Answered step by step

Verified Expert Solution

Question

1 Approved Answer

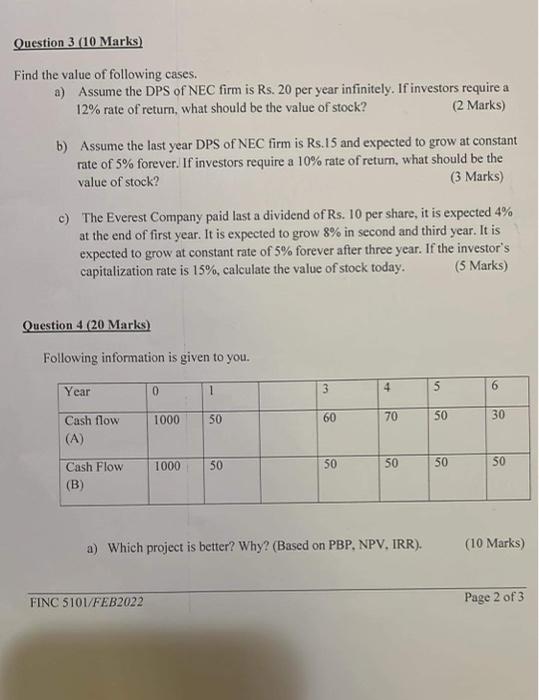

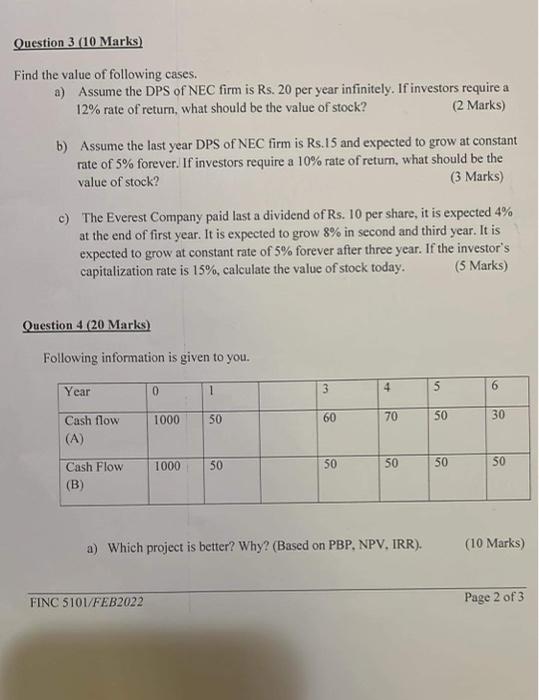

urgent please Question 3 (10 Marks) Find the value of following cases. a) Assume the DPS of NEC firm is Rs. 20 per year infinitely.

urgent please

Question 3 (10 Marks) Find the value of following cases. a) Assume the DPS of NEC firm is Rs. 20 per year infinitely. If investors require a 12% rate of return, what should be the value of stock? (2 Marks) b) Assume the last year DPS of NEC firm is Rs. 15 and expected to grow at constant rate of 5% forever. If investors require a 10% rate of return, what should be the value of stock? (3 Marks) c) The Everest Company paid last a dividend of Rs. 10 per share, it is expected 4% at the end of first year. It is expected to grow 8% in second and third year. It is expected to grow at constant rate of 5% forever after three year. If the investor's capitalization rate is 15%, calculate the value of stock today. (5 Marks) Question 4 (20 Marks) Following information is given to you. Year 0 1 3 4 6 5 50 1000 50 60 70 30 Cash flow (A) 1000 50 50 50 50 50 Cash Flow (B) a) Which project is better? Why? (Based on PBP, NPV. IRR). (10 Marks) FINC 5101/FEB2022 Page 2 of 3 b) Which one is the best tool of capital budgeting and why? Mark Should we consideranly quantitative result and it is enough and why? (5 M) *** END OF QUESTIONS - Page 3 of 3 TINCSW FER33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started