Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT please solve all questions :) Part A-True or Falve (11K) 1. An account payable is an obligation in the form of a written promisory

URGENT please solve all questions :)

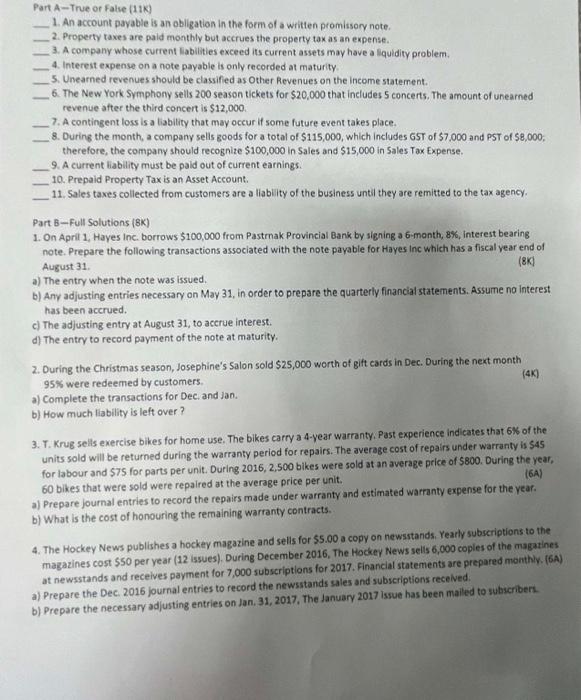

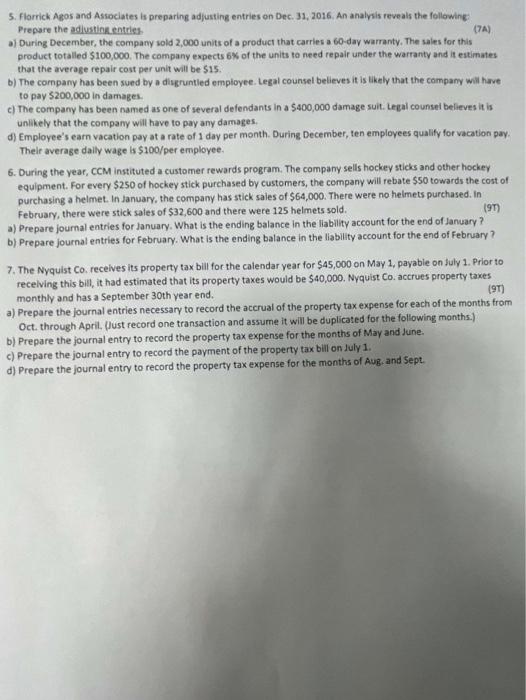

Part A-True or Falve (11K) 1. An account payable is an obligation in the form of a written promisory note. 2. Property taxes are paid monthly but accrues the property tax as an expense. 3. A company whose current liabilities exceed its current assets may have a liquidity problem. 4. Interest expense on a note payable is only recorded at maturity. 5. Unearned revenues should be classified as Other Revenues on the income statement. 6. The New York Symphony sells 200 season tickets for $20,000 that includes 5 concerts. The amount of unearned revenue after the third concert is $12,000. 7. A contingent loss is a liability that may occur if some future event takes place. 8. During the month, a company selis goods for a total of $115,000, which includes 65 of $7,000 and PST of $8,000. therefore, the company should recognize $100,000 in Sales and $15,000 in Sales Tax Expense. 9. A current liability must be paid out of current earnings. 10. Prepaid Property Tax is an Asset Account. 11. Sales taxes collected from customers are a liability of the business until they are remitted to the tax agency. Part B - Full Solutions (8K) 1. On April 1, Hayes inc. borrows $100,000 from Pastmak Provincial Bank by signing a 6 -month, 8%, interest bearing note. Prepare the following transactions associated with the note payable for Hayes inc which has a fiscal year end of August 31. (8K) a) The entry when the note was issued. b) Any adjusting entries necessary on May 31, in order to prepare the quarterly financial statements. Assume no interest has been accrued. c) The adjusting entry at August 31 , to accrue interest. d) The entry to record payment of the note at maturity. 2. During the Christmas season, Josephine's Salon sold $25,000 worth of gift cards in Dec. During the next month 95% were redeemed by customers. (4K) a) Complete the transactions for Dec. and Jan. b) How much liability is left over? 3. T. Krug sells exercise bikes for home use. The bikes carry a 4-year warranty, Past experience indicates that 6% of the units sold will be returned during the warranty period for repairs. The average cost of repairs under warranty is $45 for labour and 575 for parts per unit. During 2016, 2,500 bikes were sold at an average price of $800. During the year, 60 bikes that were sold were repaired at the average price per unit. b) What is the cost of honouring the remaining warranty contracts. 4. The Hockey News publishes a hockey magazine and sells for $5.00 a copy on newsstands, Yearly subscriptions to the magazines cost $50 per year (12 issues). During December 2016, The Hockey News selis 6,000 coples of the magatines at newsstands and receives payment for 7,000 subscriptions for 2017. Financial statements are prepared monthiy. (6A) a) Prepare the Dec. 2016 journal entries to record the newsstands sales and subscriptions recelved. b) Prepare the necessary adjusting entries on Jan, 31, 2017, The January 2017 issue has been mailed to subscriberi. 5. Florrick. Agos and Associates is preparing adjusting entries on Dec. 31, 2016. An analysis reveals the following: Prepare the adiusting entries. (7) a) During December, the company sold 2,000 units of a product that carries a 60 -day warranty, The sales for this product totalled 5100,000 . The company expects 6% of the units to need repair under the warranty and it eatimates that the average repair cost per unit will be $15. b) The company has been sued by a diggruntled employee. Legal counsel believes it is tikely that the compamy will have to pay 5200,000 in damages. c) The company has been named as one of several defendants in a $400,000 damage suit. Legal counsel believes it is unlikely that the company will have to pay any damages. d) Employee's earn vacation pay at a rate of 1 day per month. During December, ten employees qualify for vacation pay. Thelr average dally wage is $100/per employee. 6. During the year, cCM instituted a customer rewards program. The company sells hockey sticks and other hockey equipment. For every $250 of hockey stick purchased by customers, the company will rebate $50 towards the cost of purchasing a helmet. In January, the company has stick sales of $64,000. There were no helmets purchased. In February, there were stick sales of $32,600 and there were 125 helmets sold. (97) a) Prepare journal entries for January. What is the ending balance in the liability account for the end of January? b) Prepare journal entries for February. What is the ending balance in the liability account for the end of February? 7. The Nyquist Co, recelves its property tax bill for the calendar year for $45,000 on May 1, payable on July 1. Prior to recelving this bill, it had estimated that its property taxes would be $40,000. Nyquist Co. accrues property taxes monthly and has a September 30 th year end. a) Prepare the journal entries necessary to record the accrual of the property tax expense for each of the months from Oct. through April. (Just record one transaction and assume it will be duplicated for the following months.) b) Prepare the journal entry to record the property tax expense for the months of May and June. c) Prepare the journal entry to record the payment of the property tax bill on duly 1 . d) Prepare the journal entry to record the property tax expense for the months of Aug. and Sept. Part A-True or Falve (11K) 1. An account payable is an obligation in the form of a written promisory note. 2. Property taxes are paid monthly but accrues the property tax as an expense. 3. A company whose current liabilities exceed its current assets may have a liquidity problem. 4. Interest expense on a note payable is only recorded at maturity. 5. Unearned revenues should be classified as Other Revenues on the income statement. 6. The New York Symphony sells 200 season tickets for $20,000 that includes 5 concerts. The amount of unearned revenue after the third concert is $12,000. 7. A contingent loss is a liability that may occur if some future event takes place. 8. During the month, a company selis goods for a total of $115,000, which includes 65 of $7,000 and PST of $8,000. therefore, the company should recognize $100,000 in Sales and $15,000 in Sales Tax Expense. 9. A current liability must be paid out of current earnings. 10. Prepaid Property Tax is an Asset Account. 11. Sales taxes collected from customers are a liability of the business until they are remitted to the tax agency. Part B - Full Solutions (8K) 1. On April 1, Hayes inc. borrows $100,000 from Pastmak Provincial Bank by signing a 6 -month, 8%, interest bearing note. Prepare the following transactions associated with the note payable for Hayes inc which has a fiscal year end of August 31. (8K) a) The entry when the note was issued. b) Any adjusting entries necessary on May 31, in order to prepare the quarterly financial statements. Assume no interest has been accrued. c) The adjusting entry at August 31 , to accrue interest. d) The entry to record payment of the note at maturity. 2. During the Christmas season, Josephine's Salon sold $25,000 worth of gift cards in Dec. During the next month 95% were redeemed by customers. (4K) a) Complete the transactions for Dec. and Jan. b) How much liability is left over? 3. T. Krug sells exercise bikes for home use. The bikes carry a 4-year warranty, Past experience indicates that 6% of the units sold will be returned during the warranty period for repairs. The average cost of repairs under warranty is $45 for labour and 575 for parts per unit. During 2016, 2,500 bikes were sold at an average price of $800. During the year, 60 bikes that were sold were repaired at the average price per unit. b) What is the cost of honouring the remaining warranty contracts. 4. The Hockey News publishes a hockey magazine and sells for $5.00 a copy on newsstands, Yearly subscriptions to the magazines cost $50 per year (12 issues). During December 2016, The Hockey News selis 6,000 coples of the magatines at newsstands and receives payment for 7,000 subscriptions for 2017. Financial statements are prepared monthiy. (6A) a) Prepare the Dec. 2016 journal entries to record the newsstands sales and subscriptions recelved. b) Prepare the necessary adjusting entries on Jan, 31, 2017, The January 2017 issue has been mailed to subscriberi. 5. Florrick. Agos and Associates is preparing adjusting entries on Dec. 31, 2016. An analysis reveals the following: Prepare the adiusting entries. (7) a) During December, the company sold 2,000 units of a product that carries a 60 -day warranty, The sales for this product totalled 5100,000 . The company expects 6% of the units to need repair under the warranty and it eatimates that the average repair cost per unit will be $15. b) The company has been sued by a diggruntled employee. Legal counsel believes it is tikely that the compamy will have to pay 5200,000 in damages. c) The company has been named as one of several defendants in a $400,000 damage suit. Legal counsel believes it is unlikely that the company will have to pay any damages. d) Employee's earn vacation pay at a rate of 1 day per month. During December, ten employees qualify for vacation pay. Thelr average dally wage is $100/per employee. 6. During the year, cCM instituted a customer rewards program. The company sells hockey sticks and other hockey equipment. For every $250 of hockey stick purchased by customers, the company will rebate $50 towards the cost of purchasing a helmet. In January, the company has stick sales of $64,000. There were no helmets purchased. In February, there were stick sales of $32,600 and there were 125 helmets sold. (97) a) Prepare journal entries for January. What is the ending balance in the liability account for the end of January? b) Prepare journal entries for February. What is the ending balance in the liability account for the end of February? 7. The Nyquist Co, recelves its property tax bill for the calendar year for $45,000 on May 1, payable on July 1. Prior to recelving this bill, it had estimated that its property taxes would be $40,000. Nyquist Co. accrues property taxes monthly and has a September 30 th year end. a) Prepare the journal entries necessary to record the accrual of the property tax expense for each of the months from Oct. through April. (Just record one transaction and assume it will be duplicated for the following months.) b) Prepare the journal entry to record the property tax expense for the months of May and June. c) Prepare the journal entry to record the payment of the property tax bill on duly 1 . d) Prepare the journal entry to record the property tax expense for the months of Aug. and Sept

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started