Answered step by step

Verified Expert Solution

Question

1 Approved Answer

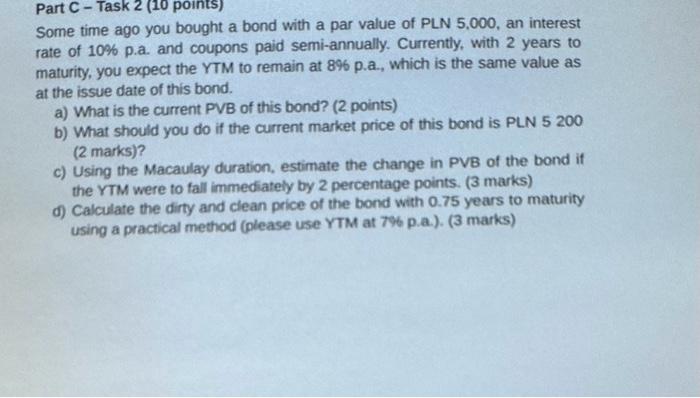

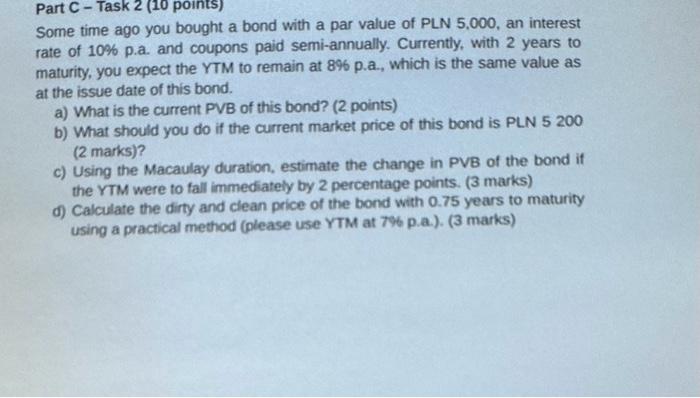

URGENT! Some time ago you bought a bond with a par value of PLN 5,000, an interest rate of 10% p.a. and coupons paid semi-annually.

URGENT!

Some time ago you bought a bond with a par value of PLN 5,000, an interest rate of 10% p.a. and coupons paid semi-annually. Currently, with 2 years to maturity, you expect the YTM to remain at 8%6 p.a., which is the same value as at the issue date of this bond. a) What is the current PVB of this bond? (2 points) b) What should you do if the current market price of this bond is PLN 5200 ( 2 marks)? c) Using the Macaulay duration, estimate the change in PVB of the bond if the YTM were to fall immediately by 2 percentage points. ( 3 marks) d) Calculate the dirty and clean price of the bond with 0.75 years to maturity using a practical method (please use YTM at 7\$6 p.a.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started