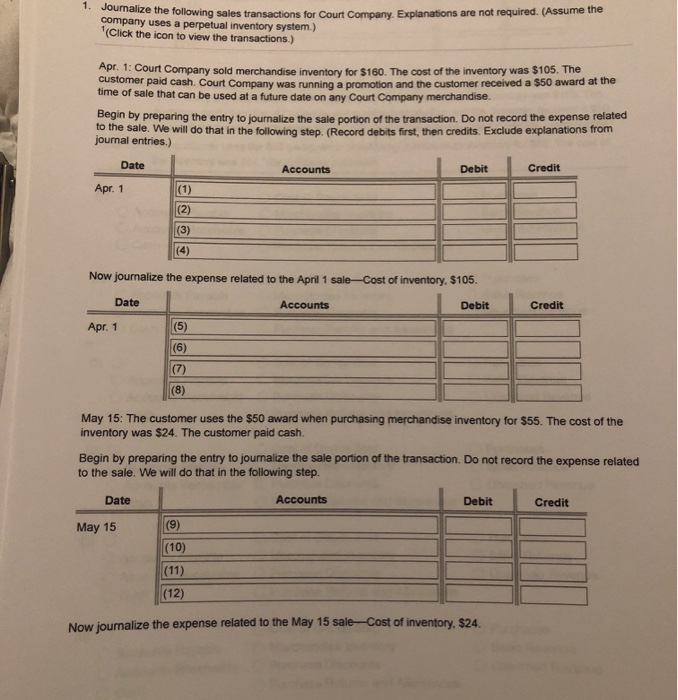

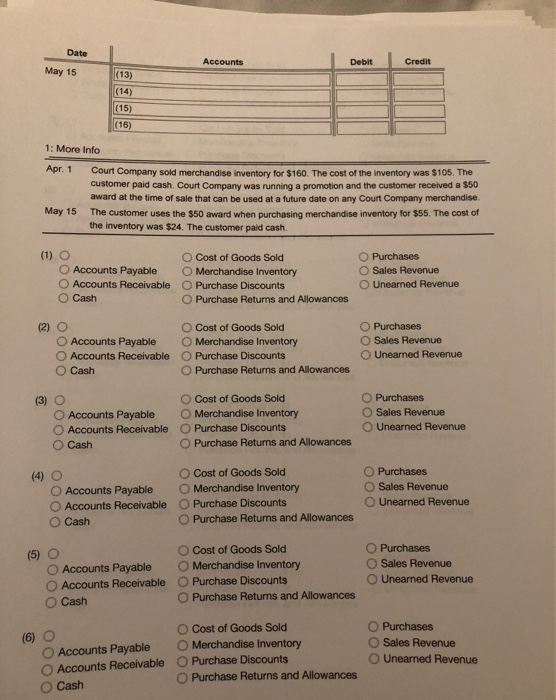

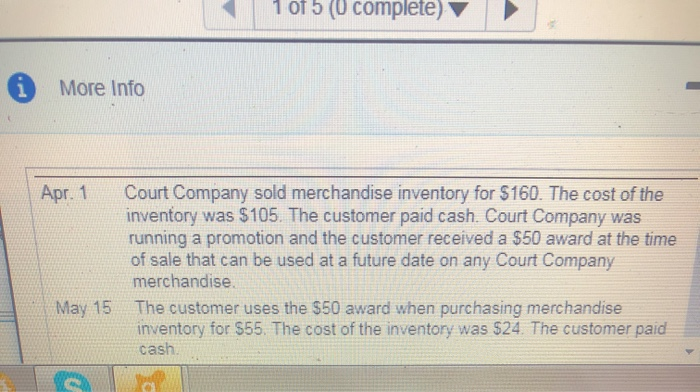

urnalize the following sales transactions for Court Company. Explanations are not required. (Assume the company uses a perpetual inventory system.) (Click the icon to view the transactions.) Apr. 1: Court Company sold merchandise inventory for $160 The cost of the inventory was $105. The Gustomer paid cash Court Company was running a promotion and the customer received a $50 award at the time of sale that can be used at a future date on any Court Company merchandise Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. (Record debits first, then credits. Exclude explanations from journal entries.) Date Accounts Debit Credit Apr. 1 Now journalize the expense related to the April 1 sale--Cost of inventory, $105. Date Accounts Debit Credit Apr. 1 May 15: The customer uses the $50 award when purchasing merchandise inventory for $55. The cost of the inventory was $24. The customer paid cash. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. Date Accounts Debit Credit May 15 (12) Now journalize the expense related to the May 15 sale-Cost of inventory $24 Date Accounts Debit Credit May 15 (13) (15) (16) 1: More Info Court Company sold merchandise inventory for $160. The cost of the inventory was $105. The customer paid cash. Court Company was running a promotion and the customer received a $50 award at the time of sale that can be used at a future date on any Court Company merchandise May 15 The customer uses the $50 award when purchasing merchandise inventory for $55. The cost of the inventory was $24. The customer paid cash. (1) O Accounts Payable O Accounts Receivable O Cash Cost of Goods Sold Merchandise Inventory O Purchase Discounts Purchase Returns and Allowances Purchases O Sales Revenue O Unearned Revenue (2) O Accounts Payable O Accounts Receivable O Cash O Cost of Goods Sold O Merchandise Inventory Purchase Discounts O Purchase Returns and Allowances O Purchases O Sales Revenue Unearned Revenue (3) O O Accounts Payable O Accounts Receivable O Cash Cost of Goods Sold O Merchandise Inventory Purchase Discounts O Purchase Returns and Allowances O Purchases O Sales Revenue Unearned Revenue (4) Accounts Payable O Accounts Receivable O Cash Cost of Goods Sold Merchandise Inventory Purchase Discounts O Purchase Returns and Allowances O Purchases Sales Revenue Unearned Revenue (5) O O Accounts Payable O Accounts Receivable O Cash O Cost of Goods Sold O Merchandise Inventory O Purchase Discounts O Purchase Returns and Allowances O Purchases Sales Revenue Unearned Revenue (6) O O Cost of Goods Sold Merchandise Inventory O Purchase Discounts O Purchase Returns and Allowances Purchases Sales Revenue Unearned Revenue Accounts Payable Accounts Receivable Cash 101 5 (0 complete) More Info Apr. 1 Court Company sold merchandise inventory for $160. The cost of the inventory was $105. The customer paid cash. Court Company was running a promotion and the customer received a $50 award at the time of sale that can be used at a future date on any Court Company merchandise The customer uses the $50 award when purchasing merchandise inventory for $55. The cost of the inventory was $24. The customer paid cash May 15