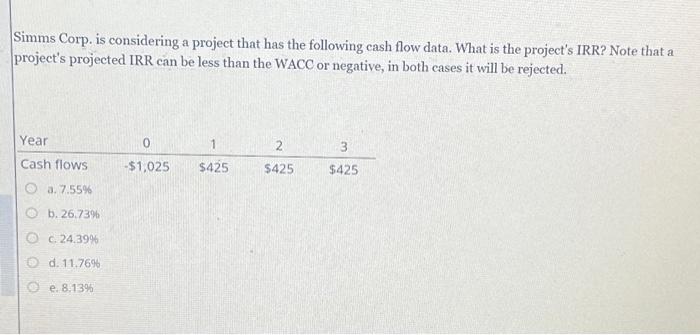

Sorenson Corp.'s expected year-end dividend is D1=$2.70, its required return is r5=9.00%, its dividend yield is 6.00%, and its growth rate is expected to be constant in the future. What is Sorenson's expected stock price in 8 years, i.e, what is P ? Do not round intermediate calculations. a. $89.67 b. $55.34 c. $57.00 d. $71.72 e. $46,35 Liberty Services is now at the end of the final year of a project. The equipment was purchased prior to the new tax law and originally cost $14,000, of which 75% has been depreciated. The firm can sell the used equipment today for $6,100, and its tax rate is 25%. What is the equipment's after-tax salvage value for use in a capital budgeting analysis? Note that if the equipment's final market value is less than its book value, the firm will receive a tax credit as a result of the sale that will offset expenses from the company's other projects. a. $4,150 b. $6,750 c. $6,100 d. $4,575 e. $5,450 Simms Corp. is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC or negative, in both cases it will be rejected. a. 7.55% b. 26.73% c. 24.39% d. 11.76% e. 8.13%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started