Answered step by step

Verified Expert Solution

Question

1 Approved Answer

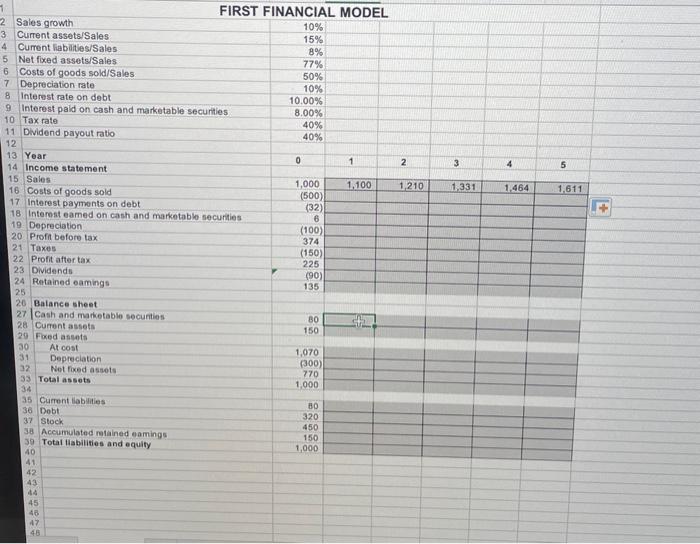

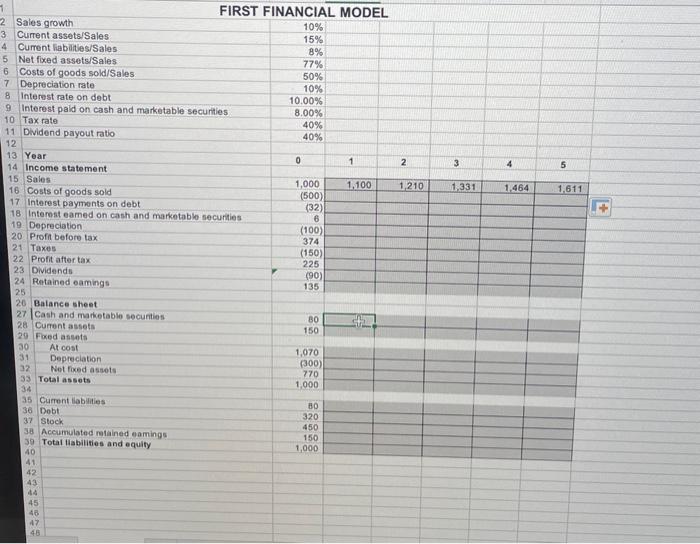

urgent, please with explantion FIRST FINANCIAL MODEL Sales growth Current assets/Sales Cument liabilites/Sales Net fixed assets/Sales Costs of goods sold/Sales. Depreciation rate Interest rate on

urgent, please with explantion

FIRST FINANCIAL MODEL Sales growth Current assets/Sales Cument liabilites/Sales Net fixed assets/Sales Costs of goods sold/Sales. Depreciation rate Interest rate on debt Interest paid on cash and marketable securities Tax rate Dividend payout ratio Year Income statement 5 Sales 6 Costs of goods sold 17 Interest payments on debt 18 Interest eamed on cash and marketablo securties 19 Depreciation 20 Profi before tax 1 Taxes. 22 Profit after tax 23 Dividends 24 Retained eamings Balance sheet Casance sheet Cash marketable securties Curent assots Fred assets At cost Depreciation Net fored assets Total assets Current liabilities Dobt. Stock. Accumuloted netained eamings Total liabilities and equity 10%15%8%77%50%10%10.00%8.00%40%40% 0 1 2 3 4 5 \begin{tabular}{r|r|} 1,000 & 1,100 \\ \hline \end{tabular} 1,210 1,331 1,464 1,611 (32) 6 (100) 374 374 (150) 225 (90) (90) 135 80 150 1,070 (300) 7701,000 320 450 150 450150 1,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started