Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENTTTT !!!!!!!!!!!! PLEASE ANSWER ASAPPPPP !!!!!!!!!!!!!!!!!!! WILL BE BETTER IF THE ANSWERS ARE TYPED, THANK YOUUUUUU Ahmad and Barathan are in a partnership. They share

URGENTTTT !!!!!!!!!!!! PLEASE ANSWER ASAPPPPP !!!!!!!!!!!!!!!!!!! WILL BE BETTER IF THE ANSWERS ARE TYPED, THANK YOUUUUUU

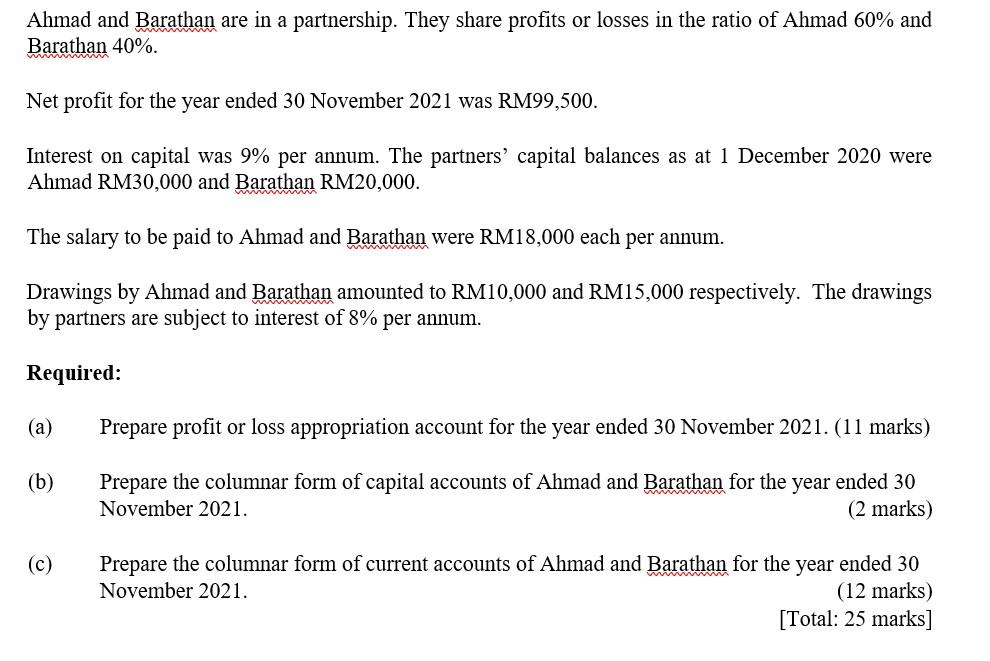

Ahmad and Barathan are in a partnership. They share profits or losses in the ratio of Ahmad 60% and Barathan 40%. Net profit for the year ended 30 November 2021 was RM99,500. Interest on capital was 9% per annum. The partners' capital balances as at 1 December 2020 were Ahmad RM30,000 and Barathan RM20,000. The salary to be paid to Ahmad and Barathan were RM18,000 each per annum. Drawings by Ahmad and Barathan amounted to RM10,000 and RM15,000 respectively. The drawings by partners are subject to interest of 8% per annum. Required: (a) Prepare profit or loss appropriation account for the year ended 30 November 2021. (11 marks) (b) Prepare the columnar form of capital accounts of Ahmad and Barathan for the year ended 30 November 2021. (2 marks) (C) Prepare the columnar form of current accounts of Ahmad and Barathan for the year ended 30 November 2021. (12 marks) [Total: 25 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started