Answered step by step

Verified Expert Solution

Question

1 Approved Answer

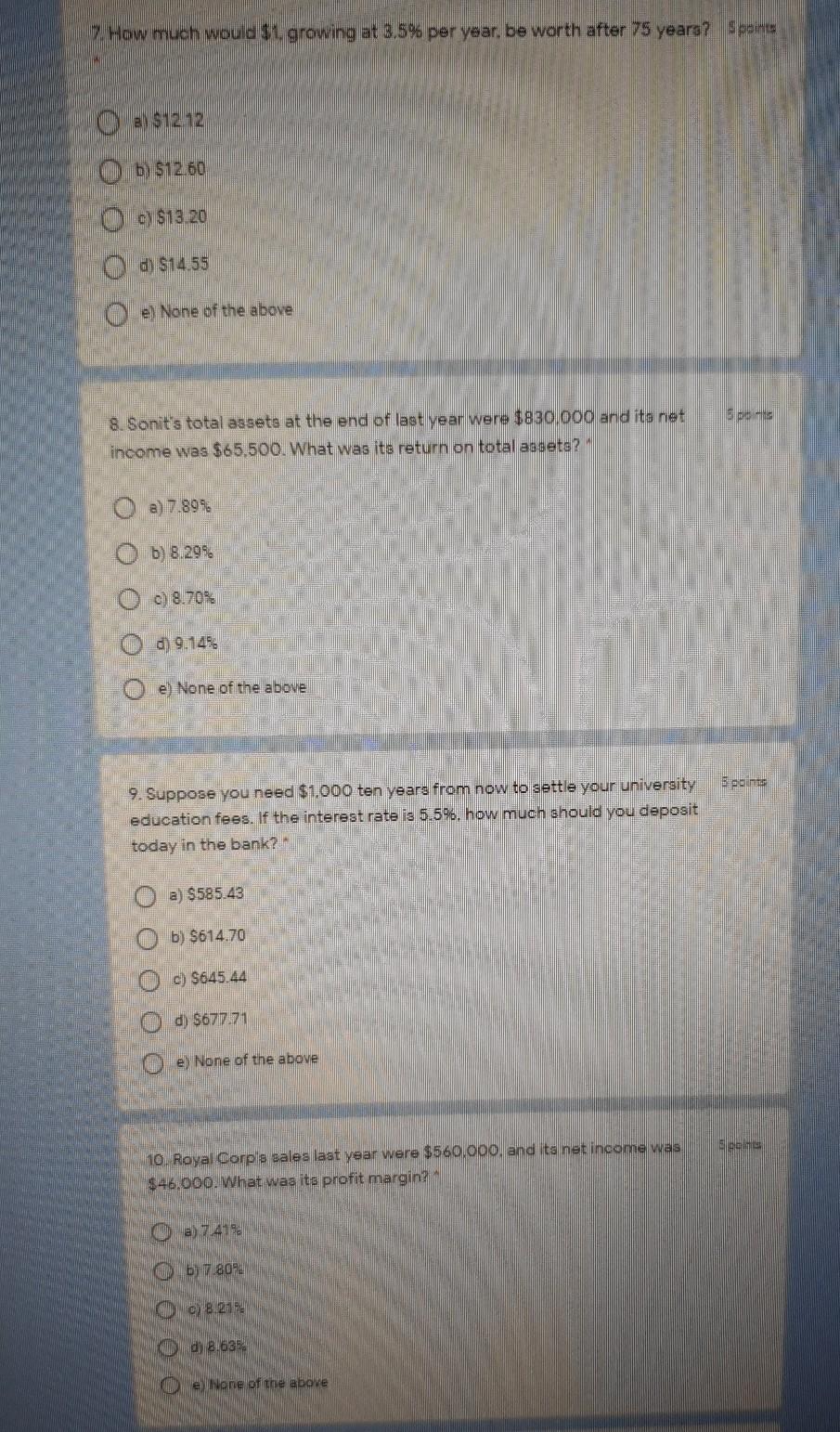

urgent please How much would I growing at 8,5% per year be worth after 75 years? Sports O a $1212 O 51260 O ) $13.20

urgent please

How much would I growing at 8,5% per year be worth after 75 years? Sports O a $1212 O 51260 O ) $13.20 O a 514 55 O e) None of the above 300 mg 8. Sonit's total assets at the end of last year were $830,000 and its net income was $65,500. What was its return on total assets? O a) 7.899 b) 8.299. c) 8.708 O 09.145 O e) None of the above 50 9. Suppose you need $1,000 ten years from now to settle your university education fees. If the interest rate is 5.596. how much should you deposit today in the bank? O a) $585 43 O b) $614.70 O O O O c) $645.44 d) $67771 O e) None of the above en 10. Royal Corp's sales last year were $560,000, and its net income was $46.000. What was its profit margin? a) 7416 b) 7.802 e) 8.21 KO d 8.636 Ce none of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started