Answered step by step

Verified Expert Solution

Question

1 Approved Answer

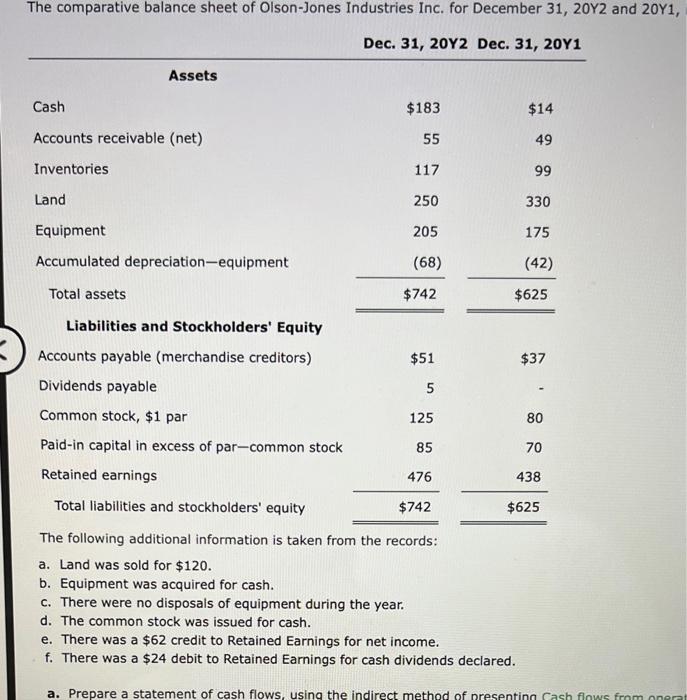

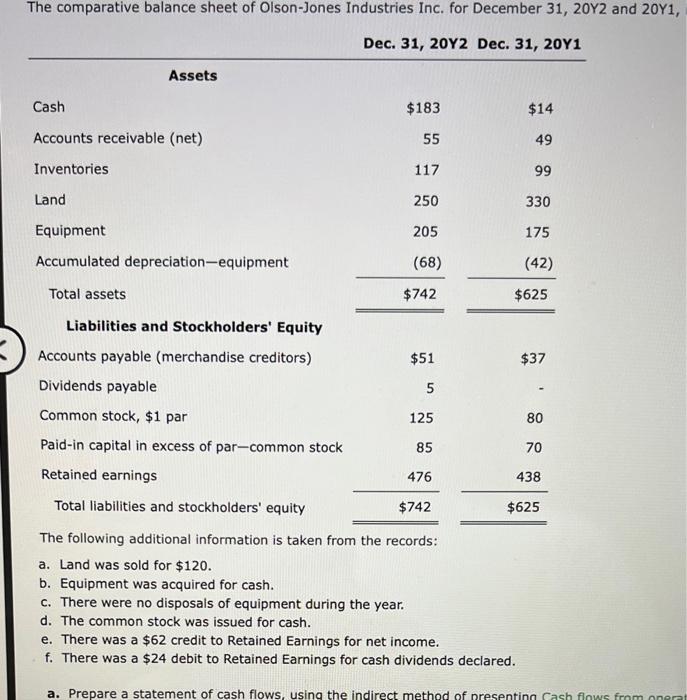

URGENT!!!! The comparative balance sheet of Olson-Jones Industries Inc. for December 31, 20Y2 and 20Y1, Dec. 31, 20Y2 Dec. 31, 20Y1 Cash Assets Accounts receivable

URGENT!!!!

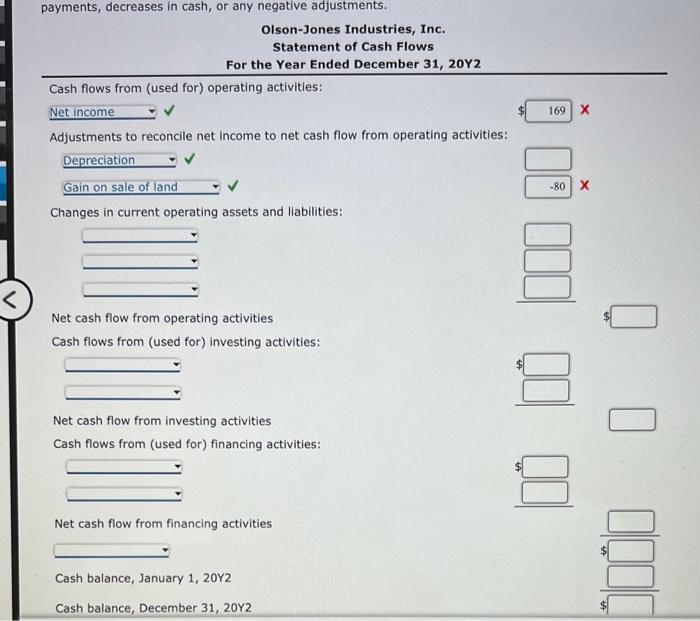

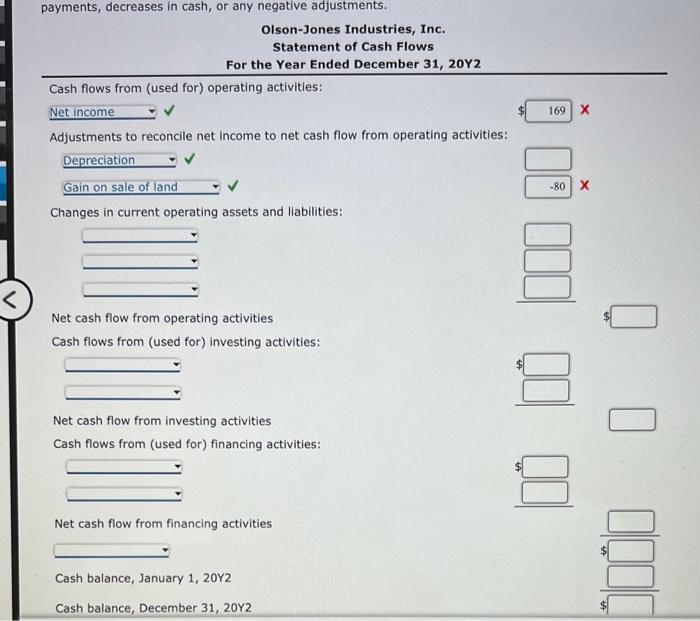

The comparative balance sheet of Olson-Jones Industries Inc. for December 31, 20Y2 and 20Y1, Dec. 31, 20Y2 Dec. 31, 20Y1 Cash Assets Accounts receivable (net) Inventories Land Equipment Accumulated depreciation-equipment Total assets Liabilities and Stockholders' Equity $183 55 117 250 205 (68) $742 Accounts payable (merchandise creditors) Dividends payable Common stock, $1 par Paid-in capital in excess of par-common stock Retained earnings Total liabilities and stockholders' equity The following additional information is taken from the records: a. Land was sold for $120. b. Equipment was acquired for cash. c. There were no disposals of equipment during the year. $51 5 125 85 476 $742 $14 49 99 330 175 (42) $625 $37 80 70 438 $625 d. The common stock was issued for cash. e. There was a $62 credit to Retained Earnings for net income. f. There was a $24 debit to Retained Earnings for cash dividends declared. a. Prepare a statement of cash flows, using the indirect method of presenting Cash flows from onerat payments, decreases in cash, or any negative adjustments. Olson-Jones Industries, Inc. Statement of Cash Flows For the Year Ended December 31, 20Y2 Cash flows from (used for) operating activities: Net income Adjustments to reconcile net income to net cash flow from operating activities: Depreciation Gain on sale of land Changes in current operating assets and liabilities: Net cash flow from operating activities Cash flows from (used for) investing activities: Net cash flow from investing activities Cash flows from (used for) financing activities: Net cash flow from financing activities Cash balance, January 1, 2012 Cash balance, December 31, 20Y2 169 X -80 X 000 00 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started