Answered step by step

Verified Expert Solution

Question

1 Approved Answer

urgent You are valuing a private company for sale and have made the following estimates of cashflows and expected growth rates: 1 Run by the

urgent

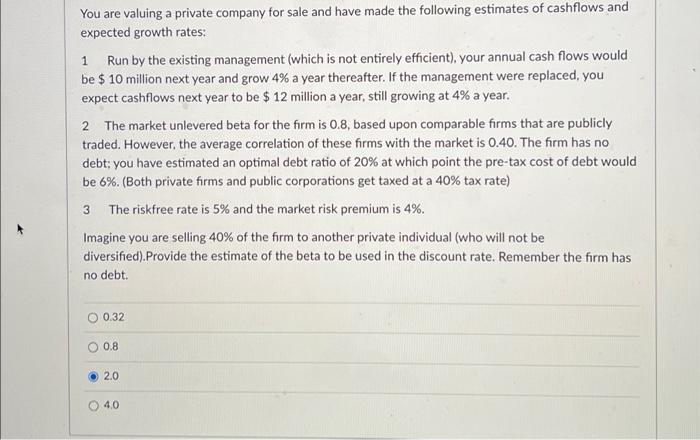

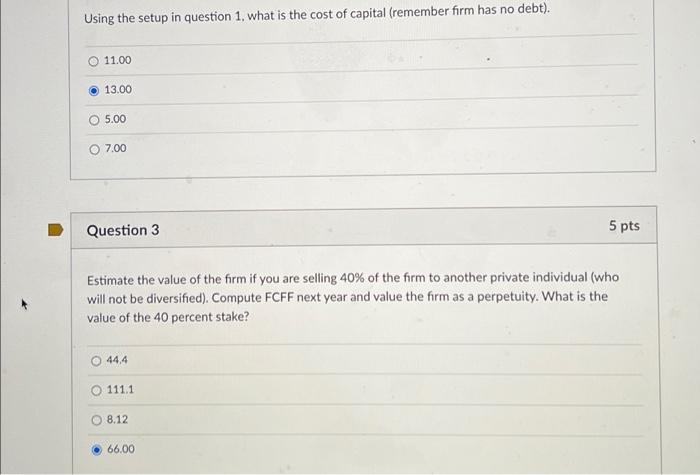

You are valuing a private company for sale and have made the following estimates of cashflows and expected growth rates: 1 Run by the existing management (which is not entirely efficient), your annual cash flows would be $ 10 million next year and grow 4% a year thereafter. If the management were replaced, you expect cashflows next year to be $ 12 million a year, still growing at 4% a year. 2 The market unlevered beta for the firm is 0.8, based upon comparable firms that are publicly traded. However, the average correlation of these firms with the market is 0.40. The firm has no debt; you have estimated an optimal debt ratio of 20% at which point the pre-tax cost of debt would be 6%. (Both private firms and public corporations get taxed at a 40% tax rate) The riskfree rate is 5% and the market risk premium is 4%. Imagine you are selling 40% of the firm to another private individual (who will not be diversified). Provide the estimate of the beta to be used in the discount rate. Remember the firm has no debt. 3 0.32 0.8 2.0 40 Using the setup in question 1, what is the cost of capital (remember firm has no debt). O 11.00 13.00 5.00 0 7.00 Question 3 5 pts Estimate the value of the form if you are selling 40% of the firm to another private individual (who will not be diversified). Compute FCFF next year and value the firm as a perpetuity. What is the value of the 40 percent stake? 44,4 111.1 8.12 66.00 You are valuing a private company for sale and have made the following estimates of cashflows and expected growth rates: 1 Run by the existing management (which is not entirely efficient), your annual cash flows would be $ 10 million next year and grow 4% a year thereafter. If the management were replaced, you expect cashflows next year to be $ 12 million a year, still growing at 4% a year. 2 The market unlevered beta for the firm is 0.8, based upon comparable firms that are publicly traded. However, the average correlation of these firms with the market is 0.40. The firm has no debt; you have estimated an optimal debt ratio of 20% at which point the pre-tax cost of debt would be 6%. (Both private firms and public corporations get taxed at a 40% tax rate) The riskfree rate is 5% and the market risk premium is 4%. Imagine you are selling 40% of the firm to another private individual (who will not be diversified). Provide the estimate of the beta to be used in the discount rate. Remember the firm has no debt. 3 0.32 0.8 2.0 40 Using the setup in question 1, what is the cost of capital (remember firm has no debt). O 11.00 13.00 5.00 0 7.00 Question 3 5 pts Estimate the value of the form if you are selling 40% of the firm to another private individual (who will not be diversified). Compute FCFF next year and value the firm as a perpetuity. What is the value of the 40 percent stake? 44,4 111.1 8.12 66.00 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started