Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT! QUICKLY PLEASE DO QUESTION 2 3 - 2 8 Please show the formulas of how to find these answers step by step without excel

URGENT! QUICKLY PLEASE DO QUESTION Please show the formulas of how to find these answers step by step without excel spreadsheet

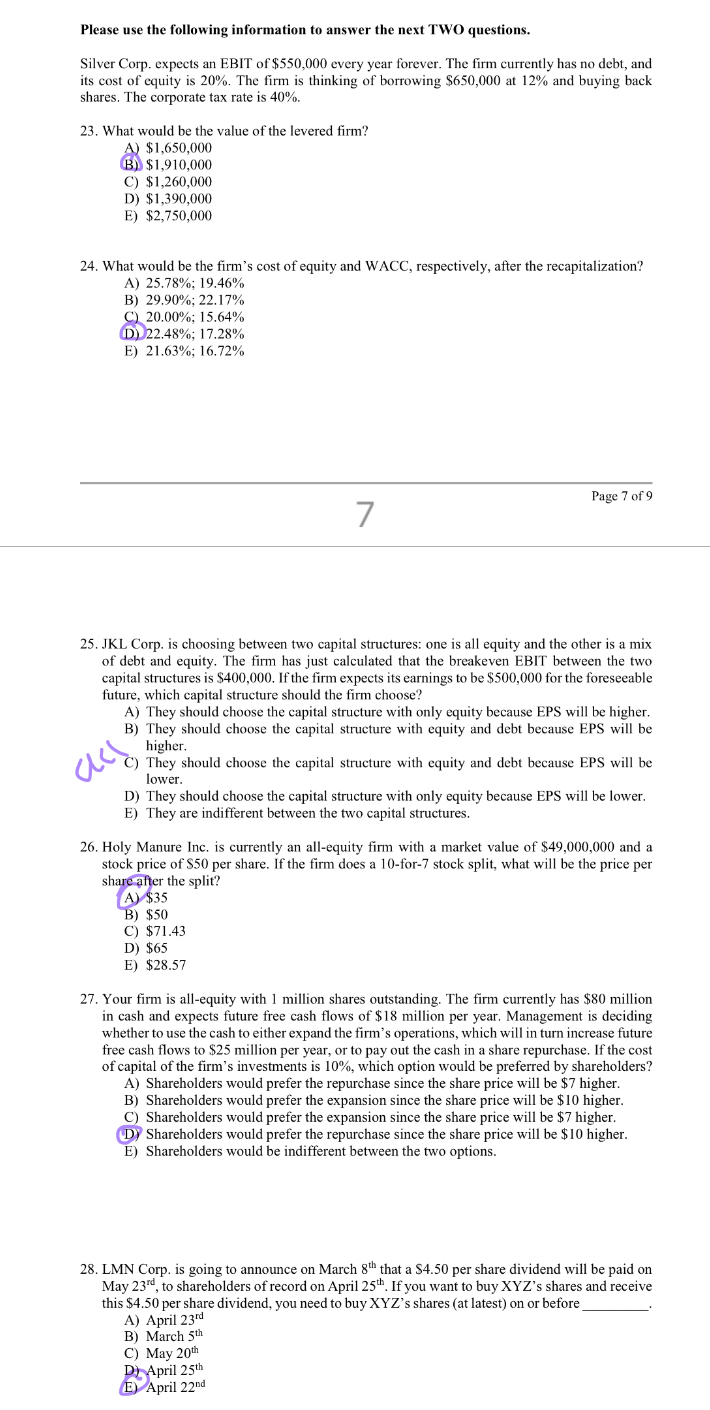

Please use the following information to answer the next TWO questions.

Silver Corp. expects an EBIT of $ every year forever. The firm currently has no debt, and its cost of equity is The firm is thinking of borrowing $ at and buying back shares. The corporate tax rate is

What would be the value of the levered firm?

A $

B $

C $

D $

E $

What would be the firm's cost of equity and WACC, respectively, after the recapitalization?

A;

B;

C;

D;

E;

JKL Corp. is choosing between two capital structures: one is all equity and the other is a mix of debt and equity. The firm has just calculated that the breakeven EBIT between the two capital structures is $ If the firm expects its earnings to be $ for the foreseable future, which capital structure should the firm choose?

A They should choose the capital structure with only equity because EPS will be higher.

B They should choose the capital structure with equity and debt because EPS will be higher.

C They should choose the capital structure with equity and debt because EPS will be lower.

D They should choose the capital structure with only equity because EPS will be lower.

E They are indifferent between the two capital structures.

Holy Manure Inc. is currently an allequity firm with a market value of $ and a stock price of $ per share. If the firm does a for stock split, what will be the price per share after the split?

A $

B $

C $

D $

E $

Your firm is allequity with million shares outstanding. The firm currently has $ million in cash and expects future free cash flows of $ million per year. Management is deciding whether to use the cash to either expand the firm's operations, which will in turn increase future free cash flows to $ million per year, or to pay out the cash in a share repurchase. If the cost of capital of the firm's investments is which option would be preferred by shareholders?

A Shareholders would prefer the repurchase since the share price will be $ higher.

B Shareholders would prefer the expansion since the share price will be $ higher.

C Shareholders would prefer the expansion since the share price will be $ higher.

D Shareholders would prefer the repurchase since the share price will be $ higher.

E Shareholders would be indifferent between the two options.

LMN Corp. is going to announce on March that a $ per share dividend will be paid on May to shareholders of record on April If you want to buy XYZs shares and receive this $ per share dividend, you need to buy XYZs shares at latest on or before

A April

B March

C May

D April

E April

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started