Answered step by step

Verified Expert Solution

Question

1 Approved Answer

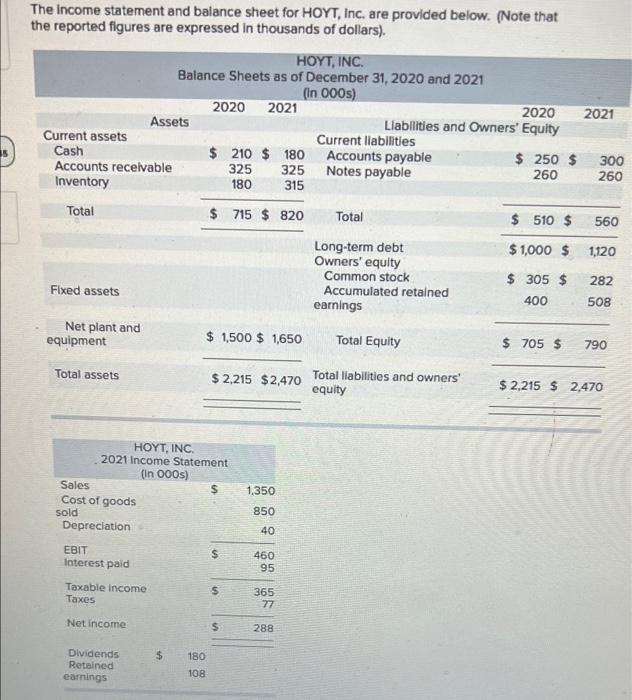

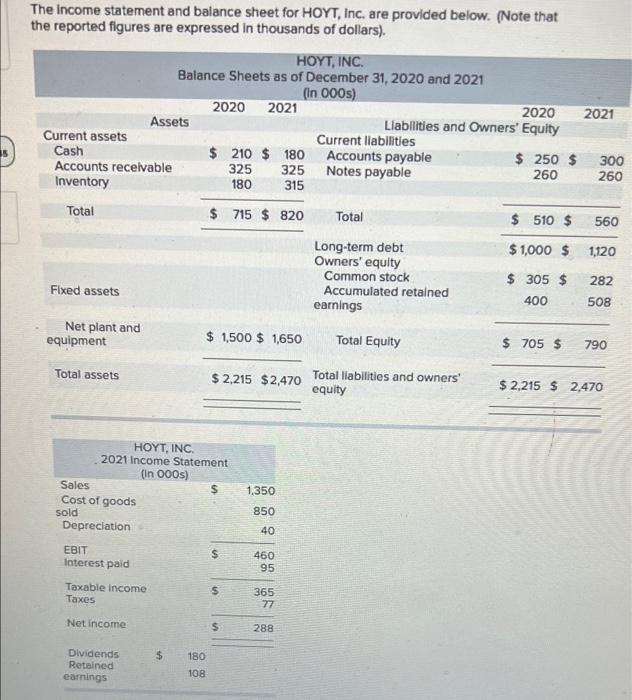

URGENT The Income statement and balance sheet for HOYT, Inc. are provided below. (Note that the reported figures are expressed in thousands of dollars). Current

URGENT

The Income statement and balance sheet for HOYT, Inc. are provided below. (Note that the reported figures are expressed in thousands of dollars). Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes Net income HOYT, INC. Balance Sheets as of December 31, 2020 and 2021 (in 000s) 2020 2021 Assets Dividends Retained earnings HOYT, INC. 2021 Income Statement (in 000s) $ 210 $ 180 325 325 180 315 $ 715 $ 820 $ 180 108 $1,500 $1,650 $2,215 $2,470 $ $ $ 1,350. 850 40 460 95 365 77 288 2020 Llabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock Accumulated retained earnings Total Equity Total liabilities and owners' equity $250 $ 260 $ 510 $ $1,000 $ $ 305 $ 400 $ 705 $ 2021 300 260 560 1,120 282 508 790 $2,215 $2,470 Requirement #3: Based on DuPont analysis, how would you explain the difference in the return on equity (ROE) for HOYT, Inc. vs. the industry as a whole in 2021 (i.e., why is the ROE for HOYT higher/lower than the ROE for the average firm in the industry)? The Income statement and balance sheet for HOYT, Inc. are provided below. (Note that the reported figures are expressed in thousands of dollars). Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes Net income HOYT, INC. Balance Sheets as of December 31, 2020 and 2021 (in 000s) 2020 2021 Assets Dividends Retained earnings HOYT, INC. 2021 Income Statement (in 000s) $ 210 $ 180 325 325 180 315 $ 715 $ 820 $ 180 108 $1,500 $1,650 $2,215 $2,470 $ $ $ 1,350. 850 40 460 95 365 77 288 2020 Llabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock Accumulated retained earnings Total Equity Total liabilities and owners' equity $250 $ 260 $ 510 $ $1,000 $ $ 305 $ 400 $ 705 $ 2021 300 260 560 1,120 282 508 790 $2,215 $2,470 Requirement #3: Based on DuPont analysis, how would you explain the difference in the return on equity (ROE) for HOYT, Inc. vs. the industry as a whole in 2021 (i.e., why is the ROE for HOYT higher/lower than the ROE for the average firm in the industry)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started