Answered step by step

Verified Expert Solution

Question

1 Approved Answer

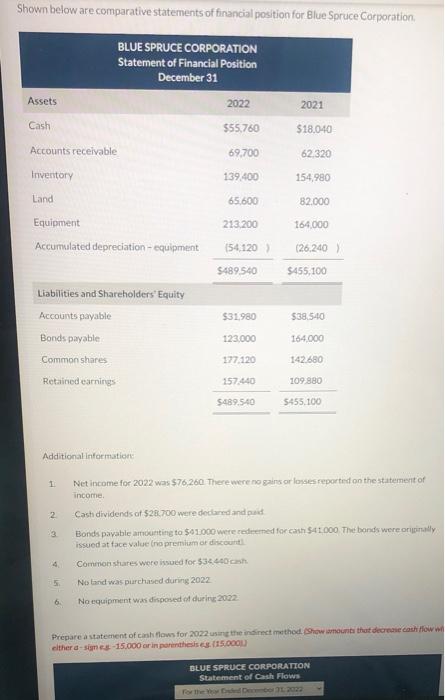

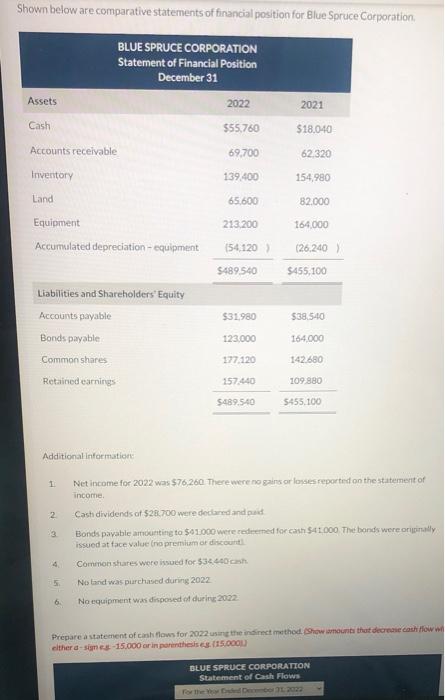

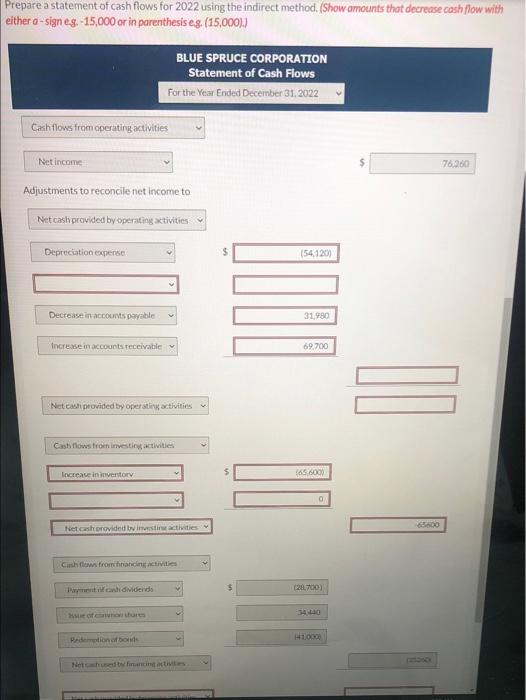

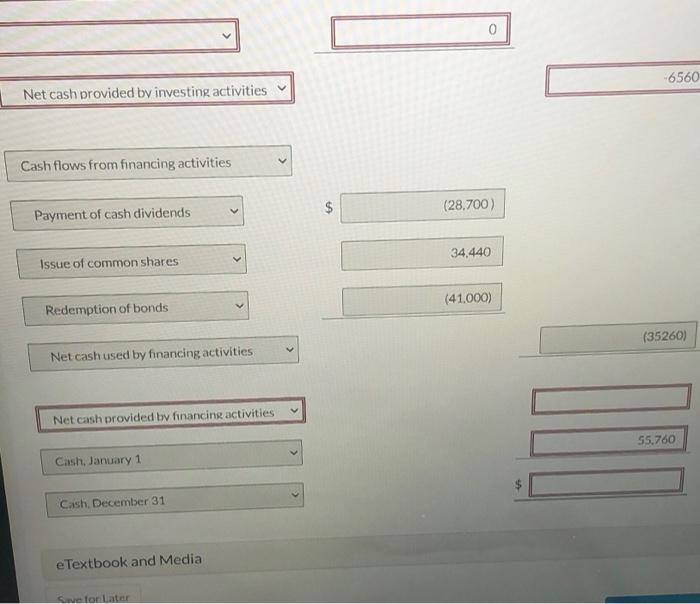

Urgent!!! Thanks in advance Shown below are comparative statements of financial position for Blue Spruce Corporation BLUE SPRUCE CORPORATION Statement of Financial Position December 31

Urgent!!! Thanks in advance

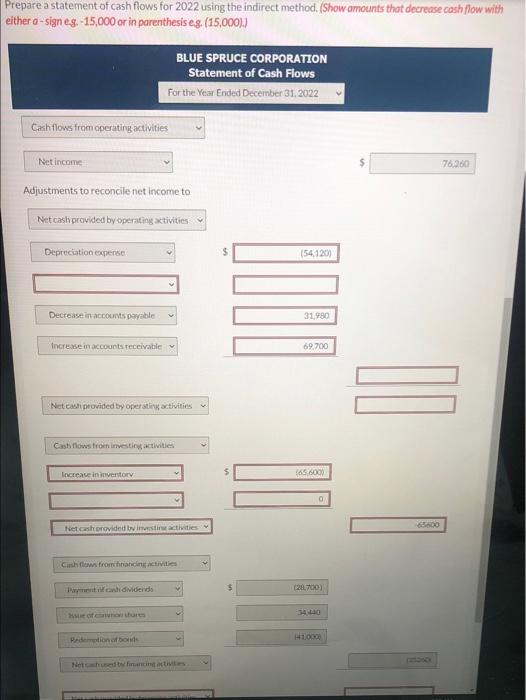

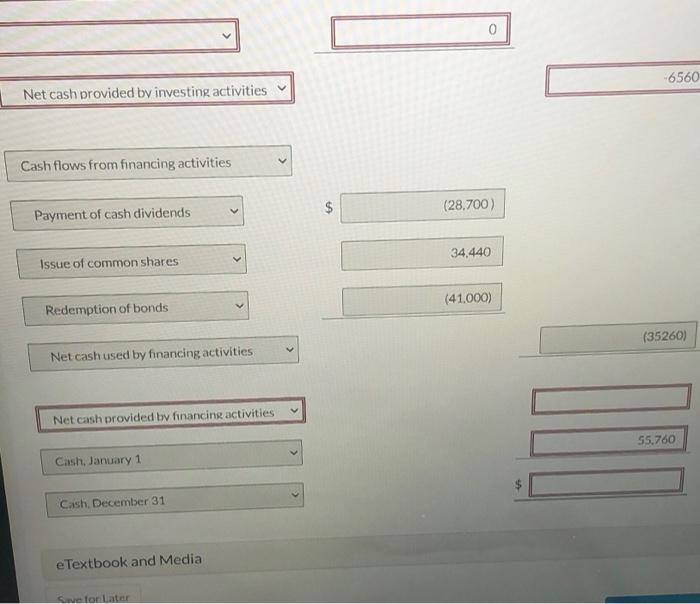

Shown below are comparative statements of financial position for Blue Spruce Corporation BLUE SPRUCE CORPORATION Statement of Financial Position December 31 Assets 2022 2021 Cash $55,760 $18,040 Accounts receivable 69.700 62 320 Inventory 139.400 154.980 Land 65.600 82.000 213.200 164,000 Equipment Accumulated depreciation - equipment - 154, 120 (26.240 5489.540 $455,100 $31.980 $38.540 Liabilities and Shareholders' Equity Accounts payable Bonds payable Common shares Retained earnings 123.000 164.000 177120 142680 157.440 109 880 $489.540 5455.100 Additional information 1 2 3 Net income for 2022 was $76.260 There were no gains or losses reported on the statement of income Cash dividends of $28.700 were declared and paid Bonds payable amounting to $1.000 were redeered for cash $41.000 The bonds were originally issued at face value (no premium or discount Common shares were issued for $340 Notand was purchased during 2022 No equipment was disposed of during 2002 4 5 6 Prepare a statement of cash flows for 2022 using the indirect method. Show mounts that decrease coshow either a-si-15.000 or in pothesis 115.000 BLUE SPRUCE CORPORATION Statement of Cash Flows for the 2022 Prepare a statement of cash flows for 2022 using the indirect method. (Show amounts that decrease cash flow with either a - sign eg -15,000 or in parenthesis eg. (15,000).) BLUE SPRUCE CORPORATION Statement of Cash Flows For the Year Ended December 31, 2022 Cash flows from operating activities Net income 76.260 Adjustments to reconcile net income to Net cash provided by operating aktivities Depreciation experte (54.120) MOOD Decrease in accounts payable 31980 Increase in accounts receivable 69.700 Netcash provided by operating activities Cash flows from investing activities Increase in inventory (45, 6000 0 Net cashbrovided twintin activities 65500 Cirshows tromicing Activities Payment individends 28.7003 34.110 Redentibus H1,000 -6560 Net cash provided by investing activities Cash flows from financing activities $ (28.700) Payment of cash dividends 34,440 Issue of common shares (41.000) Redemption of bonds (35260) Net cash used by financing activities Net cash provided by financing activities 55.760 Cash, January 1 Cash, December 31 e Textbook and Media Sive for Later

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started