Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT use excel please! Calculate and journalize depreciation for 2020 and 2021 for each of the following independent situations. Assume the company produces financial reports

URGENT use excel please!

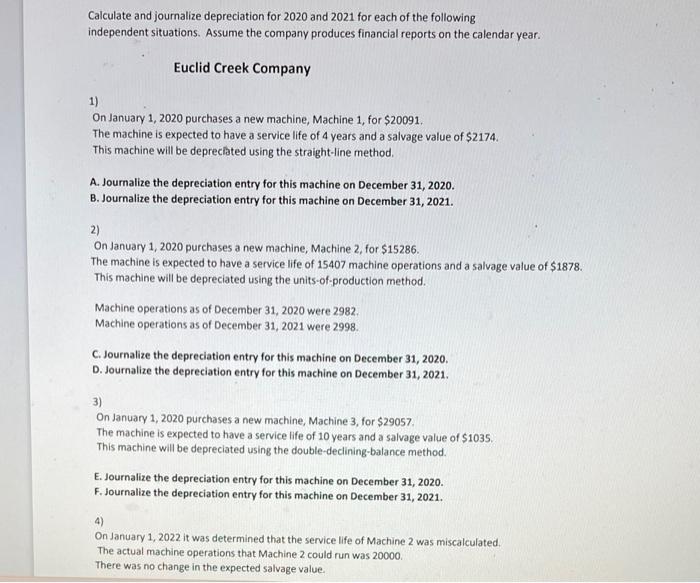

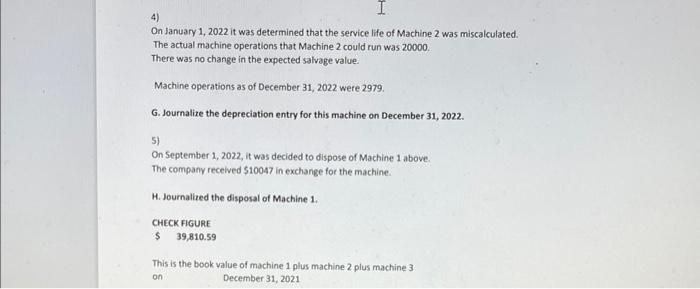

Calculate and journalize depreciation for 2020 and 2021 for each of the following independent situations. Assume the company produces financial reports on the calendar year. Euclid Creek Company 1) On January 1, 2020 purchases a new machine, Machine 1, for \$20091. The machine is expected to have a service life of 4 years and a salvage value of $2174. This machine will be deprechted using the straight-line method. A. Journalize the depreciation entry for this machine on December 31, 2020. B. Journalize the depreciation entry for this machine on December 31, 2021. 2) On January 1, 2020 purchases a new machine, Machine 2, for $15286. The machine is expected to have a service life of 15407 machine operations and a salvage value of $1878. This machine will be depreciated using the units-of-production method. Machine operations as of December 31, 2020 were 2982. Machine operations as of December 31, 2021 were 2998. C. Journalize the depreciation entry for this machine on December 31, 2020. D. Journalize the depreciation entry for this machine on December 31,2021. 3) On January 1, 2020 purchases a new machine, Machine 3, for \$29057. The machine is expected to have a service life of 10 years and a salvage value of $1035. This machine will be depreciated using the double-declining-balance method. E. Journalize the depreciation entry for this machine on December 31, 2020. F. Journalize the depreciation entry for this machine on December 31, 2021. 4) On January 1,2022 it was determined that the service life of Machine 2 was miscalculated. The actual machine operations that Machine 2 could run was 20000 . There was no change in the expected salvage value. 4) On January 1, 2022 it was determined that the service life of Machine 2 was miscalculated. The actual machine operations that Machine 2 could run was 20000 . There was no change in the expected salvage value. Machine operations as of December 31,2022 were 2979 . G. Journalize the depreciation entry for this machine on December 31, 2022. 5) On 5eptember 1, 2022, it was decided to dispose of Machine 1 above. The company received $10047 in exchange for the machine. H. Journalized the disposal of Machine 1 . CHECK FIGURE 539,810.59 This is the book value of machine 1 plus machine 2 plus machine 3 . on December 31,2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started