Answered step by step

Verified Expert Solution

Question

1 Approved Answer

US Airways is a major US air carrier engaged primarily in the business of transporting pas- sengers, property, and mail US Airways operates predominantly

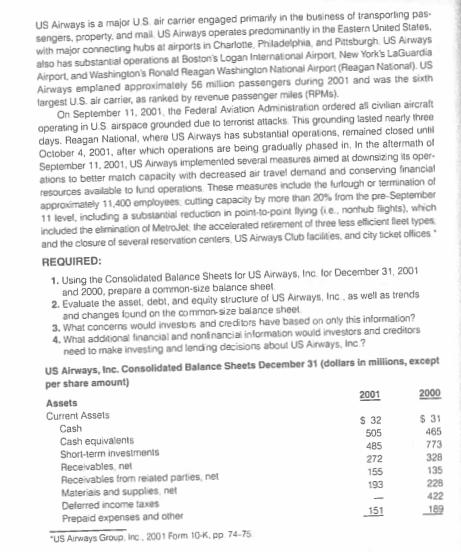

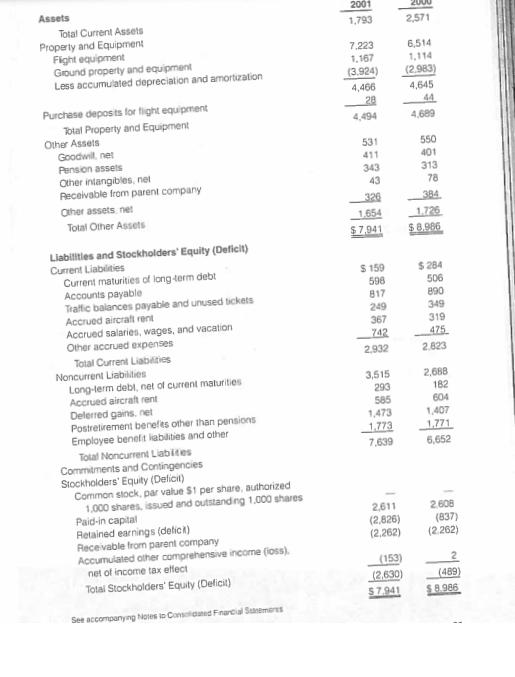

US Airways is a major US air carrier engaged primarily in the business of transporting pas- sengers, property, and mail US Airways operates predominantly in the Eastern United States. with major connecting hubs at airports in Charlotte, Philadelphia, and Pittsburgh US Airways also has substantial operations at Boston's Logan International Airport, New York's LaGuardia Airport, and Washington's Ronald Reagan Washington National Airport (Reagan National). US Airways emplaned approximately 56 million passengers during 2001 and was the sixth fargest U.S. air carrier, as ranked by revenue passenger miles (RPMs). On September 11, 2001, the Federal Aviation Administration ordered all civilian aircraft operating in US airspace grounded due to terrorist attacks. This grounding lasted nearly three days. Reagan National, where US Airways has substantial operations, remained closed until October 4, 2001, after which operations are being gradually phased in, In the aftermath of September 11, 2001, US Airways implemented several measures aimed at downsizing its oper- ations to better match capacity with decreased air travel demand and conserving financial resources available to fund operations. These measures include the furlough or termination of approximately 11,400 employees cutting capacity by more than 20% from the pre-September 11 level, including a substantial reduction in point-to-point flying (ie, nonhub flights), which included the elimination of MetroJet the accelerated retirement of three less efficient fleet types and the closure of several reservation centers, US Airways Club facilities, and city ticket offices REQUIRED: 1. Using the Consolidated Balance Sheets for US Airways, Inc. for December 31, 2001 and 2000, prepare a common-size balance sheet 2. Evaluate the asset, debt, and equity structure of US Airways, Inc, as well as trends and changes found on the common-size balance sheet 3. What concerns would investors and creditors have based on only this information? 4. What additional financial and nonfinancial information would investors and creditors need to make investing and lending decisions about US Airways, Inc.? US Airways, Inc. Consolidated Balance Sheets December 31 (dollars in millions, except per share amount) Assets Current Assets Cash Cash equivalents Short-term investments Receivables, net Receivables from related parties, net Materials and supplies, net Deferred income taxes Prepaid expenses and other "US Airways Group, Inc. 2001 Form 10-K, pp 74-75 2001 $ 32 505 485 272 155 193 151 2000 $ 31 465 773 328 135 228 422 189 Assets Total Current Assets Property and Equipment Fight equipment Ground property and equipment Less accumulated depreciation and amortization Purchase deposits for fight equipment Total Property and Equipment Other Assets Goodwill, net Pension assets Other intangibles, net Receivable from parent company Other assets net Total Other Assets Liabilities and Stockholders' Equity (Deficit) Current Liabilities Current maturities of long-term debt Accounts payable Traffic balances payable and unused tickets Accrued aircraft rent Accrued salaries, wages, and vacation Other accrued expenses Total Current Liabilities Noncurrent Liabilities Long-term debt, net of current maturities Accrued aircraft rent Delerred gains, net Postretirement benefits other than pensions Employee beneft liabilities and other Total Noncurrent Liabites Commitments and Contingencies Stockholders' Equity (Deficit) Common stock, par value $1 per share, authorized 1,000 shares, issued and outstanding 1,000 shares Paid-in capital Retained earnings (delick) Receivable from parent company Accumulated other comprehensive income (loss). net of income tax effect Total Stockholders' Equity (Deficit) See accompanying Notes to Consolidated Financial Stanemeres 2001 1,793 7.223 1,167 (3.924) 4,466 28 4,494 531 411 343 43 326 1,654 $7,941 $ 159 598 817 249 367 742 2,932 3,515 293 585 1,473 1,773 7,639 2,611 (2,826) (2.262) (153) (2,630) $7.941 2,571 6,514 1,114 (2.983) 4,645 44 4,689 550 401 313 78 384 1.726 $8.986 $284 506 890 349 319 475 2.823 2,688 182 604 1,407 1.771 6,652 2.608 (837) (2.262) (489) $8.986

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

CommonSize Balance Sheet Assets Current Assets Cash 327941 04 Cash Equivalents 5057941 64 ShortTerm Investments 4857941 61 Receivables Net 317941 04 Receivables from Related Parties Net 4657941 59 Mat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started