Answered step by step

Verified Expert Solution

Question

1 Approved Answer

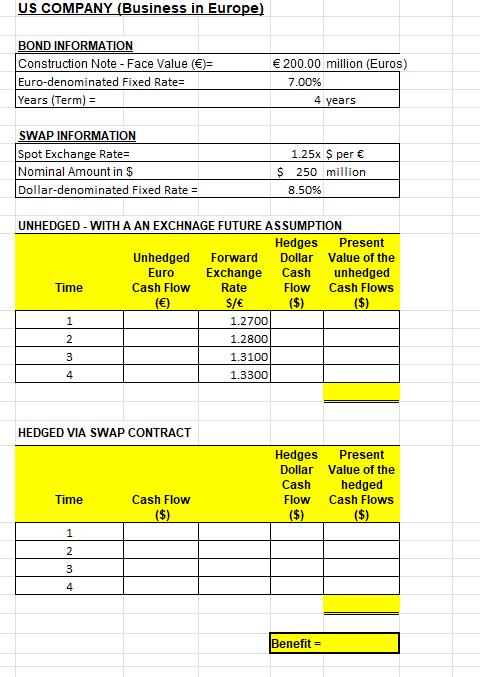

US COMPANY (Business in Europe) BOND INFORMATION Construction Note - Face Value ()= Euro-denominated Fixed Rate= Years (Term) = 200.00 million (Euros) 7.00% 4

US COMPANY (Business in Europe) BOND INFORMATION Construction Note - Face Value ()= Euro-denominated Fixed Rate= Years (Term) = 200.00 million (Euros) 7.00% 4 years SWAP INFORMATION Spot Exchange Rate= Nominal Amount in $ Dollar-denominated Fixed Rate = 1.25x $ per $ 250 million 8.50% UNHEDGED-WITH A AN EXCHNAGE FUTURE ASSUMPTION Hedges Unhedged Forward Dollar Present Value of the Euro Exchange Cash Time Cash Flow () Rate Flow unhedged Cash Flows $/ ($) ($) 1 2 3 4 1.2700 1.2800 1.3100 1.3300 HEDGED VIA SWAP CONTRACT Hedges Present Dollar Value of the Cash Time Cash Flow Flow hedged Cash Flows ($) ($) ($) 1 2 3 4 Benefit =

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The problem is asking us to analyze the financing options for a US company operating in Europe The company has two options 1 Issue eurodenominated fix...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started