Answered step by step

Verified Expert Solution

Question

1 Approved Answer

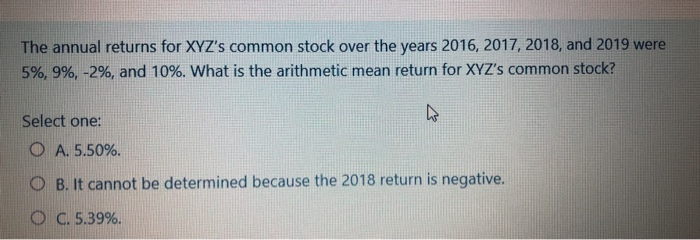

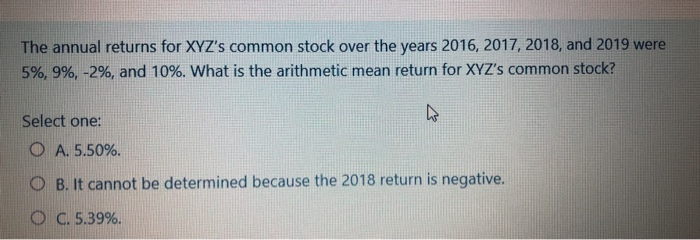

urgent The annual returns for XYZ's common stock over the years 2016, 2017, 2018, and 2019 were 5%, 9%, -2%, and 10%. What is the

urgent

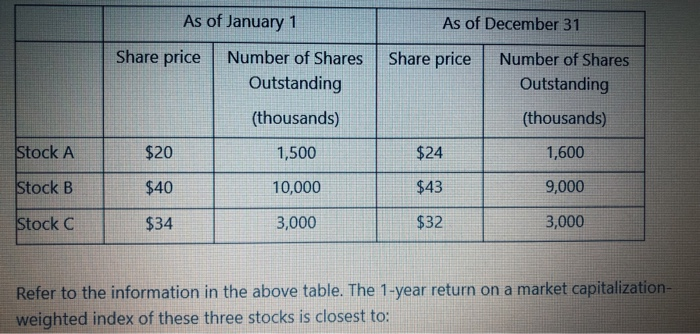

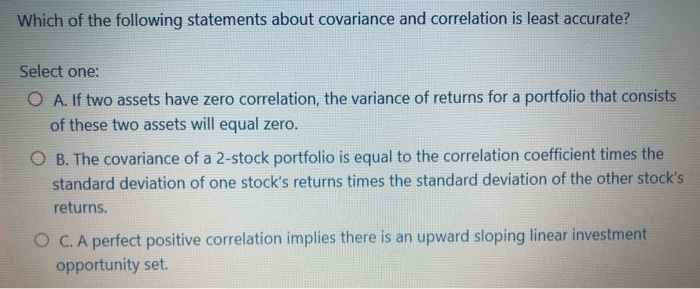

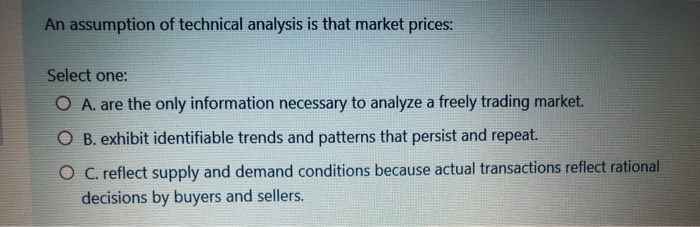

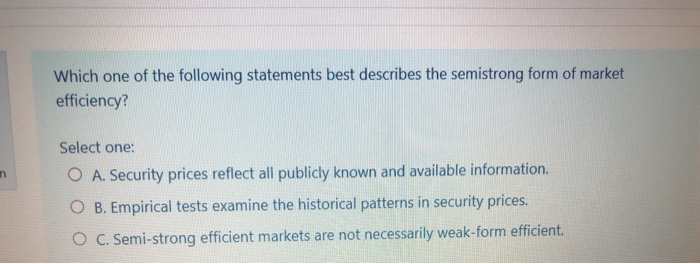

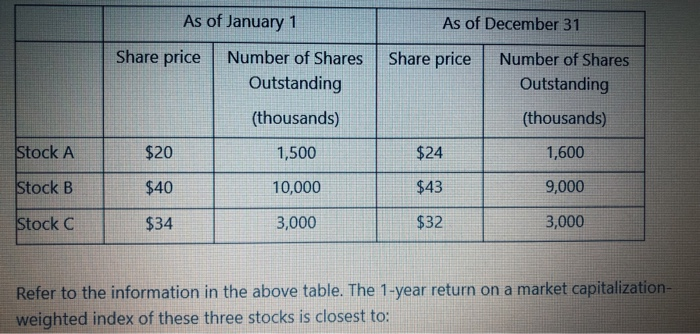

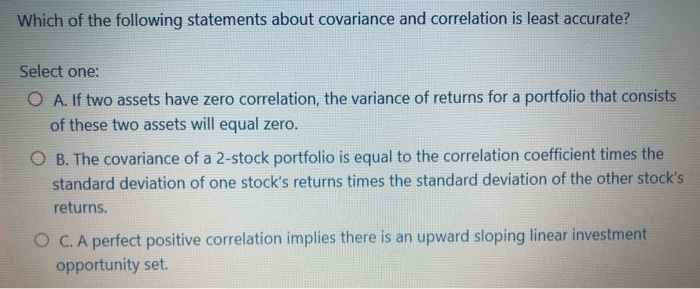

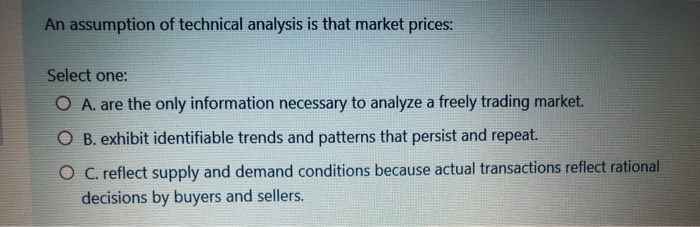

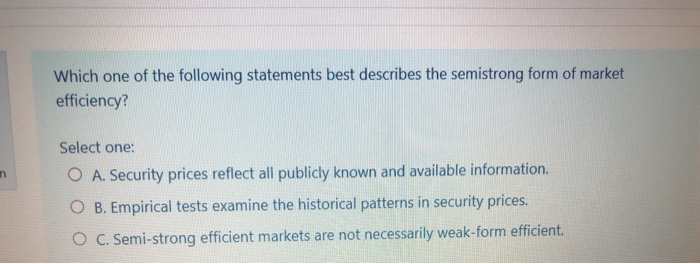

The annual returns for XYZ's common stock over the years 2016, 2017, 2018, and 2019 were 5%, 9%, -2%, and 10%. What is the arithmetic mean return for XYZ's common stock? Select one: O A. 5.50%. O B. It cannot be determined because the 2018 return is negative. O C.5.39%. As of January 1 Share price Number of shares Outstanding As of December 31 Share price Number of Shares Outstanding (thousands) (thousands) $20 1,500 $24 1,600 Stock A Stock B $40 10,000 $43 9,000 Stock C $34 3,000 $32 3,000 Refer to the information in the above table. The 1-year return on a market capitalization- weighted index of these three stocks is closest to: Which of the following statements about covariance and correlation is least accurate? Select one: O A. If two assets have zero correlation, the variance of returns for a portfolio that consists of these two assets will equal zero. O B. The covariance of a 2-stock portfolio is equal to the correlation coefficient times the standard deviation of one stock's returns times the standard deviation of the other stock's returns. O C. A perfect positive correlation implies there is an upward sloping linear investment opportunity set An assumption of technical analysis is that market prices: Select one: O A. are the only information necessary to analyze a freely trading market. O B. exhibit identifiable trends and patterns that persist and repeat. O C. reflect supply and demand conditions because actual transactions reflect rational decisions by buyers and sellers. Which one of the following statements best describes the semistrong form of market efficiency? Select one: O A. Security prices reflect all publicly known and available information. O B. Empirical tests examine the historical patterns in security prices. O C. Semi-strong efficient markets are not necessarily weak-form efficient

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started