Answered step by step

Verified Expert Solution

Question

1 Approved Answer

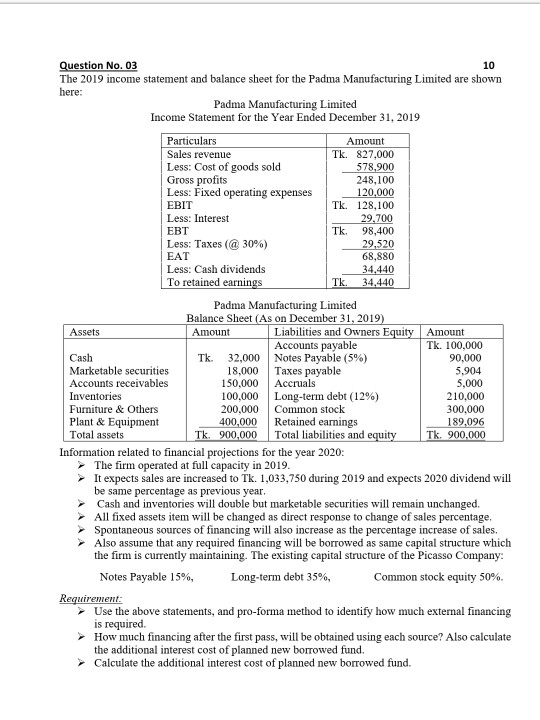

Urgently please Question No. 03 10 The 2019 income statement and balance sheet for the Padma Manufacturing Limited are shown here: Padma Manufacturing Limited Income

Urgently please

Question No. 03 10 The 2019 income statement and balance sheet for the Padma Manufacturing Limited are shown here: Padma Manufacturing Limited Income Statement for the Year Ended December 31, 2019 Particulars Amount Sales revenue Tk. 827,000 Less: Cost of goods sold 578,900 Gross profits 248,100 Less: Fixed operating expenses 120.000 EBIT Tk. 128,100 Less: Interest 29,700 EBT Tk 98,400 Less: Taxes (@ 30%) 29,520 EAT 68,880 Less: Cash dividends 34,440 To retained earnings Tk. 34,440 Padma Manufacturing Limited Balance Sheet (As on December 31, 2019) Assets Amount Liabilities and Owners Equity Amount Accounts payable Tk. 100.000 Cash Tk. 32,000 Notes Payable (5%) 90,000 Marketable securities 18,000 Taxes payable 5,904 Accounts receivables 150,000 Accruals 5,000 Inventories 100,000 Long-term debt (12%) 210,000 Furniture & Others 200,000 Common stock 300,000 Plant & Equipment 400,000 Retained earnings 189,096 Total assets Tk. 900,000 Total liabilities and equity Tk. 900.000 Information related to financial projections for the year 2020: The firm operated at full capacity in 2019. It expects sales are increased to Tk. 1,033,750 during 2019 and expects 2020 dividend will be same percentage as previous year. Cash and inventories will double but marketable securities will remain unchanged. All fixed assets item will be changed as direct response to change of sales percentage Spontaneous sources of financing will also increase as the percentage increase of sales. Also assume that any required financing will be borrowed as same capital structure which the firm is currently maintaining. The existing capital structure of the Picasso Company: Notes Payable 15%, Long-term debt 35%, Common stock equity 50%. Requirement: Use the above statements, and pro-forma method to identify how much external financing is required. How much financing after the first pass, will be obtained using each source? Also calculate the additional interest cost of planned new borrowed fund. Calculate the additional interest cost of planned new borrowed fundStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started