Question

URGENTLY NEEDED -- PLEASE HELP ME SOLVE Mr. Yamaha writes 1,000 shares of put options on Raven Groups stocks. The expiry date of the options

URGENTLY NEEDED -- PLEASE HELP ME SOLVE

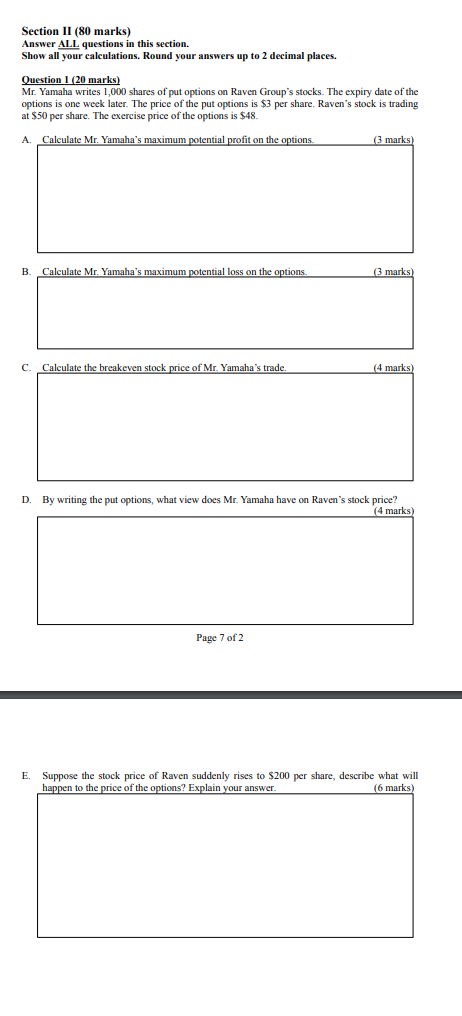

Mr. Yamaha writes 1,000 shares of put options on Raven Groups stocks. The expiry date of the options is one week later. The price of the put options is $3 per share. Ravens stock is trading at $50 per share. The exercise price of the options is $48.

-

Calculate Mr. Yamahas maximum potential profit on the options. (3 marks)

-

Calculate Mr. Yamahas maximum potential loss on the options. (3 marks)

-

Calculate the breakeven stock price of Mr. Yamahas trade. (4 marks)

-

By writing the put options, what view does Mr. Yamaha have on Ravens stock price?

(4 marks)

-

Suppose the stock price of Raven suddenly rises to $200 per share, describe what will happen to the price of the options? Explain your answer. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started