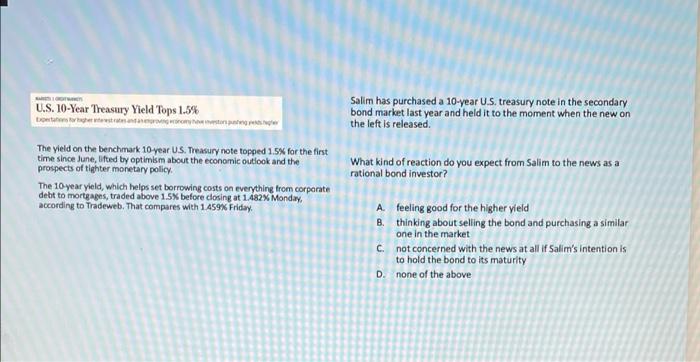

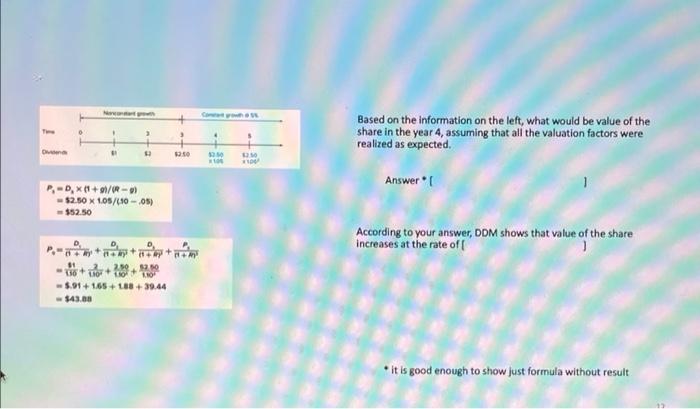

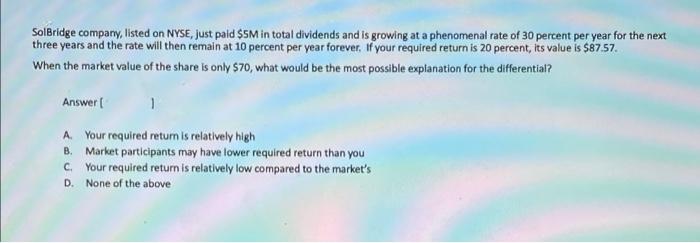

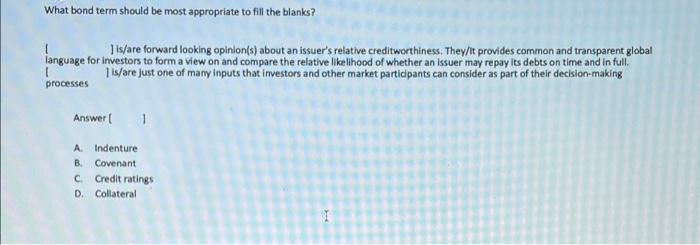

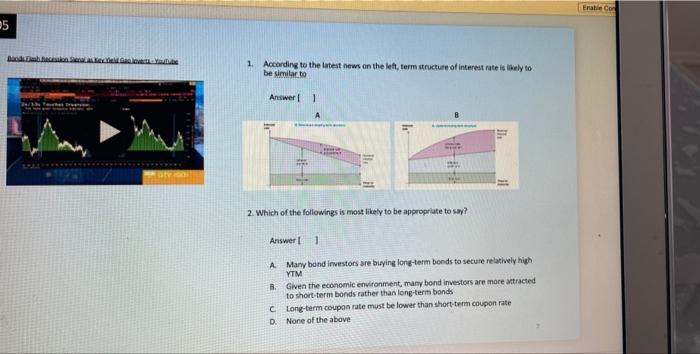

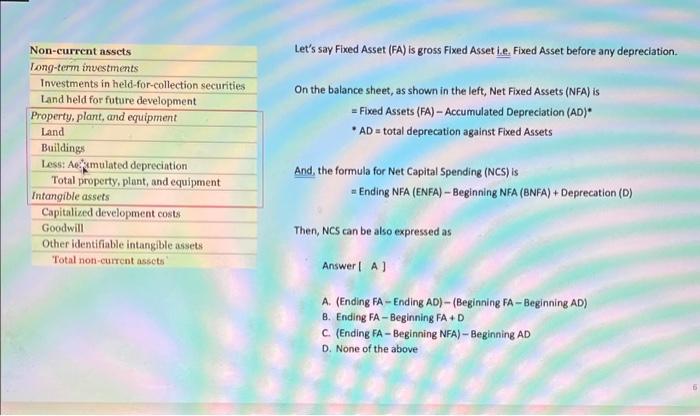

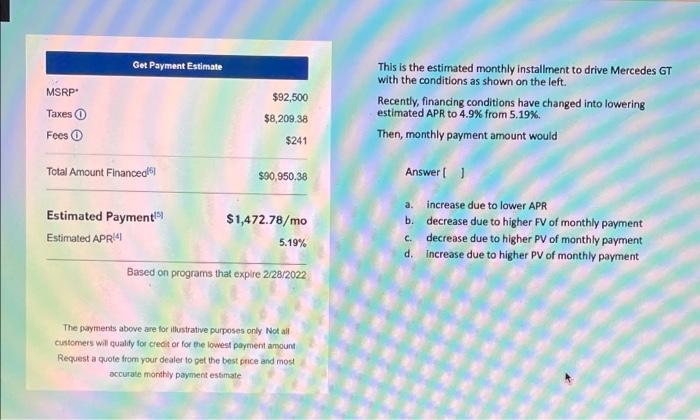

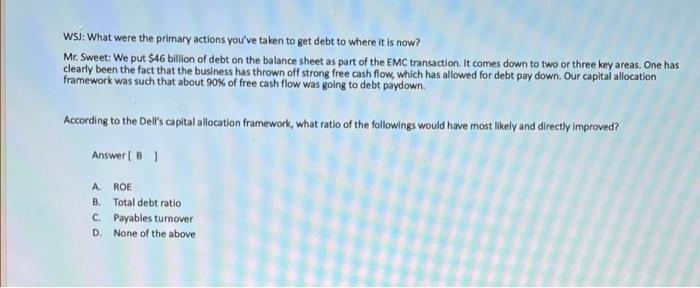

U.S. 10-Year Treasury Yield Tops 1.5% Salim has purchased a 10-year U.S. treasury note in the secondary bond market last year and held it to the moment when the new on the left is released tot The yield on the benchmark 10 year US Treasury note topped 1.5% for the first time since June, Ifted by optimism about the economic outlook and the prospects of tighter monetary policy The 10 year yield, which helps set borrowing costs on everything from corporate debt to mortgages, traded above 1.5% before closing at 1.482% Monday, according to Tradeweb. That compares with 1459% Friday What kind of reaction do you expect from Salim to the news as a rational bond investor? A. feeling good for the higher yield B. thinking about selling the bond and purchasing a similar one in the market C not concerned with the news at all if Salim's intention is to hold the bond to its maturity D. none of the above Based on the information on the left, what would be value of the share in the year 4, assuming that all the valuation factors were realized as expected *100 Answert , -0,X (1+1/R-) $2.50 X 105/10 - 05) $52.50 According to your answer, DDM shows that value of the share increases at the rate of D. + 81 10 $.91 +165 + 188 +39.44 $43.00 08209210 it is good enough to show just formula without result SolBridge company, listed on NYSE, just paid $SM in total dividends and is growing at a phenomenal rate of 30 percent per year for the next three years and the rate will then remain at 10 percent per year forever. If your required return is 20 percent, its value is $87.57. When the market value of the share is only $70, what would be the most possible explanation for the differential? Answert 1 A. Your required retum is relatively high Market participants may have lower required return than you Your required return is relatively low compared to the market's D. None of the above B C What bond term should be most appropriate to fill the blanks? Jis/are forward looking opinion(s) about an issuer's relative creditworthiness. They/It provides common and transparent global language for investors to form a view on and compare the relative likelihood of whether an issuer may repay its debts on time and in full. 1 is/are just one of many inputs that investors and other market participants can consider as part of their decision-making processes Answert 1 A Indenture . Covenant c. Credit ratings D. Collateral Enable Cor 25 1. According to the latest news on the leftterm structure of interest rate is likely to be similar to Answer 1 A 2. Which of the followings is most likely to be appropriate to swy? Answer! 1 A Many bond investors are buying long-term bonds to secure relatively high YTM B. Given the economic environment, many bond investors are more attracted to short-term bonds rather than long-term bonds c Long-term coupon rate must be lower than short-term coupon rate D. None of the above Let's say Fixed Asset (FA) is gross Fixed Asset i.e. Fixed Asset before any depreciation. On the balance sheet, as shown in the left, Net Fixed Assets (NFA) is = Fixed Assets (FA) - Accumulated Depreciation (AD)* * AD = total deprecation against Fixed Assets Non-current assets Long-term investments Investments in held-for-collection securities Land held for future development Property, plant, and equipment Land Buildings Less: Aermulated depreciation Total property, plant, and equipment Intangible assets Capitalized development costs Goodwill Other identifiable intangible assets Total non-current assets And the formula for Net Capital Spending (NCS) is = Ending NFA (ENFA) - Beginning NFA (BNFA) + Deprecation (D) Then, NCS can be also expressed as Answer AD A. (Ending FA - Ending AD) - (Beginning FA - Beginning AD) B. Ending FA - Beginning FA+D C. (Ending FA - Beginning NFA) - Beginning AD D. None of the above Get Payment Estimate MSRP $92,500 This is the estimated monthly installment to drive Mercedes GT with the conditions as shown on the left. Recently, financing conditions have changed into lowering estimated APR to 4.9% from 5.19%. Then, monthly payment amount would $8,209.38 Taxes Fees $241 Total Amount Financed $90,950.38 Answer Estimated Payment Estimated APR4 $1,472.78/mo 5.19% a. increase due to lower APR b. decrease due to higher FV of monthly payment c. decrease due to higher PV of monthly payment Increase due to higher PV of monthly payment d. Based on programs that expire 2/28/2022 The payments above are for illustrative purposes only Not all customers will quality for creditor for the lowest payment amount Request a quote from your dealer to put the best price and most accurate monthly payment estimate Free cash flow is cash flow distributable to creditors and stockholders. Which of the followings is not correct? Answer A. Interest should be deducted for free cash flow B. Dividends distributable should not be deducted for free cash flow C. Depreciation expenses should be added back to EBIT for free cash flow D. Sum of current asset minus current liability should be deducted from EBIT for free cash flow WSI: What were the primary actions you've taken to get debt to where it is now? Mr. Sweet: We put $46 billion of debt on the balance sheet as part of the EMC transaction. It comes down to two or three key areas. One has clearly been the fact that the business has thrown off strong free cash flow, which has allowed for debt pay down. Our capital allocation framework was such that about 90% of free cash flow was going to debt paydown. According to the Dells capital allocation framework, what ratio of the followings would have most likely and directly improved? Answer [ B] AROE B. Total debt ratio C. Payables turnover D. None of the above U.S. 10-Year Treasury Yield Tops 1.5% Salim has purchased a 10-year U.S. treasury note in the secondary bond market last year and held it to the moment when the new on the left is released tot The yield on the benchmark 10 year US Treasury note topped 1.5% for the first time since June, Ifted by optimism about the economic outlook and the prospects of tighter monetary policy The 10 year yield, which helps set borrowing costs on everything from corporate debt to mortgages, traded above 1.5% before closing at 1.482% Monday, according to Tradeweb. That compares with 1459% Friday What kind of reaction do you expect from Salim to the news as a rational bond investor? A. feeling good for the higher yield B. thinking about selling the bond and purchasing a similar one in the market C not concerned with the news at all if Salim's intention is to hold the bond to its maturity D. none of the above Based on the information on the left, what would be value of the share in the year 4, assuming that all the valuation factors were realized as expected *100 Answert , -0,X (1+1/R-) $2.50 X 105/10 - 05) $52.50 According to your answer, DDM shows that value of the share increases at the rate of D. + 81 10 $.91 +165 + 188 +39.44 $43.00 08209210 it is good enough to show just formula without result SolBridge company, listed on NYSE, just paid $SM in total dividends and is growing at a phenomenal rate of 30 percent per year for the next three years and the rate will then remain at 10 percent per year forever. If your required return is 20 percent, its value is $87.57. When the market value of the share is only $70, what would be the most possible explanation for the differential? Answert 1 A. Your required retum is relatively high Market participants may have lower required return than you Your required return is relatively low compared to the market's D. None of the above B C What bond term should be most appropriate to fill the blanks? Jis/are forward looking opinion(s) about an issuer's relative creditworthiness. They/It provides common and transparent global language for investors to form a view on and compare the relative likelihood of whether an issuer may repay its debts on time and in full. 1 is/are just one of many inputs that investors and other market participants can consider as part of their decision-making processes Answert 1 A Indenture . Covenant c. Credit ratings D. Collateral Enable Cor 25 1. According to the latest news on the leftterm structure of interest rate is likely to be similar to Answer 1 A 2. Which of the followings is most likely to be appropriate to swy? Answer! 1 A Many bond investors are buying long-term bonds to secure relatively high YTM B. Given the economic environment, many bond investors are more attracted to short-term bonds rather than long-term bonds c Long-term coupon rate must be lower than short-term coupon rate D. None of the above Let's say Fixed Asset (FA) is gross Fixed Asset i.e. Fixed Asset before any depreciation. On the balance sheet, as shown in the left, Net Fixed Assets (NFA) is = Fixed Assets (FA) - Accumulated Depreciation (AD)* * AD = total deprecation against Fixed Assets Non-current assets Long-term investments Investments in held-for-collection securities Land held for future development Property, plant, and equipment Land Buildings Less: Aermulated depreciation Total property, plant, and equipment Intangible assets Capitalized development costs Goodwill Other identifiable intangible assets Total non-current assets And the formula for Net Capital Spending (NCS) is = Ending NFA (ENFA) - Beginning NFA (BNFA) + Deprecation (D) Then, NCS can be also expressed as Answer AD A. (Ending FA - Ending AD) - (Beginning FA - Beginning AD) B. Ending FA - Beginning FA+D C. (Ending FA - Beginning NFA) - Beginning AD D. None of the above Get Payment Estimate MSRP $92,500 This is the estimated monthly installment to drive Mercedes GT with the conditions as shown on the left. Recently, financing conditions have changed into lowering estimated APR to 4.9% from 5.19%. Then, monthly payment amount would $8,209.38 Taxes Fees $241 Total Amount Financed $90,950.38 Answer Estimated Payment Estimated APR4 $1,472.78/mo 5.19% a. increase due to lower APR b. decrease due to higher FV of monthly payment c. decrease due to higher PV of monthly payment Increase due to higher PV of monthly payment d. Based on programs that expire 2/28/2022 The payments above are for illustrative purposes only Not all customers will quality for creditor for the lowest payment amount Request a quote from your dealer to put the best price and most accurate monthly payment estimate Free cash flow is cash flow distributable to creditors and stockholders. Which of the followings is not correct? Answer A. Interest should be deducted for free cash flow B. Dividends distributable should not be deducted for free cash flow C. Depreciation expenses should be added back to EBIT for free cash flow D. Sum of current asset minus current liability should be deducted from EBIT for free cash flow WSI: What were the primary actions you've taken to get debt to where it is now? Mr. Sweet: We put $46 billion of debt on the balance sheet as part of the EMC transaction. It comes down to two or three key areas. One has clearly been the fact that the business has thrown off strong free cash flow, which has allowed for debt pay down. Our capital allocation framework was such that about 90% of free cash flow was going to debt paydown. According to the Dells capital allocation framework, what ratio of the followings would have most likely and directly improved? Answer [ B] AROE B. Total debt ratio C. Payables turnover D. None of the above