URGENTTT

URGENTTT

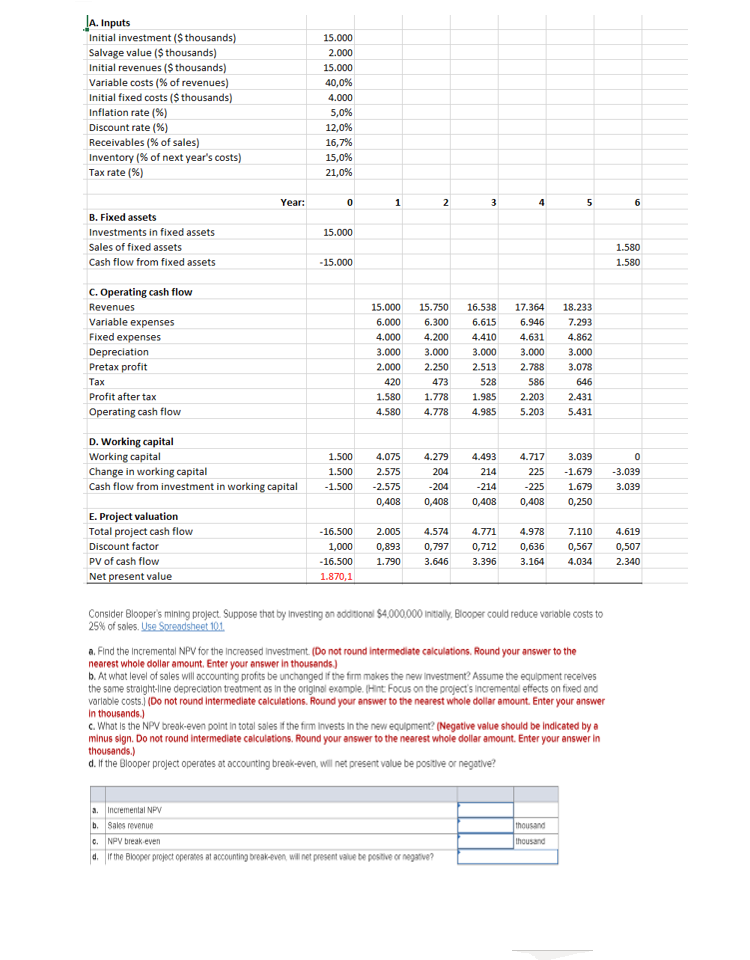

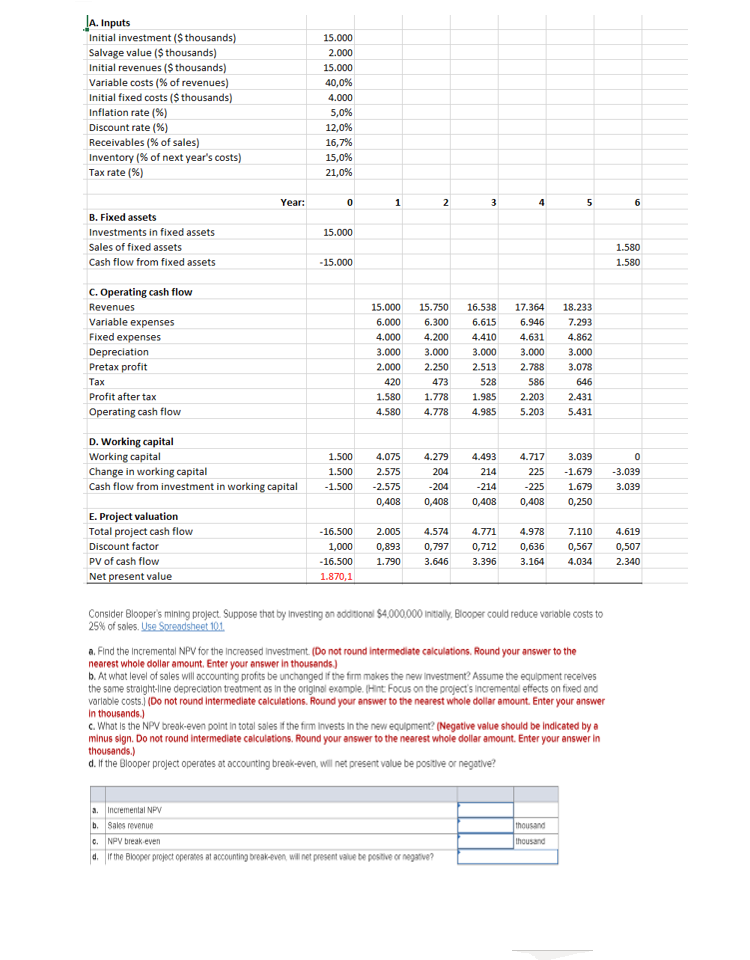

A. Inputs Initial investment ($ thousands) Salvage value ($thousands) Initial revenues ($thousands) Variable costs (% of revenues) Initial fixed costs ($ thousands) Inflation rate (%) Discount rate (%) 15.000 2.000 15.000 40,0% 4.000 5,0% 12,0% 16,7% 15,0% 21,0% Inventory (% of next year's costs) Tax rate (%) Year: 0 15.000 B. Fixed assets Investments in fixed assets Sales of fixed assets Cash flow from fixed assets 1.580 1.580 - 15.000 C. Operating cash flow Revenues Variable expenses Fixed expenses Depreciation Pretax profit Tax Profit after tax Operating cash flow 17.364 6.946 4.631 3.000 15.000 6.000 4.000 3.000 2.000 420 1.580 4.580 15.750 6.300 4.200 3.000 2.250 473 1.778 4.778 16.538 6.615 4.410 3.000 2.513 528 1.985 4.985 18.233 7.293 4.862 3.000 3.078 646 2.431 5.431 2.203 5.203 4.279 D. Working capital Working capital Change in working capital Cash flow from investment in working capital 1.500 1.500 -1.500 4.075 2.575 -2.575 0,408 4.493 214 -214 0,408 4.717 225 -225 0,408 3.039 -1.679 1.679 0,250 0 -3.039 3.039 0,408 E. Project valuation Total project cash flow Discount factor PV of cash flow Net present value -16.500 1,000 -16.500 1.870,1 2.005 0,893 1.790 4.574 0,797 3.646 4.771 0,712 3.396 4.978 0,636 3.164 7.110 0,567 4.034 4.619 0,507 2.340 Consider Blooper's mining project. Suppose thot by Investing an additional $4,000,000 initially, Blooper could reduce variable costs to 25% of sales. Use Spreadsheet 101 a. Find the incremental NPV for the increased investment. (Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount. Enter your answer in thousands) b. At what level of sales will accounting profits be unchanged if the firm makes the new Investment? Assume the equipment receives the same straight-line depreciation treatment as in the original example. (Hint Focus on the project's incremental effects on fixed and variable costs. (Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount. Enter your answer in thousands) c. What is the NPV break-even point in total sales if the firm invests in the new equipment (Negative value should be indicated by a minus sign. Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount. Enter your answer in thousands.) d. If the Blooper project operates at accounting break-even wil net present value be positive or negative? Incremental NPV a. b. Sales revenue thousand 0. NPV break even thousand d. If the Blooper project operates at accounting break-even wil net present value be positive or negative? A. Inputs Initial investment ($ thousands) Salvage value ($thousands) Initial revenues ($thousands) Variable costs (% of revenues) Initial fixed costs ($ thousands) Inflation rate (%) Discount rate (%) 15.000 2.000 15.000 40,0% 4.000 5,0% 12,0% 16,7% 15,0% 21,0% Inventory (% of next year's costs) Tax rate (%) Year: 0 15.000 B. Fixed assets Investments in fixed assets Sales of fixed assets Cash flow from fixed assets 1.580 1.580 - 15.000 C. Operating cash flow Revenues Variable expenses Fixed expenses Depreciation Pretax profit Tax Profit after tax Operating cash flow 17.364 6.946 4.631 3.000 15.000 6.000 4.000 3.000 2.000 420 1.580 4.580 15.750 6.300 4.200 3.000 2.250 473 1.778 4.778 16.538 6.615 4.410 3.000 2.513 528 1.985 4.985 18.233 7.293 4.862 3.000 3.078 646 2.431 5.431 2.203 5.203 4.279 D. Working capital Working capital Change in working capital Cash flow from investment in working capital 1.500 1.500 -1.500 4.075 2.575 -2.575 0,408 4.493 214 -214 0,408 4.717 225 -225 0,408 3.039 -1.679 1.679 0,250 0 -3.039 3.039 0,408 E. Project valuation Total project cash flow Discount factor PV of cash flow Net present value -16.500 1,000 -16.500 1.870,1 2.005 0,893 1.790 4.574 0,797 3.646 4.771 0,712 3.396 4.978 0,636 3.164 7.110 0,567 4.034 4.619 0,507 2.340 Consider Blooper's mining project. Suppose thot by Investing an additional $4,000,000 initially, Blooper could reduce variable costs to 25% of sales. Use Spreadsheet 101 a. Find the incremental NPV for the increased investment. (Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount. Enter your answer in thousands) b. At what level of sales will accounting profits be unchanged if the firm makes the new Investment? Assume the equipment receives the same straight-line depreciation treatment as in the original example. (Hint Focus on the project's incremental effects on fixed and variable costs. (Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount. Enter your answer in thousands) c. What is the NPV break-even point in total sales if the firm invests in the new equipment (Negative value should be indicated by a minus sign. Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount. Enter your answer in thousands.) d. If the Blooper project operates at accounting break-even wil net present value be positive or negative? Incremental NPV a. b. Sales revenue thousand 0. NPV break even thousand d. If the Blooper project operates at accounting break-even wil net present value be positive or negative

URGENTTT

URGENTTT