Question

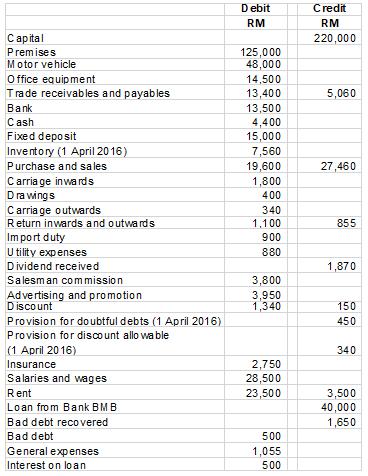

Puan Suraya owns a retailing business, known as SHK Enterprise. The following Trial Balance was extracted from the books of SHK Enterprise as at 31

Puan Suraya owns a retailing business, known as SHK Enterprise. The following Trial Balance was extracted from the books of SHK Enterprise as at 31 March 2017:

Additional information:

(i) Inventory as at 31 March 2017 was RM9,500.

(ii) The owner has brought in a motor vehicle of RM45,000 on 1 April 2016 as an additional capital but this has not been recorded in the books.

(iii) The loan from BMB Bank was taken on 1 August 2016 and the interest charged is 5% per annum. The interest paid on loan was for 3 months only.

(iv) The advertising expenses included RM600 for petrol. One third of it is considered to be private purpose.

(v) The owner took out cash worth RM1,000 for her son’s medical treatment and goods worth RM400 for her daughter’s birthday party.

(vi) Insurance of RM600 and salaries of RM1,500 were still outstanding.

(vii) A debtor with an outstanding amount of RM400 has been declared bankrupt by court. The provision for doubtful debts and provision for discount allowable is to be adjusted to 5% and 2% respectively.

(viii) During the year, Puan Suraya has renovated the premises. The renovation cost of premises RM10,500 has been wrongly entered in wages account.

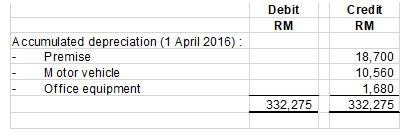

(x) Depreciation on yearly basis is to be provided as follows:

Premise | 10% on cost |

Motor vehicle | 10% on cost |

Office equipment | 5% on book value |

Required to prepare:

(a) A Statement of Comprehensive Income for the year ended 31 March 2017 (show all workings).

(b) A Statement of Financial Position as at 31 March 2017 (show all workings).

Debit Credit RM RM apital 220,000 Premises Motor vehicle 125,000 48,000 O fice equipment 14,500 Trade receivables and payables 13,400 5,060 Bank 13,500 4,400 15,000 7,560 19,600 1,800 Cash Fixed deposit Inventory (1 April 2016) Purchase and sales 27,460 Carria ge inwards Dra wings 400 Carria ge outwards 340 Return inwards and outwards 1.100 855 Im port duty U tility expenses 900 880 Dividend received 1,870 Salesman commission 3,800 Advertising and promotion Discount 3,950 1,340 150 Provision for doubtful debts (1 April 2016) 450 Provision for disco unt allo wa ble (1 April 20 16) 340 2,750 28,500 23,500 Insurance Salaries and wages Rent 3,500 40,000 1,650 Loan from Bank BM B Bad debt recovered Bad debt 500 General expenses 1,055 Interest on lo an 500

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started