Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT! QUICKLY PLEASE show the formulas of how to find these answers Question 6 to 1 1 step by step without excel spreadsheet Lucron Corp.

URGENT! QUICKLY PLEASE show the formulas of how to find these answers Question to step by step without excel spreadsheet

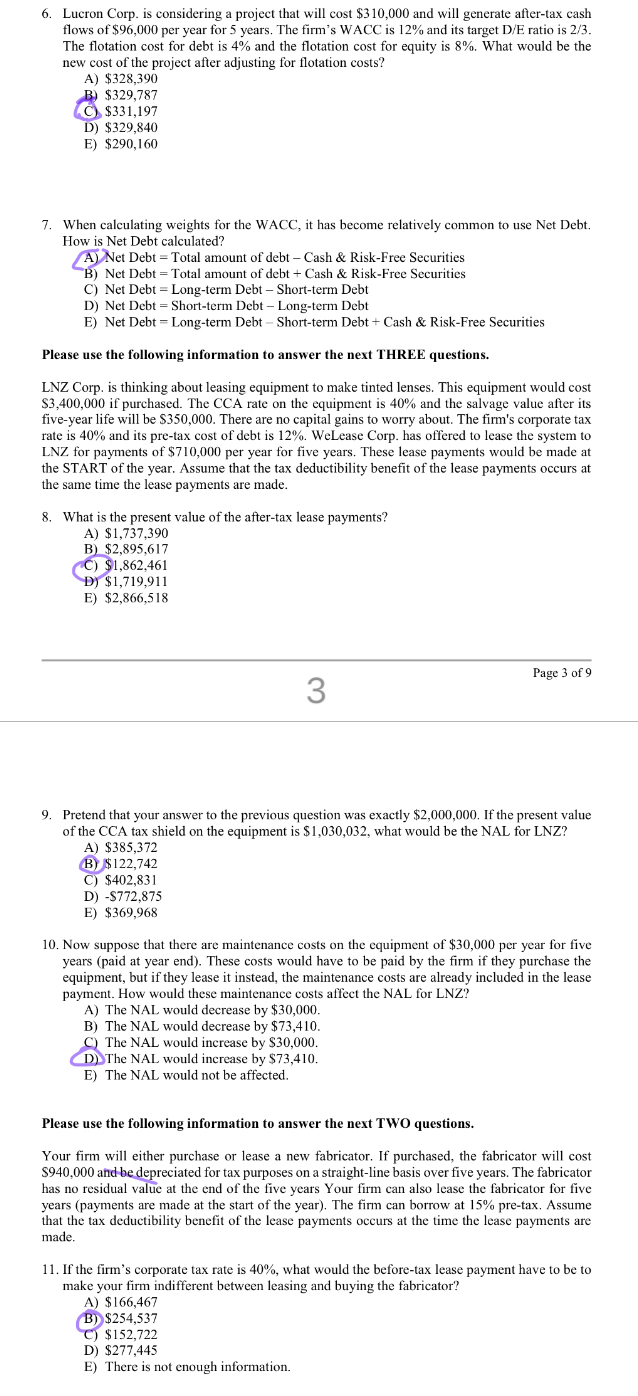

Lucron Corp. is considering a project that will cost $ and will generate aftertax cash flows of $ per year for years. The firm's WACC is and its target DE ratio is The flotation cost for debt is and the flotation cost for equity is What would be the new cost of the project after adjusting for flotation costs?

A $

B $

C $

D $

E $

When calculating weights for the WACC, it has become relatively common to use Net Debt. How is Net Debt calculated?

A Net Debt Total amount of debt Cash & RiskFree Securities

B Net Debt Total amount of debt Cash & RiskFree Securities

C Net Debt Longterm Debt Shortterm Debt

D Net Debt Shortterm Debt Longterm Debt

E Net Debt Longterm Debt Shortterm Debt Cash & RiskFree Securities

Please use the following information to answer the next THREE questions.

LNZ Corp. is thinking about leasing equipment to make tinted lenses. This equipment would cost $ if purchased. The CCA rate on the equipment is and the salvage value after its fiveyear life will be $ There are no capital gains to worry about. The firm's corporate tax rate is and its pretax cost of debt is WeLease Corp. has offered to lease the system to LNZ for payments of $ per year for five years. These lease payments would be made at the START of the year. Assume that the tax deductibility benefit of the lease payments occurs at the same time the lease payments are made.

What is the present value of the aftertax lease payments?

A $

B $

C $

$

E $

Pretend that your answer to the previous question was exactly $ If the present value of the CCA tax shield on the equipment is $ what would be the NAL for LNZ

A $

B $

C $

D$

E $

Now suppose that there are maintenance costs on the equipment of $ per year for five years paid at year end These costs would have to be paid by the firm if they purchase the equipment, but if they lease it instead, the maintenance costs are already included in the lease payment. How would these maintenance costs affect the NAL for LNZ

A The NAL would decrease by $

B The NAL would decrease by $

C The NAL would increase by $

D The NAL would increase by $

E The NAL would not be affected.

Please use the following information to answer the next TWO questions.

Your firm will either purchase or lease a new fabricator. If purchased, the fabricator will cost $ and be depreciated for tax purposes on a straightline basis over five years. The fabricator has no residual value at the end of the five years Your firm can also lease the fabricator for five years payments are made at the start of the year The firm can borrow at pretax. Assume that the tax deductibility benefit of the lease payments occurs at the time the lease payments are made.

If the firm's corporate tax rate is what would the beforetax lease payment have to be to make your firm indifferent between leasing and buying the fabricator?

A $

B $

C $

D $

E There is not enough information.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started